Get the free Form Ohio Blanket Exemption Certificate

Get, Create, Make and Sign form ohio blanket exemption

How to edit form ohio blanket exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form ohio blanket exemption

How to fill out form ohio blanket exemption

Who needs form ohio blanket exemption?

Understanding the Ohio Blanket Exemption Form

Understanding the Ohio blanket exemption form

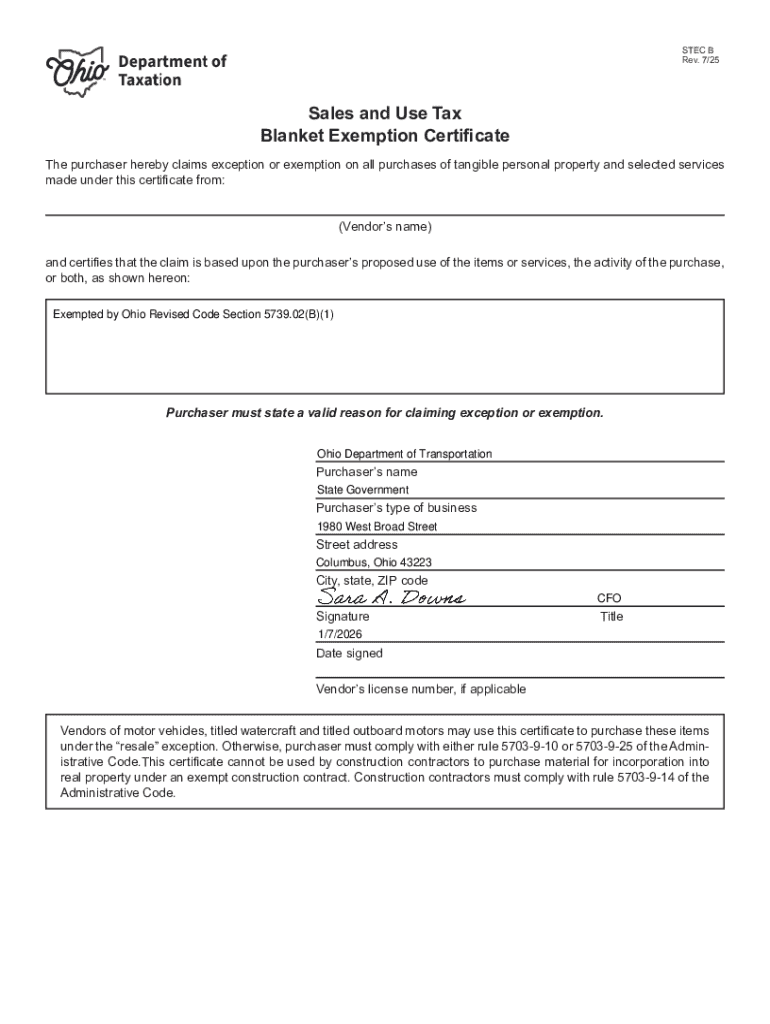

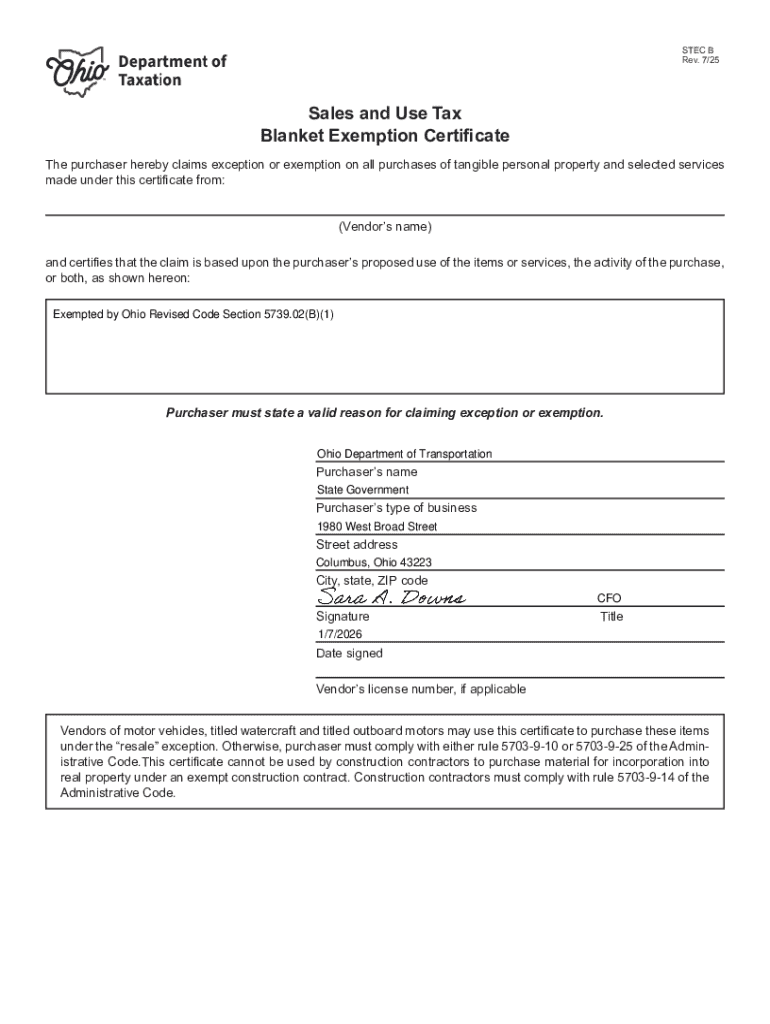

The Ohio Blanket Exemption Form is essential for businesses and individuals seeking relief from paying state sales tax on certain purchases. The form serves as a declaration that the buyer is making an exempt purchase, which eliminates the sales tax burden for qualifying transactions. By using this form, organizations can maintain financial efficiency while complying with Ohio's tax regulations.

