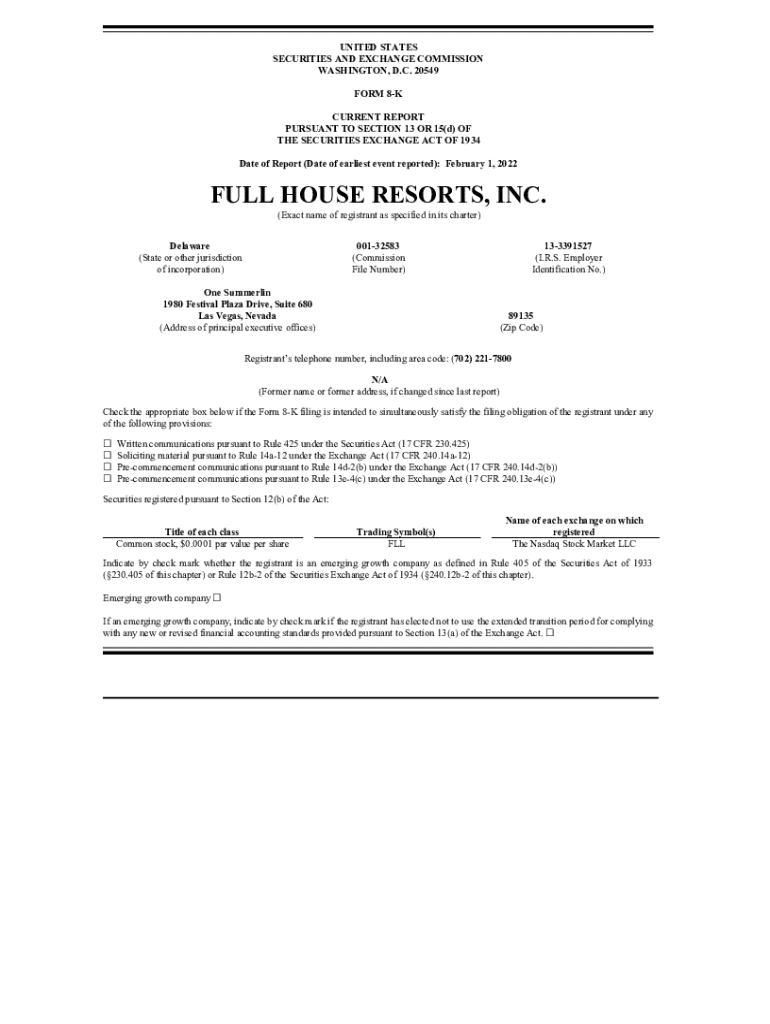

Get the free On January 26, 2022, Full House Resorts, Inc

Get, Create, Make and Sign on january 26 2022

How to edit on january 26 2022 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out on january 26 2022

How to fill out on january 26 2022

Who needs on january 26 2022?

Understanding the January 26, 2022 Form: A Complete Guide

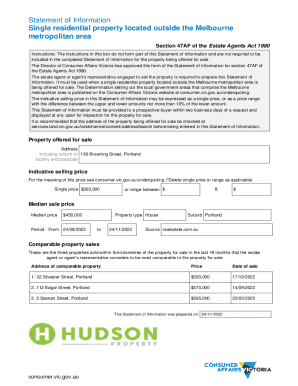

Overview of the January 26, 2022 form

The January 26, 2022 form serves a critical purpose in document management, particularly for individuals and entities seeking to meet compliance obligations. Known alternately in various contexts, this form is instrumental as it relates to financial disclosures. Typically, it demands a high level of transparency from taxpayers, ensuring that they provide accurate and complete information to relevant authorities. Understanding this form is not just about filling out information; it involves comprehending its implications on financial responsibilities.

The importance of the January 26, 2022 form in document management can neither be overstated nor overlooked. It significantly impacts compliance, transparency, and the legal obligations of taxpayers. High-level features of this form include its structured layout for data extraction and its compatibility with various document management systems, including pdfFiller, which enables users to handle their documentation seamlessly.

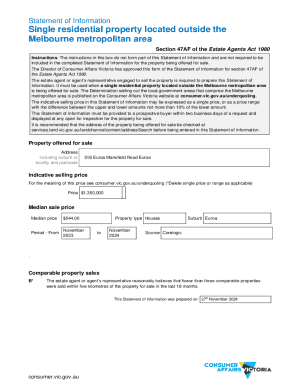

Key components of the form

The January 26, 2022 form contains several crucial components that require careful attention. Each section is designed to elicit specific required information from the user. The following breakdown outlines the major sections:

Commonly required information also encompasses details about previous form submissions, tax identification numbers, and sometimes, signed disclosures, all vital for a robust understanding of a taxpayer's financial situation.

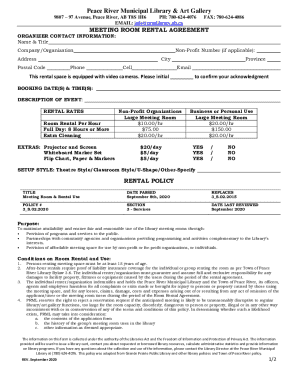

Preparing to fill out the form

Preparation is key before diving into filling out the January 26, 2022 form. Gather all necessary documentation that verifies both identity and financial standing. Identification documents may include government-issued IDs or driver's licenses, while financial statements are paramount for ensuring accuracy.

