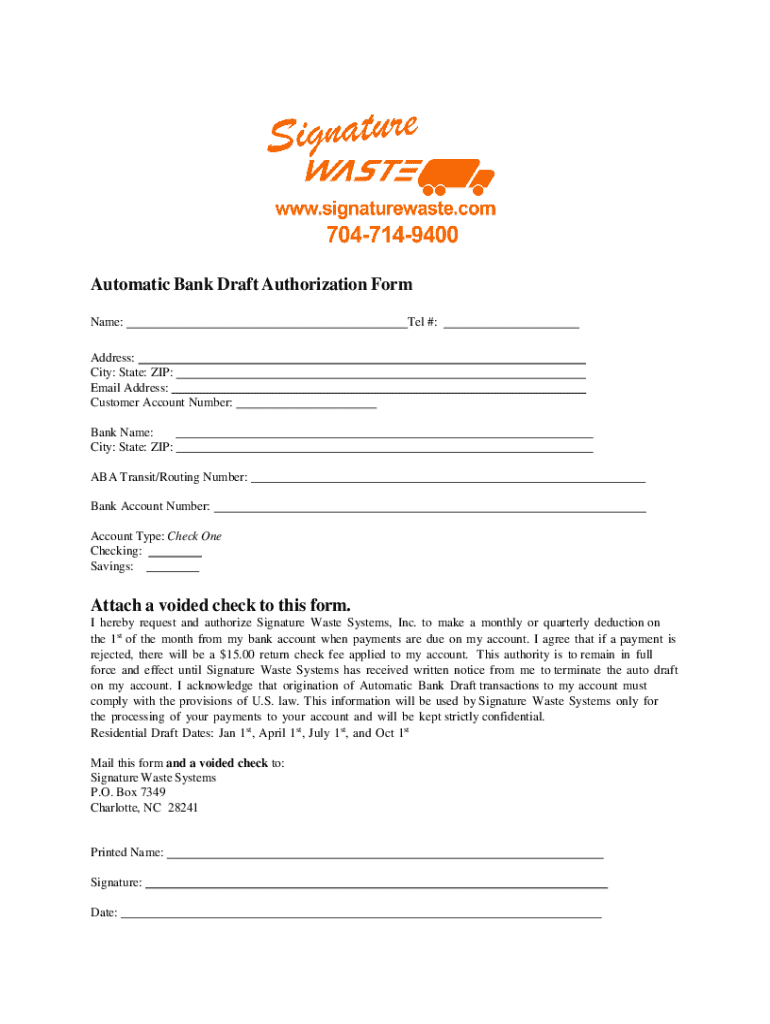

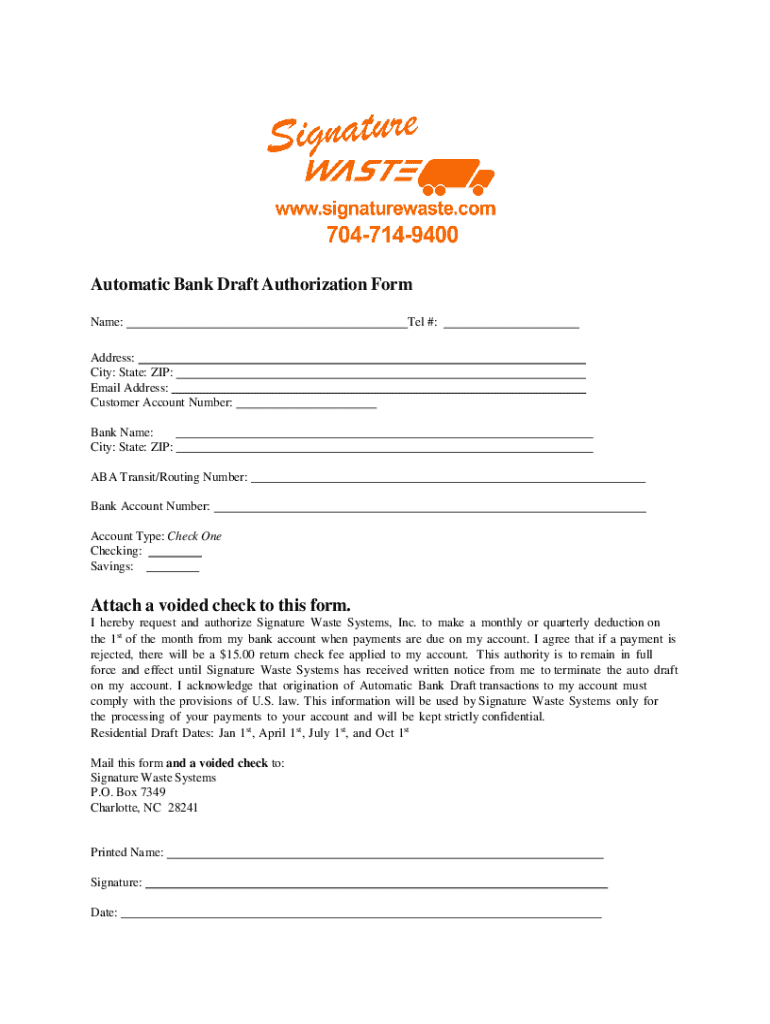

Get the free Automatic Bank Draft Authorization Form Attach a voided check ...

