Get the free E-ASSETS-LIABILITIES-FORM.pdf

Get, Create, Make and Sign e-assets-liabilities-formpdf

How to edit e-assets-liabilities-formpdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out e-assets-liabilities-formpdf

How to fill out e-assets-liabilities-formpdf

Who needs e-assets-liabilities-formpdf?

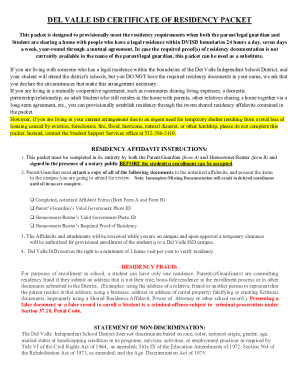

Comprehensive Guide to the e-assets-liabilities-formpdf Form

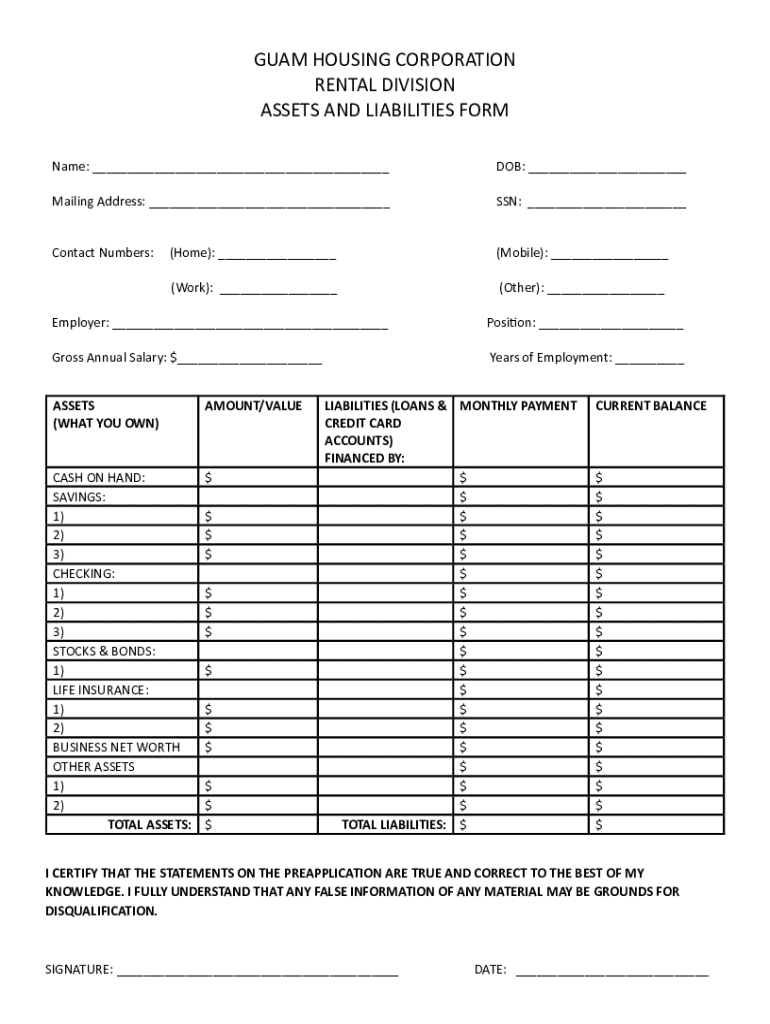

Overview of e-assets liabilities form

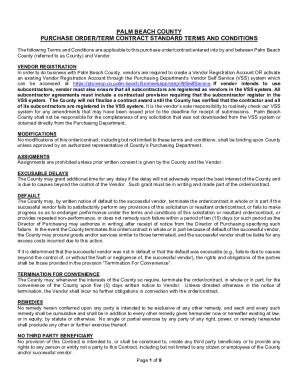

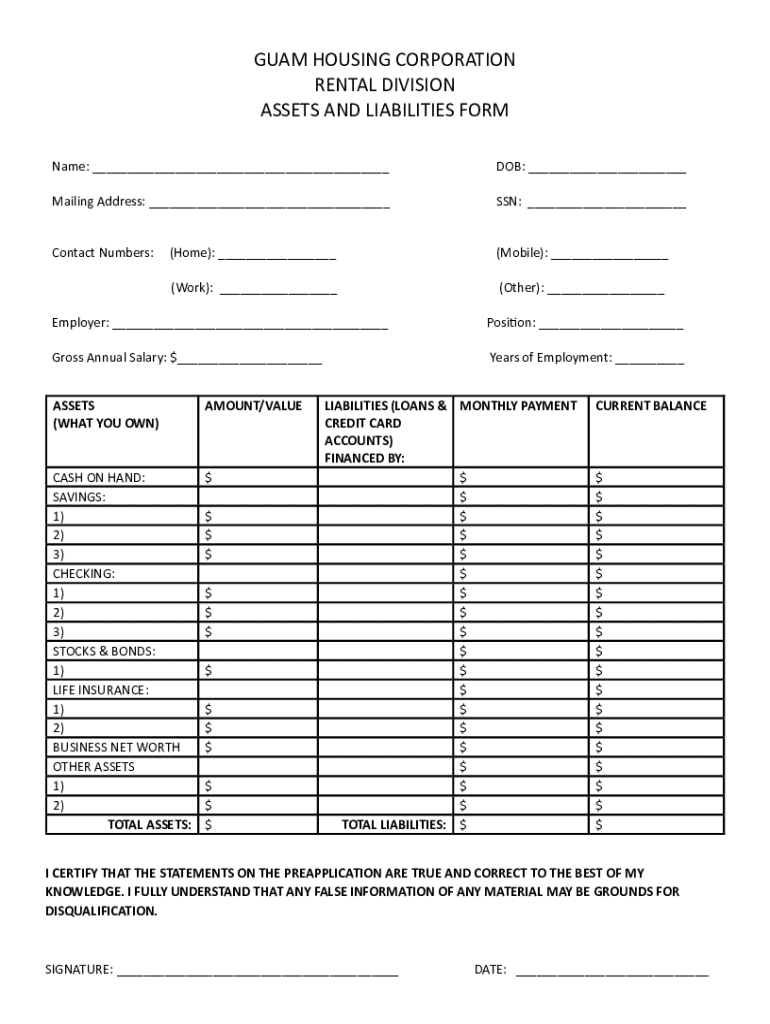

The e-assets liabilities form is a vital document that outlines an individual's or entity's financial situation, detailing both assets and liabilities. This form provides a clear view of one's financial health, aiding in better decision-making regarding loans, investments, and financial planning. With increasing emphasis on financial transparency, having an accurate e-assets liabilities form has become important for individuals and businesses alike.

Primarily, this form is utilized by individuals applying for loans or mortgages, financial institutions assessing creditworthiness, and professionals conducting financial interviews or evaluations. It serves as a formal declaration of financial standings, which is essential for compliance and regulatory purposes.

Key components of the form

