Get the free Proposed tax increase and flost votePerry, FL

Get, Create, Make and Sign proposed tax increase and

Editing proposed tax increase and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out proposed tax increase and

How to fill out proposed tax increase and

Who needs proposed tax increase and?

Understanding Proposed Tax Increases and Forms: A Comprehensive Guide

Understanding proposed tax increases

A proposed tax increase occurs when governments aim to raise additional revenue by adjusting existing tax rates or creating new taxes. It can manifest in various forms, including hikes in income, sales, or property taxes. Understanding these increases is crucial for citizens and businesses alike, as the financial impacts can significantly influence household budgets and operational costs.

Tax increases generally fall into two categories: rate increases, where the percentage charged on income or goods grows, and base broadenings, where the definition of taxable income or sales expands. For instance, if a state increases its income tax from 5% to 6%, it’s implementing a rate increase. Meanwhile, broadening the sales tax to encompass services previously exempt falls into the second category.

Implications of proposed tax increases

The implications of proposed tax increases affect not only the government’s revenue but also the financial stability of taxpayers, businesses, and the economy as a whole. For individuals and families, higher tax rates can lead to reduced disposable income, hindering their ability to save, invest, or spend on essential goods and services. This can collectively dampen economic growth.

Businesses face similar challenges. Increased tax burdens force employers to reconsider employee compensation or prices for goods and services. When businesses cannot pass on the costs to consumers, they may cut jobs or invest less in expansion, further affecting the economy. Therefore, understanding the broader economic consequences of proposed tax increases is essential for stakeholders at all levels.

Overview of the tax increase proposal process

Understanding the tax increase proposal process is vital for all taxpayers. This process typically comprises several key steps, initiating from the initial drafting of tax provisions to gathering stakeholder feedback and carrying out legislative reviews. Each stage ensures that a variety of voices can weigh in before any new tax policy is implemented.

The initial drafting often occurs within a specific government agency, where officials outline intended changes. Stakeholder consultations involve industry experts and public input, making sure the effects of proposed changes are well understood. After gathering insights, proposals move to legislative chambers for discussion, amendments, and voting.

Important terms and concepts to understand

For taxpayers navigating proposed tax increases, several key terms are essential. Understanding the difference between rate increases and base broadening can clarify how tax policies affect finances. The budget reconciliation process offers a streamlined route for enacting tax changes, often allowing proposals to pass with a simple majority, rather than the traditional two-thirds required in the Senate.

Another critical aspect is fiscal responsibility, wherein governments must balance revenue needs with the economic impact of tax increases. Communication around these issues fosters greater public understanding and trust.

