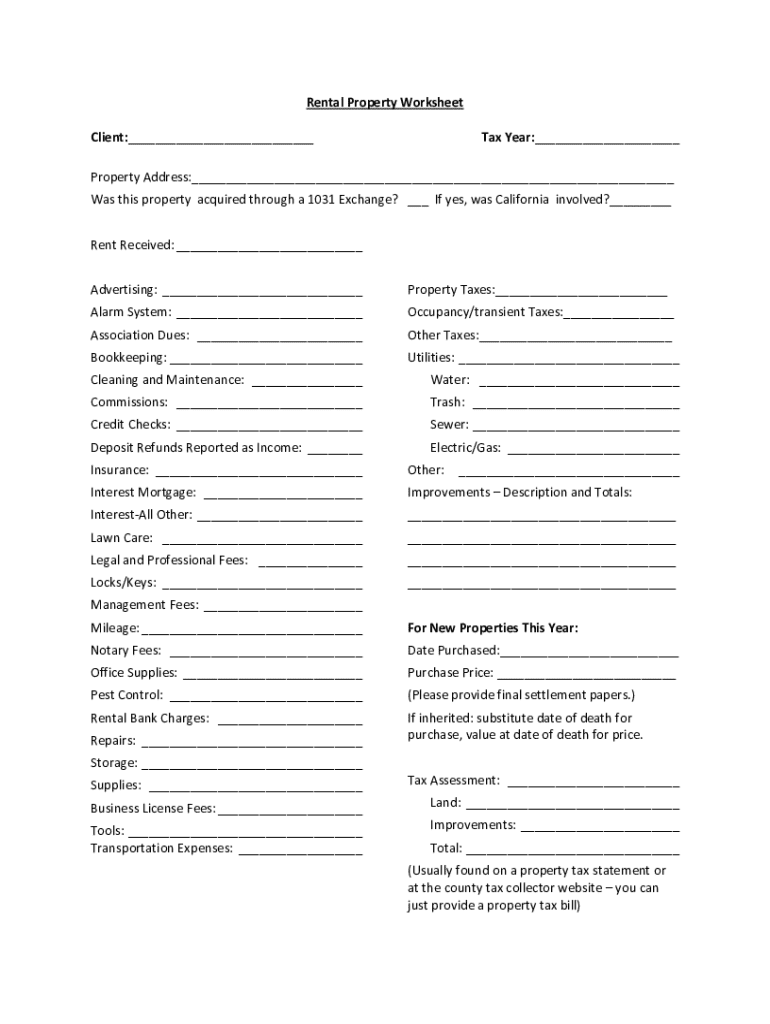

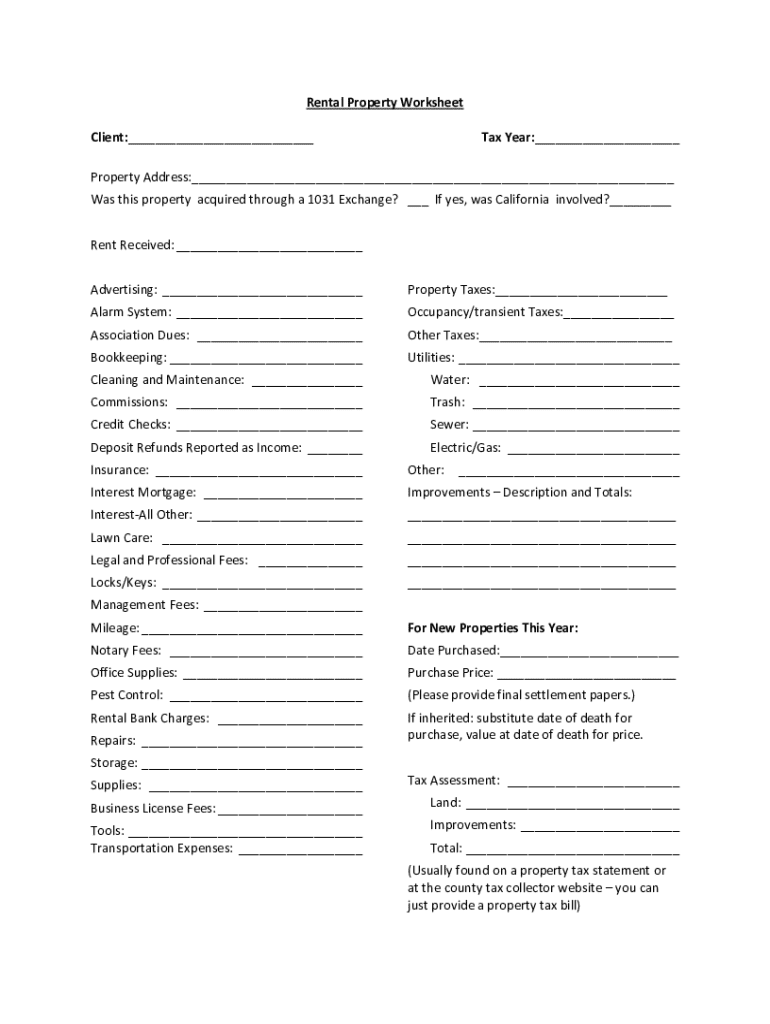

Get the free Was this property acquired through a 1031 Exchange

Get, Create, Make and Sign was this property acquired

Editing was this property acquired online

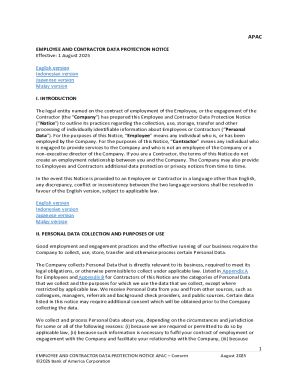

Uncompromising security for your PDF editing and eSignature needs

How to fill out was this property acquired

How to fill out was this property acquired

Who needs was this property acquired?

Was This Property Acquired From: A Comprehensive Guide

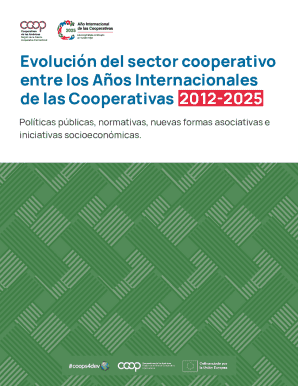

Understanding property acquisition

Property acquisition refers to the process through which an individual or entity legally gains ownership of real estate. This encompasses various methods including purchase, inheritance, and donation, each defining the circumstances under which the property transitioned from one party to another. Understanding these different types of acquisitions is fundamental because they dictate the subsequent rights and responsibilities associated with the property.

Confirming acquisition details is crucial for multiple reasons, including legal implications that could affect ownership claims, financial considerations such as market value and potential return on investment, and implications on taxation which might differ depending on how the property was acquired.

