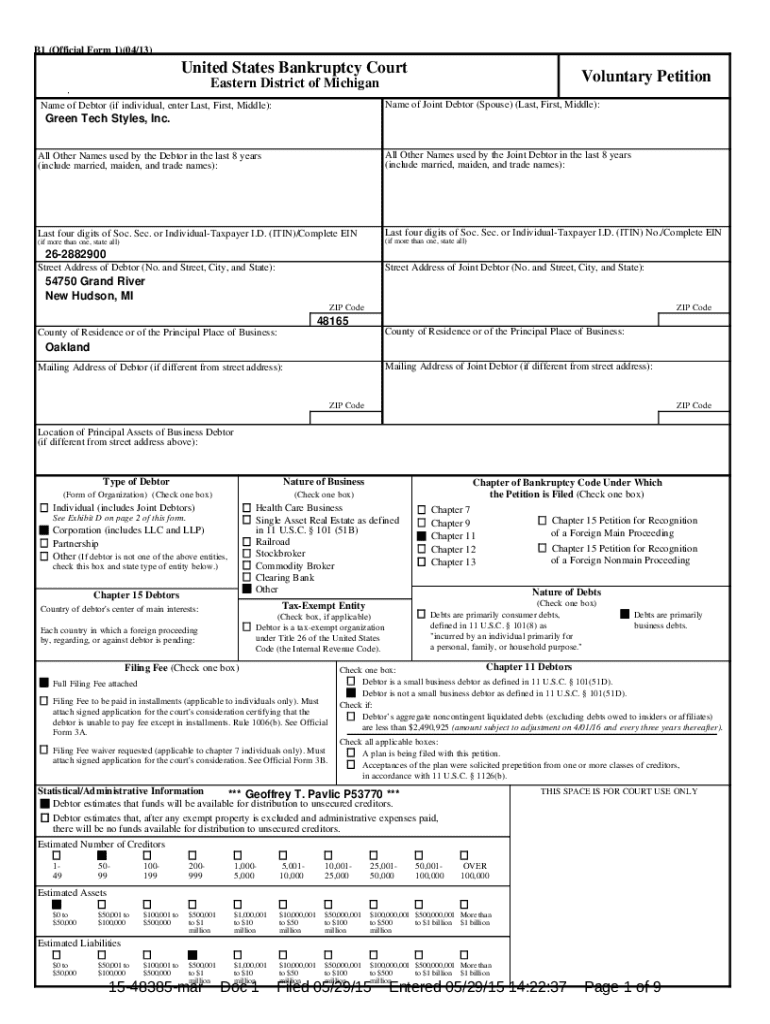

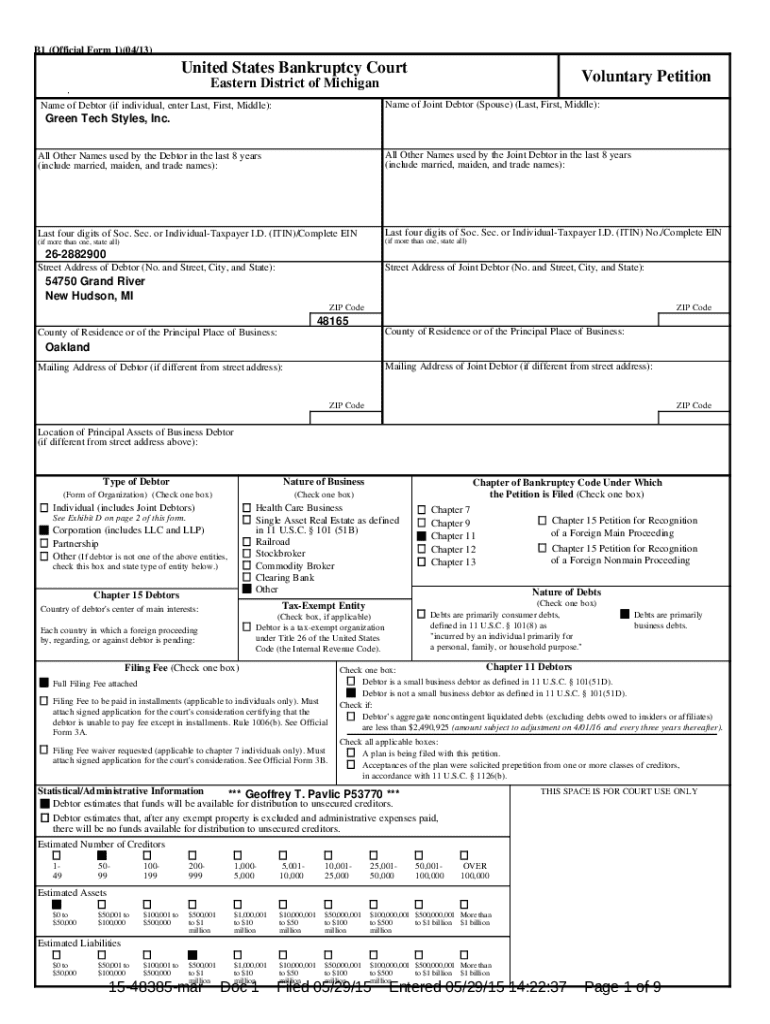

Get the free Bankruptcy Forms. Green Tech Styles, Inc. - Geoffrey T. Pavlic P53770

Get, Create, Make and Sign bankruptcy forms green tech

Editing bankruptcy forms green tech online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bankruptcy forms green tech

How to fill out bankruptcy forms green tech

Who needs bankruptcy forms green tech?

Bankruptcy Forms Green Tech Form: A Comprehensive Guide

Understanding bankruptcy: A quick overview

Bankruptcy serves as a legal relief mechanism for individuals and corporations overwhelmed by debt. It allows debtors to either eliminate or repay their debts under the protection of the bankruptcy court. This legal process holds significant importance as it provides a fresh financial start and organizes the process of debt repayment. When individuals or businesses file for bankruptcy, they can shield themselves from collection activities, repossessions, and garnishments.

Common reasons for filing include job loss, medical expenses, and poor financial management. In the corporate sector, companies may file for bankruptcy due to market downturns or excessive debt load. The two primary categories of bankruptcy are Chapter 7, which entails liquidation of assets to pay creditors, and Chapter 11, which allows for reorganization while retaining operational control. Chapter 13 is aimed at individuals with regular income, enabling them to create a plan to repay debts over time.

The role of green tech in bankruptcy

Green technology, or cleantech, encompasses innovations designed to mitigate environmental degradation and reduce carbon footprints. This sector is rapidly growing, driven by the increasing demand for sustainable solutions. However, green tech firms often face unique challenges, including high initial costs and fluctuating market conditions. As a result, they may find themselves in precarious financial situations, leading to bankruptcy filings.

Bankruptcy can offer green tech companies an opportunity for a reset. Companies can shed unsustainable business practices, reorganize operations, and focus on their core strengths. Furthermore, filing for bankruptcy can help protect tangible assets—like patents and proprietary technologies—that might otherwise be lost. The benefits of this process amplify as businesses frequently emerge from bankruptcy with clearer goals and revitalized approaches that cater better to market demands.

