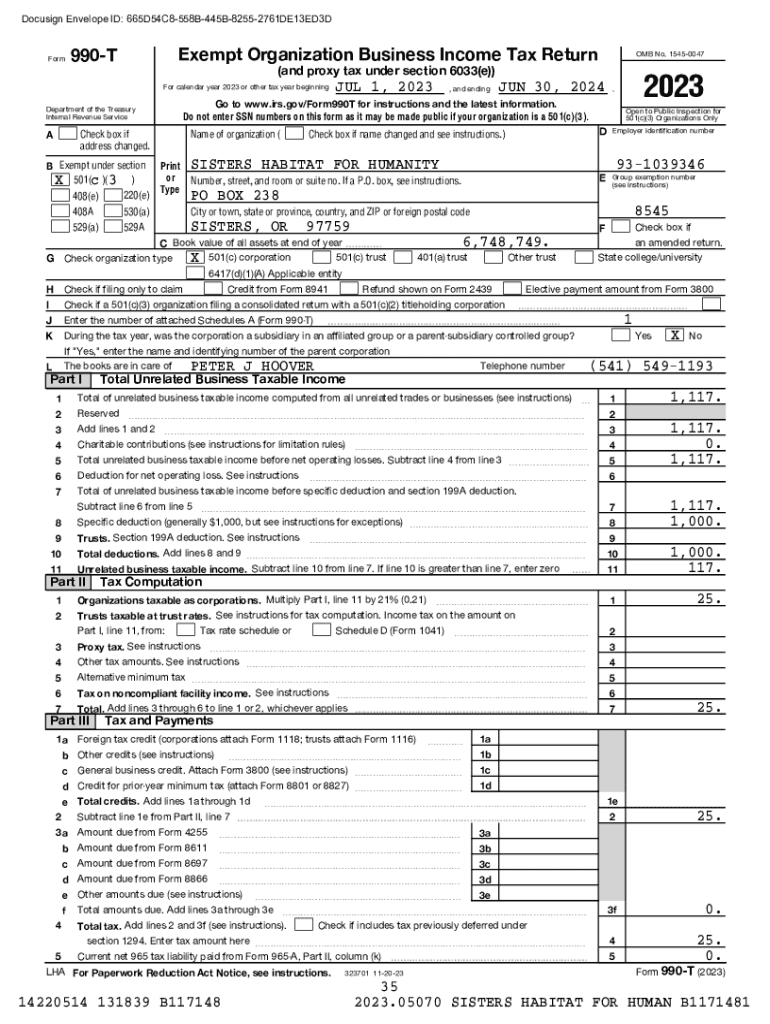

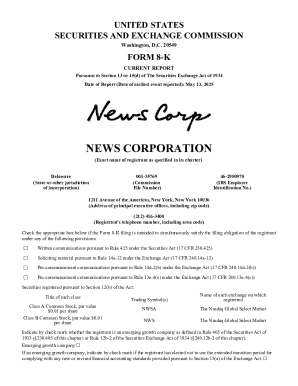

Get the free Check if filing only to claim

Get, Create, Make and Sign check if filing only

Editing check if filing only online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check if filing only

How to fill out check if filing only

Who needs check if filing only?

