Get the free Clean Fuel Production CreditInternal Revenue Service

Get, Create, Make and Sign clean fuel production creditinternal

Editing clean fuel production creditinternal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out clean fuel production creditinternal

How to fill out clean fuel production creditinternal

Who needs clean fuel production creditinternal?

Understanding the Clean Fuel Production Credit Internal Form

Understanding the Clean Fuel Production Credit

The Clean Fuel Production Credit serves as a vital financial incentive designed to bolster the production of clean, renewable fuels in the United States. This tax credit aims not only to stimulate innovation within the energy industry but also to significantly reduce dependence on fossil fuels, thereby contributing to a sustainable energy future.

As the world shifts toward more sustainable energy sources, the importance of clean fuels has never been clearer. These fuels play a crucial role in reducing greenhouse gas emissions and combating climate change, aligning with global efforts toward cleaner air and improved public health.

Eligibility criteria

Eligibility for the Clean Fuel Production Credit varies depending on several factors. To qualify, producers must demonstrate that they meet specific criteria related to their production processes, the fuels they manufacture, and adherence to regulatory guidelines.

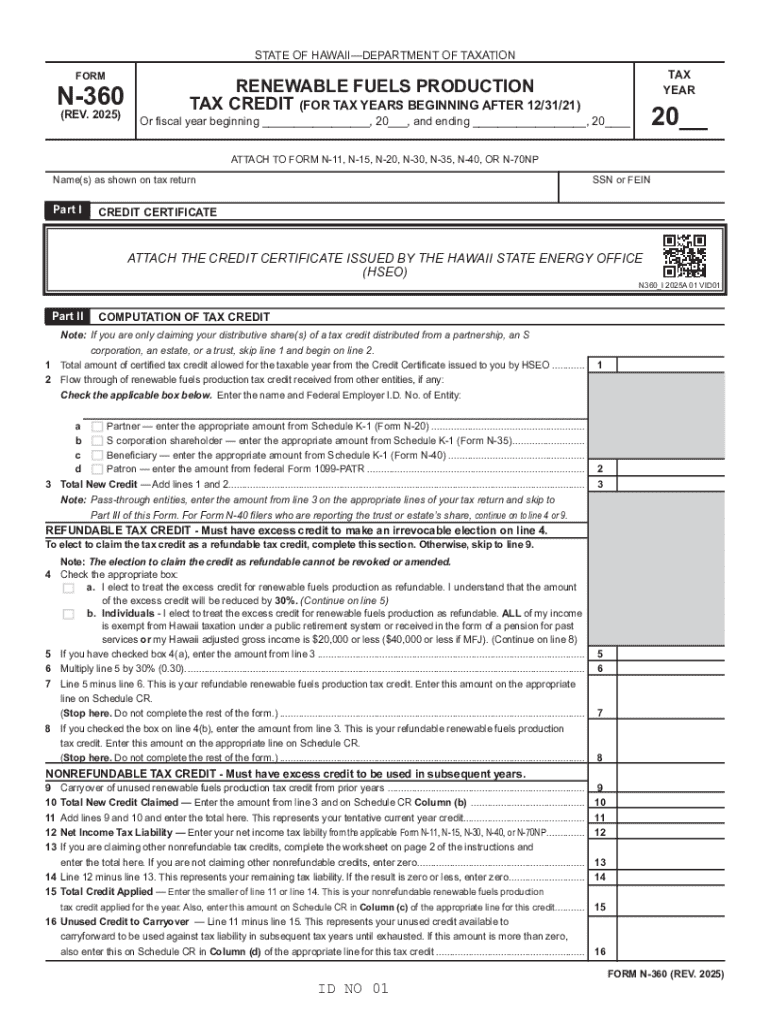

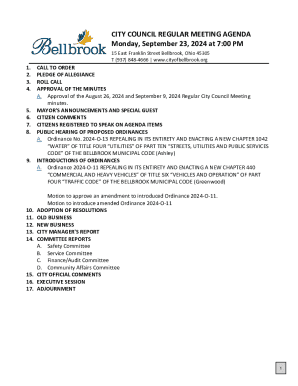

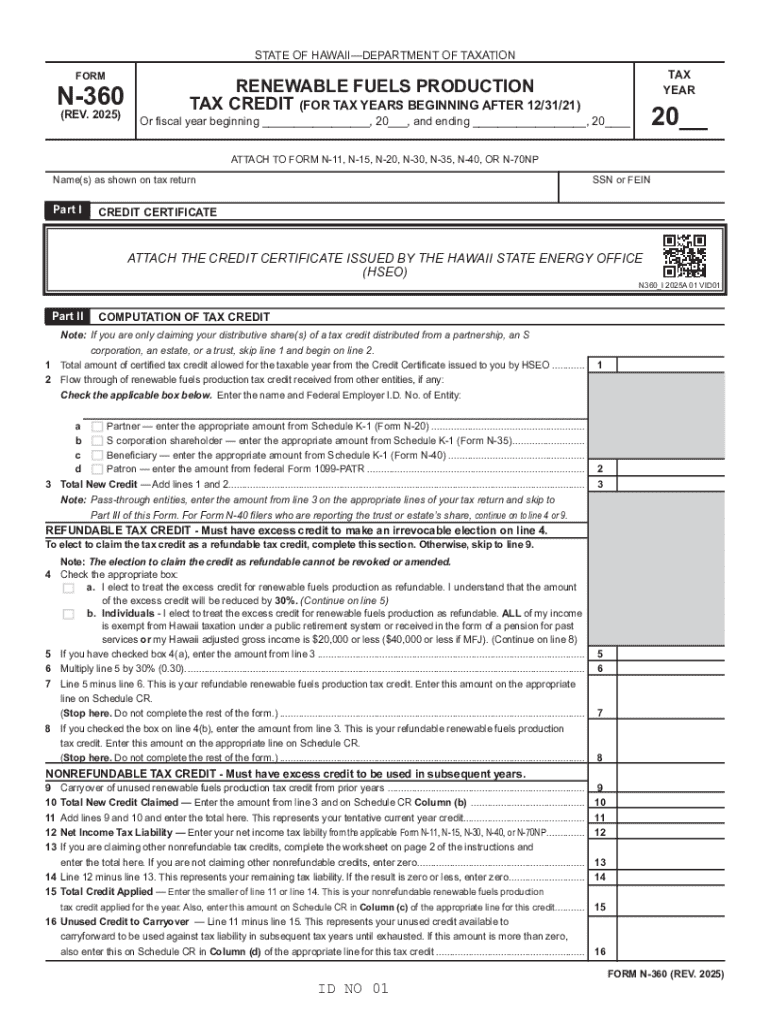

Overview of the Clean Fuel Production Credit Internal Form

The Clean Fuel Production Credit Internal Form is a critical tool for producers seeking to apply for the Clean Fuel Production Credit. This form not only simplifies the application process but also facilitates the collection of essential information needed to evaluate eligibility.

Submitting this form ensures that authorities can accurately assess the production details and compliance status of applicants, ultimately speeding up the approval process.

Key sections of the form

The internal form is divided into several key sections, each serving a distinct purpose. Understanding these sections is essential for ensuring complete and accurate submissions.

Being aware of common pitfalls in filling out this form can help avoid delays. Missing signatures or inaccurate data entries can result in processing issues, thereby undermining the benefits of the credit.

Step-by-step guide to completing the internal form

Before diving into the specifics of completing the Clean Fuel Production Credit Internal Form, it’s crucial to prepare adequately. Collecting all necessary documents and understanding how the scoring criterion for credits operates will ensure a smooth application process.

Preparation before filling out the form

Gathering materials beforehand can significantly ease the completion of the form. Required documentation usually includes proof of production metrics, compliance records, and other pertinent approvals that demonstrate eligibility.

Understanding scoring criteria for credits also equips applicants in presenting their data effectively, increasing their chances for a successful approval.

Section-by-section instructions

1. **Personal Information Section**: This section requires the applicant's name, address, detailed contact info, and any other necessary personal identifiers.

2. **Business Information Section**: Here, businesses should provide their legal name, tax ID number, and a summary of ownership structure.

3. **Fuel Production Metrics**: Accurate reporting of production metrics is vital. This requires precise data on production volumes, feedstock types, and energy outputs.

4. **Compliance and Regulation Acknowledgment**: This section involves sign-offs by authorized representatives confirming adherence to all relevant guidelines.

5. **Declaration and Signature**: A legitimate signature is critical, emphasizing the authenticity of the submission.

