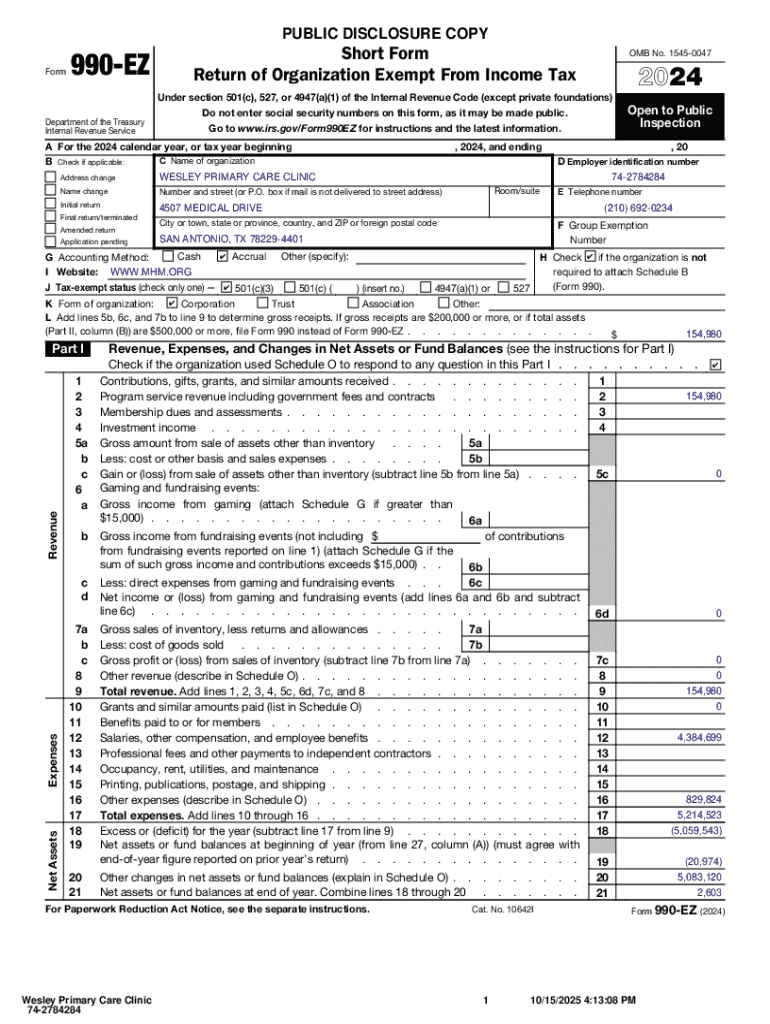

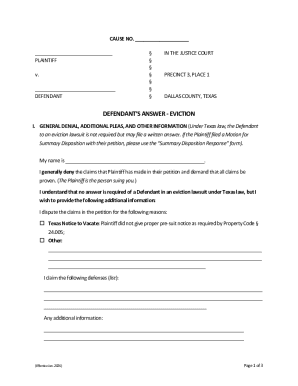

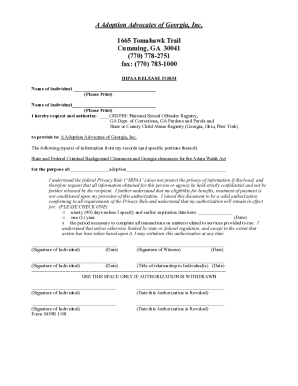

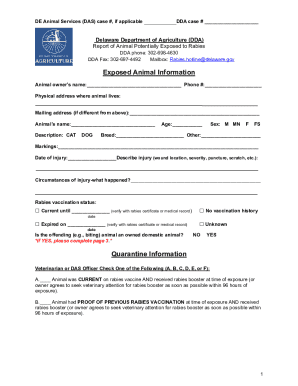

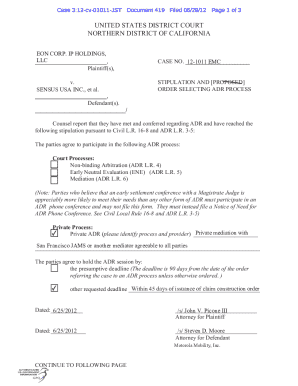

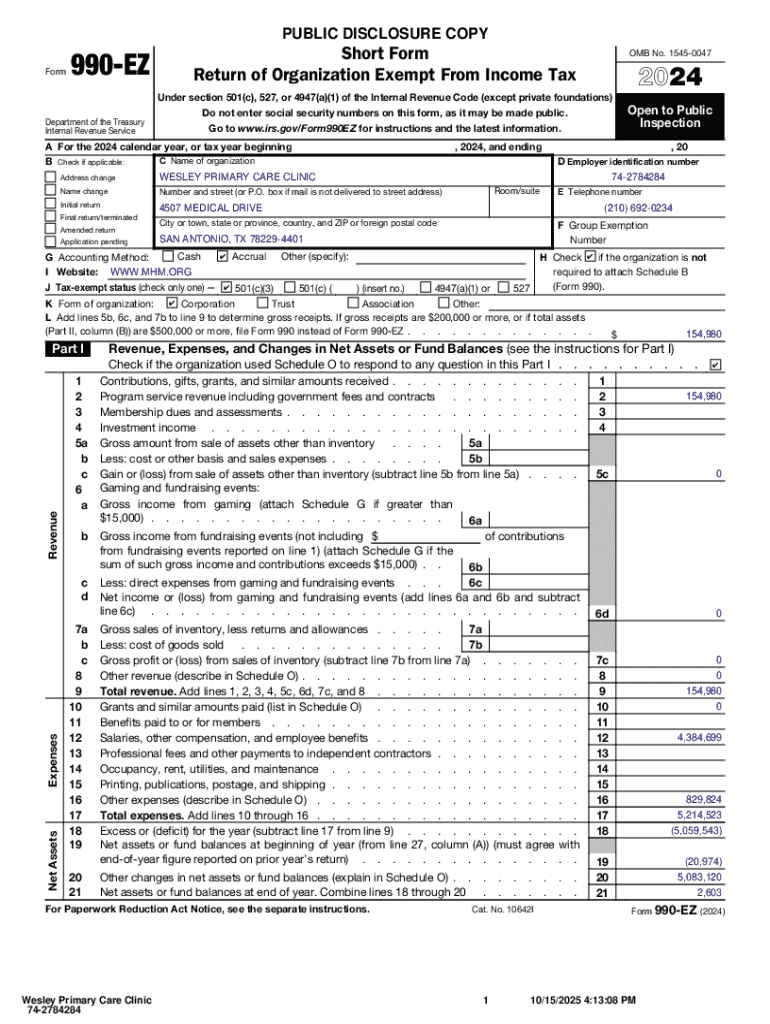

Get the free 2024 Public Disclosure Form: Wesley Primary Care Clinic ...

Get, Create, Make and Sign 2024 public disclosure form

How to edit 2024 public disclosure form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 public disclosure form

How to fill out 2024 public disclosure form

Who needs 2024 public disclosure form?

2024 Public Disclosure Form: A How-to Guide Long-read

Understanding the 2024 public disclosure form

The 2024 public disclosure form serves a critical role in ensuring transparency and compliance across various sectors. Essentially, this form is a declaration made by required entities detailing their financial and operational activities. By actively filing the public disclosure form, organizations contribute to accountability within their industries and adhere to regulatory mandates that foster trust and integrity.

Accurate public disclosure is paramount, as inaccuracies can lead to legal implications or loss of credibility. Companies and individuals must diligently detail all required disclosures to avoid potential scrutiny from authorities or the public. Failing to provide truthful or comprehensive information can result in significant penalties and a tarnished reputation.

Entities required to file the 2024 public disclosure form include corporations, partnerships, non-profits, and other organizations that meet specific revenue thresholds or operational criteria. It's essential for these filers to understand their obligations, as oversight may lead to affirmative legal actions or reputational damage, outlining the necessity for meticulous compliance.

Key revisions and updates for 2024

In 2024, significant revisions to the public disclosure form aim to streamline the filing process and enhance the clarity of information presented. One notable change is the introduction of new data fields that capture a broader range of organizational activities and financial transactions. This modification ensures that stakeholders receive a more comprehensive overview of an entity's operations and fiscal health than in previous years.

Filing entities must be aware of these updates, as they may affect data reporting and lead to adjustments in how organizations categorize their financial data. Additionally, new compliance guidelines have been established, which necessitate that filers verify the accuracy of their submissions more rigorously than before. Failure to adhere to these guidelines can result in higher scrutiny during audits or requests for further information.

The implementation of user-friendly digital features with the 2024 public disclosure form enhances user experience. Filers will find interactive fields within the forms, reducing the likelihood of errors when inputting data. The provisions for easier collaboration between team members handling the disclosures also streamline the overall process, reducing turnaround time for submissions.

Step-by-step guide to completing the 2024 public disclosure form

