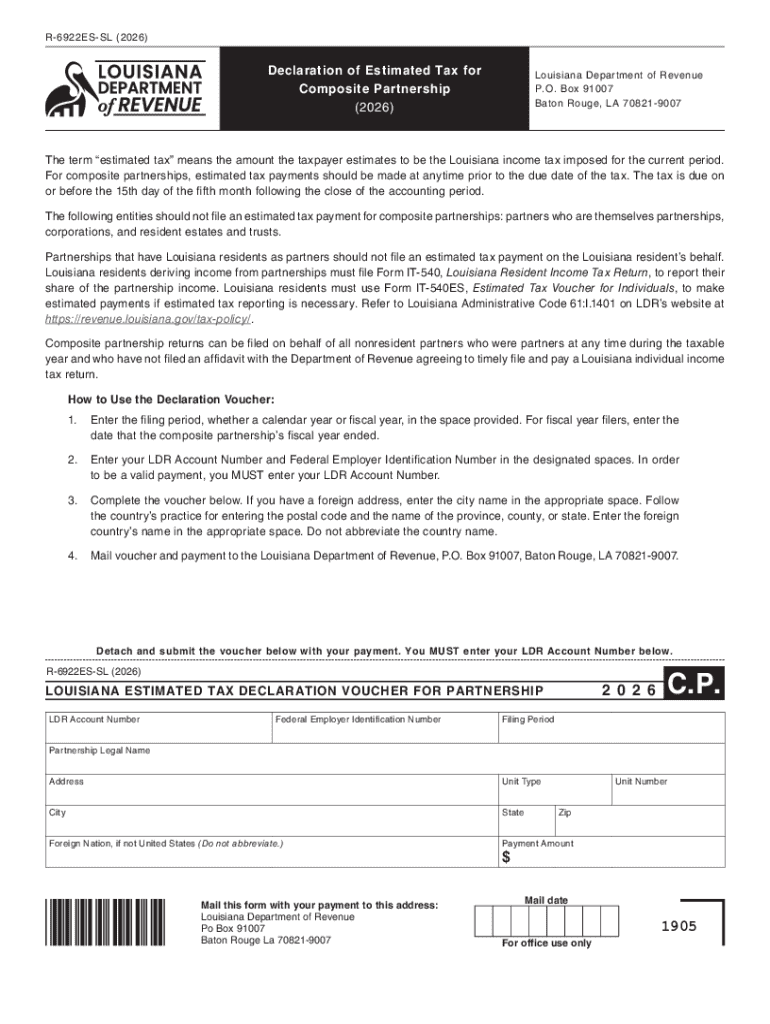

Get the free Form R-6922, Composite return information and calculations

Get, Create, Make and Sign form r-6922 composite return

Editing form r-6922 composite return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form r-6922 composite return

How to fill out form r-6922 composite return

Who needs form r-6922 composite return?

