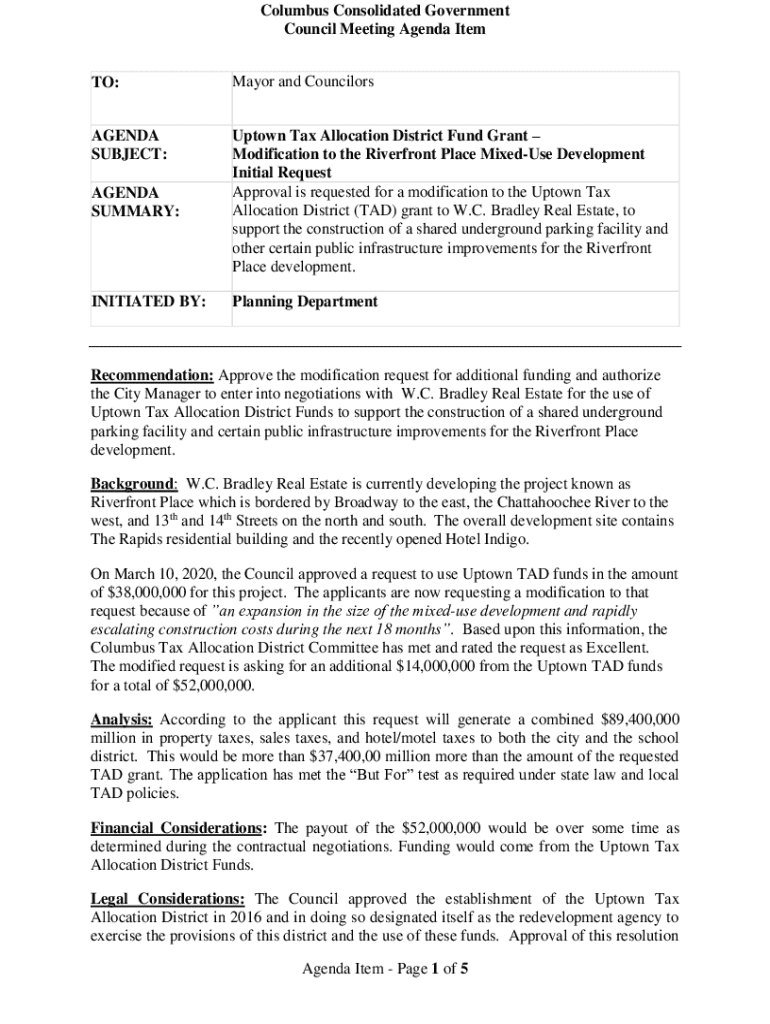

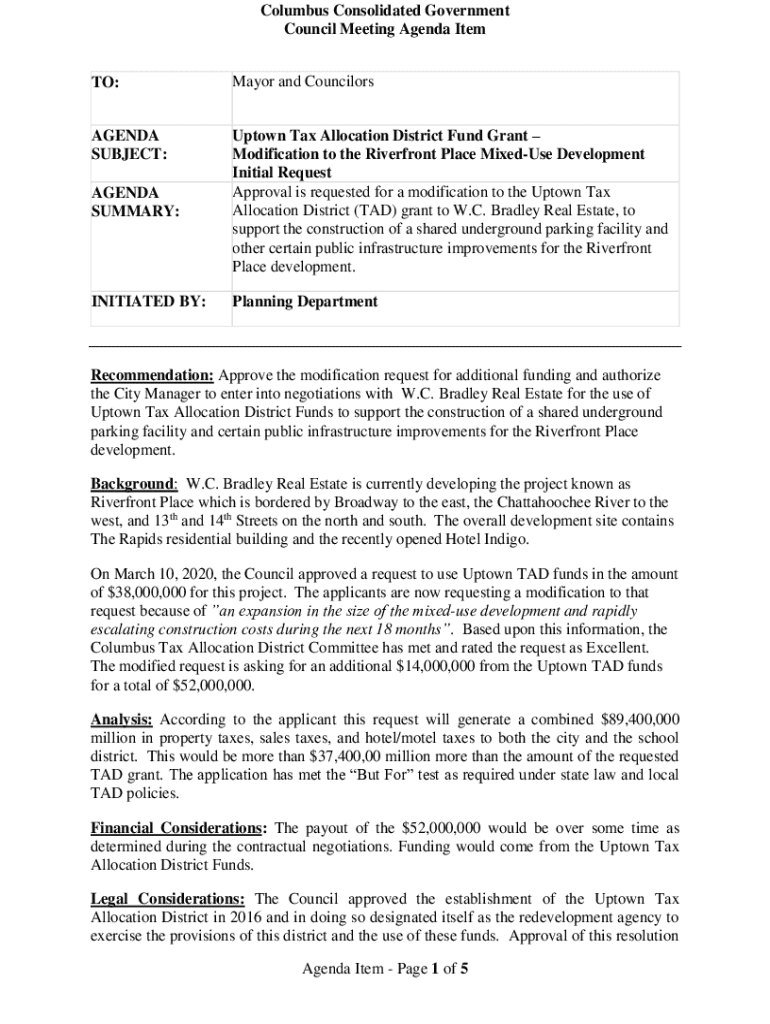

Get the free Place, LLC, an affiliate of WC Bradley Co. Real Estate, LLC, to

Get, Create, Make and Sign place llc an affiliate

Editing place llc an affiliate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out place llc an affiliate

How to fill out place llc an affiliate

Who needs place llc an affiliate?

