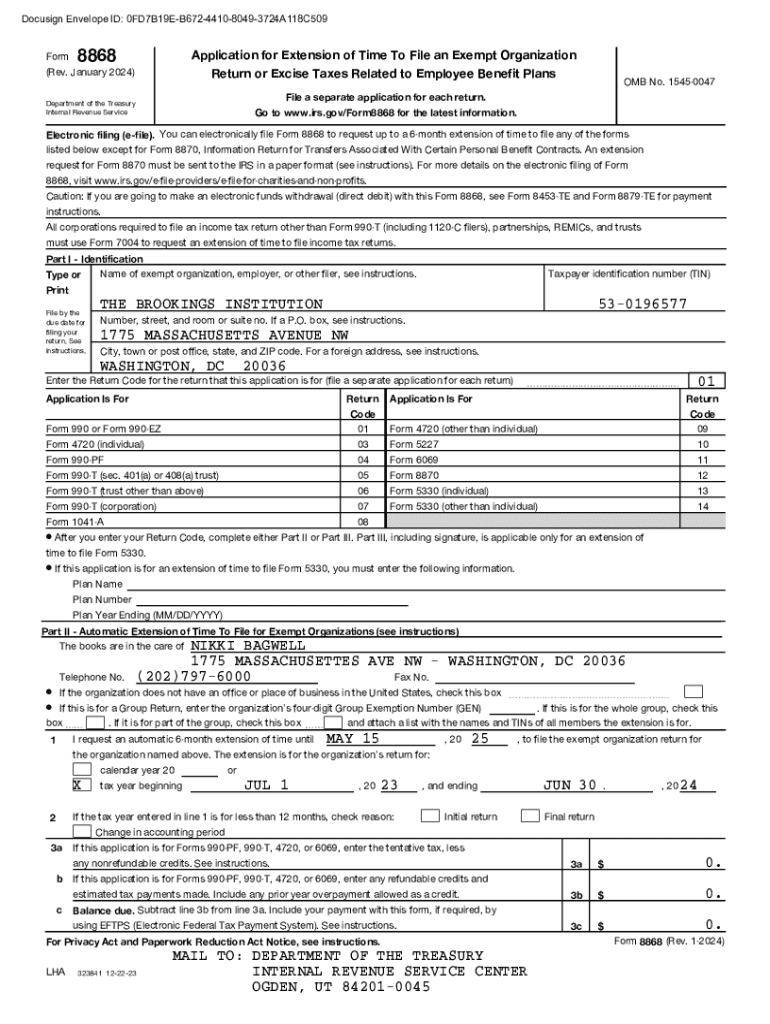

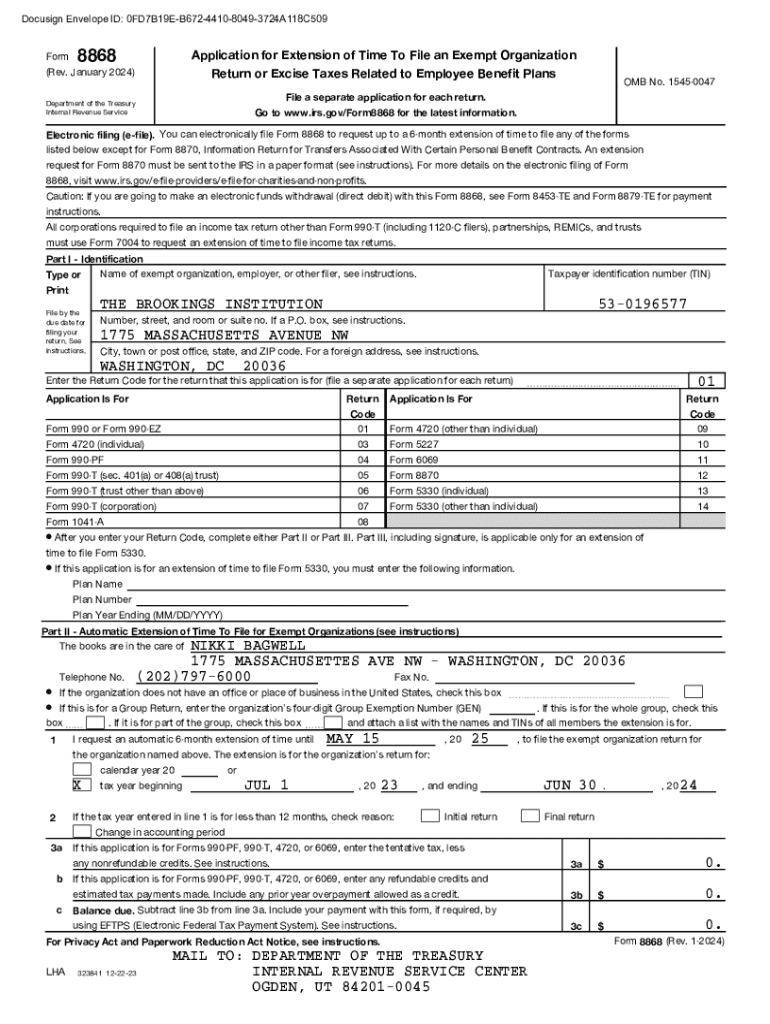

Get the free You can electronically file Form 8868 to request up to a 6-month extension of time t...

Get, Create, Make and Sign you can electronically file

How to edit you can electronically file online

Uncompromising security for your PDF editing and eSignature needs

How to fill out you can electronically file

How to fill out you can electronically file

Who needs you can electronically file?

You can electronically file form

Understanding electronic filing

Electronic filing, commonly referred to as e-filing, represents a method of submitting documents via the internet instead of using traditional paper forms. This approach has gained traction due to advancements in technology, making it easier for individuals and businesses alike to handle document submissions without the hassle of mailing physical copies.

The benefits of electronically filing forms extend beyond mere convenience. Let's explore some key advantages:

Types of forms eligible for electronic filing

A wide array of forms can be electronically filed, streamlining processes across various sectors. Some common examples include:

It's important to note, however, that some forms may require additional steps for compliance with state and federal regulations. Always verify eligibility before proceeding.

Getting started with electronic filing

Before you can electronically file a form, there are several prerequisites you'll need to address. First, gather all necessary documents related to your filing; for instance, tax-related filings might require information from your long-term care or health savings account.

Understanding e-filing requirements is critical, as each form may have specific guidelines. Choosing the right platform to aid your submissions can make a significant difference.

When selecting e-filing software, pdfFiller stands out with its array of benefits. This platform allows you to edit PDFs, eSign documents, and manage files from any location. Look for features like easy navigation, a vast library of templates, and robust security measures when making your choice.

Step-by-step guide to electronic filing

To successfully electronically file a form, follow these steps:

Advanced features to simplify your experience

Once you've mastered the basics of electronic filing, you'll discover advanced features that enhance your experience. Collaborating with team members is easy on pdfFiller, allowing you to share forms seamlessly within the platform.