Understanding the requirements ahead of time is equally crucial. This involves determining eligibility criteria which may vary based on jurisdiction. Additionally, be mindful of key deadlines to avoid penalties related to late submissions, especially if you are participating in a voluntary disclosure practice or related compliance.

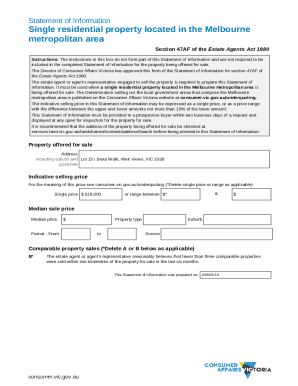

Step-by-step instructions for completing the January 26, 2022 form

Completing the January 26, 2022 form via pdfFiller simplifies the process significantly. Here’s how to get started:

Editing and modifying your form

Editing your January 26, 2022 form using pdfFiller’s platform is straightforward. The editing tools allow for a fluid experience, letting you add or remove information seamlessly. This is particularly useful for users who realize they need to make adjustments after initial inputs.

Collaboration is essential in form management, especially in team environments. Utilize annotation features for better teamwork while filling out the form collectively. This allows multiple stakeholders to input necessary information or provide feedback directly on the document.

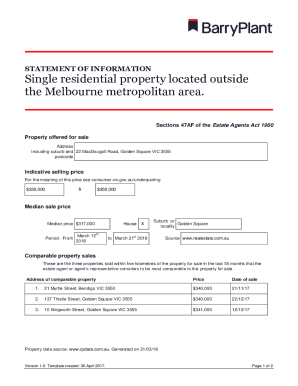

Signing the form digitally

Digital signatures have revolutionized how documents are executed, and the January 26, 2022 form is no exception. The importance of eSigning cannot be overstated; it adds a layer of security and validation to your submission.

To eSign through pdfFiller, follow these steps: First, confirm that all the information on the form is accurate. Next, select the eSign option and identify your signature method, which could be drawing, typing, or uploading an image of your signature. Finally, place your signature on the appropriate section of the document. Understand that eSignatures hold legal validity under various legislation, making them a suitable alternative to traditional pen-and-paper signatures.

Submitting the form

Submitting the January 26, 2022 form follows certain protocols and methods. Users can choose between direct submission to the concerned authority or via third-party platforms that facilitate document delivery.

To ensure successful submission, here are some tips:

Tracking your submission

Once you submit the January 26, 2022 form, tracking its progress is equally vital. pdfFiller offers various tools that allow users to monitor the status of their submissions in real-time.

In case you encounter issues, having a plan is essential. Initiate a follow-up via email or phone to address any concerns with your submission. Be familiar with the timelines for approval or processing, which may vary across jurisdictions.

Managing your completed form

After submission, managing your completed January 26, 2022 form is crucial. Proper storage and organization are key to avoiding misplacement. Utilize pdfFiller's cloud-based solutions to store your documents securely.

Sharing your completed form with team members or stakeholders becomes easier with pdfFiller’s tools. Consider best practices for document management and security to safeguard sensitive information, especially if dealing with financial disclosures.

Troubleshooting common issues

Facing issues with the January 26, 2022 form is not uncommon. Frequent problems include inaccurate data entry, submission errors, or confusion regarding requirements. Having a FAQ section can ease the pain of unforeseen obstacles.

Access resources within pdfFiller for assistance. If challenges persist, contacting customer support provides users with expert guidance tailored to their specific needs.

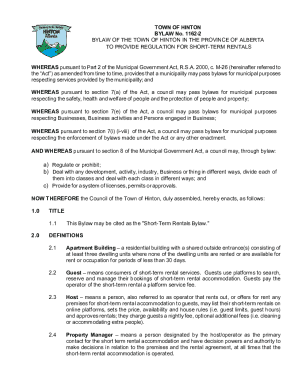

Advanced tips for efficient form management

To maximize efficiency in handling the January 26, 2022 form, consider utilizing templates available on pdfFiller for repetitive tasks. This dramatically reduces the time spent recreating documents from scratch.

Leverage additional features offered by pdfFiller, such as collaboration for teams and cloud storage, to ensure accuracy and compliance. Being vigilant about adherence to legal standards is essential, particularly if operating under strict compliance frameworks like the Internal Revenue Manual’s guidelines or requirements tied to offshore voluntary disclosure programs.

Case studies and user experiences

Real-life applications of the January 26, 2022 form can be insightful, especially when users share experiences. Various taxpayers have leveraged pdfFiller to navigate through complexities successfully.

User testimonials highlight the effective management of financial disclosures, where practitioners experienced a decrease in compliance-related penalties due to thoroughness enabled by digital documentation tools. Success stories emerge from different sectors, illustrating versatility and effectiveness in various applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify on january 26 2022 without leaving Google Drive?

How do I make changes in on january 26 2022?

Can I create an electronic signature for signing my on january 26 2022 in Gmail?

What is on January 26, 2022?

Who is required to file on January 26, 2022?

How to fill out on January 26, 2022?

What is the purpose of on January 26, 2022?

What information must be reported on on January 26, 2022?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.