How to check if filing only form is right for you

Understanding the filing process

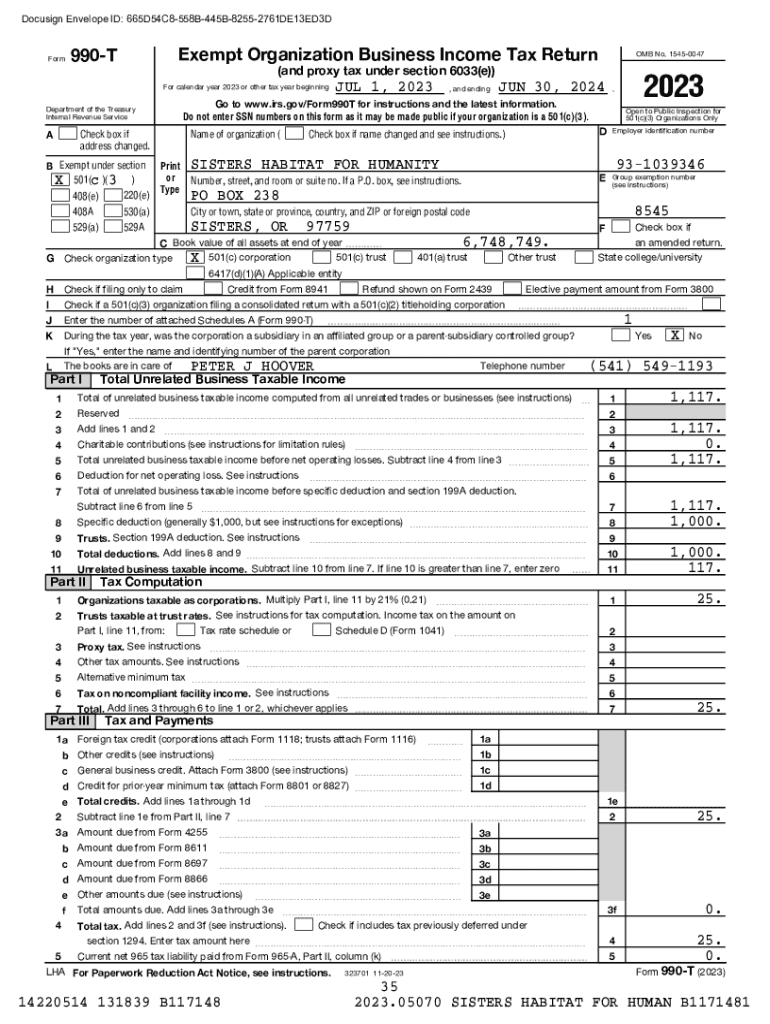

When navigating the complexities of tax obligations or legal documentation, you may encounter phrases like 'filing only.' This typically means submitting a specific form that clears certain requirements without needing to file a complete return. Understanding this distinction can significantly streamline your process and even save you time and money.

Common scenarios where filing only is applicable include situations where individuals receive income reported via W-2 or 1099 forms. In such cases, you might not need to submit full income tax returns if your income falls below a certain threshold. Similarly, legal documents, like affidavits or declarations, may also be filed independently without the surrounding paperwork typically associated with more extensive filings.

The importance of determining whether you need to file a full return versus opting for a 'filing only' form cannot be overstated. By understanding your specific obligations and the criteria that apply to your situation, you can ensure compliance while minimizing unnecessary effort.

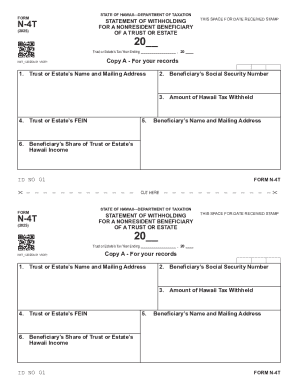

Types of forms typically filed alone

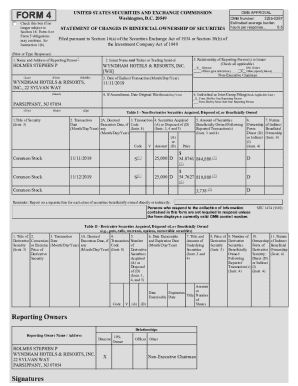

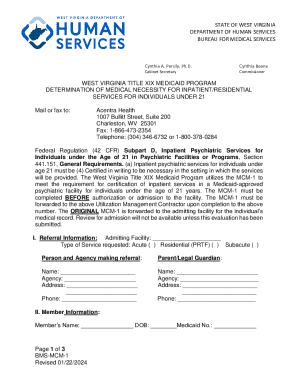

Certain forms are designed explicitly for standalone submission without requiring a full tax return. For example, tax forms like W-2 and 1099 are commonly used to report various types of income. These forms inform the IRS of income earned by employees or independent contractors and can sometimes be filed independently, particularly if income doesn't necessitate a complete return.

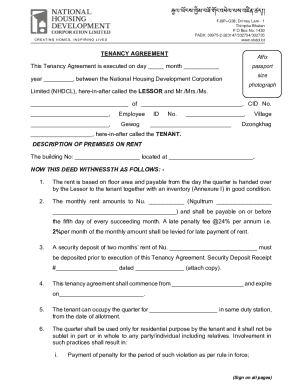

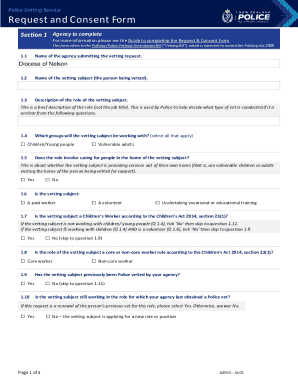

Legal documents also fit into this category. Items such as powers of attorney, notices, and simple applications may not require a lengthy filing process. Depending on state regulations, forms like these can often be submitted directly to the appropriate agency, allowing for a more efficient submission process.

