Get the free Business Sole Proprietor Application

Get, Create, Make and Sign business sole proprietor application

How to edit business sole proprietor application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business sole proprietor application

How to fill out business sole proprietor application

Who needs business sole proprietor application?

Business Sole Proprietor Application Form: Your Comprehensive Guide

Understanding sole proprietorship

A sole proprietorship is the simplest form of business ownership, where an individual operates the business on their own. This business structure is characterized by the absence of a legal distinction between the owner and the business, meaning the owner is personally liable for all debts and obligations of the enterprise.

The key advantages of becoming a sole proprietor include a hassle-free setup process, as it requires minimal paperwork compared to other business structures like LLCs or corporations. Moreover, the owner has complete control over all business decisions, allowing for quick adaptations and innovative ideas without needing to consult partners or a board. Tax benefits are another significant perk, as income generated through the business is taxed as personal income, often leading to a lower tax burden.

Nonetheless, misconceptions about sole proprietorships still persist. Common myths include the belief that sole proprietors can’t hire employees or that they are required to file complex forms regularly. In truth, sole proprietors can hire staff, and while they have fewer filing requirements than corporations, they must still comply with local, state, and federal regulations.

Importance of the sole proprietor application form

The sole proprietor application form is a critical document for anyone looking to start a business as a sole proprietor. This form serves several key purposes, including legally registering the business name, distinguishing it from other businesses, and fulfilling state and local compliance requirements. By completing this form, you create a legal basis for operating your business, which is essential for taxation and personal liability.

Failing to file your sole proprietor application can lead to serious consequences, including potential fines, inability to legally conduct business, and a lack of protection against personal liability. The application form is a component of broader business registration requirements that vary by state but typically include obtaining licenses, permits, and even federal tax ID numbers. Properly filling out and submitting this form sets a foundation that ensures your business operates within legal bounds.

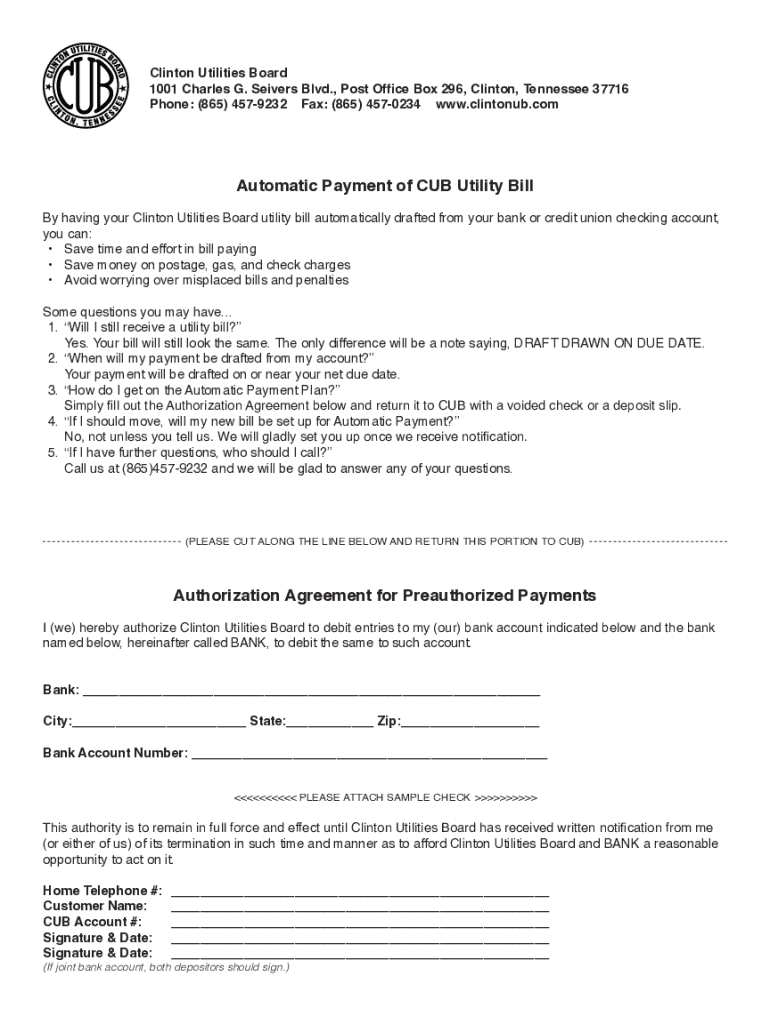

Step-by-step guide on filling out the business sole proprietor application form

Filling out the business sole proprietor application form is straightforward if you systematically approach the requirements. To get started, you need to gather important information that is essential for accurately completing the form.

