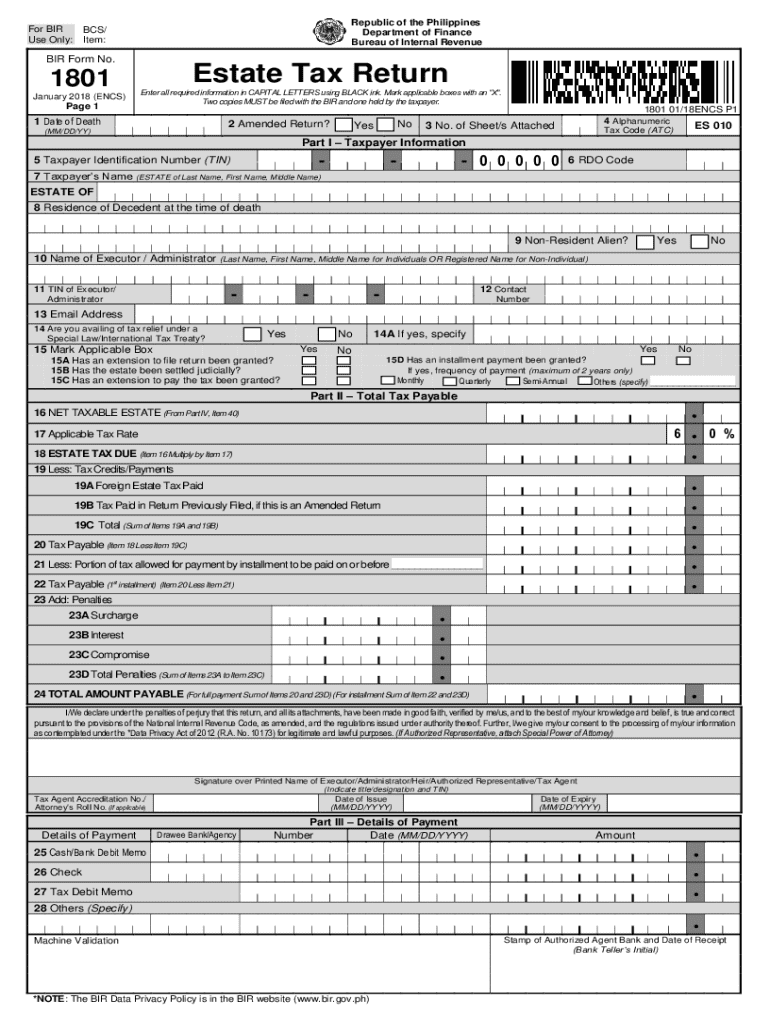

Get the free BIR Form 1801 Estate Tax Return .pdf - For BIR Use Only

Get, Create, Make and Sign bir form 1801 estate

How to edit bir form 1801 estate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bir form 1801 estate

How to fill out bir form 1801 estate

Who needs bir form 1801 estate?

BIR Form 1801 Estate Form How-to Guide

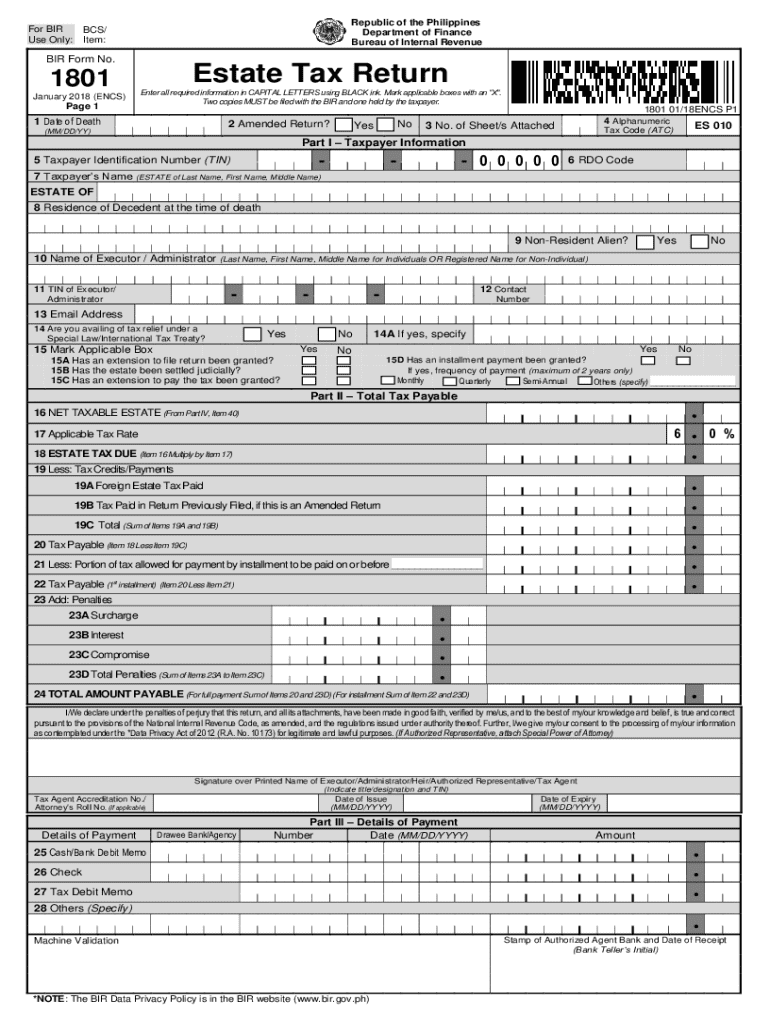

Understanding BIR Form 1801

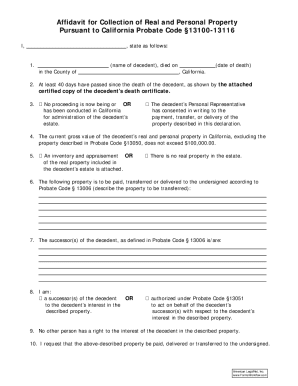

BIR Form 1801 is a vital document used to report the estate tax liabilities of a deceased individual in the Philippines. This form plays an essential role in ensuring that all pertinent taxes related to the estate are calculated and settled according to the country's tax laws. Estate taxation arises from the transfer of assets following an individual’s death, which means filing Form 1801 is not merely a legal obligation but also a way to show financial accountability in managing an estate.