It's critical to understand that the blanket exemption goes beyond just one-time purchases. Instead, it allows repeat exemptions on similar purchases made over a specified period, streamlining the purchasing process for exempt organizations.

The importance of the blanket exemption lies in its ability to support certain roles within Ohio's economy, such as non-profit organizations or government entities. By receiving tax exemptions, these organizations can allocate more resources towards their core missions.

Eligibility criteria

To qualify for using the Ohio Blanket Exemption Form, applicants need to meet specific eligibility criteria. Primarily, the exemption is available to non-profit organizations, governmental entities, and select corporations engaged in the manufacturing sector. Each of these categories must demonstrate a clear purpose for the exemption, typically tied to their operational needs.

Documentation is a crucial element in the application process. Applicants should prepare various documents, including proof of non-profit status or government affiliation. These documents are critical in verifying that the buyer qualifies for the exemption and regularly reports it to county treasurers.

Step-by-step guide to completing the Ohio blanket exemption form

Completing the Ohio Blanket Exemption Form involves several steps, beginning with gathering all necessary information. Essential details include identifying information such as the name of the organization, address, and tax identification number, as well as a clear description of the exempt use—a vital aspect of successfully filling out the form.

As you fill out the Ohio Blanket Exemption Form, remember to carefully read instructions for each section. This includes the declaration of exempt use, the identification of the seller, and the applicable exemptions for specific items. One common mistake applicants make is not providing a detailed explanation of the exempt purpose, which can lead to rejection of the form.

Submitting the Ohio blanket exemption form

Once you have completed the Ohio Blanket Exemption Form, the next vital step is submission. Knowing where to submit the form is crucial—typically, forms are sent to the county treasurer's office in your region. It's also important to ascertain whether your county offers online submissions or prefers traditional mailing methods.

Processing times can vary depending on the county's workload, so it's wise to follow up after submitting the form. Submission methods can include online uploads, mailing hard copies, or in-person drop-offs, allowing applicants flexibility based on their preferences and urgency.

Managing your blanket exemption status

After submission, it’s essential to keep track of the status of your blanket exemption. Most counties will provide a way to verify whether your exemption has been approved. This might involve contacting the county treasurer's office or accessing an online portal if available. Timely verification ensures that you can proceed with your exempt purchases without complications.

If your exemption is denied, it's imperative to understand the reasons behind the decision. Most counties will provide feedback outlining why the application was not accepted. This feedback will guide you in addressing any deficiencies and reapplying or appealing the decision.

Making changes to your blanket exemption form

Changes may become necessary to your Ohio Blanket Exemption Form due to various factors—like a shift in your organization’s status or incorrect information on the initial submission. Knowing when and how to amend the form is essential for maintaining your exemption status. It's recommended to consult the form's instructions or the county treasurer about the correct amendment procedure.

Typically, amendments will require submitting a new form alongside documentation supporting the changes. This might include updates on addresses, organizational status, or additional exempt purchases.

Using the pdfFiller platform for your Ohio blanket exemption form

pdfFiller streamlines the process of managing your Ohio Blanket Exemption Form with its user-friendly tools. Users can edit, sign, and collaborate seamlessly on their documents. This cloud-based platform allows you to modify the form from anywhere, making it easier than ever to ensure your application is complete and accurate before submission.

Additionally, pdfFiller provides interactive tools such as form templates specifically designed for Ohio Blanket Exemption Forms, ensuring you start with the right framework. E-signature capabilities enable secure validation of your fills and make the process more efficient.

Frequently asked questions about the Ohio blanket exemption form

Many users have common queries surrounding the Ohio Blanket Exemption Form. For instance, individuals frequently ask about the types of purchases that qualify for exemption and how to handle denied applications. Addressing these questions early in the process can facilitate a smoother application experience.

In addition, troubleshooting tips are invaluable. If you encounter issues while filling out or submitting your form, having access to resources or a contact point at the county treasurer can make a significant difference.

Advanced tips for a seamless application process

To ensure a seamless application process for the Ohio Blanket Exemption Form, best practices include reviewing your filled form for completeness and accuracy. Utilize pdfFiller’s resources to guide you through each section of the form, ensuring you do not overlook any critical details that could impede your approval.

Additionally, collaborating with your team members via pdfFiller can enhance your submission’s quality. Having multiple eyes on the document can reveal potential errors or areas needing clarification, ultimately leading to a more robust application.

Case studies: Success stories of the Ohio blanket exemption

Real-life examples of organizations benefiting from the Ohio Blanket Exemption Form demonstrate its significance. Several non-profit organizations report saving thousands on essential supplies, allowing them to allocate those funds towards charitable initiatives. These success stories underscore the value of understanding and appropriately utilizing tax exemptions.

Moreover, businesses in the manufacturing sector often share testimonials regarding streamlined purchasing processes, attributing their enhanced operational efficiency to the comprehension of exemption eligibility and proper documentation practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form ohio blanket exemption in Gmail?

Where do I find form ohio blanket exemption?

Can I create an electronic signature for the form ohio blanket exemption in Chrome?

What is form ohio blanket exemption?

Who is required to file form ohio blanket exemption?

How to fill out form ohio blanket exemption?

What is the purpose of form ohio blanket exemption?

What information must be reported on form ohio blanket exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.