Efficiently importing data can significantly streamline the process. With the ability to use templates, you can make repeated tasks much quicker. Moreover, automated reminders ensure you never miss important deadlines, keeping your filings on track.

The flexibility of accessing your documents anytime, anywhere reinforces the convenience of electronic filing, allowing for productivity to thrive even when on the go.

Common mistakes to avoid when electronically filing

While electronic filing makes the process more accessible, there are common pitfalls that can lead to complications. Errors in form completion can lead to delays or rejections, so it’s critical to enter information accurately.

Another frequent mistake is failing to verify submission receipts, which can result in missed deadlines. Additionally, overlooking state-specific requirements might cause unnecessary complications.

FAQs on electronic filing

As you navigate electronic filing, several common questions often arise:

Expert tips for smooth electronic filing

Preparation is key when it comes to electronic filing. Start gathering your documents well in advance of important deadlines, especially during tax season.

Stay informed about the latest IRS regulations to avoid penalties related to filing errors. Leverage resources provided by pdfFiller for support in navigating the e-filing landscape. Their guides and help center can be invaluable in assisting you through complex processes.

Conclusion: Embracing the future of document management

Embracing electronic filing is not just about convenience; it signifies a shift towards more efficient management of documents in our increasingly digital world. As technology continues to evolve, platforms like pdfFiller will empower users to handle their document needs effortlessly, offering a more sustainable and secure approach to filing forms.

By harnessing the capabilities provided through electronic filing, you position yourself and your organization ahead of the curve, simplifying the process and paving the way for future innovations in document handling.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get you can electronically file?

Can I create an electronic signature for signing my you can electronically file in Gmail?

Can I edit you can electronically file on an iOS device?

What is you can electronically file?

Who is required to file you can electronically file?

How to fill out you can electronically file?

What is the purpose of you can electronically file?

What information must be reported on you can electronically file?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.