Get the free Uptown Tax Allocation District Fund Grant

Get, Create, Make and Sign uptown tax allocation district

How to edit uptown tax allocation district online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uptown tax allocation district

How to fill out uptown tax allocation district

Who needs uptown tax allocation district?

Understanding the Uptown Tax Allocation District Form: A Comprehensive Guide

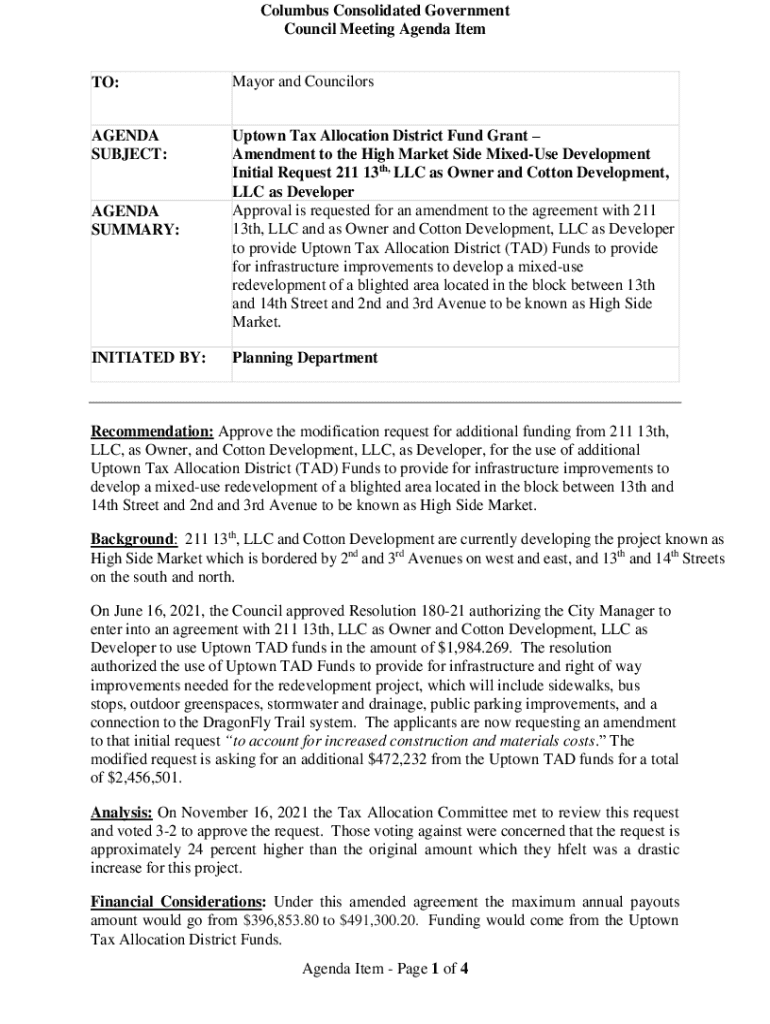

Overview of the Uptown Tax Allocation District

A Tax Allocation District (TAD) is a designated geographical area where the incremental property tax revenue is used to finance public infrastructure and economic development projects within that district. The Uptown Tax Allocation District (Uptown TAD) serves a critical role in enhancing the community’s economic vitality and supports local businesses, housing initiatives, and other developments. By leveraging future tax growth, the Uptown TAD enables investments that stimulate job creation, improve public infrastructure, and uplift local neighborhoods.

The Uptown TAD is particularly significant to local economic development, as it channels funding towards revitalization efforts. It helps transform underdeveloped or economically challenged areas into thriving commercial centers. Not only does this establish a baseline for enhanced property values, but it also fosters community pride and attracts private investments to the region.

Understanding the Uptown Tax Allocation District Form

The Uptown Tax Allocation District Form is integral to the TAD process, providing a standardized way to document and process requests for funding. This form ensures compliance with local regulations while streamlining the application process for potential developments seeking funding assistance. Properly filled forms can directly influence the timing and success of project approvals.

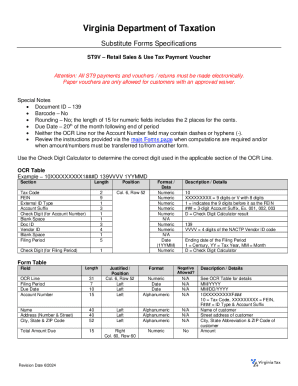

Key components of this form typically include specific fields and pertinent data required to adequately review and process requests. Understanding common terminology encapsulated on the form, such as ‘incremental tax revenue,’ ‘Eligible Projects,’ or ‘Public Benefit,’ provides clarity in completing the document accurately and comprehensively.

Step-by-step instructions for filling out the Uptown Tax Allocation District Form

Filling out the Uptown Tax Allocation District Form accurately is critical to ensure timely processing of your application. Here’s a checklist to gather all necessary documents and data required prior to filling it out.