Filling out the 2024 public disclosure form may seem daunting at first, but with the right approach and organization, the process can be smooth and straightforward. Here’s a step-by-step guide to assist you through each crucial phase.

Interactive tools for form management

pdfFiller's platform is designed to empower users through advanced features that simplify the handling of public disclosure forms. Utilizing pdfFiller’s strengths can enhance your document creation experience, making it easier to craft and manage the 2024 public disclosure form effectively.

The platform includes powerful PDF editing tools that allow you to modify text, add annotations, and integrate images directly into your documents. Furthermore, eSignature options facilitate secure signing without the hassle of printing and scanning physical forms, thus expediting the submission process.

Collaborating with team members is seamless with pdfFiller, as multiple users can access and work on the form synchronously. Track changes and version history effortlessly to ensure all modifications are noted and can be reverted if necessary. This collaborative environment enhances the efficiency and accuracy of the process.

Frequently asked questions (FAQ) about the 2024 public disclosure form

Several common questions arise as filers navigate the specifics of the 2024 public disclosure form. Addressing these inquiries can provide clarity and guidance for users.

Contact information for assistance

For users seeking assistance, pdfFiller has dedicated support channels in place to address questions and issues regarding the 2024 public disclosure form. Whether through live chat, email support, or an extensive online help center, users can find the solutions they require.

Additionally, pdfFiller’s platform itself contains numerous resources to assist users in navigating the complexities of their forms. From video tutorials to comprehensive guides, users can explore a wealth of information to ensure a smooth filing experience.

Conclusion: Empowering your disclosure process

As the deadline for the 2024 public disclosure form approaches, it’s crucial to approach this process with confidence and attention to detail. By leveraging the resources and support provided by pdfFiller, you can simplify the complexities associated with filing and ensure accurate submissions.

Recap your learnings and the strategies discussed throughout this guide, and make a plan to utilize pdfFiller's tools for an efficient filing experience. Remember, taking the time to understand the requirements and utilizing interactive capabilities will lead to a smoother and more effective disclosure process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2024 public disclosure form straight from my smartphone?

How do I edit 2024 public disclosure form on an iOS device?

How do I edit 2024 public disclosure form on an Android device?

What is 2024 public disclosure form?

Who is required to file 2024 public disclosure form?

How to fill out 2024 public disclosure form?

What is the purpose of 2024 public disclosure form?

What information must be reported on 2024 public disclosure form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.