Get the free Corporation EFile Program - Louisiana Department of Revenue

Get, Create, Make and Sign corporation efile program

Editing corporation efile program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporation efile program

How to fill out corporation efile program

Who needs corporation efile program?

A Comprehensive Guide to the Corporation Efile Program Form

Understanding the corporation efile program form

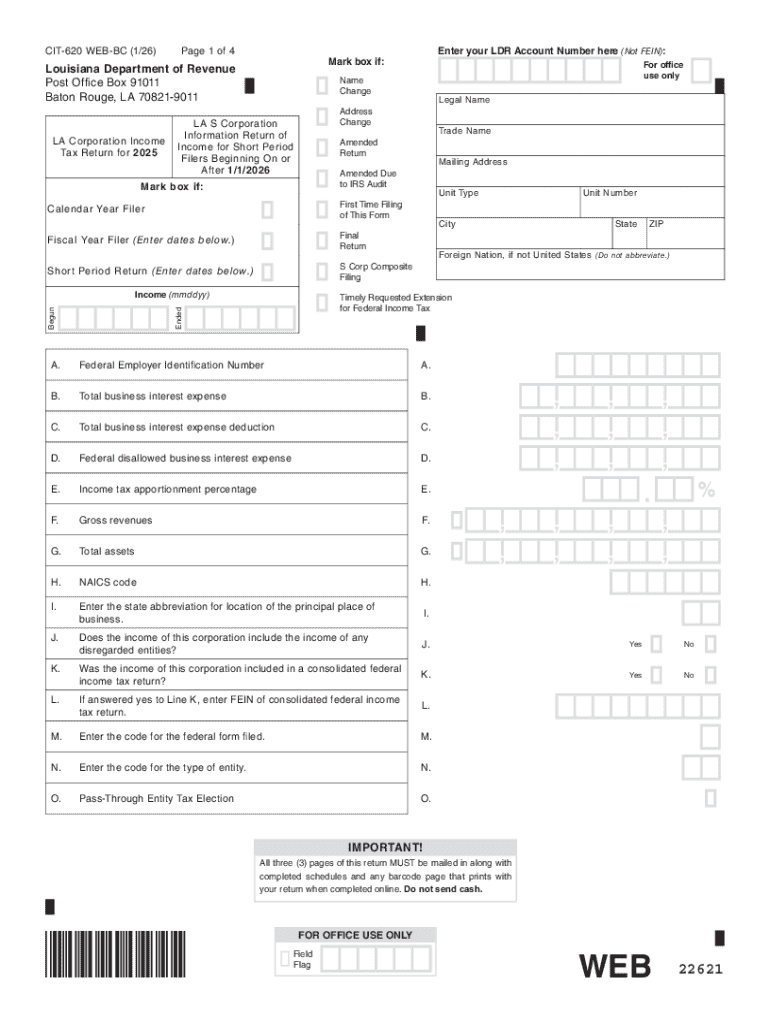

The Corporation Efile Program is an online initiative that simplifies the tax filing process for corporations. Managed typically by the department of revenue in various jurisdictions, this program enables companies to submit their tax returns electronically, promoting efficiency and reducing paperwork. By leveraging the corporation efile program form, businesses can ensure that they meet compliance requirements more easily while benefiting from a streamlined submission process.

One of the key benefits of using the corporation efile program is the speed with which submissions can be processed. Unlike traditional paper forms that may take weeks to be processed, e-filing allows corporations to receive confirmations of receipt typically within 24 hours. This rapid processing ensures that businesses can better manage their cash flow and planning by knowing exactly when their taxes have been filed and accepted.

Eligibility criteria for the corporation efile program

To utilize the corporation efile program, companies must meet specific eligibility criteria. Typically, this program is available to domestic corporations that are in good standing and meet state requirements. Additionally, it is important to ensure that the business has all necessary documentation, including a valid Employer Identification Number (EIN), which is crucial for proper identification during the filing process.

Prerequisites to file using the corporation efile program often include meeting minimum annual revenue thresholds and complying with local tax regulations. Corporations must also have an established online account with the department of revenue, which facilitates the e-filing process. Failing to comply with any local regulations could delay or invalidate submissions, so thorough awareness of these requirements is essential.

