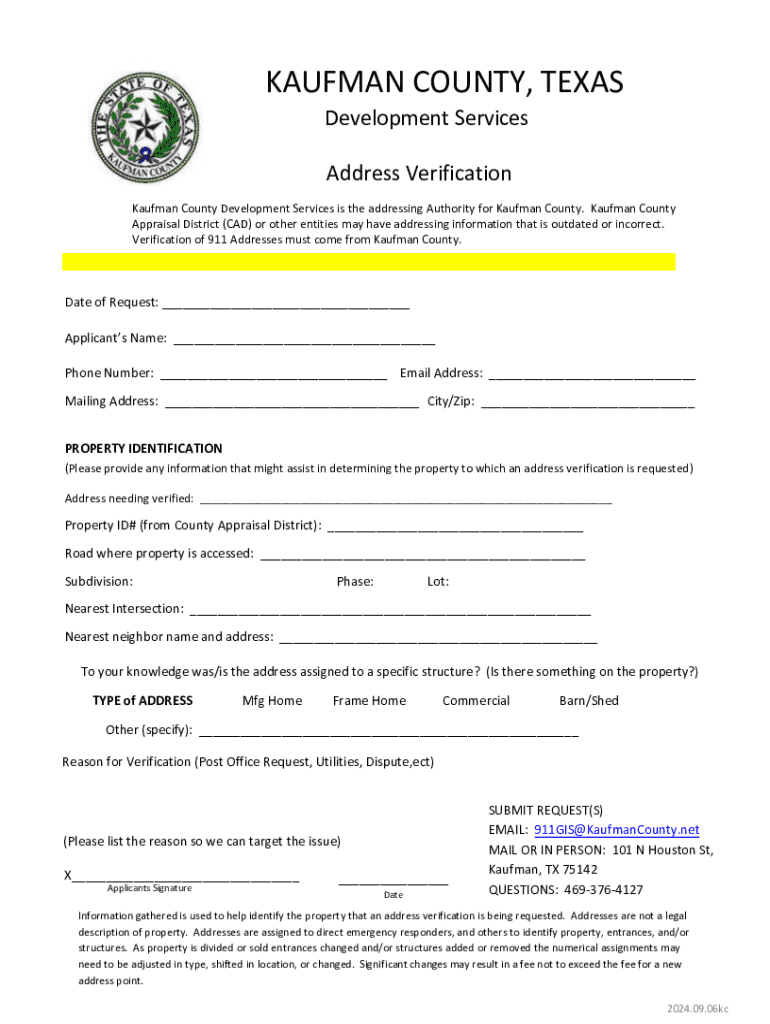

Get the free Appraisal District (CAD) or other entities may have addressing information that is o...

Get, Create, Make and Sign appraisal district cad or

Editing appraisal district cad or online

Uncompromising security for your PDF editing and eSignature needs

How to fill out appraisal district cad or

How to fill out appraisal district cad or

Who needs appraisal district cad or?

Understanding appraisal district CAD or form: A comprehensive guide

Overview of appraisal districts

Appraisal districts are pivotal entities within the property valuation ecosystem. Their primary purpose is to evaluate property values to ensure fair taxation based on market conditions. Each district operates within a specific jurisdiction and plays a crucial role in property tax systems, influencing how public services are funded. Without accurate property valuations, local governments would struggle to generate adequate revenue, impacting essential services such as education, infrastructure, and emergency services.

A Central Appraisal District (CAD) serves as the primary institution for property appraisal in a given area. Typically governed by a board, the CAD oversees property assessments and ensures that properties are valued uniformly across the district. Interaction with local governments, taxpayers, and other stakeholders is essential, as the CAD provides the foundational value assessments that local tax authorities rely on for revenue generation.

Types of forms in appraisal districts

Appraisal districts utilize various forms to manage property assessments and facilitate taxpayer interactions. One of the most common forms is the Appraisal Review Board (ARB) Application. This form is essential for property owners who wish to contest their property’s assessed value. By submitting this application, property owners signal their intent to appeal the assessment, which begins the review process.

