Get the free 2024 Tax Documents - Fields Accounting & Tax

Get, Create, Make and Sign 2024 tax documents

Editing 2024 tax documents online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 tax documents

How to fill out 2024 tax documents

Who needs 2024 tax documents?

A comprehensive guide to the 2024 tax documents form

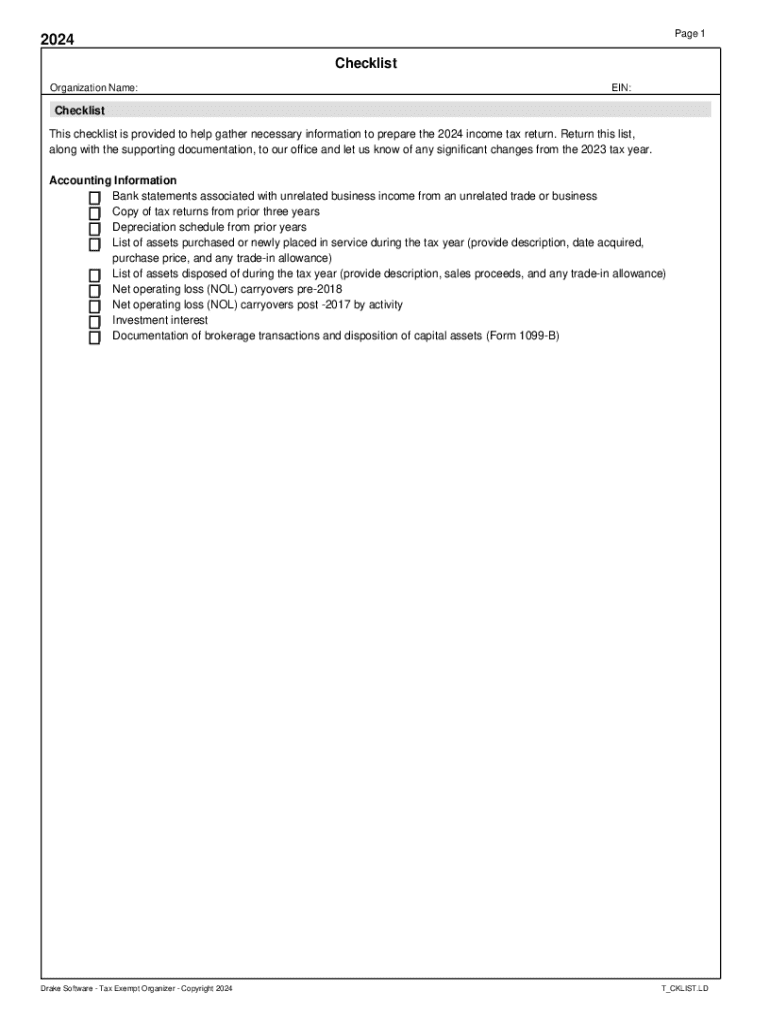

Understanding the 2024 tax documents form

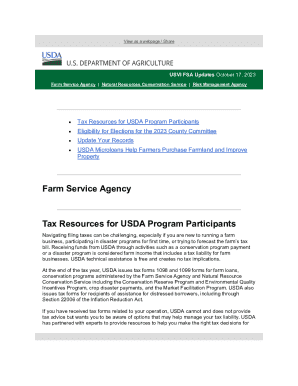

The 2024 tax documents form serves as a crucial tool for both individuals and businesses to accurately report their financial activities to the IRS. This form is essential for compliance, ensuring that filers do not miss critical deductions and credits that could significantly reduce their tax liability.

The importance of accurate tax documentation cannot be overstated. Mistakes or omissions can lead to audits, penalties, or delays in refunds. Therefore, understanding the structure and requirements of the 2024 tax documents form is vital for anyone engaging in the filing process.

