Get the free Refund Final Rule Small Business Compliance Guidance.pdf

Get, Create, Make and Sign refund final rule small

Editing refund final rule small online

Uncompromising security for your PDF editing and eSignature needs

How to fill out refund final rule small

How to fill out refund final rule small

Who needs refund final rule small?

Comprehensive guide to the refund final rule small form

Understanding the refund final rule

The refund final rule establishes clear guidelines for the processing of refunds across various industries, particularly focusing on consumer protections. This rule aims to streamline the refund process, ensuring that consumers receive their money promptly and without unnecessary barriers.

Historically, refund policies varied widely across companies and industries. This lack of standardization often left consumers confused about their rights and the refund status. The final rule seeks to resolve these inconsistencies, offering a unified framework that enhances efficiency and transparency.

For consumers and stakeholders, the importance of an organized refund system cannot be overstated. A well-defined refund policy protects consumers from unsatisfactory services or products, providing a necessary safety net while enhancing trust in businesses.

How the refund final rule impacts small form usage

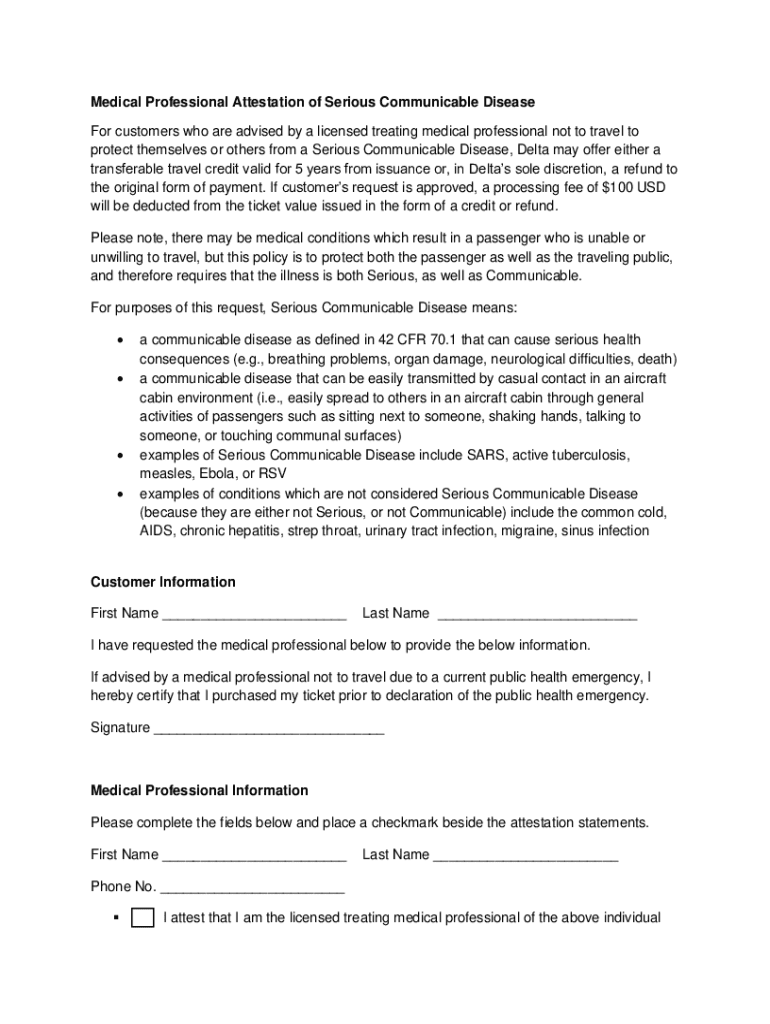

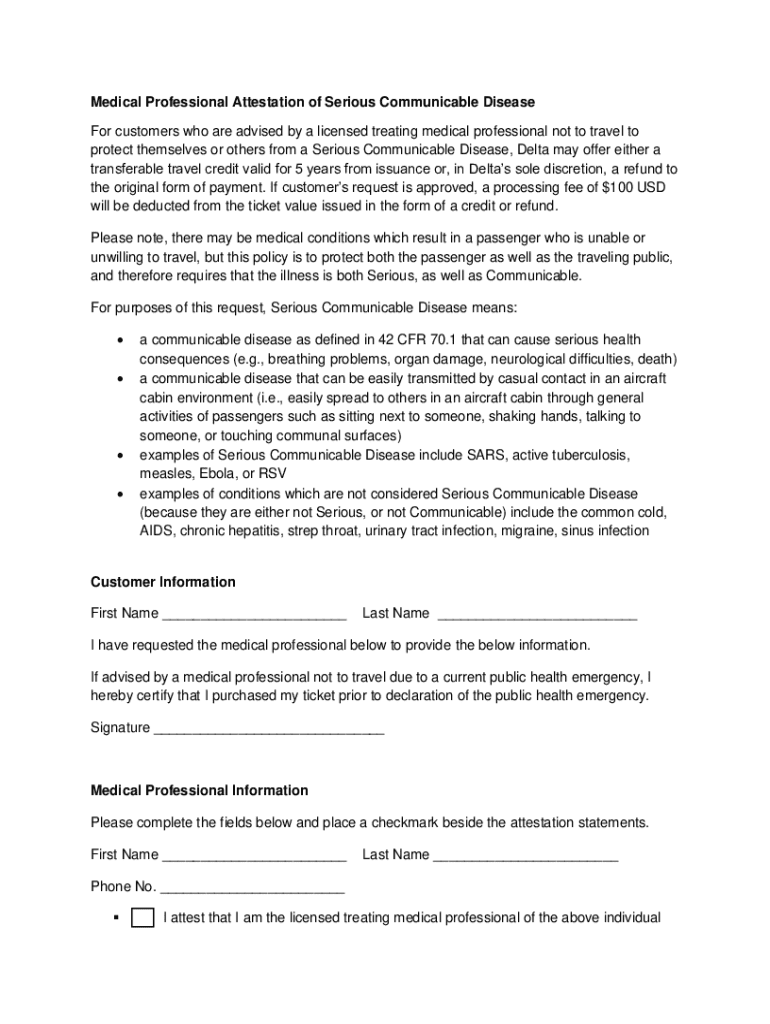

The refund final rule significantly impacts the use of small forms, which are simplified documents typically employed for requesting refunds. In the context of this rule, a small form refers to straightforward, often one-page documents that facilitate the process of claiming refunds.

