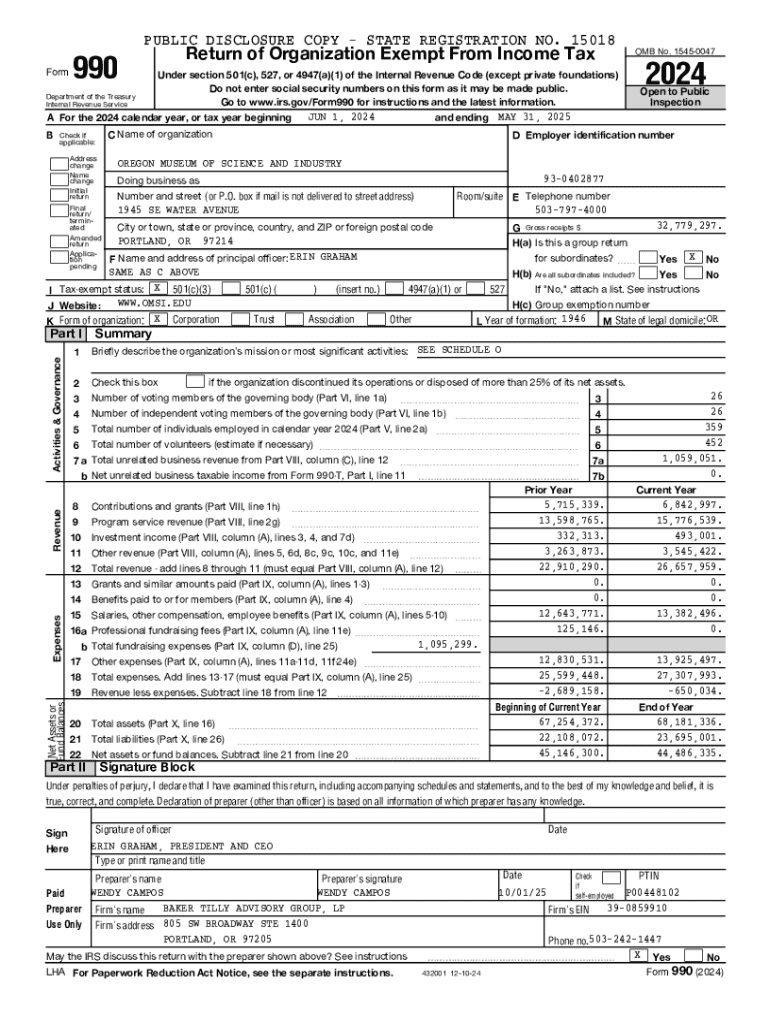

Get the free 011-03 - Public Disclosure Copy 2024 Form 990 (81231 - MAY 2025 - TAX 990 5/31/2025 ...

Get, Create, Make and Sign 011-03 - public disclosure

How to edit 011-03 - public disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 011-03 - public disclosure

How to fill out 011-03 - public disclosure

Who needs 011-03 - public disclosure?

Understanding the 011-03 Public Disclosure Form

Understanding the 011-03 public disclosure form

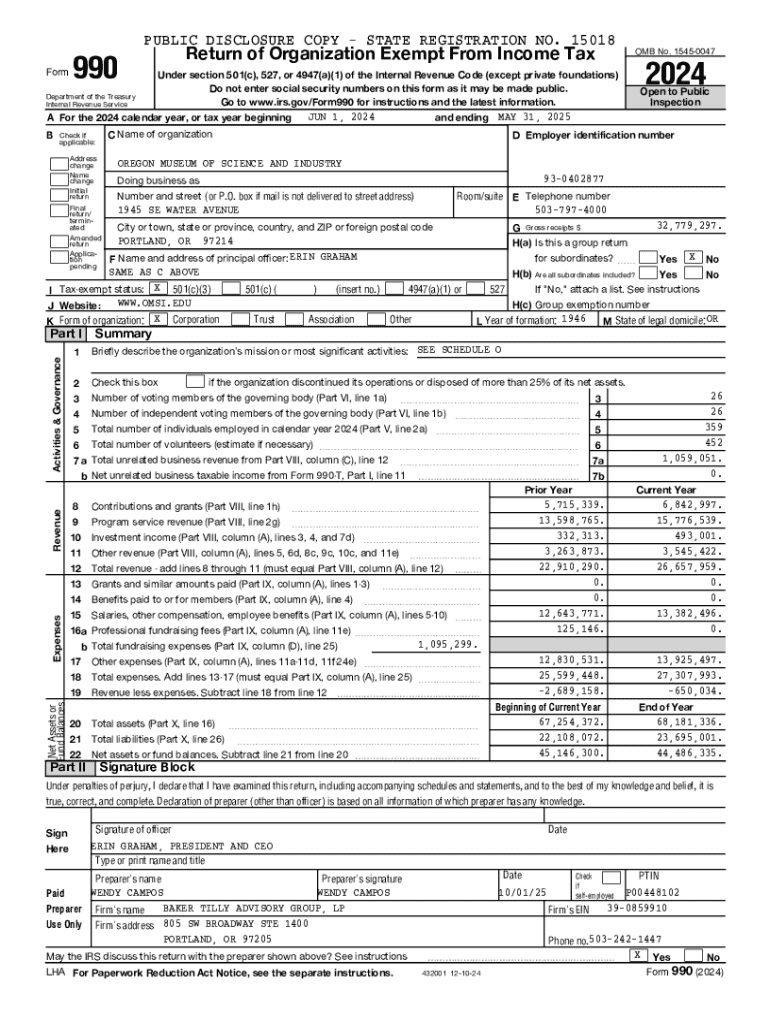

The 011-03 Public Disclosure Form is a critical document designed for public officials and certain employees in the United States, mandated to disclose financial and conflict-of-interest information. Its primary purpose is to promote transparency, ensuring that public servants' financial dealings do not interfere with their duties. The completion of this form is not just a procedural requirement; it is a reflection of a commitment to ethical governance and accountability in public service.

