Get the free Case 20-11370

Get, Create, Make and Sign case 20-11370

Editing case 20-11370 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out case 20-11370

How to fill out case 20-11370

Who needs case 20-11370?

Understanding and Navigating the Case 20-11370 Form: A Comprehensive Guide

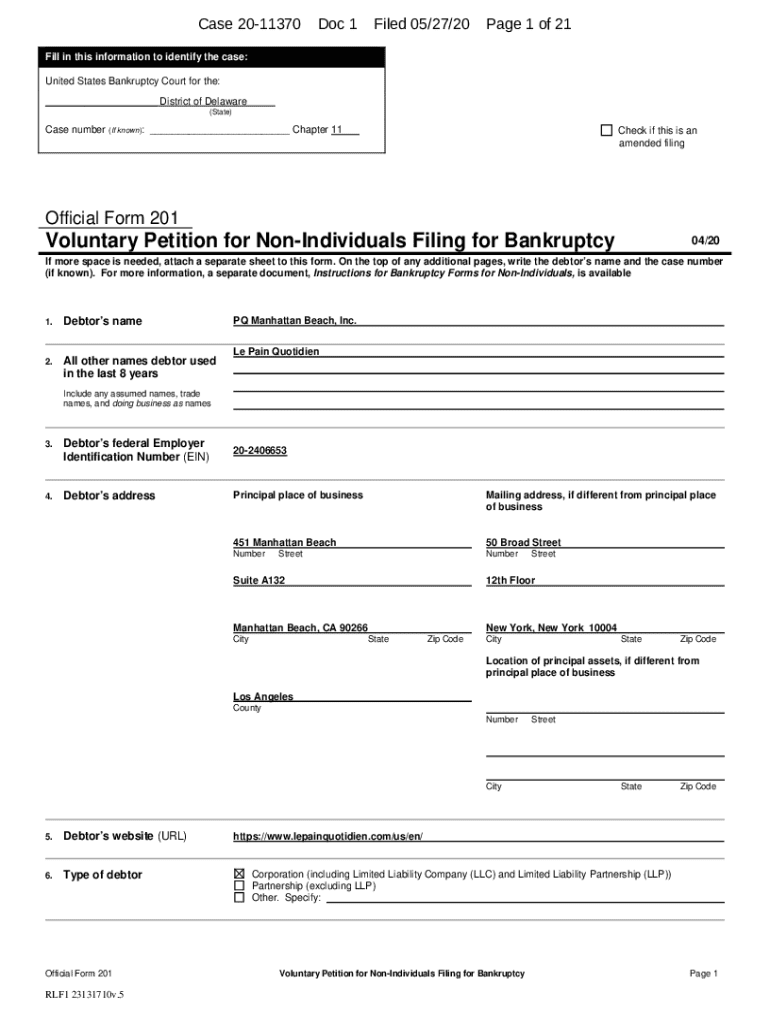

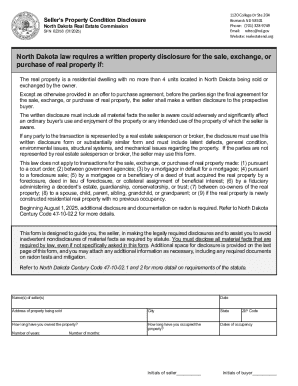

Understanding the case 20-11370 form

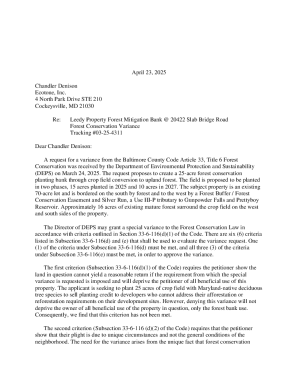

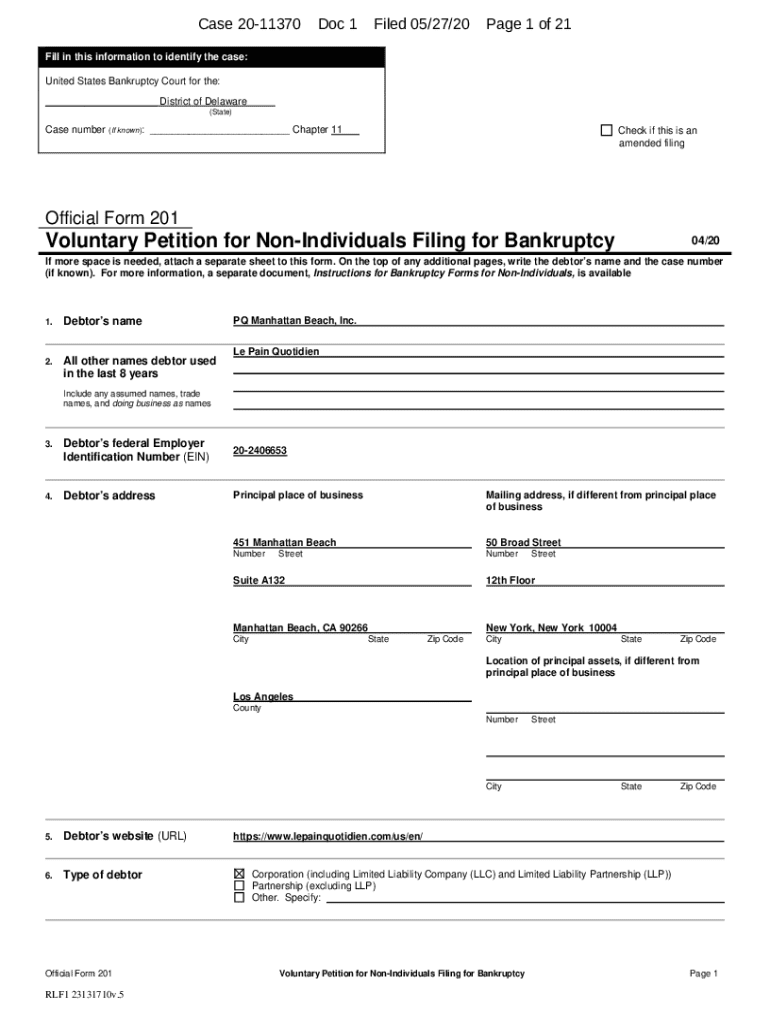

The Case 20-11370 Form serves as a crucial document within the realm of bankruptcy filings. It is specifically designed for individuals seeking relief through Chapter 11 of the bankruptcy code. This form encapsulates various details about the case and is pivotal for the court's overview and approval of the bankruptcy plan.

Understanding the intricacies of this form is essential, not only for compliance but also to facilitate the legal process efficiently. Filling out the form correctly ensures that all required information is provided, significantly reducing the chances for delays.

The Case 20-11370 Form is typically used by businesses and individuals looking to reorganize their debts while continuing operations. Those involved in financial distress need to utilize this document to articulate their case clearly to the bankruptcy court.

In instances where there's ambiguity in the form, it's critical to seek assistance and clarify any doubts before submission to avoid potential legal complications.

Key components of the case 20-11370 form

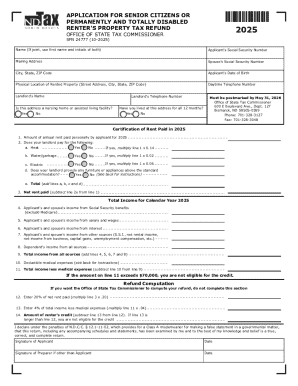

The Case 20-11370 Form encompasses several key sections that need to be completed accurately and thoroughly. Here's a breakdown of its structure and essential components:

Familiarity with these components and the terminology involved is crucial for anyone looking to navigate the complexities of the bankruptcy process successfully.

