Get the free 0001289419-25-000041. Form 10-K filed on 2025-02-28 for the period ending 2024-12-31

Get, Create, Make and Sign 0001289419-25-000041 form 10-k filed

Editing 0001289419-25-000041 form 10-k filed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 0001289419-25-000041 form 10-k filed

How to fill out 0001289419-25-000041 form 10-k filed

Who needs 0001289419-25-000041 form 10-k filed?

Comprehensive Guide to Form 0001289419-25-000041: Your Essential 10-K Filing Resource

Overview of the 10-K form

The 10-K form serves as a detailed annual report that publicly-traded companies file with the SEC. This comprehensive document includes important financial statements, insights into company operations, and potential risks that may affect business performance. The primary purpose of the 10-K is to provide shareholders and other stakeholders with a transparent overview of the company's financial health and future prospects.

Understanding its importance is vital for investors, as the 10-K reveals significant financial and operational insights that can drive investment decisions. The SEC mandates the 10-K filing annually, and timely submission is critical to avoid penalties.

Navigating the 10-K filing process

Completing the 10-K form requires a systematic approach. The first step is gathering all necessary financial data, which includes income statements, balance sheets, cash flow statements, and an understanding of accounting estimates related to revenues and expenses. Consistency is key to maintaining accurate documentation for reporting.

pdfFiller enhances this process by providing editing tools that streamline the documentation of figures and narratives. Users can easily input and adjust data within their templates, ensuring timely, accurate submissions while minimizing errors.

Common mistakes include underestimating the complexity of disclosures or failing to update previous filings with current information. Following best practices, such as keeping meticulous records throughout the year, can aid in avoiding these pitfalls.

Key sections of the 10-K form

A well-structured 10-K report features various sections that provide comprehensive insights into different aspects of the company. Key items include:

Each section provides vital information related to the company’s performance, operational strategy, litigation concerns, and various financial disclosures necessary for transparency in its operations.

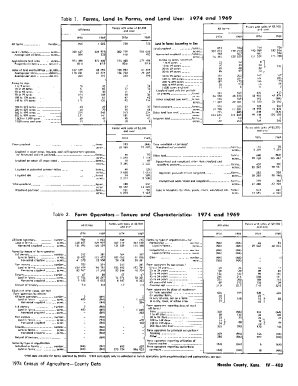

Analyzing financial information in the 10-K

Financial statements are the lifeblood of the 10-K form, presenting the quantitative data that investors depend on. Understanding both quantitative and qualitative disclosures is critical. Factors such as revenue trends, operating margins, and amortization expenses are pivotal in evaluating overall performance.

Management's Discussion and Analysis (MD&A) adds a qualitative element, allowing stakeholders to comprehend the rationale behind financial numbers. By evaluating this section, analysts can gain deeper insights into the company's direction, operational challenges, and strategies for future growth.

Navigating regulatory compliance

Compliance with SEC regulations is fundamental when submitting a 10-K form. Awareness of specific laws and regulations, such as the Sarbanes-Oxley Act, can help companies avoid common pitfalls that may occur during the filing process. Non-compliance can result in severe penalties.

Monitoring new legislation and guidance from the SEC will also assist in keeping filings accurate and current. Keeping abreast of changes ensures that the 10-K filing meets the latest standards, safeguarding against discrepancies.

Trends in 10-K filings

Recent transformations in 10-K reporting standards reflect a shift toward more digital and integrated approaches to financial reporting. Companies are increasingly leveraging technology to enhance the accuracy and efficiency of their filings. Automation tools are becoming standard, aiding in seamless data integration.

Looking ahead, we can anticipate more regulations tailored towards improving transparency and streamlining disclosures. The incorporation of artificial intelligence and machine learning could redefine how data is analyzed and reported, making it imperative for companies to stay updated on emerging technologies that could impact their reporting processes.

Leveraging pdfFiller for 10-K filing efficiency

pdfFiller acts as an invaluable resource for individuals and teams involved in the 10-K filing process. Its interactive tools facilitate document management, enabling users to gather, edit, and sign documents all from a centralized, cloud-based platform that enhances collaboration.

With real-time collaboration capabilities, teams can work together seamlessly, rectifying any issues before submission. The platform is designed for efficiency, allowing access from anywhere, ensuring that users can manage their filings effectively without being tethered to a specific location.

Case studies

Examining successful 10-K filings by prominent companies reveals valuable lessons in effective reporting. For instance, companies that adhere to best practices regarding transparency and comprehensiveness often earn greater trust from their stakeholders, leading to enhanced market value.

Conversely, organizations that submit incomplete or incorrect filings face auditor scrutiny and shareholder backlash. By learning from both successes and failures, businesses can refine their processes, ultimately leading to more reliable and effective financial reporting.

FAQs on form 10-K

Clarifying common queries surrounding the 10-K form helps alleviate confusion that many may face during the filing process. Notable questions often relate to deadlines, filing formats, and disclosure specifics. For instance, many are unaware that early submissions can enhance a company’s credibility, while standardized formats help maintain consistency.

Practical troubleshooting can also provide guidance; for instance, understanding the implications of filing errors can help circumvent potential issues down the line.

Preparing for future filings

Proactive record-keeping is paramount for any business aiming for smooth future 10-K filings. Keeping updated financial data and comprehensive records of transactions year-round can simplify the process during filing periods. Investment in accounting software can also significantly enhance accuracy and save time when preparing documents.

Furthermore, maintaining ongoing financial monitoring aids in delivering accurate reports in compliance with SEC regulations, allowing for continuous improvement of the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 0001289419-25-000041 form 10-k filed?

Can I create an electronic signature for the 0001289419-25-000041 form 10-k filed in Chrome?

How do I complete 0001289419-25-000041 form 10-k filed on an iOS device?

What is 0001289419-25-000041 form 10-k filed?

Who is required to file 0001289419-25-000041 form 10-k filed?

How to fill out 0001289419-25-000041 form 10-k filed?

What is the purpose of 0001289419-25-000041 form 10-k filed?

What information must be reported on 0001289419-25-000041 form 10-k filed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.