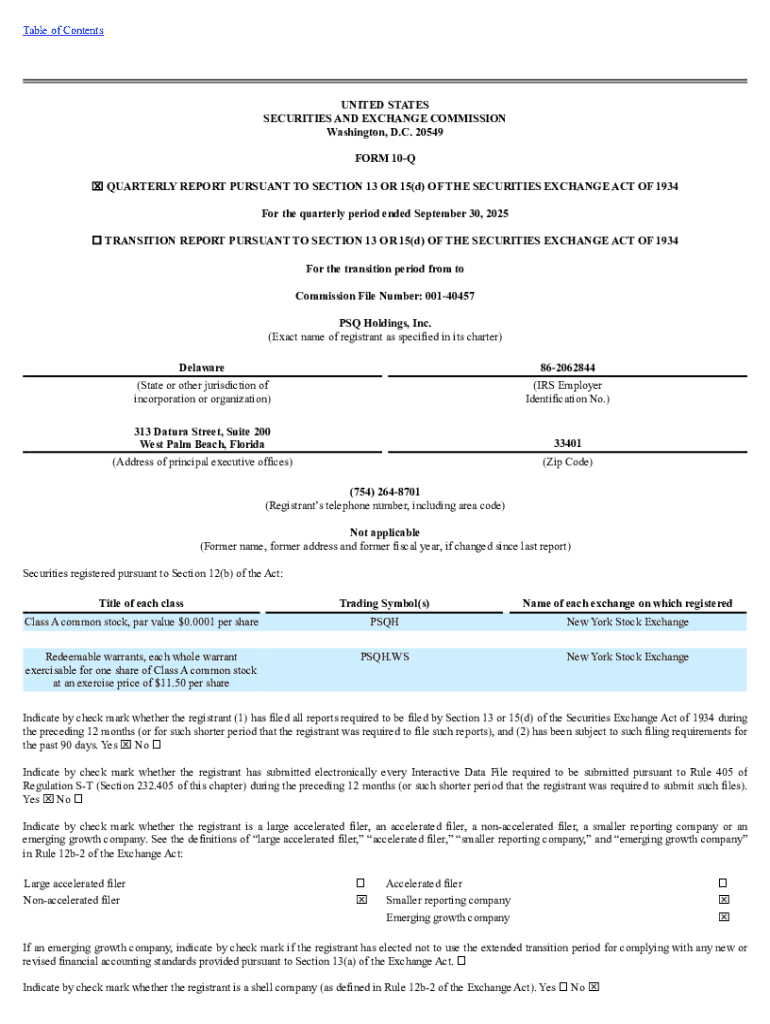

Get the free 0001847064-25-000010. Form 10-Q filed on 2025-11-06 for the period ending 2025-09-30

Get, Create, Make and Sign 0001847064-25-000010 form 10-q filed

How to edit 0001847064-25-000010 form 10-q filed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 0001847064-25-000010 form 10-q filed

How to fill out 0001847064-25-000010 form 10-q filed

Who needs 0001847064-25-000010 form 10-q filed?

0001847064-25-000010 Form 10-Q Filed Form

Understanding the 10-Q filing

Form 10-Q is a comprehensive, quarterly financial report that publicly traded companies must file with the Securities and Exchange Commission (SEC). This form provides essential insights into a company's financial performance, operations, and overall health during the fiscal quarter. Unlike annual reports—Form 10-Ks—10-Qs offer a more immediate snapshot of a company’s financial situation, thereby enabling stakeholders to track progress and trends in real-time.

The importance of quarterly reports, such as the 0001847064-25-000010 Form 10-Q, cannot be understated. They enhance transparency, giving investors and analysts critical information that impacts stock valuations and investment decisions. Notably, the distinction between 10-Q and 10-K forms lies primarily in their frequency—10-Qs are submitted quarterly, while 10-Ks are submitted annually, encompassing a broader range of comprehensive data including audited financials.

Key elements of the Form 10-Q

Form 10-Q contains several key components that offer crucial insights into a company’s financial health. One prominent section includes the condensed consolidated financial statements, which summarize financial positioning through income for the quarter along with expenses. These statements are essential at a glance for stakeholders to measure profitability and assess how well the company is managing its financial resources.

Moving beyond numbers, the Management Discussion and Analysis (MD&A) section provides qualitative insights. Here, management discusses performance trends, event impacts, and operational strategies affecting the financial results. This narrative often helps investors understand how specific market conditions or internal challenges are being navigated. Additionally, companies discuss their exposure to various risks in the Quantitative and Qualitative Disclosures about Market Risk section, analyzing risk factors such as credit revenue fluctuations and potential impact on future earnings.

Preparing your Form 10-Q

The preparation of the 0001847064-25-000010 Form 10-Q requires meticulous attention to detail. Step one involves gathering relevant financial data, where companies must collect accurate data from their internal financial statements. Ensuring the accuracy and completeness of this data is crucial because this information directly influences investor perception and regulatory compliance.