Filing BIR Form 1801 allows the heirs or executors to determine the correct amount of estate tax owed, processing the estate into the rightful hands while adhering to the local tax regulations. Thus, understanding this form is crucial for any individual managing estate matters, including family members and professionals involved in succession planning.

Preparing to fill out BIR Form 1801

Before you start filling out BIR Form 1801, gathering the necessary documents and information is crucial. This ensures that the process is as smooth as possible and minimizes errors that could lead to delays in tax processing. Important documents include the decedent's Will, Death Certificate, asset valuation documents, and the Tax Identification Number (TIN) of the deceased.

Having these documents ready not only saves time but also ensures accuracy in reporting the estate's financial data. Additionally, understanding key terminology related to estate tax is beneficial for correctly interpreting the form and engaging in any discussions with tax professionals.

Step-by-step instructions for filling out BIR Form 1801

Filling out BIR Form 1801 can be straightforward when approached methodically. The form consists of several sections, each focusing on specific information such as personal details of the deceased, heir information, estate valuation, and applicable deductions or exemptions. The thoroughness of each section impacts the accuracy of completed tax calculations.

Let's break down the different sections of the form for easier comprehension.

Throughout the filling process, there are common pitfalls to avoid. Misplacing decimal points, omitting essential information, or miscalculating valuation can result in filing errors. Double-checking entries and ensuring all pertinent documents are attached can curb these mistakes.

Editing and signing BIR Form 1801

Once BIR Form 1801 is completed, editing and signing the document is the next key step. Utilizing tools like pdfFiller can greatly enhance this process. With pdfFiller, users can upload their PDF form directly into the platform, enabling seamless editing with helpful features such as annotating and highlighting essential information.

The platform enables users to prepare their forms online from anywhere, making it particularly useful for executors and heirs who may not be physically present to handle the documents. Furthermore, once the document is finalized, an electronic signature can be affixed, which is legally valid on tax forms, ensuring compliance and streamlining the submission process.

Submitting BIR Form 1801

Once BIR Form 1801 is edited and signed, the next step is submission. There are primarily two options: online filing and in-person submission. Each comes with specific steps and requirements.

For online submission, you must log into the Bureau of Internal Revenue (BIR) e-Services portal and upload your completed form. On the other hand, in-person filing requires going to designated BIR offices with the physical copy of your completed form. Understanding which method is most suited for your situation can help streamline the compliance process.

Once your form is submitted, it's essential to keep track of your submission status. This can typically be done through the BIR’s portal or by contacting their office directly.

Managing your estate tax documents with pdfFiller

Efficient management of estate tax documents is crucial for ongoing compliance and future reference. pdfFiller provides robust tools for organizing these documents, ensuring that important files are easily accessible when needed. This can include everything from the initial Form 1801 to subsequent amendments in case of errors.

Collaboration with tax professionals and executors is made simple with pdfFiller’s cloud-based platform that allows multiple users to work on documents simultaneously. Furthermore, maintaining the confidentiality of sensitive tax information is paramount; tools within pdfFiller help safeguard these documents with advanced security measures.

Troubleshooting common issues with BIR Form 1801

Despite your best efforts, complications can arise when dealing with BIR Form 1801. Whether it's incorrect information submitted on the initial form or needing to make amendments, knowing how to address these issues is essential. For instance, if you discover inconsistencies post-submission, consider filing an amended return to correct errors.

When addressing issues such as late submissions or mistakes, seeking professional assistance might be necessary, especially for complex estates that require navigational expertise in Filipino tax law.

Frequently asked questions about BIR Form 1801

Navigating BIR Form 1801 can be complex, leading to numerous inquiries. Here are some common questions that individuals often ponder regarding this estate form.

Success stories: How pdfFiller simplified estate management

Many users have turned to pdfFiller for help in managing the complexities associated with estate documentation. From individuals managing family estates to small teams working on larger estates, the platform has simplified the document creation and management process significantly. Success stories reflect how using pdfFiller has improved their overall efficiency.

Users have reported experiencing smoother interactions with tax professionals, allowing for quicker resolutions and submissions. Testimonials highlight the convenience of editability and ease of document sharing as essential features that have transformed how estate matters are handled.

Getting more help with pdfFiller

To ensure users maximize their experience with pdfFiller, access to robust support is available. For issues related to document management, the pdfFiller customer support team can assist with queries and troubleshooting. They also offer extensive online tutorials and webinars geared towards helping users navigate the platform effectively.

Community forums serve as an excellent resource, where users can share their experiences, challenges, and success tips, creating a collaborative learning environment for all who seek guidance on utilizing pdfFiller more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit bir form 1801 estate from Google Drive?

Where do I find bir form 1801 estate?

How do I edit bir form 1801 estate on an Android device?

What is bir form 1801 estate?

Who is required to file bir form 1801 estate?

How to fill out bir form 1801 estate?

What is the purpose of bir form 1801 estate?

What information must be reported on bir form 1801 estate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.