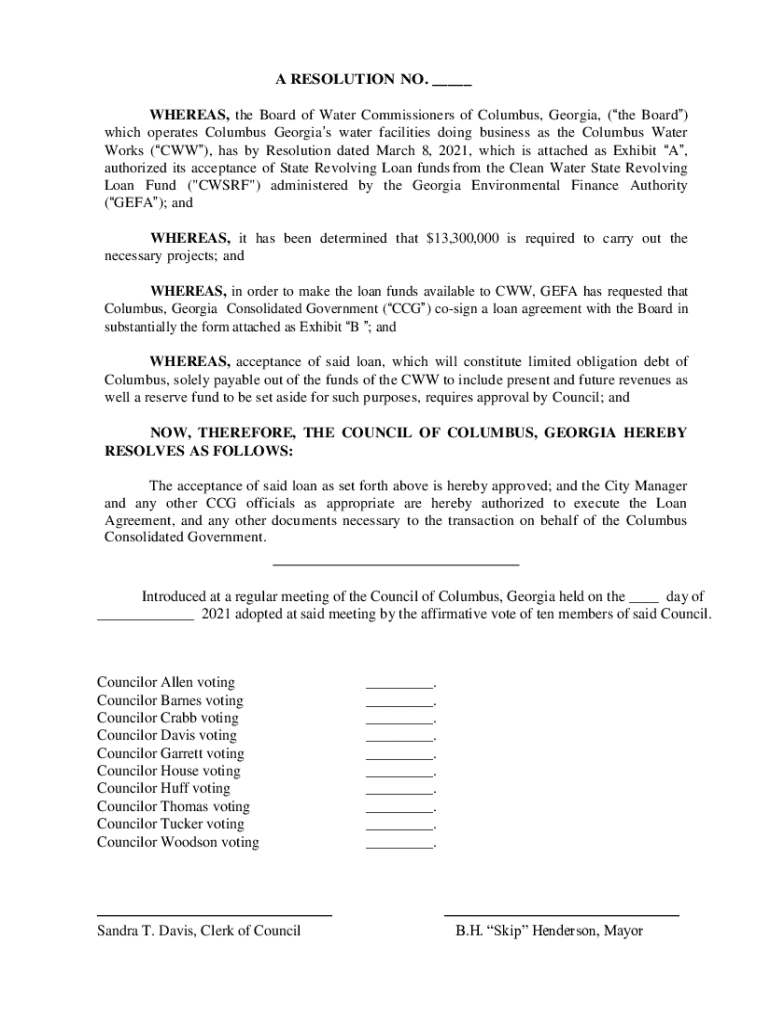

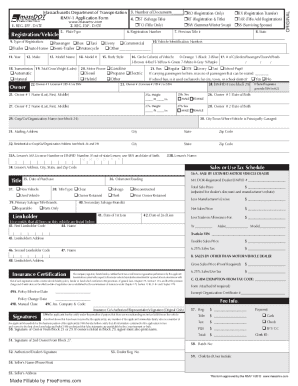

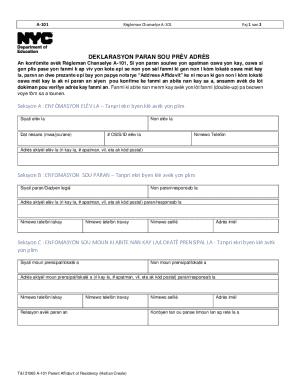

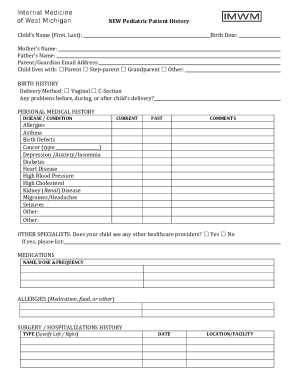

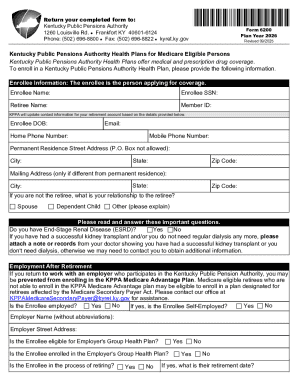

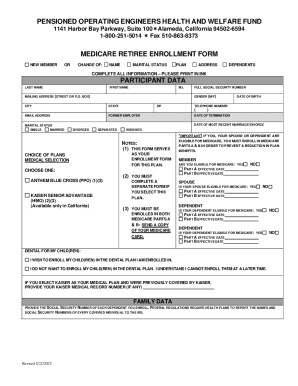

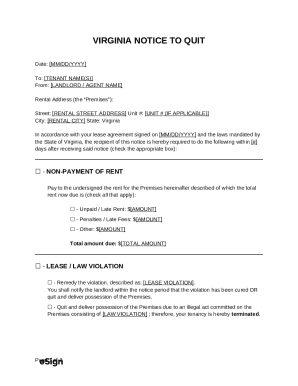

Navigating forms related to proposed tax increases

Taxpayers must be aware of the forms needed when dealing with proposed tax increases. Depending on the nature of the increase—be it changes in income tax, sales tax, or property tax—various forms will need to be filled out to ensure compliance with the new regulations. Properly navigating these forms is essential to avoid penalties and ensure accurate reporting.

Key forms might include updated income tax returns reflecting amended rates, sales tax reports that adapt to new taxable goods, or property tax reassessments. Each state or federal agency will have specific requirements, and understanding these can significantly influence a taxpayer’s liability.

Where to find the right forms

Finding the correct forms is crucial for timely compliance with tax regulations. Taxpayers should start by consulting their state’s tax authority website for the most recent forms and instructions. These sites often include a section specifically for current tax proposals and associated documentation.

For federal requirements, the IRS website is the key destination, providing all necessary forms and guidance. Additionally, online resources like pdfFiller simplify the process of document retrieval, allowing taxpayers to access, edit, and submit forms conveniently from the cloud.

Step-by-step guide to filling out tax increase forms

Filling out tax increase forms can seem daunting, but a structured approach makes it manageable. Start by gathering all necessary personal information and ensuring you have details about your income sources and deductions. This preparation simplifies the subsequent steps, making it easier to accurately report your financial status in light of the tax changes.

Understanding tax terminology is another critical step. Definitions of terms like taxable income, deductions, and credits will aid in accurately completing the forms. Each section requires careful consideration, especially regarding any changes to tax rates that might impact your overall tax liability.

Detailed instructions for form filling

While filling out your forms, accuracy is paramount. Begin with your personal information; ensure your name, address, and Social Security number are correct. When reporting income, itemize all sources, including wages, dividends, and any other income streams to prevent discrepancies.

After detailing income, you will need to summarize deductions carefully, as these impact your taxable income. If tax rate changes affect your payments, confirm that these adjustments are reflected in your final calculations before submitting.