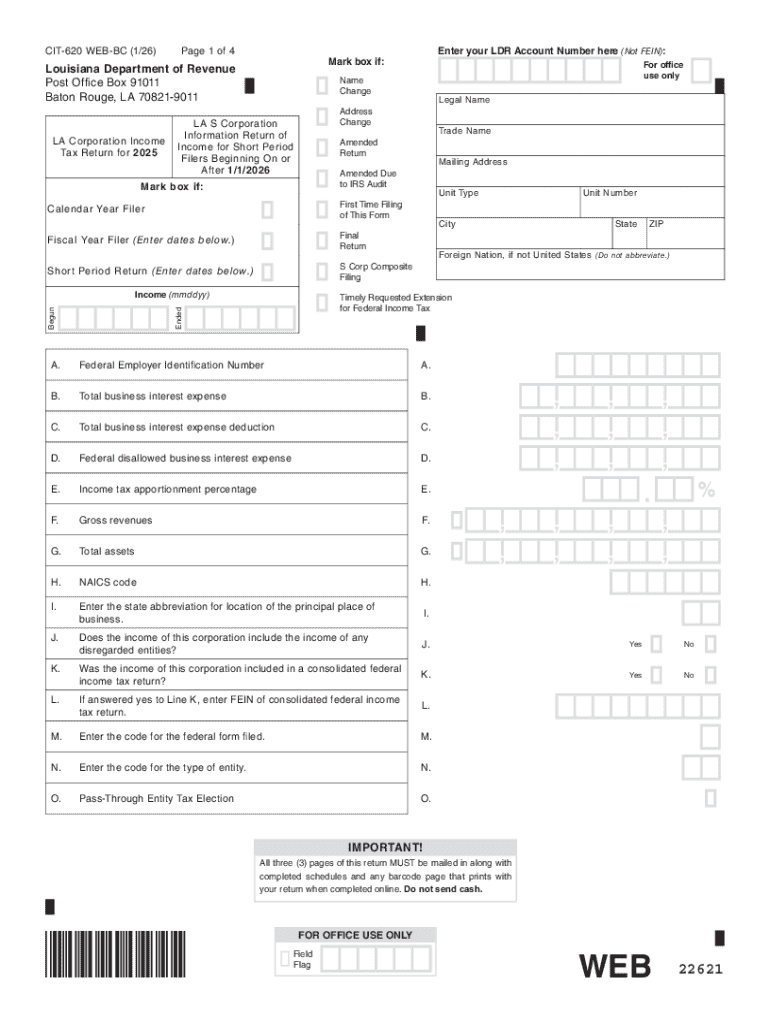

Essential components of the corporation efile form

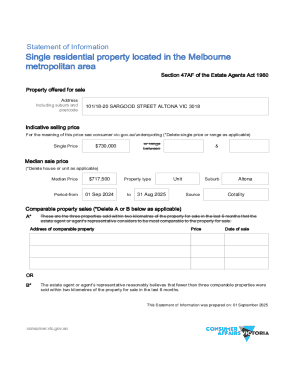

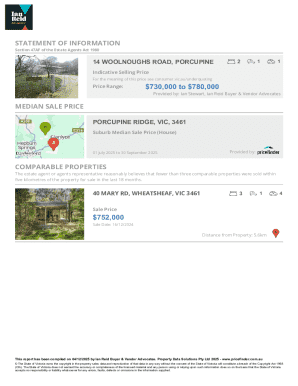

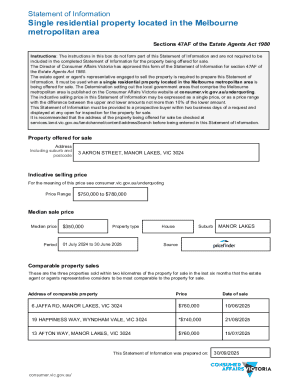

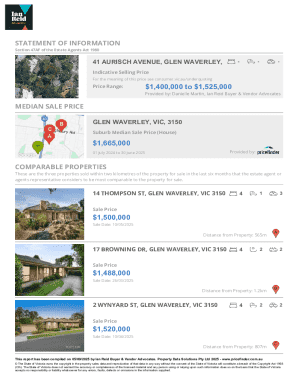

When preparing to fill out the corporation efile form, it’s vital to understand its structure and the various sections included. The form is typically divided into several parts, starting with basic information about the corporation, such as its name, address, and EIN. These fundamental details help the tax authorities identify the business and ensure that the filings are credited appropriately.

The subsequent sections of the form require detailed financial information, including total income, allowable deductions, and tax calculation. Collecting necessary documents, like profit and loss statements and receipts, is crucial to accurately fill out these sections. Accurate reporting in each part not only ensures compliance but also minimizes the risk of audits or penalties.

Step-by-step guide to completing the corporation efile form

Gathering required information

The first step in completing the corporation efile form is to gather all required information. This includes verifying the business details such as the corporation's name, registered address, and EIN. Ensure that all information matches previous filings to prevent discrepancies that could lead to delays in processing.

Next, collect pertinent financial information, which typically comprises total income, various types of deductions, and perhaps prior year loss carryforwards. Having these details organized ahead of time will streamline the filling process considerably. Utilize accounting records and financial summaries to obtain accurate figures, further ensuring compliance with the tax regulations.