With this information at hand, you can now proceed to complete the form. Each section is structured to collect specific details:

To ensure clarity and correctness in your application, avoid common errors such as misspellings, incorrect personal details, or omitting important information. It’s also helpful to have someone review the form before submitting it for a fresh perspective.

Editing and signing the application form with pdfFiller

Once your application form is filled out, using pdfFiller allows you to edit and ensure that all the information is accurate before submission. With pdfFiller, uploading your existing PDF form is easy, and you can make the necessary changes without starting from scratch, saving you time.

Editing features on pdfFiller enable simple adjustments to text and fields, making corrections a breeze. More importantly, you can electronically sign your application using pdfFiller's eSignature functionality. Here’s how:

Electronic signatures have legal validity in many jurisdictions, including the United States, ensuring that your signed application is compliant and recognized. As a result, you can proceed with confidence.

Submitting your sole proprietor application form

Once your sole proprietor application form is accurately completed and signed, it’s time to submit it. The submission process largely depends on your location and can vary significantly from state to state. Generally, you will first identify the appropriate agency for submission, often at the state or county level.

After submission, it's wise to track your application status. Knowing when to follow up is crucial. Depending on your state, application processing can take anywhere from a few days to several weeks. Understanding the approval timeline will help you manage expectations as you pave the way for your new business.

Maintaining compliance as a sole proprietor

As a sole proprietor, maintaining compliance with local regulations is essential for the continued success of your business. Keeping your business information updated—such as your contact details and business address—is crucial to avoid interruptions or legal issues. If you move locations or change your business name, be sure to update the necessary registration forms promptly.

Filing taxes correctly is another critical aspect. Your business income is reported on your personal tax return, meaning you have specific tax obligations as a sole proprietor. It's advisable to consult a tax professional to understand your filing requirements and deductions available to you. Furthermore, utilizing pdfFiller can simplify the tax filing process, allowing you to prepare and submit tax documents seamlessly.

By proactively managing your compliance and obligations, you can focus more on growing your business and serving your customers.

Common questions and troubleshooting

When navigating the sole proprietor application process, many individuals have similar questions. Common inquiries include understanding the repercussions of a rejected application or how to modify details after submission. If your application is rejected, reviewing the denial notice will provide insights into specific shortcomings. Generally, the agency will specify what changes are required to resubmit your application correctly.

If you realize changes are needed post-submission—like correcting a typo in your business name—it’s essential to contact the registering agency promptly to learn about their policies on amendments. Keeping a proactive communication line with your agency will serve you well as you navigate the formalities of establishing your business.

Interactive tools to simplify your application process

pdfFiller provides a range of interactive tools aimed at easing your application process. The platform not only facilitates document editing but also offers cloud storage to keep your important paperwork organized and easily accessible from any device. This feature is especially advantageous for individuals who might be working from varied locations during the startup phase of their business.

Utilizing a cloud-based platform allows you to collaborate with others on the application process efficiently. For instance, if you’re seeking assistance from a lawyer or accountant, you can share your documents with them securely, ensuring smooth communication and faster completion of your filing. Overall, the combination of features on pdfFiller enhances the efficiency of setting up your sole proprietorship, allowing you to focus on growing your venture.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business sole proprietor application in Gmail?

How do I make changes in business sole proprietor application?

How do I fill out business sole proprietor application using my mobile device?

What is business sole proprietor application?

Who is required to file business sole proprietor application?

How to fill out business sole proprietor application?

What is the purpose of business sole proprietor application?

What information must be reported on business sole proprietor application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.