Following this, a detailed step-by-step guide for completing each section of the form can help avoid errors:

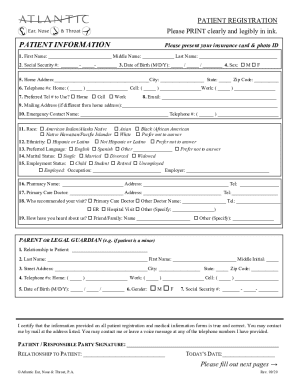

1. Personal Information Section

Begin by accurately entering your name, contact information, and your relationship to the property. Adhere to formatting guidelines, ensuring clarity in your submissions.

2. Property Details Section

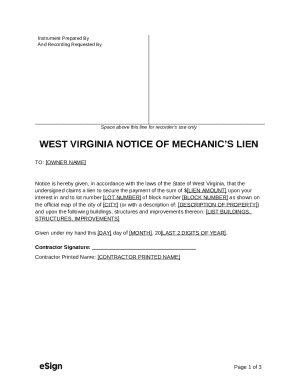

Accurately describe the property, including its address, current usage, and current property tax assessment. Providing comprehensive information helps expedite the review process.

3. Project Description Section

Articulating project scope and expected benefits clearly is crucial. Highlight motivations for the project, projected timelines, and expected community enhancements.

4. Financial Information Section

List all funding requests and expected revenue projections. It’s important to include key financial metrics such as return on investment (ROI) and anticipated tax revenues.

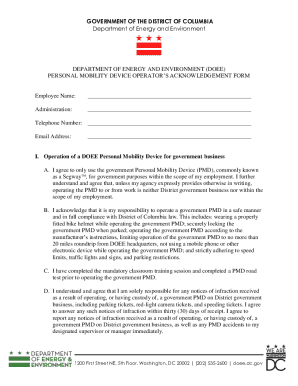

5. Compliance Verification Section

This section ensures that your project adheres to local policies. Prepare any necessary documentation proving regulatory compliance to fast-track your application.

Interactive tools and features for form management

Managing the Uptown Tax Allocation District Form has been made easier with tools provided by pdfFiller. Utilizing PDF editing tools allows users to add annotations, comments, or even necessary revisions seamlessly. These user-friendly tools enhance collaboration and ensure all requirements are met.

For finalizing the form, eSigning capabilities simplify document signing processes. Here are the steps for secure eSigning:

Sharing the form with relevant stakeholders, such as municipal authorities or potential partners, is also straightforward, facilitating streamlined collaboration on the application process.

Tips for successfully submitting your Uptown Tax Allocation District Form

Successful submission of your Uptown Tax Allocation District Form hinges on best practices that ensure accuracy and clarity. Recommended formats include PDF, as electronic submissions are preferred. Double-checking every field before submission is vital to minimize the chances of application delays.

To navigate common submission errors, it’s advisable to maintain a checklist of frequent pitfalls, such as missing signatures, incomplete financial information, and mismatches in property descriptions.

If mistakes are found post-submission, it's crucial to immediately notify the relevant authorities and provide corrected documentation promptly.

Frequently asked questions (FAQs) regarding the Uptown Tax Allocation District Form

Common clarifications about requirements often relate to eligibility and documentation. Applicants frequently ask if their project qualifies for funding through the Uptown TAD. Providing thorough project evaluations and compliance with specified guidelines are crucial for eligibility.

Other FAQs typically revolve around processing times for the submitted forms. While this may vary based on the volume of applications, maintaining communication with local authorities and following up regularly can facilitate a smoother process.

Real-life examples and case studies

Highlighting notable TAD projects within the Uptown area offers a glimpse into the successful integration of the Uptown Tax Allocation District Form in real-world scenarios. For instance, a recent commercial development that utilized TAD funding significantly revitalized a previously neglected area, creating thousands of jobs and enhancing public amenities.

Learnings from past TAD applications reveal the importance of community engagement and thorough project planning. Applicants who engaged stakeholders early in the process often benefited from streamlined approvals and enhanced project support from local governments.

Contact and support information

For individuals or teams looking for assistance with the Uptown Tax Allocation District Form, several resources are available through pdfFiller. Support channels include customer service, live chat, and comprehensive walkthrough guides that help users through any part of the process.

Additionally, local authorities can provide guidance specific to the Uptown Tax Allocation District. Having the right contacts can facilitate a smoother application process. Ensuring clear lines of communication with both pdfFiller support and local officials will enhance the applicant’s experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute uptown tax allocation district online?

How can I edit uptown tax allocation district on a smartphone?

How do I edit uptown tax allocation district on an iOS device?

What is uptown tax allocation district?

Who is required to file uptown tax allocation district?

How to fill out uptown tax allocation district?

What is the purpose of uptown tax allocation district?

What information must be reported on uptown tax allocation district?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.