Public disclosure plays an essential role in fostering trust between government entities and the citizens they serve. By making financial affairs transparent, it helps to prevent corruption and conflicts of interest, thereby enhancing the integrity of governmental operations. Laws governing public disclosure vary by state and federal guidelines, necessitating compliance with specific protocols. In this context, understanding the nuances of the 011-03 form becomes crucial for compliance with these regulations.

Key features of the 011-03 public disclosure form

The 011-03 Public Disclosure Form comprises several key sections that serve various purposes. The essential fields typically include personal information, financial disclosures, and conflict of interest statements. Each section is crafted to elicit information necessary for evaluating potential ethical breaches. Users should be aware of the importance of accuracy in each of these sections to ensure their report reflects their true financial situation.

Common mistakes while completing the form can lead to complications or rejections of submissions. For instance, failing to provide complete financial disclosures or neglecting to include pertinent conflict of interest statements may render the form incomplete. Hence, an understanding of these critical areas is vital to avoid pitfalls that could harm one's career or lead to legal ramifications.

Step-by-step guide to completing the 011-03 public disclosure form

Completing the 011-03 Public Disclosure Form can appear daunting, but breaking it down into manageable steps simplifies the process. Start by gathering necessary documents and information such as identification documents, including a government-issued ID, and financial records, which may consist of income statements, property valuations, and bank statements. Having all documents ready facilitates a smoother completion of the form.

Next, you can access the form through official government websites or by utilizing digital document management platforms like pdfFiller. If you choose pdfFiller, you can conveniently find and fill out the 011-03 form online. After obtaining the form, fill out each section meticulously. As you go through, ensure that you enter data accurately, perhaps with the assistance of pdfFiller’s editing tools, which can help avoid common errors.

Tools and resources for managing the 011-03 public disclosure form

Leveraging digital solutions like pdfFiller can significantly enhance your experience in managing the 011-03 Public Disclosure Form. The platform allows for easy editing and signing, crucial for ensuring your document is complete and accurate. You can upload the form, edit it as needed, and utilize the eSigning capabilities for added convenience. This means you can sign the document electronically, which saves time and enhances security by reducing the physical handling of paperwork.

Moreover, if you are collaborating with team members or advisors, pdfFiller offers collaboration features that allow you to share the form with others efficiently. You can add comments, provide feedback, and make necessary adjustments in real-time, which streamlines the completion process. Such tools ensure everyone involved is aligned and informed about the status of the disclosure form.

Frequently asked questions about the 011-03 public disclosure form

Filing the 011-03 Public Disclosure Form can prompt several questions, especially concerning compliance and what happens if the filing is late. If you find yourself in a situation where the form is submitted after the deadline, it is crucial to understand that penalties may apply. Timely filings are essential, and late submissions can lead to inquiries or complications with your public service role.

Additionally, if corrections are required, knowing how to amend a submitted 011-03 Form is paramount. To do so, you typically need to prepare an amended disclosure and follow the same protocols as you would with a regular submission. Lastly, confidentiality and data privacy are significant considerations; understanding how your information is handled post-submission is crucial for protecting sensitive data.

Advanced tips for a smooth filing experience

To ensure a successful filing experience with the 011-03 Public Disclosure Form, being proactive can help immensely. Understanding the review process is essential; anticipate potential questions or issues that may arise from reviewers by double-checking your documentation for completeness and accuracy. Utilizing pdfFiller's integrated solutions can facilitate efficient management through their suite of features.

Moreover, staying updated on the submission status online can provide peace of mind. Knowing where your form stands in the review or processing phase can alleviate anxiety and help you prepare for any follow-up actions. Leveraging tools available through pdfFiller can also improve your overall experience, ensuring nothing is left to chance.

Case studies: Successful public disclosure filing

Real-world examples of individuals and entities completing the 011-03 Public Disclosure Form effectively can provide valuable insights. One notable scenario involved a local government employee who diligently followed all guidelines while filing the form. By gathering their financial information early and utilizing pdfFiller's editing features, they submitted their completed form on time and without errors. This diligent process not only safeguarded their position but also increased their credibility within the community.

Another case involved a non-profit organization that required its board members to file the 011-03 form. By holding a preparatory workshop addressing the form’s intricacies, they equipped their members with the knowledge and tools necessary for successful submission. This proactive measure not only ensured compliance but also fostered a culture of transparency and accountability within the organization, serving as an excellent best practice model for others.

Final thoughts on the importance of accurate disclosure

Accurate completion of the 011-03 Public Disclosure Form is more than just fulfilling a bureaucratic obligation; it is a commitment to transparency in governance. Public officials and employees play a significant role in maintaining the public's trust, which depends heavily on their integrity. By engaging with the disclosure process and ensuring accuracy, individuals contribute to a system that values accountability, ultimately benefiting society as a whole.

Encouraging all public servants to participate actively in this process is paramount. By understanding the essential aspects of the 011-03 form and leveraging tools like pdfFiller, they can navigate the complexities with ease. As we strive for accountable governance, let us recognize the power of transparency and the role each of us plays in reinforcing ethical standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 011-03 - public disclosure online?

How can I fill out 011-03 - public disclosure on an iOS device?

How do I fill out 011-03 - public disclosure on an Android device?

What is 011-03 - public disclosure?

Who is required to file 011-03 - public disclosure?

How to fill out 011-03 - public disclosure?

What is the purpose of 011-03 - public disclosure?

What information must be reported on 011-03 - public disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.