Get, Create, Make and Sign automatic bank draft authorization

How to edit automatic bank draft authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out automatic bank draft authorization

How to fill out automatic bank draft authorization

Who needs automatic bank draft authorization?

Understanding the Automatic Bank Draft Authorization Form

Understanding automatic bank drafts

An automatic bank draft is a financial arrangement that allows businesses or service providers to withdraw specified amounts from a bank account at scheduled intervals. This convenient method of managing recurring payments benefits both the payer and the payee by ensuring timely transactions without needing manual intervention.

Utilizing automatic bank drafts streamlines the payment process, helping individuals avoid late fees and ensuring continuous service from utility providers, subscription services, and more. For payees, it guarantees a more reliable cash flow, simplifying the accounting process.

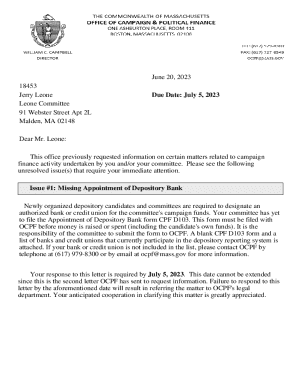

The purpose of an automatic bank draft authorization form

The automatic bank draft authorization form is essential for establishing a formal agreement between the account holder and the business provider. This form signifies the account holder's consent, allowing the company to withdraw funds directly from their bank account on specified dates.

Legally, this form serves as proof of authorization, which can protect both parties in case of disputes. By ensuring the authorization form is filled out correctly, users can maintain control over their finances while benefiting from automatic payments.

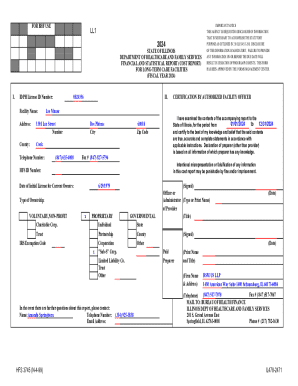

Step-by-step guide to filling out the authorization form

To properly complete an automatic bank draft authorization form, it's essential to gather all necessary information beforehand. Ensuring accuracy will help avoid mistakes that could hinder the drafting process.

Start by collecting your personal information, including your name, address, and any identification numbers required by the service renderer. You'll also need your bank account details, such as your account number and the bank's routing number.

Editing and customizing your authorization form

pdfFiller provides an excellent platform for editing and customizing your automatic bank draft authorization form. With its user-friendly interface, you can easily adapt your form to meet specific requirements or preferences.

Using pdfFiller allows you to modify text, add your logos or branding, and ensure the template is suited to your needs. Here's a brief step-by-step tutorial to help you navigate the customization process smoothly.

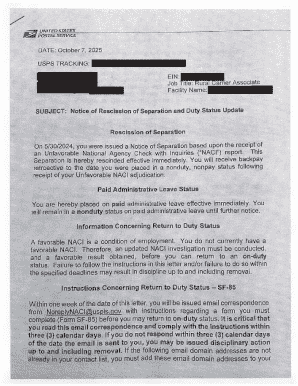

Submitting and managing your authorization form

Once your automatic bank draft authorization form is complete, it’s important to submit it through the appropriate channels, ensuring your bank and service provider receive it promptly. Depending on the organization, you may have several submission methods available.

You can typically submit the form via email, postal mail, or in person at your service provider's office. It's critical to confirm that your authorization has been processed, so consider requesting a confirmation of receipt or monitoring your bank transactions.

Troubleshooting common issues

Filling out the automatic bank draft authorization form can sometimes lead to small errors that result in payment issues. The most common mistake is providing incomplete or incorrect information, such as missing signatures or inaccurate bank details.

If a payment fails due to a processing error, the first step is to review your form for any mistakes. Once corrections are made, contact your bank to address failures promptly.

Maintaining your automatic bank drafts

It’s essential to periodically review your automatic bank drafts to ensure they still align with your financial goals. Regularly checking your bank statements not only helps monitor outgoing payments but also enables you to make adjustments when necessary.

If you need to update the terms of your authorization or cancel an automatic draft, it’s crucial to follow the correct procedures to avoid disruptions in services.

Security considerations

Maintaining the integrity of your bank information is crucial when engaging in automatic bank drafts. Safeguard your personal details by ensuring that any authorization form is shared only with trusted companies and keeps your financial information secured.

Moreover, remain vigilant against potential scams involving automatic bank debits. Awareness of common red flags can help protect your finances and enable you to act quickly in case of suspicious activity.

Conclusion of the process

The automatic bank draft authorization form is a powerful tool for managing your recurring payments efficiently. By utilizing this form, users can streamline their financial management process and maintain better control over their expenses.

pdfFiller plays a vital role in this process, providing a comprehensive, cloud-based platform that empowers users to edit PDFs, securely eSign documents, and collaborate with ease. With pdfFiller, navigating the intricacies of the automatic bank draft authorization form becomes a seamless experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete automatic bank draft authorization online?

How do I edit automatic bank draft authorization in Chrome?

Can I create an electronic signature for the automatic bank draft authorization in Chrome?

What is automatic bank draft authorization?

Who is required to file automatic bank draft authorization?

How to fill out automatic bank draft authorization?

What is the purpose of automatic bank draft authorization?

What information must be reported on automatic bank draft authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.