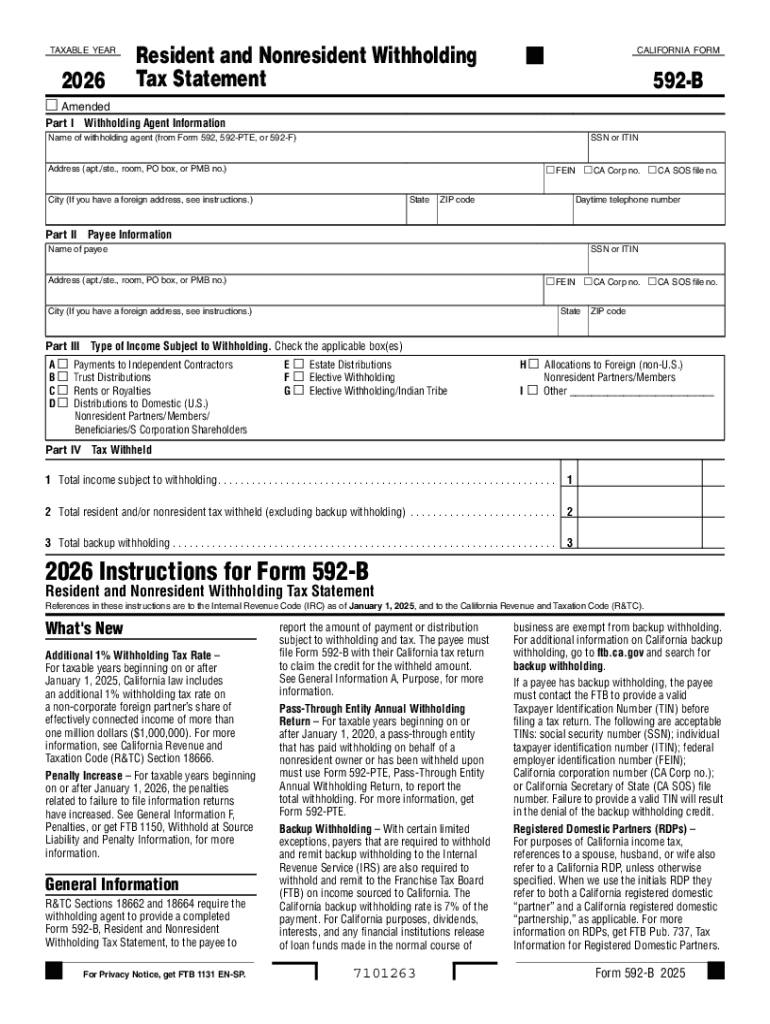

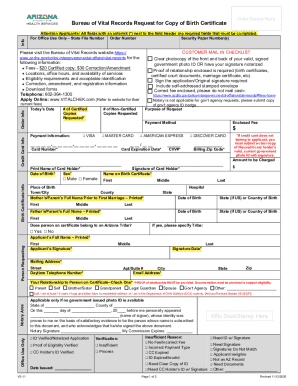

Get the free 2026 Form 592-B Resident and Nonresident Withholding Tax Statement with Instructions...

Get, Create, Make and Sign 2026 form 592-b resident

How to edit 2026 form 592-b resident online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 form 592-b resident

How to fill out 2026 form 592-b resident

Who needs 2026 form 592-b resident?

Complete Guide to the 2026 Form 592-B Resident Form

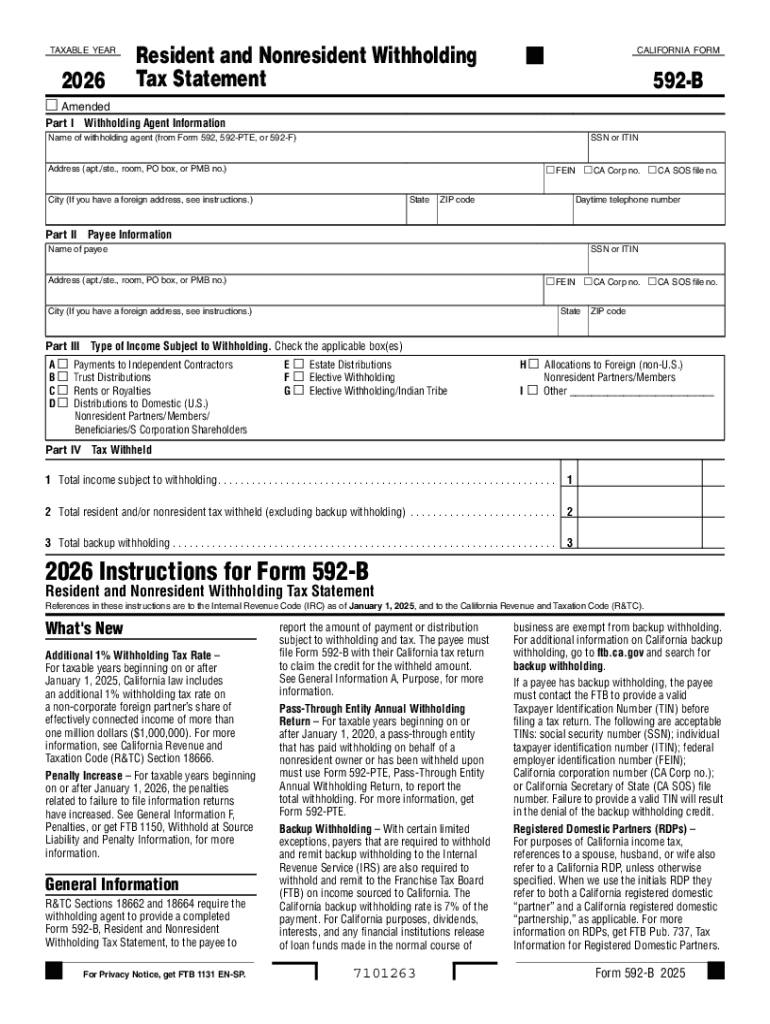

Overview of Form 592-B

The 2026 Form 592-B plays a crucial role in ensuring compliance with California's withholding tax regulations. This form is specifically designed for California resident individuals and entities to report income received from California sources. The significance of Form 592-B cannot be overstated, as it's essential for both the payers and the payees involved in transaction activities that pertain to California's tax requirements.