Steps to determine if you should file only a form

The process of determining whether you should file only a form involves a few clear steps. First, you need to identify the specific form in question. Government websites and resources like pdfFiller provide comprehensive lists of common forms that you can file independently. Understanding these forms will help you streamline your filing process effectively.

Next, you'll want to assess your eligibility based on the criteria associated with the form. For instance, if you earned under a certain gross income threshold, you might not be required to submit a full tax return, thus making a standalone form sufficient. It’s essential to be aware of either federal or state-specific guidelines that may impact this decision.

Finally, reviewing the associated instructions and requirements is crucial. Each form comes with its own set of guidelines that detail the proper procedure for submission. Ignoring these instructions can lead to confusion or misinformation. Make sure to read the guidelines carefully to ensure that you meet all necessary conditions and avoid complications.

Interactive tools for evaluating filing needs

In this digital age, several tools can assist you in determining whether you should file only a form rather than a more extensive return. pdfFiller offers various eligibility checkers designed to guide users through the assessment of their filing needs. Using these tools can significantly simplify the decision-making process by asking relevant questions to assess your specific situation.

For example, eligibility checkers often prompt users to input key information, such as income levels and the type of form under consideration. After answering a few simple questions, they typically provide an informed recommendation. Additionally, pdfFiller’s form preview feature allows you to visually comprehend what you are filing, ensuring you understand each section before submission.

Interactive forms enhance user experience by providing essential context around what needs to be completed, leading to greater accuracy and confidence in the submission process. Utilizing pdfFiller’s tools minimizes confusion and sets you up for success.

Common concerns and FAQs about filing only forms

As with any filing process, various concerns may arise. A common question is whether additional documents need to be filed alongside the main form. In most cases, if your filing requires additional declarations or applicable schedules, it is crucial to include them to avoid any future issues. Familiarize yourself with the conditions for filing independently to mitigate complications.

For those unsure about their filing status, seeking professional advice is highly encouraged. Tax professionals or legal advisors can offer insights tailored to your situation and guide you through the complexities of your obligations. Moreover, should you need to amend your filing later, ensure you understand the correct procedure to follow, which often requires filing a specific amendment form.

Benefits of using pdfFiller for filing only forms

Using pdfFiller streamlines the filing process significantly, especially when filing only a form. One major benefit includes seamless editing capabilities that allow you to fill in forms accurately without the headache of manual paperwork. This digital solution permits your team members or collaborators to make comments or ask questions directly within the document, making it easier than ever to track changes and finalize submissions.

Additionally, the electronic signature feature allows you to sign documents instantly, ensuring that each file is ready for submission right when you need it. With pdfFiller's cloud-based platform, you can access your files from anywhere, promoting flexibility and responsiveness.

Collaboration features also stand out; this functionality provides the ability to work alongside advisors or team members, allowing you to manage document versions efficiently, ensuring all involved are aligned with the most recent filings without clutter and confusion.

Troubleshooting common issues in filing

Filing forms independently may save time, but issues can still arise. Common problems include late filings, which can lead to penalties. If you find yourself in this situation, understanding your options is crucial. Often, tax authorities may provide relief for first-time offenders, especially if there are mitigating circumstances.

Forms can also face rejection for various reasons, including missing signatures or incorrect information. To grasp the potential pitfalls and avoid them, familiarize yourself with common rejection reasons, such as failing to provide supporting documentation required for specific forms. Lastly, if you encounter technical difficulties while using pdfFiller, there are numerous resources available for troubleshooting, including FAQs and customer support services.

Tips for efficient document management

Efficient document management is essential when considering the filing of specific forms. Organizing your files neatly can significantly ease the strain of last-minute filings, especially during tax season. Create a structured filing system that categorically separates forms—be it tax-related, legal documentation, or other types of paperwork—to ease access and reduce retrieval time.

Additionally, staying informed on changes in filing requirements or legislative updates ensures compliance. Regularly review authoritative sources, such as IRS announcements or updates from local tax authorities, to remain aware of any adjustments in laws governing your forms. Utilizing newsletters, webinars, or informative blogs to keep up-to-date will empower you to manage your documentation effectively and avoid potential complications down the line.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find check if filing only?

Can I create an electronic signature for signing my check if filing only in Gmail?

How do I edit check if filing only on an Android device?

What is check if filing only?

Who is required to file check if filing only?

How to fill out check if filing only?

What is the purpose of check if filing only?

What information must be reported on check if filing only?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.