Determining the source of property acquisition

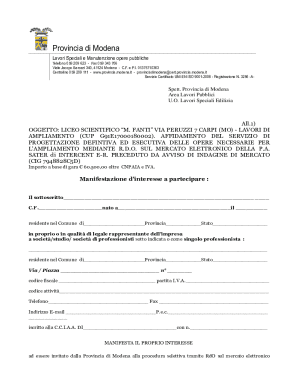

Property can be acquired from a range of sources. Common sources include individuals selling their properties, corporations looking to expand their portfolios, or government and municipal entities that often engage in land development projects. Identifying these sources is essential to understanding the origin of the property and the legitimacy of the ownership.

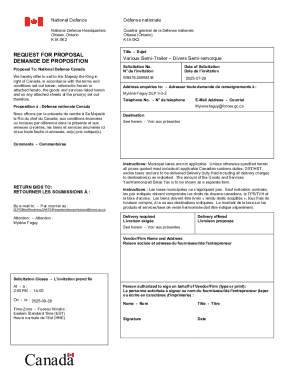

Verification requires specific documentation including titles and deeds that confirm legal ownership, purchase agreements that detail the transaction, and tax records indicating the financial history connected to the property.

Navigating the property acquisition process

To verify property ownership, there are several steps one should follow. First, locate the property's original title, as this is the primary document confirming ownership. Next, check with local government offices, as they will have records of property transfers. Lastly, consult financial records, such as Form 1099-A, which deals with property transfers to ensure comprehensive documentation.