Filling out the form

When filling out the corporation efile form, it helps to break it down section by section. In the income section, report all revenue streams accurately, ensuring to include any non-taxable portions separately. Deductions must be reported meticulously as well; take care to include only eligible deductions supported by receipts or appropriate documentation.

The tax calculation section will require applying current tax rates to your taxable income, which means understanding recent tax legislation relevant to your situation. Finally, ensure that all calculations are checked and double-checked for accuracy before submission, as errors can initiate audits and other complications.

Important considerations before submission

Prior to submitting the corporation efile form, review the entire document carefully. Common mistakes like typos or miscalculations might seem trivial but could lead to significant issues. Engage another set of eyes, whether it's a teammate or a professional, to review the form for clarity and accuracy.

Utilizing pdfFiller's features for efficient filling and submission

Interactive tools for enhanced editing

Using pdfFiller to complete your corporation efile program form offers a myriad of interactive tools that enhance the editing experience. Users can easily modify text, insert necessary information, and format sections as needed directly within the platform. These functionalities not only save time but also allow for immediate corrections.

eSignature capabilities

In today’s fast-paced environment, the ability to digitally sign the completed form is invaluable. pdfFiller’s eSignature feature ensures that you can execute the necessary forms while complying with all regulations surrounding electronic signatures. This facility eliminates the need for printing and scanning documents, simplifying the process for teams operating remotely or on tight timelines.

Collaboration tools for teams

pdfFiller also supports team collaboration effectively through its sharing feature, allowing multiple stakeholders to access and input into the corporation efile form as needed. Assigning tasks, leaving comments, and editing in real-time ensures that all opinions are accounted for, which can enhance the accuracy and thoroughness of the final submission.

Managing your efile submission with pdfFiller

Once you've submitted your corporation efile form through pdfFiller, the work doesn't stop there. You have the capability to track your submission status directly within the platform. This feature provides peace of mind as you can see when the form was received and when it is expected to be processed.

Additionally, pdfFiller allows you to access and manage submitted forms easily. You can store these documents securely in the cloud, ensuring that files are not lost and remain accessible for future reference. This cloud storage convenience means that your essential tax documents are just a few clicks away, whether you’re in the office or on the go.

Frequently asked questions about the corporation efile program

When considering the corporation efile program, potential filers often have several common questions regarding eligibility and processes. One common query is whether small businesses qualify for e-filing. Generally, any registered corporation meeting state requirements can e-file, provided they aren’t exempted or restricted due to specific circumstances or revenue limits.

Additionally, many individuals wonder about specific form sections—like how to report losses or deductions accurately. Seeking answers to these questions beforehand not only assists in preparing accurate submissions but also can avert complications or delays when filing. To bridge any gaps in knowledge, pdfFiller’s dedicated resources can provide clarity on typical queries, helping users navigate the filing landscape.

Technical support and assistance

Navigating the complexities of tax filings can be daunting, which is why pdfFiller offers robust technical support to ensure your experience is smooth. Should you encounter any issues while using the service or have questions about the corporation efile program form, pdfFiller provides several avenues for assistance. You can easily contact their support team via chat or email for personalized help.

Additionally, pdfFiller hosts a range of online resources and tutorials designed to empower users with the knowledge necessary for successful document preparation. These resources include guides, FAQs, and video tutorials, which cover common pitfalls and best practices for filing the corporation efile form efficiently.

Alternative options for corporation tax filing

While the corporation efile program is a valuable resource for many businesses, some may prefer exploring alternative submission methods. Offline submission remains an option for businesses that focus on traditional practices, although it comes with longer processing times and a higher risk of losses or delays in transit.

Additionally, hiring professional tax preparation services can relieve businesses of the complexities involved in tax filings. These services offer expertise that can be particularly helpful for larger corporations or those with complicated financial situations. However, it's essential to weigh the costs against the efficiency and convenience the corporation efile program through services like pdfFiller offers.

Conclusion: Why choose pdfFiller for your corporation efile needs

pdfFiller stands out as a premier solution for managing the filing of the corporation efile program form. With its user-friendly interface and innovative features, businesses are empowered to complete their tax submissions swiftly and successfully. The integration of tools for editing, e-signature, and collaboration enhances the overall experience, making it easier for teams to work together seamlessly.

Real customer testimonials highlight the platform's effectiveness, illustrating numerous successful experiences. As users report on the efficiency and ease of managing their documentation through pdfFiller, it becomes clear that this service simplifies the complexities involved in tax filing. The corporation efile program form will never feel as daunting when you have pdfFiller supporting your journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete corporation efile program online?

How do I edit corporation efile program online?

How do I complete corporation efile program on an iOS device?

What is corporation efile program?

Who is required to file corporation efile program?

How to fill out corporation efile program?

What is the purpose of corporation efile program?

What information must be reported on corporation efile program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.