Another critical form is the Property Tax Exemption Application, which property owners must complete to qualify for tax breaks on eligible properties, such as those used for nonprofit work or agricultural purposes. The Homestead Exemption Form is yet another vital document that allows homeowners to reduce the taxable value of their primary residence. Each form often requires specific supporting documentation, such as proof of identification and ownership, to process requests accurately.

Accessing appraisal district forms online

Accessing appraisal district forms online can often streamline the process of property tax management and appeals. Most appraisal districts maintain a website that provides downloadable forms and essential information. It’s important to navigate these sites efficiently. First, familiarize yourself with the layout, focusing on sections prominently labeled 'Forms,' 'Resources,' or 'Taxpayer Services.'

When looking for forms, ensure that you verify they are up to date and reflect the latest regulations. Many appraisal district websites feature dates indicating when the forms were last revised. This can prevent potential issues caused by outdated documents. pdfFiller can assist in this by hosting many of these forms, making them accessible and editable on different devices, enhancing usability for all taxpayers.

Step-by-step guide to filling out appraisal district forms

Filling out appraisal district forms accurately entails several preparatory steps. First, gather necessary information such as property details, personal identification, and any documentation related to your claim or appeal. Familiarity with common terminology related to the forms is also beneficial, as it reduces confusion during the completion process.

Each form has specific fields that require attention. For the ARB Application, details like your name, property identification number, and basis for appeal must be filled out precisely. In contrast, exemption applications may require additional paperwork, such as tax ID numbers and proof of property eligibility. It’s essential to double-check for completeness before submission, ensuring that signatures and dates are included, as omissions can lead to processing delays.

Editing and managing appraisal district forms

Utilizing pdfFiller for document management can significantly enhance your efficiency when dealing with appraisal district forms. This platform allows users to edit PDF forms directly online. Features include adding text, checking boxes, and signing documents, all from one convenient location. It's particularly beneficial for individuals or teams who may need to collaborate on submissions, as the platform supports various user inputs and comments.

After completing forms, it’s critical to save and secure them properly. pdfFiller offers options to store completed documents securely in the cloud, facilitating easy access from any device with an internet connection. This ensures that you can retrieve important forms at any time without the risk of loss or damage.

The electronic submission process

Understanding the submission methods for appraisal district forms can greatly enhance the efficiency of the process. Many districts now offer direct submission via online portals, allowing users to upload their completed forms securely. Alternatively, forms can often be submitted through email, though this method may vary by district.

Once your application is submitted, verifying that it has been received is crucial. Many districts provide confirmation emails or notifications through their online systems. Keeping track of your submission helps in following up or addressing any outstanding issues, ensuring a smoother process for any appeals or claims made.

Common issues and troubleshooting

Navigating appraisal district forms can sometimes lead to common mistakes. Issues often stem from incomplete submissions, missing signatures, or misunderstandings regarding required documentation. Developers and administrators of these forms recognize these pitfalls and frequently address them in FAQs on their websites. Familiarizing yourself with this guidance can save time and reduce the likelihood of problems during the submission process.

If challenges arise, contacting your appraisal district can provide clarity and assistance. Most districts have designated contact methods, whether through phone, email, or in-person visits. Knowing these contact details and office hours ensures that you can reach out for help when needed, facilitating smoother resolutions to any issues that may disrupt your filing process.

Latest updates on appraisal district regulations

Staying informed about changes to property tax laws is critical for anyone involved with appraisal district CAD or form processes. Regulations can shift annually, impacting forms, submission processes, and deadlines all of which affect property valuations and tax liabilities. Awareness of these changes enables better preparation and adherence to required standards.

To keep up with evolving regulations, taxpayers should regularly check their appraisal district's website for updates. Many districts provide newsletters or alert systems that communicate timely updates on property tax regulations and deadlines. Using these resources is essential for ensuring compliance and taking full advantage of any exemptions or appeals available.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit appraisal district cad or from Google Drive?

How do I make edits in appraisal district cad or without leaving Chrome?

How can I fill out appraisal district cad or on an iOS device?

What is appraisal district cad or?

Who is required to file appraisal district cad or?

How to fill out appraisal district cad or?

What is the purpose of appraisal district cad or?

What information must be reported on appraisal district cad or?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.