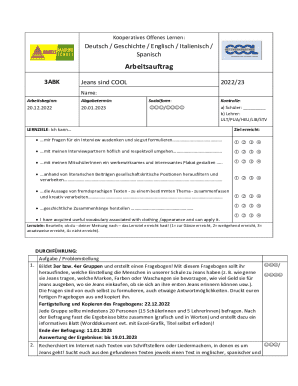

Using document management tools like pdfFiller can greatly enhance the organization and accessibility of these documents. By utilizing cloud-based solutions, users can effectively track acquisition histories and manage numerous forms seamlessly.

Specific situations surrounding property acquisition

Acquiring property from family can differ significantly from purchasing it through a traditional sale. Valuations and tax implications may vary, as familial transfers might qualify for special tax considerations, making the financial landscape different than a typical real estate transaction. Additionally, emotional factors often come into play, making these transactions more complex.

When considering commercial versus residential property acquisitions, there are notable differences in the acquisition process and legal framework. Typically, commercial acquisitions involve extensive due diligence, considering factors like zoning laws and business viability, unlike most residential transactions which may focus more on personal preferences and residential requirements.

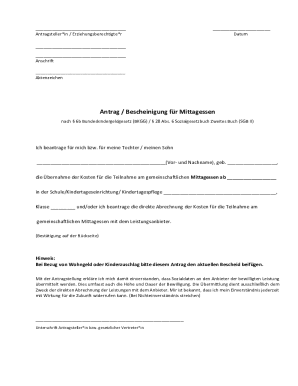

Exploring forms relevant to property acquisition

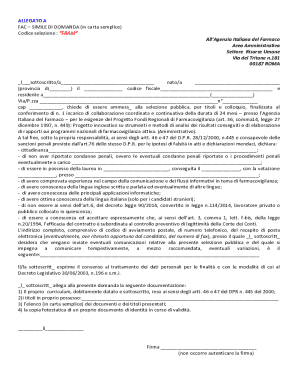

Certain forms are essential when navigating property acquisition. Form 1099-A, which addresses the acquisition or abandonment of secured property, serves a critical role during tax declarations and financial assessments. Users need to understand its purpose and the process for filling it out correctly to avoid complications.

Filling out these forms correctly involves following specific instructions to ensure compliance with IRS regulations and to facilitate the smooth transition of property ownership.

The role of pdfFiller in property management

pdfFiller offers seamless document creation and management features, empowering users to edit PDFs of critical forms effortlessly. Whether it's adjusting details or entering new information, the platform's user-friendly interface enhances the collaboration among stakeholders involved in property transactions.

The benefits of electronic signing and secure storage of documents cannot be overstated. Many individuals and teams appreciate the security features of pdfFiller, which safeguard sensitive information while allowing easy access to documents from various devices, ensuring that important papers are always within reach.

Moreover, case studies highlight the success stories of individuals and teams who have effectively managed property transactions using pdfFiller, showcasing its versatility as a crucial document management tool.

Addressing FAQs about property acquisition

There are several common misconceptions surrounding property acquisition, such as the belief that all property transfers are straightforward or that certain forms are not necessary. Understanding the complexities involved, including the necessity of proper documentation, can greatly minimize disputes over ownership.

In cases where property ownership is contested, it’s vital to take specific steps. This situation often necessitates a thorough review of all documents and forms related to the acquisition, ensuring that all paperwork is in order and can substantiate ownership claims.

Final steps in finalizing acquisition

Ensuring compliance with local laws is a final step in the property acquisition process. Every region has specific regulations that can impact ownership, transfer taxes, and property obligations. Familiarizing oneself with these laws can save potential legal issues down the road.

Closing the deal requires certain key practices to ensure that every aspect is in order. Utilizing pdfFiller can assist in facilitating a smooth transaction, helping users keep all documents organized and properly signed. This leads to a more efficient conclusion to the acquisition, ultimately empowering individuals and teams to manage their property-related tasks confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send was this property acquired to be eSigned by others?

How do I edit was this property acquired online?

How do I make edits in was this property acquired without leaving Chrome?

What is was this property acquired?

Who is required to file was this property acquired?

How to fill out was this property acquired?

What is the purpose of was this property acquired?

What information must be reported on was this property acquired?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.