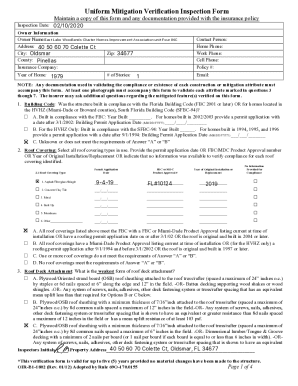

These small forms must adhere to specific requirements regarding documentation and reporting. Businesses need to ensure that their small forms capture the necessary information to comply with the final rule, making the process easier for consumers.

Key components of the refund final rule

One of the central tenets of the refund final rule is the automatic refund requirement. Businesses must establish criteria for eligibility that align with the rule, which generally includes clearly defined circumstances under which a refund is warranted.

Transparency is also a key component, ensuring that consumers receive comprehensive information about their rights and processes. Businesses must provide clear guidance on how refunds are calculated and how to initiate disputes if needed.

Steps to utilize the refund final rule for small forms

Step 1: Identify applicable forms

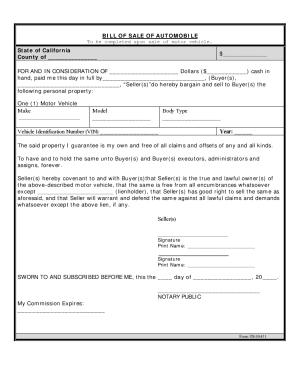

Identifying forms that fall under the refund final rule is the first step for consumers. It is essential to know which small forms are eligible for refunds. Common examples include flight refunds, service cancellations, or product returns.

To verify form eligibility, resources such as the company’s website or customer support can provide insights into which refund forms qualify under this rule.

Step 2: Fill out the small form correctly

Completing the small form accurately is crucial for processing your refund efficiently. It's essential to provide all required fields to avoid unnecessary delays. Missing documentation can hinder the processing of refunds.

Avoid common pitfalls by reviewing the form thoroughly before submission. Ensure all details are accurate, as errors can lead to processing delays or outright rejection.

Step 3: Submitting your small form

Submission of the small form is a critical step in receiving your refund. Best practices involve deciding between electronic and mail submission. Electronic submission tends to be faster and offers immediate confirmation, while mail submission may take longer.

Regardless of the method chosen, ensure to verify the receipt of your form to avoid complications in the refund process.

Step 4: Tracking your refund

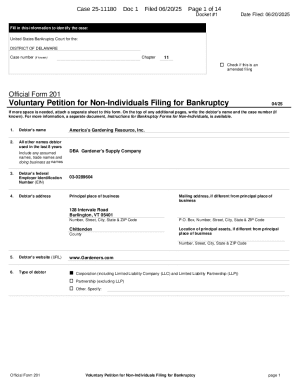

Tracking your refund can provide peace of mind during the often stressful wait for money to be returned. Use tools from pdfFiller to monitor the status of your small form. These tools allow you to see when the form is processed.

Collaboration and document management

Managing small forms often requires teamwork, especially in larger organizations. Using pdfFiller’s collaborative features can enhance document management significantly.

These features ensure compliance by allowing multiple users to access and edit documents, ensuring that each step aligns with regulatory requirements. This collaborative approach helps maintain the integrity of the documentation across all phases of the refund process.

Interactive tools for streamlined management

pdfFiller offers interactive features that simplify form preparation. By utilizing these tools, users can enjoy an enhanced document creation experience, making every step more efficient.

These features are instrumental in ensuring quick turnaround times for form management and facilitating a smoother refund process.

Adapting to changes: future of the refund final rule

The refund final rule is not static; it is subject to updates reflecting changing consumer needs and market trends. As businesses adapt, it is vital for consumers and organizations to stay informed about regulatory changes that may affect refund processes.

Regularly consulting pdfFiller resources ensures users are aware of any modifications that could impact their rights or procedural requirements regarding refunds.

User testimonials and case studies

Real-world examples amplify the understanding of how effective small form refund management can be. Users have shared testimonials about seamless experiences navigating the refund process using organized small forms.

These feedback stories illustrate best practices learned, emphasizing the importance of thoroughness in documentation and understanding one’s rights.

Support and customer assistance

Access to customer support can make or break the refund process experience. pdfFiller offers various resources to help users navigate queries related to refund forms.

Utilizing these customer support channels can assist users in obtaining specific information or resolving common inquiries about filling out forms or tracking refunds effectively.

Conclusion of key takeaways

The refund final rule significantly enhances the clarity and efficiency of small forms used for refunds. Understanding each step from identification to submission ensures that consumers benefit from the protections afforded by the rule.

In a landscape where effective document management is critical, embracing tools like pdfFiller can empower users to streamline their refund processes and engage proactively with their rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute refund final rule small online?

How do I make changes in refund final rule small?

Can I create an electronic signature for the refund final rule small in Chrome?

What is refund final rule small?

Who is required to file refund final rule small?

How to fill out refund final rule small?

What is the purpose of refund final rule small?

What information must be reported on refund final rule small?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.