An e-assets liabilities form consists of several crucial sections, designed to gather comprehensive financial information. Typical sections include personal identification information, asset declarations, liability disclosures, and additional comments or notes. Each section is structured to ensure that all the necessary financial details are captured accurately.

Common terms in the form can include 'net worth', 'liquid assets', 'secured debt', and 'unsecured debt'. Understanding these terms is essential for accurately filling the form and ensuring clarity in financial negotiations.

Step-by-step guide to filling out the e-assets liabilities form

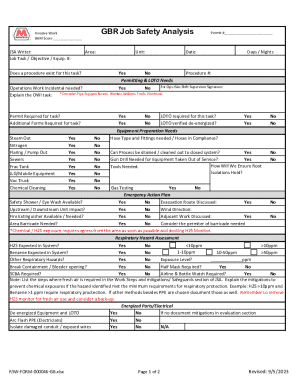

Before you start filling out the e-assets liabilities form, it's crucial to gather all necessary documents and information. This may include bank statements, mortgage statements, credit card balances, and any income documentation. Having this information at hand will facilitate a smoother filling process and ensure accuracy.

When completing your form, start with the personal information section. Enter your identification details accurately, ensuring that your name, address, and social security number are correct. This is crucial for avoiding any identification issues later on.

Next, move onto the asset declaration section. List out various types of assets, such as real estate, vehicles, and investments. Each listed asset should be described with its current market value which can be determined through valuations or online estimations.