How to place an as an affiliate form

Understanding the basics of LLCs in affiliate marketing

A Limited Liability Company (LLC) is a legal business structure that combines the simplicity of a sole proprietorship or partnership with the limited liability protection typically associated with corporations. This hybrid model offers vital legal protections for your personal assets, making it an excellent choice for entrepreneurs, particularly in the affiliate marketing business.

In affiliate marketing, an LLC can provide the necessary framework to manage your operations without the fear of personal liability. However, it's crucial to consider the legal implications thoroughly.

Is forming an right for your affiliate business?

When considering whether to set up an LLC for your affiliate marketing efforts, weighing the pros and cons is essential. One significant advantage is liability protection; if your business faces a lawsuit, your personal assets will likely remain safe. That’s a cushion that can give peace of mind, especially in a space as dynamic as affiliate marketing.

However, some misconceptions abound regarding LLCs. For instance, many believe that forming an LLC is overly complicated or only beneficial for larger businesses. On the contrary, affiliate marketing entrepreneurs can reap substantial benefits from an LLC structure, particularly in regards to branding and professionalism.

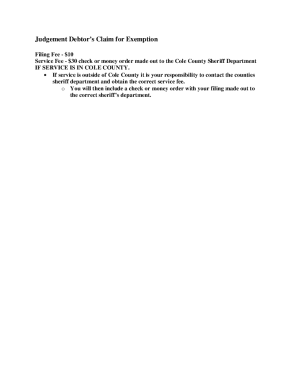

Detailed steps to form an for your affiliate business

Creating an LLC for your affiliate marketing business is a structured process. Here are the essential steps.

Managing your as an affiliate marketer

After successfully forming your LLC, management becomes the next crucial step. Best practices for running your LLC involve maintaining a clear separation between personal and business finances. This not only simplifies bookkeeping but also protects your assets.

Insurance considerations for your

While forming an LLC offers liability protection, it doesn't cover all business risks. Various types of insurance can fortify your affiliate marketing enterprise.

FAQs about starting an for affiliate marketing

Navigating the formation of your LLC could raise several questions. Here are some frequently asked queries.

State-specific considerations for forming an

Each state has its requirements for LLC formation that may include specific forms, fees, and processing times. For example, certain states such as Delaware and Wyoming are known for their business-friendly regulations, often making them ideal for formation.

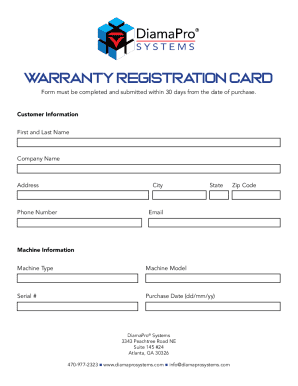

Exploring the benefits of using pdfFiller for your documentation

In the digital age, managing documents doesn't need to be cumbersome. pdfFiller offers an intuitive platform to streamline your LLC documentation process.

Navigating common situations where LLCs are beneficial for affiliate marketers

As an affiliate marketer, there are various scenarios where having an LLC could provide significant advantages. For instance, when entering into affiliate marketing contracts, an LLC's status can boost your credibility and allow for negotiations on more favorable terms.

Additional resources for formation in affiliate marketing

As you embark on your journey to form an LLC for your affiliate marketing business, various resources can simplify the process. Tools and templates available online can facilitate creation and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my place llc an affiliate directly from Gmail?

How can I edit place llc an affiliate from Google Drive?

How do I edit place llc an affiliate on an Android device?

What is place llc an affiliate?

Who is required to file place llc an affiliate?

How to fill out place llc an affiliate?

What is the purpose of place llc an affiliate?

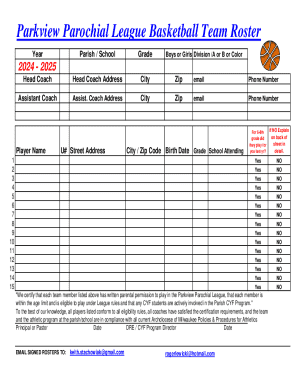

What information must be reported on place llc an affiliate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.