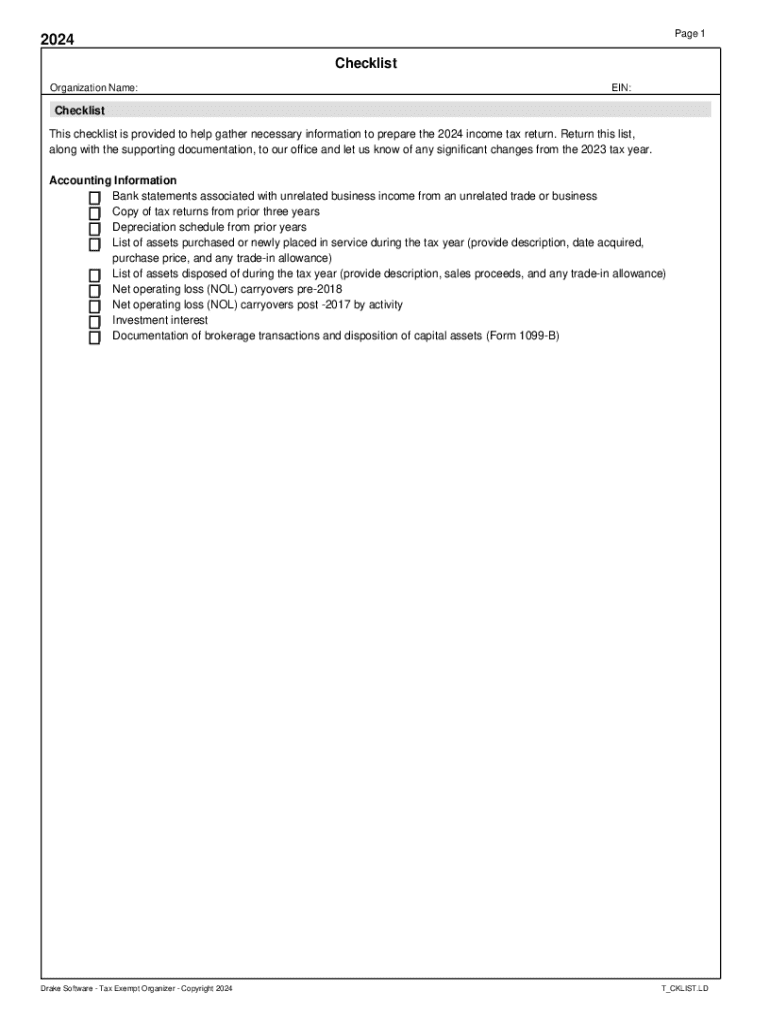

Essential components of the 2024 tax documents form

The 2024 tax documents form includes several essential components that must be accurately filled out. Understanding these components is critical for maximizing tax efficiency.

Required information generally comprises personal identification details, income reporting particulars, and specifics regarding deductions and credits. Each section demands careful attention to avoid common pitfalls.

Common mistakes to avoid include incorrect Social Security numbers, misreporting income, and overlooking available deductions. Each of these errors can lead to significant complications.

Step-by-step guide to completing the form

Completing the 2024 tax documents form can be streamlined effectively with a systematic approach. Start by determining if you will be using a pre-filled form, which can save you considerable time and effort.

If opting for manual entry, break down each section methodically to ensure nothing is overlooked.

For ensuring accuracy and completeness, double-check every entry, use calculators for complex figures, and consider consulting with a tax professional if needed.

Utilizing pdfFiller for your 2024 tax documents

pdfFiller offers a range of features designed to make the filing process as straightforward as possible. With powerful tools to edit PDFs, eSign documents, and collaborate with others, it transforms how users manage their tax documents.

To access the 2024 tax documents form in pdfFiller, simply navigate to their template library and search for the relevant form. The interface is user-friendly, allowing you to find the document you need quickly.

Editing and customizing your 2024 tax documents form

With pdfFiller, you can easily upload your tax documents and begin making necessary edits. This allows you to tailor the form to your specific circumstances, which is particularly beneficial for those with complex financial situations.

The editing process is intuitive: select the area you want to modify, make your changes, and immediately see the impact on the document. Adding signatures and dates is also straightforward, making it simple to finalize your form.

eSigning your 2024 tax documents form

The eSigning process with pdfFiller is designed to be simple and efficient. Understanding how to sign documents electronically ensures that you meet all legal requirements for submission without the need for physical paperwork.

You can validate signatures easily within the platform, giving peace of mind that your form will be processed timely and securely.

Managing and storing your 2024 tax documents

Once your 2024 tax documents form is completed, managing and storing your documents efficiently is crucial. pdfFiller provides a robust solution for organizing your tax documentation securely.

You can easily access previous tax years and keep all your documentation in one secure location, which simplifies filing in subsequent years.

FAQs about the 2024 tax documents form

Navigating the 2024 tax documents form can raise several questions. Understanding common queries can help alleviate concerns and streamline the filing process.

For instance, if you make a mistake on your form, there are specific steps you can take to amend your filing, ensuring you stay compliant with IRS regulations.

Join the pdfFiller community

Engagement with the pdfFiller community offers tremendous benefits. By connecting with other users, you can discover tips, tricks, and best practices to ensure you are maximizing the use of the 2024 tax documents form.

Accessing support resources through pdfFiller also enhances your filing experience. You can share your experiences, find solutions to common problems, and engage in collaborative efforts for improved efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the 2024 tax documents electronically in Chrome?

How can I edit 2024 tax documents on a smartphone?

How do I edit 2024 tax documents on an iOS device?

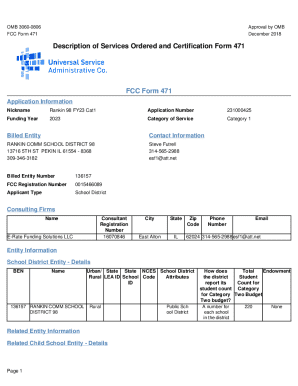

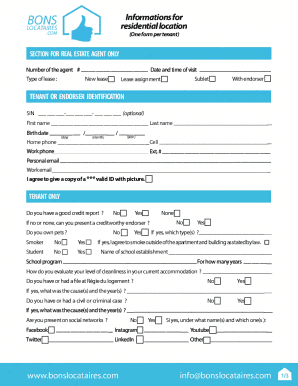

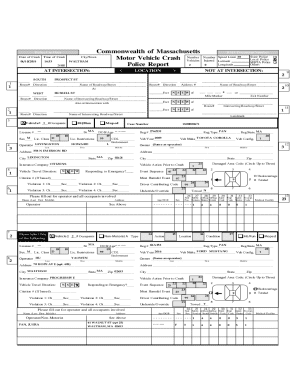

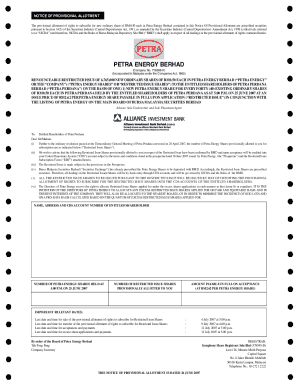

What is 2024 tax documents?

Who is required to file 2024 tax documents?

How to fill out 2024 tax documents?

What is the purpose of 2024 tax documents?

What information must be reported on 2024 tax documents?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.