For the liability disclosure, report all debts and obligations, from mortgages to personal loans. It's important to be transparent in this section, as misreporting can result in financial penalties or denial of loan applications.

Finally, complete any additional sections, if any. Add comments or special considerations that may be relevant to your financial situation.

Editing and managing your e-assets liabilities form

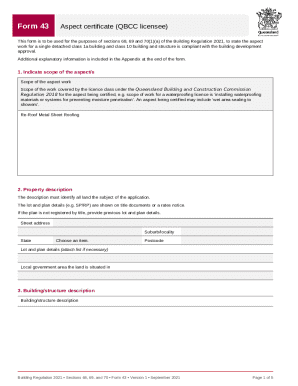

After filling out your e-assets liabilities form, you may need to edit it. pdfFiller provides several tools to help you revise your document easily. Features such as highlighting, annotating, and inserting text make it user-friendly for editing PDF forms.

If corrections are necessary post-filing, pdfFiller allows you to modify your submitted forms while keeping track of changes. This feature is particularly useful for ensuring all your financial information remains accurate and up to date.

When it comes to saving and sharing your e-assets liabilities form, pdfFiller offers various options. You can save changes directly to cloud storage or download to your local device. For those looking to collaborate, securely share your form with financial advisors or stakeholders with a few clicks, ensuring all parties have access to the most current version.

Signing the e-assets liabilities form

The use of electronic signatures has transformed how we sign documents, enhancing both efficiency and security. The legal validity of e-signatures means that they can be used just like traditional signatures, streamlining the process of submitting financial forms.

Using pdfFiller for eSigning provides numerous benefits. You can easily apply your signature digitally with a few clicks, saving time and reducing the hassle of printing documents.

If your e-assets liabilities form requires multiple signatures, pdfFiller allows you to add additional signatures easily, ensuring all necessary parties are included in the submission.

Tips for successfully managing your e-assets liabilities over time

Regularly updating your e-assets liabilities form is crucial, especially when there are significant changes in your finances, such as purchasing a new property or paying off debt. Keeping this document current helps in maintaining an accurate reflection of your financial status and is vital for any future financial endeavors.

Establishing a routine for reviewing your form can greatly assist in this process. Consider setting reminders using pdfFiller's organizational tools to prompt you every quarter or bi-annually to check on your financial status and make necessary adjustments.

Common mistakes to avoid when completing the e-assets liabilities form

Even with careful preparation, several common mistakes can lead to issues with the e-assets liabilities form. One prevalent error is missing essential information, which can delay approvals and lead to complications with financial assessments.

Another frequent mistake is misrepresenting asset values. Underestimating or overestimating the worth of your assets can create inaccuracies in your overall financial picture. Thoroughly research values and perhaps consult financial advisors to avoid these pitfalls.

Understanding the implications of your e-assets liabilities form

The implications of your e-assets liabilities form extend beyond immediate financial evaluations. Accurate reporting of assets and liabilities plays a crucial role in securing loans or mortgages. Financial institutions rely on this form to assess your creditworthiness and may base their lending decisions on the information provided.

Additionally, this form impacts tax considerations. Accurate disclosures are essential when filing taxes, as they affect your income reporting and potential deductions. A well-prepared e-assets liabilities form ensures you remain compliant with financial regulations and optimally manage your tax obligations.

Conclusion and support options

In summary, the e-assets liabilities form is a key document for anyone looking to present their financial standing accurately. With tools from pdfFiller, managing your form—from filling it out to signing and sharing—has never been easier. Ensuring accuracy and timeliness in your submissions can have significant benefits, including favorable loan terms and simplified tax reporting.

Should you encounter challenges while navigating the e-assets liabilities form, pdfFiller offers customer support for assistance. Utilize the platform’s comprehensive help resources to enhance your document management experience and ensure you’re leveraging all the functionalities available for managing your financial forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my e-assets-liabilities-formpdf directly from Gmail?

Where do I find e-assets-liabilities-formpdf?

Can I sign the e-assets-liabilities-formpdf electronically in Chrome?

What is e-assets-liabilities-formpdf?

Who is required to file e-assets-liabilities-formpdf?

How to fill out e-assets-liabilities-formpdf?

What is the purpose of e-assets-liabilities-formpdf?

What information must be reported on e-assets-liabilities-formpdf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.