Taxpayers must be aware of key deadlines associated with this form. Typically, Form 592-B must be filed by January 31 of the following year for income paid during the previous calendar year. This filing deadline is crucial for maintaining proper records and avoiding potential penalties. It's imperative to know who needs to use this form; generally, any California resident receiving payments subject to withholding must complete and submit Form 592-B.

Understanding resident vs. nonresident status

For tax purposes, a resident is defined as an individual or entity whose domicile is in California or who spends a significant portion of the year in the state. Understanding this distinction between resident and nonresident status is pivotal because it influences the type of income that needs to be reported and the specific forms that must be filled out, including Form 592-B.

Nonresidents, on the other hand, are individuals or entities that do not meet the residency requirements. This difference affects not only what forms need to be filed but also how income is taxed. Proper identification of residency status is essential, as misclassifying oneself can lead to severe tax consequences, including additional penalties and interest on unpaid taxes.

Step-by-step guide to completing the 2026 Form 592-B

Filing the 2026 Form 592-B may seem daunting, but with a systematic approach, it can be accomplished smoothly. Start by gathering all necessary information and documents. You'll need to collect personal identification details, including your name, address, and taxpayer identification numbers, as well as any relevant payment information. This foundational step is crucial to ensure that the form is filled out correctly.

Gathering necessary information

The required documents include previous tax returns, any relevant receipts, and information about the payments received. Ensuring that all documents are in order will streamline the completion process. Additionally, personal identification detail requirements encompass full names, Social Security numbers for individuals, and Employer Identification Numbers for entities. This organized approach sets the stage for filling out the form accurately.

Section-by-section breakdown

The 2026 Form 592-B is divided into several sections, each serving a specific purpose.

Common mistakes to avoid when filling out Form 592-B

When completing Form 592-B, certain common mistakes frequently occur that taxpayers should be mindful of. These include providing incorrect or incomplete information, misclassifying residency status, and failing to sign the form. It's vital to double-check all entries against your records and supporting documents before submission.

Additionally, seeking guidance from a tax professional or utilizing resources like pdfFiller can help minimize errors. Remember, ensuring accuracy in your submission not only helps in adhering to tax regulations but also safeguards against potential audits or penalties.

Understanding withholding requirements

Withholding requirements under Form 592-B are critical for compliance with California tax laws. Withholding is generally required when payments made to payees are considered taxable income and are subject to taxation under California law. For example, payments for services rendered by independent contractors typically fall under this requirement.

When withholding is required

Conditions that necessitate withholding include:

When withholding is not required

In some situations, withholding may not be necessary. Identifying these scenarios is essential to avoid unnecessary deductions. Examples include payments made for goods rather than services, payments to individuals or entities maintaining control of an account that meet exemption criteria, or distributions of tax-free income.

Supporting documentation to claim these exemptions is vital for adherence to regulations.

Managing Form 592-B after submission

Once you have submitted Form 592-B, effective management of this form is crucial for maintaining compliance and records. Keeping accurate records of all submitted forms and related documents ensures you can quickly respond to any inquiries from the IRS or the California tax authority. Generally, maintaining these records for at least four years is a best practice.

Record-keeping best practices

Additionally, it's essential to manage copies of Form 592-B and any related documentation carefully. Consider digitalizing these documents and using cloud storage solutions for easy access. This approach not only supports efficiency but also allows for secure access when needed for future reference.

Handling revisions or corrections

If you discover an error after submitting Form 592-B, timely action is required. The first step involves identifying the mistake and determining whether a corrected form is necessary. Submitting an amended form can clarify discrepancies and address errors like incorrect amounts or payee information.

Filing an amended return generally follows the same process as the original submission, so be sure to include all updated information.

The role of pdfFiller in managing Form 592-B

pdfFiller stands out as a powerful tool to facilitate the management of Form 592-B. With its array of features designed for document management, pdfFiller empowers users to seamlessly edit, fill out, and e-sign PDFs in a cloud-based platform.

Using pdfFiller not only enhances the ease of filling out Form 592-B but also provides users the ability to store that form securely and access it from anywhere. This ensures compliance is maintained while utilizing a smooth user experience.

FAQs on the 2026 Form 592-B

Many individuals have inquiries about the specifics of submitting Form 592-B. Here are some common questions and answers to clarify specifics.

Additional considerations

It’s important to be aware that state-specific tax implications could impact Form 592-B in 2026. Amendments to tax laws or changes in regulations may arise, so taxpayers should periodically review relevant updates that could affect how Form 592-B is filled out or filed. Keeping abreast with these changes ensures that compliance is maintained.

With the increasing complexity of tax laws, utilizing platforms like pdfFiller is beneficial, as they often update their resources to reflect current regulations. Understanding potential changes can help in navigating the intricacies of California tax laws effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2026 form 592-b resident?

How do I edit 2026 form 592-b resident online?

How do I edit 2026 form 592-b resident in Chrome?

What is 2026 form 592-b resident?

Who is required to file 2026 form 592-b resident?

How to fill out 2026 form 592-b resident?

What is the purpose of 2026 form 592-b resident?

What information must be reported on 2026 form 592-b resident?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.