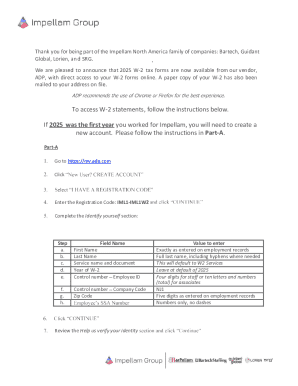

Step-by-step instructions for filling out the case 20-11370 form

Filling out the Case 20-11370 Form requires meticulous preparation and attention to detail. Here’s a structured approach to ensure you complete it accurately:

Once you've gathered your documents, you can move ahead with each section of the form.

Detailed guide to each section

Avoiding common mistakes is equally important, such as incomplete sections or missing documentation, which can significantly hinder the submission process.

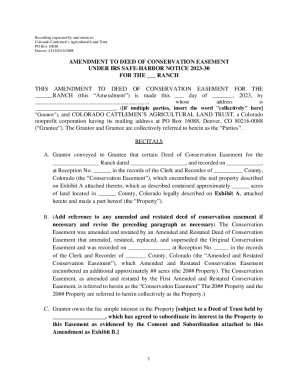

Editing your case 20-11370 form

Once you’ve filled out the Case 20-11370 Form, the editing process is crucial to ensure accuracy. Using tools like pdfFiller, you can efficiently edit and update your form.

After edits, it's vital to review the document thoroughly to ensure all changes have been made appropriately before signing.

Signing and approving the case 20-11370 form

Signing the Case 20-11370 Form can be done electronically using pdfFiller's eSign feature, enabling a straightforward and legally binding signature process.

Understanding the signing process can save time and help streamline your filing experience.

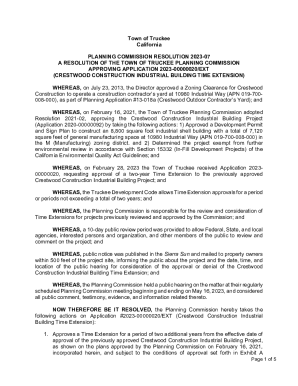

Managing and submitting your completed form

After filling out and signing the Case 20-11370 Form, submitting it correctly is the next crucial step. Choosing the appropriate submission method will depend on personal preferences and regional regulations.

It’s essential to track your submission status and maintain records to ensure accountability and transparency in the process.

Best practices for document security and management

When dealing with sensitive information related to the Case 20-11370 Form, security and document management become paramount. pdfFiller offers several features to help you maintain document integrity.

Being proactive in protecting your document can mitigate risks associated with data breaches and unauthorized access.

Troubleshooting common issues

Even after thorough preparations, issues may arise when completing the Case 20-11370 Form. Here's how to tackle them effectively:

An awareness of these potential hiccups can save time and ensure a smoother filing process.

Frequently asked questions about the case 20-11370 form

Navigating the complexities of the Case 20-11370 Form can lead to many questions. Here are some of the most common queries related to this form:

Being equipped with answers to these questions can empower you during the filing process.

Additional tools and resources

Beyond the Case 20-11370 Form, pdfFiller provides a suite of tools that enhance document management. Its cloud-based solutions foster collaboration and efficiency in handling various forms.

Leveraging these tools can facilitate a successful experience in handling the Case 20-11370 Form.

Case studies: success stories using the case 20-11370 form

Success stories shared by individuals and teams reveal how effectively navigating the Case 20-11370 Form can lead to successful outcomes in bankruptcy cases. For instance, many users have reported streamlined processes and faster resolutions thanks to the resources available on pdfFiller.

These narratives serve as powerful testimonials of how proper documentation and an understanding of legal processes can significantly ease the burdens of those in financial distress. Many individuals have recounted their stress being alleviated simply through organized document management and guidance provided.

Moreover, pdfFiller has empowered users to collaborate efficiently during this challenging time, making it easier to gather necessary documentation and feedback from advisors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get case 20-11370?

How do I complete case 20-11370 online?

How do I complete case 20-11370 on an Android device?

What is case 20-11370?

Who is required to file case 20-11370?

How to fill out case 20-11370?

What is the purpose of case 20-11370?

What information must be reported on case 20-11370?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.