Tips for successful submission of your clean fuel production credit form

Submitting the Clean Fuel Production Credit Internal Form isn't merely about filling it out; accuracy and compliance play pivotal roles in the assessment process. Avoiding common mistakes can save significant time and resources.

Common mistakes to avoid

Best practices include thoroughly double-checking all figures and engaging in a peer review, ensuring that another set of eyes scrutinizes the completeness and accuracy of the information.

Managing your clean fuel production credit application

Once the form is submitted, managing the application becomes the next crucial step. Monitoring the status of your Clean Fuel Production Credit application allows you timely interventions if necessary.

Tracking your application status

Utilize available online resources or tools provided by authorities to regularly check the progress of your application. Most agencies provide online portals where you can log in and view updates, significantly enhancing peace of mind.

Responding to requests for additional information

Should authorities request additional information or documentation, prompt response is critical. Delays could impact the approval timeline, affecting potential financial benefits.

Interactive tools and resources

Utilizing innovative tools can simplify the submission process for the Clean Fuel Production Credit Internal Form. Platforms like pdfFiller offer capabilities that enhance the way documents are managed and submitted.

Utilizing pdfFiller for document management

pdfFiller makes editing and managing forms an effortless endeavor. Users can easily upload documents, apply edits, or fill out necessary fields, allowing for a customized and efficient experience.

eSigning documents securely

The eSigning feature within pdfFiller allows users to sign documents electronically, eliminating the need for physical signatures and ensuring compliance with legality.

Collaboration features

What sets pdfFiller apart is its collaborative functionalities. Team members can work simultaneously on form completion, allowing for streamlined workflows and thorough oversight.

Expert insights and FAQs

Industry specialists provide helpful tips that can further enhance your chances of securing the Clean Fuel Production Credit. Being proactive about understanding the requirements and nuances of your application process is key.

Frequently asked questions

Queries related to the Clean Fuel Production Credit often revolve around eligibility, required documentation, and timeline expectations. Addressing such concerns ensures prospective applicants are well-prepared.

Additional considerations for clean fuel initiatives

The evolution of clean fuels is not only about financial incentives, but it also encompasses broader environmental impacts. The benefits of clean fuels extend beyond mere production; they offer enhanced air quality, lower emissions, and potential job creation in emerging sectors.

Future trends in clean fuel production and incentives

Anticipated changes in policies and technology are poised to reshape the landscape of clean fuel production. Emerging technologies like biofuels, hydrogen production, and advances in renewable energy systems significantly influence the future of clean fuels.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my clean fuel production creditinternal directly from Gmail?

Can I create an electronic signature for signing my clean fuel production creditinternal in Gmail?

How can I edit clean fuel production creditinternal on a smartphone?

What is clean fuel production creditinternal?

Who is required to file clean fuel production creditinternal?

How to fill out clean fuel production creditinternal?

What is the purpose of clean fuel production creditinternal?

What information must be reported on clean fuel production creditinternal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.