Next, drafting the Management Discussion and Analysis section is imperative. This means articulating key themes and insights in an easily digestible format, highlighting significant changes, revenue, and marketing expenses that shaped the quarter's results. Finally, a thorough review and compliance check should be conducted. Checklists can assist in ensuring regulatory requirements are met, and involving both legal and financial advisors will help in achieving necessary scrutiny before submission.

Filing process for the 10-Q

Filing the 0001847064-25-000010 Form 10-Q is done electronically through the SEC's EDGAR system. The process is relatively straightforward but requires attention to detail to avoid common pitfalls. Following a step-by-step guide through EDGAR will ensure all necessary components are submitted correctly. These include the financial statements, MD&A, and disclosures required by regulatory frameworks.

Understanding filing deadlines is crucial as companies must adhere to certain timelines based on their size and reporting history. The deadlines for the submission of the Form 10-Q can vary; typically, larger companies must file their reports within 40 days after a quarter’s end, while smaller companies often have an additional 30 days. Timely submissions are critical to avoid penalties and maintain investor confidence.

Understanding the impact of delayed filings

Delays in filing the Form 10-Q can have significant ramifications. Companies risk facing regulatory scrutiny, which could lead to fines or restrictions on trading. More importantly, late filings can erode investor trust and confidence, possibly leading to a decline in stock price. The reputational damage caused by late filings can diminish a company's market position, especially in competitive sectors like fintech.

Beyond regulatory consequences, timely filings are essential for maintaining transparency with investors. Delayed financial reports can leave shareholders second-guessing management’s decisions and the company’s overall financial health. Consequently, communication is key; companies should proactively engage with investors to explain any potential delays and reassure them about the financial status to mitigate concerns.

Real-world examples of 10-Q filings

Examining notable 10-Q submissions can yield valuable insights into their effects on company valuation and investor relations. One example might include a company in the fintech sector that reported strong third-quarter financial results, exceeding revenue guidance. This type of report generally boosts investor confidence and can lead to a jump in stock prices, reinforcing trust in management’s capabilities.

Conversely, there are also compelling case studies where companies faced challenges due to poor performance disclosed in their 10-Q filings. For instance, if a company reported growing marketing expenses along with declining revenues, it could cause alarm among investors, leading to stock sell-offs. The lessons from both successes and failures surrounding 10-Q filings highlight the importance of accurate financial reporting and effective communication strategies.

Tools and resources for managing your 10-Q

Utilizing tools such as pdfFiller's document management solutions can significantly streamline the preparation of the 10-Q. With features that enhance editing, e-signing, and collaboration, companies can effectively manage their document workflows while ensuring compliance with intricacies in reporting requirements. These resources allow finance teams to focus more on the content of their reports rather than the mechanics of document creation.

Interactive checklists and customizable templates available on pdfFiller can also enhance clarity and consistency during the filing process. By guiding users through each section of the 10-Q, such tools assist in ensuring that all necessary information is addressed correctly. This approach not only saves time but also improves accuracy, ultimately contributing to more transparent reporting practices.

FAQs about Form 10-Q

Many users have questions regarding the filing requirements associated with Form 10-Q. Common inquiries involve the specifics of what constitutes 'material' information necessitating disclosure. For instance, companies are often required to detail any significant changes in accounting policies or pending legal proceedings that may substantially impact financial performance.

Additional questions may arise about terminology used within the 10-Q, such as 'accelerated filer' or 'large accelerated filer.' These terms refer to companies’ filing status, influencing submission timelines. Resources for further assistance are readily available within the SEC website, as well as platforms like pdfFiller, which provide helpful guides and clarifications.

Additional considerations for investors

Investors looking to make informed decisions should focus on key metrics and figures within 10-Q filings. For instance, understanding revenue segments, especially payments revenue and credit revenue from the credit business, can reveal company trends that signal stronger growth or highlight challenging areas. Investors should closely scrutinize fluctuations in revenues and expenses reported in quarterly results to better assess organizational health.

Additionally, understanding the broader implications of a company's financial outlook beyond just the current quarter is essential. This can shed light on potential market movements and overall economic conditions, particularly in sectors like fintech, where trends rapidly change. Interpreting 10-Q filings effectively can empower investors to align their strategies with industry momentum, thereby maximizing their investment outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 0001847064-25-000010 form 10-q filed to be eSigned by others?

Where do I find 0001847064-25-000010 form 10-q filed?

Can I sign the 0001847064-25-000010 form 10-q filed electronically in Chrome?

What is 0001847064-25-000010 form 10-q filed?

Who is required to file 0001847064-25-000010 form 10-q filed?

How to fill out 0001847064-25-000010 form 10-q filed?

What is the purpose of 0001847064-25-000010 form 10-q filed?

What information must be reported on 0001847064-25-000010 form 10-q filed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.