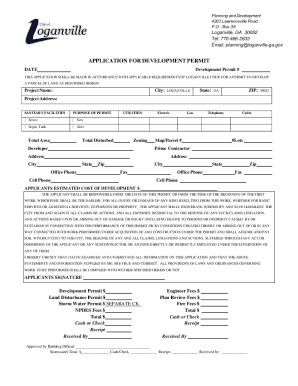

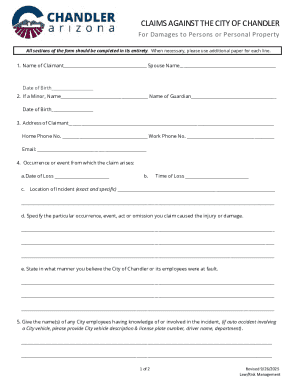

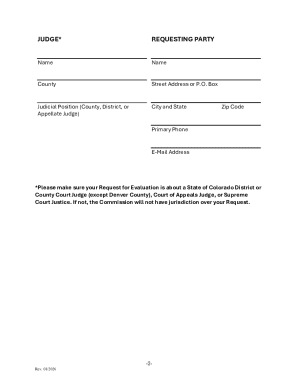

Essential bankruptcy forms for green tech firms

Navigating the bankruptcy process requires understanding specific forms mandated by the bankruptcy code. For green tech companies, there are essential forms that must be completed and submitted to the court.

Each of these forms plays a vital role in establishing the bankruptcy case's foundation and must be carefully completed to comply with legal requirements.

Step-by-step instructions for filling out bankruptcy forms

Before diving into the forms, it's crucial to prepare your financial documents. This includes gathering personal identification, recent tax returns, and statements for all outstanding debts and income. A clear understanding of your financial standing will guide you as you fill out bankruptcy forms.

Here's how to tackle each key bankruptcy form:

Ensuring accurate details on every form is paramount. Double-check entries to mitigate the risk of delays or complications in the process.

Interactive tools for form management

pdfFiller offers innovative tools that streamline the management of bankruptcy forms. Utilizing these tools can simplify the process, ensuring that documentation is accurate and well-organized.

The platform features robust options:

By leveraging these features, both individuals and teams can manage their bankruptcy documentation effectively, reducing errors and expediting the entire process.

Common mistakes to avoid when filing bankruptcy forms

Filing bankruptcy requires precision and attention to detail. Several common pitfalls can derail an otherwise smooth process:

Navigating these common issues proactively can significantly ease the bankruptcy filing process.

Frequently asked questions on bankruptcy forms

It is common to have questions surrounding the bankruptcy process. Here are answers to some frequently asked questions:

Understanding these aspects can prepare individuals and businesses for what lies ahead in their bankruptcy journey.

Additional considerations for green tech companies

Filing for bankruptcy affects not just finances; it influences operational spheres. Green tech companies must navigate the complex interplay between bankruptcy proceedings and their commitment to sustainable practices.

Post-bankruptcy strategies become crucial as businesses work to rebuild. Often, this involves re-evaluating stakeholder relations, particularly with suppliers, investors, and customers. Sustainability commitments should remain central to recovery strategies, ensuring compliance with existing environmental regulations while innovating for the future. Clear communication about the path forward promotes confidence among stakeholders.

Expert tips for successful bankruptcy management

Effective bankruptcy management hinges on diligent record keeping and timely communication. Maintain organized records that are accessible and up-to-date—a critical aspect that strengthens your case and protects your assets.

Proactively communicating with creditors can alleviate tensions and promote smoother negotiations. Establish regular check-ins to manage expectations. Additionally, engaging legal and financial advisors with experience in bankruptcy can provide invaluable support, ensuring compliance with legal requirements and sound financial advice during this turbulent period.

Maximizing pdfFiller to simplify the bankruptcy process

Leveraging a platform like pdfFiller can significantly streamline the bankruptcy filing process for green tech firms. With its cloud-based solutions, users enjoy quick access to essential forms, maximizing efficiency from anywhere.

Some of the remarkable benefits include:

In summary, utilizing such tools ensures effective management of bankruptcy documentation while promoting a successful recovery post-filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the bankruptcy forms green tech in Chrome?

How do I edit bankruptcy forms green tech straight from my smartphone?

How do I complete bankruptcy forms green tech on an iOS device?

What is bankruptcy forms green tech?

Who is required to file bankruptcy forms green tech?

How to fill out bankruptcy forms green tech?

What is the purpose of bankruptcy forms green tech?

What information must be reported on bankruptcy forms green tech?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.