Common mistakes to avoid

It's easy to make errors when filling tax forms, especially during periods of tax adjustment. One common mistake is incorrect information entry, often leading to delays or complications with processing. Always double-check personal details and numerical entries to ensure accuracy. Missing signatures can also cause issues, so be sure to complete all required fields before submission.

Awareness of filing deadlines is critical. Ignoring these deadlines can lead to penalties or interest charges, adding to the overall financial burden from tax increases. Setting reminders and using platform calendars can help keep you on track.

Editing and managing your tax increase forms

Managing tax forms efficiently is crucial for taxpayers, especially with new compliance requirements arising from tax increases. Utilizing a platform like pdfFiller can streamline document management through cloud-based storage. This allows users to access their forms from anywhere, ensuring visibility and control over their documents.

Collaboration tools within pdfFiller enable users to work together, making it easier for teams to provide input on forms. This is particularly useful when preparing complex documents that require multiple stakeholders to review before submission. By centralizing document management, pdfFiller helps taxpayers remain organized and accountable.

How to edit tax forms efficiently

Utilizing pdfFiller enhances efficiency in editing forms. Upon uploading your documents, the platform provides straightforward tools to modify text, ensuring all entries are correct. This simple process allows users to amend previous submissions or fill out new forms quickly, keeping everything consistent and updated.

Additionally, users can add notes and comments to existing documents, creating a comprehensive reference for future filing seasons. These helpful features facilitate a better understanding of adjustments needed for upcoming tax seasons, especially when dealing with forms related to proposed tax increases.

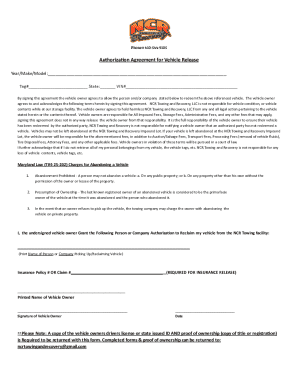

Signing and sending your forms

Legally signing and sending forms is critical in maintaining compliance with tax regulations. pdfFiller simplifies the process through its eSignature feature, allowing users to sign documents securely online. This eliminates the need for printing and scanning, making the submission process faster and more environmentally friendly.

Once signed, documents can be submitted directly to relevant authorities via email or secure upload. Keeping a record of these submissions is imperative for reference and future filings, ensuring all tax-related activities are transparent and documented.

Tracking changes and staying informed

For taxpayers, staying informed about tax policy changes is essential, especially concerning proposed tax increases. Official government announcements often provide initial details on upcoming changes, including scheduled public hearings or opportunities for comment. Monitoring these announcements can help taxpayers prepare for any adjustments to their financial planning.

Fiscal policy updates from reputable sources, such as financial news outlets or tax advocacy groups, can further inform understanding of proposed changes. Engaging with community discussions and expert forums also fosters a deeper understanding, enhancing both awareness and preparedness for navigating tax obligations.

Engaging with community and expert discussions

Connecting with discussions surrounding tax proposals can be extremely beneficial. Participating in forums and discussion groups allows taxpayers to share experiences, insights, and strategies for dealing with proposed tax increases. These interactions foster a collaborative environment that can lead to more informed decision-making.

Additionally, webinars and live question-and-answer events allow taxpayers to engage directly with tax professionals. These sessions can offer critical guidance and insights into their specific circumstances, empowering individuals to navigate the complexities of tax increases more effectively.

Future considerations for tax legislation

Looking ahead, understanding potential trends in tax policy will be beneficial for taxpayers. Emerging trends might include a shift towards digital taxation as e-commerce continues to dominate retail landscapes. Tax regulations may increasingly adapt to address the growing gig economy, impacting how income is classified and taxed.

Preparing for future tax implications requires strategic financial planning. Taxpayers should keep organized records of income, deductions, and relevant documentation to streamline their tax preparation process. Adjusting budgeting strategies to accommodate possible tax increases will also ensure families and businesses remain financially stable regardless of legislative changes.

Related topics and forms

As you navigate the complexities of proposed tax increases, understanding related topics can provide additional context. Tax credits and deductions remain pivotal in determining your overall tax obligation. Awareness of how these credits interact with potential tax increases can help taxpayers effectively plan their finances.

Accessing templates and tradeforms offered by pdfFiller gives taxpayers valuable resources at their fingertips. This support aids in capturing the necessary financial information while also enabling effective communication with tax advisors or professionals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send proposed tax increase and to be eSigned by others?

How can I get proposed tax increase and?

Can I edit proposed tax increase and on an iOS device?

What is proposed tax increase?

Who is required to file proposed tax increase?

How to fill out proposed tax increase?

What is the purpose of proposed tax increase?

What information must be reported on proposed tax increase?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.