Form R-6922 Composite Return Form: A Comprehensive Guide

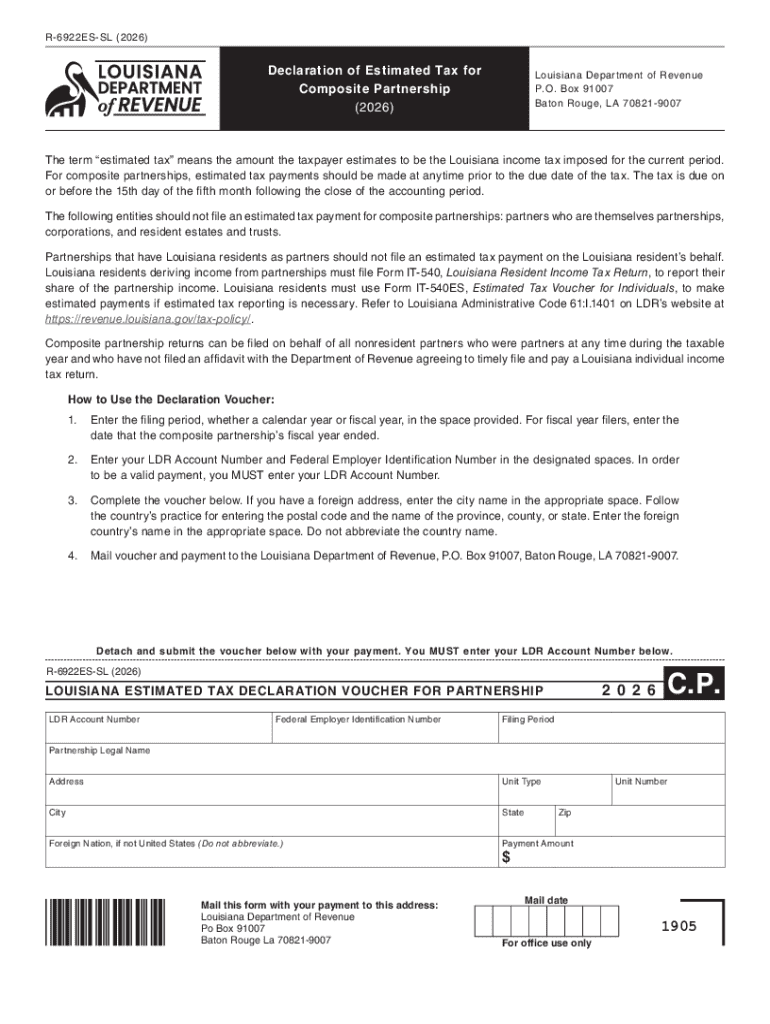

Understanding Form R-6922: An overview

Form R-6922 is a vital tax document that allows certain individuals and entities to file a combined tax return in specific states. This composite return simplifies the process for non-resident individuals who earn income within the state but do not meet the criteria for full residency. It serves to streamline the tax filing process by consolidating various income sources into a single return, reducing the burden of multiple filings.

One of the primary uses of Form R-6922 is to comply with state tax obligations without the complexity of additional paperwork that would otherwise be required. It is especially beneficial for businesses employing non-residents, who can report their earnings in one consolidated form. Understanding the significance of the composite return is essential for managing tax liabilities effectively and ensuring compliance with state tax laws.

Who needs to file Form R-6922?

The target audience for Form R-6922 includes individuals and entities that engage in business activities or earn income in states requiring this type of return. Typically, this form is designed for non-resident taxpayers—those who reside outside the state yet have gained income from its activities. Eligibility for filing is crucial; it includes criteria such as the nature of the income, the individual's residency status, and the states involved.

Common scenarios where Form R-6922 is applicable include part-time contractors working in a state, employees temporarily stationed out-of-state, or business professionals providing services across state lines. These situations often involve individuals who would incur a heavier tax filing burden without the opportunity to submit a composite return, making Form R-6922 a practical choice for both individuals and entities looking to simplify their tax responsibilities.

Step-by-step guide to completing Form R-6922

Completing Form R-6922 requires careful preparation and an understanding of specific filing requirements. Here’s a step-by-step guide to help you through the process.

Common mistakes to avoid

Filing Form R-6922 can come with its challenges, leading to frequent mistakes. Common errors include incorrect personal details, misreported income, and failure to claim eligible deductions. Each of these mistakes can result in penalties, delays, or even audits.

To avoid these pitfalls, double-check all entries for accuracy before submission. Seek clarification on any areas that may be confusing. Engaging with tax professionals is another proactive measure that can help in identifying complexities specific to your situation. Maintaining comprehensive documentation can further support your claims and provide clarity if the state requires further verification.

Edits and changes: What to do if you need to modify your submission

If you discover an error after submitting Form R-6922, it is crucial to amend your return promptly to avoid penalties. This process involves submitting the correct information along with an explanation for the amendments to the relevant tax authority.

To amend a filed Form R-6922, follow these steps: First, obtain the amendment form provided by the state tax authority. Complete this form with the necessary corrections, ensuring that all figures are accurate. Along with the amended form, submit any supporting documentation that backs the changes you are reporting. Be aware of the time frames for amendments, as these can differ by state; typically, the sooner you act, the better your chances of avoiding additional penalties.

Digital solutions for managing Form R-6922

Using digital solutions like pdfFiller for managing Form R-6922 offers many advantages. The tool enables efficient editing, signing, and sharing of documents, all from a single, user-friendly platform. This accessibility is particularly beneficial for those needing to manage documents from multiple devices or locations.

With interactive tools available on pdfFiller, users can easily input data, ensure compliance with state-specific requirements, and securely eSign forms directly from the cloud. Such conveniences enhance the overall experience of handling tax documents, catering specifically to the needs of individuals and teams seeking streamlined, efficient document management solutions.

FAQs about Form R-6922

Addressing common concerns and inquiries regarding Form R-6922 is important for ensuring accurate tax filing. Many taxpayers wonder about specific details such as deadlines for filing, what happens if they miss these deadlines, and how to handle state-specific variations in the Composite Return.

Other frequently asked questions involve issues relating to income reporting and allowable deductions. It's essential to consult with tax professionals or state tax offices to clarify complex aspects of the filing process. This approach ensures compliance with varying regulations across states, empowering individuals to navigate their tax responsibilities confidently.

Conclusion: Maximizing the benefits of Form R-6922 through efficient management

Completing Form R-6922 accurately is vital for understanding and managing tax obligations efficiently. By leveraging tools like pdfFiller, users can ensure that their document management is smooth and hassle-free. The platform’s capabilities in editing and signing PDFs make it an invaluable resource for those who need a convenient, accessible solution for handling tax returns.

Ultimately, adopting digital solutions not only saves time but also provides peace of mind when filing your composite return. Emphasizing accuracy and compliance with Form R-6922 through effective management can prevent future tax-related issues and contribute to a more streamlined tax experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form r-6922 composite return in Gmail?

How can I edit form r-6922 composite return from Google Drive?

How do I edit form r-6922 composite return on an Android device?

What is form r-6922 composite return?

Who is required to file form r-6922 composite return?

How to fill out form r-6922 composite return?

What is the purpose of form r-6922 composite return?

What information must be reported on form r-6922 composite return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.