Get the free PAGE 706 OF

Get, Create, Make and Sign page 706 of

How to edit page 706 of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out page 706 of

How to fill out page 706 of

Who needs page 706 of?

A comprehensive guide to page 706 of form 706

Understanding Form 706: Key features and purpose

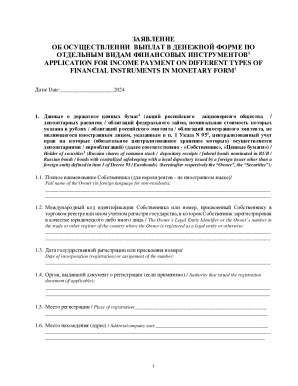

Form 706, officially known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a critical document required to report the estate of a deceased individual. It holds significant importance in the realm of estate tax management, particularly for estates exceeding the specified exemption limit set by the IRS. This form not only helps in calculating the estate taxes owed but also plays a pivotal role in determining how the assets are distributed among heirs.

Filing Form 706 is mandated when the gross estate's value surpasses $12.92 million, as of 2023. The purpose of this form extends beyond mere compliance; it directly influences tax liabilities and can significantly impact the net inheritance received by beneficiaries.

Key components of Form 706 include detailed information about the decedent, such as their name, tax identification number, and the date of death, along with a comprehensive roster of the estate's assets subject to tax. These typically encompass real estate, bank accounts, investments, and other properties held at the time of death.

Detailed breakdown of page 706

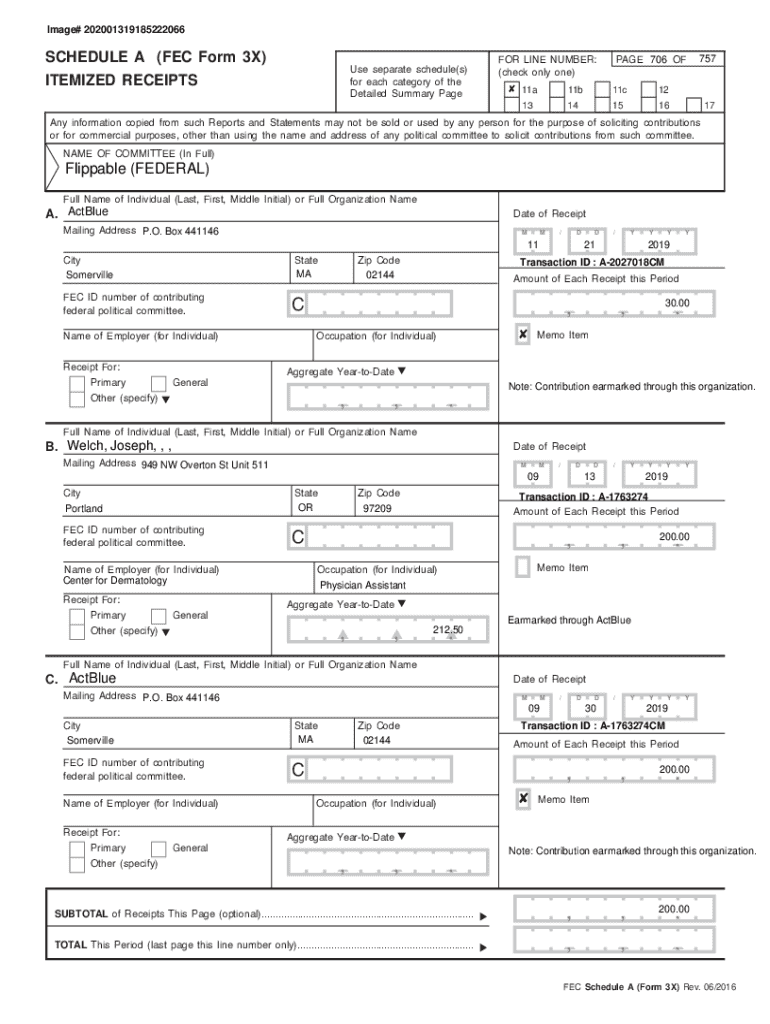

Page 706 of Form 706 is dedicated to a series of calculations and declarations that assess the estate's value comprehensively. It includes various lines focusing on specific details such as the total value of the gross estate, allowable deductions, and the calculated estate taxes due. Understanding the terms used on this page is crucial, as they range from 'gross estate' to 'taxable estate,' which can directly impact tax obligations.

Accurate and thorough information on Page 706 is paramount, as it not only influences tax calculations but also carries potential legal implications. Errors, whether minor or significant, may lead to penalties from the IRS or disputes among heirs, which can complicate the estate settlement process.

Step-by-step instructions for completing page 706

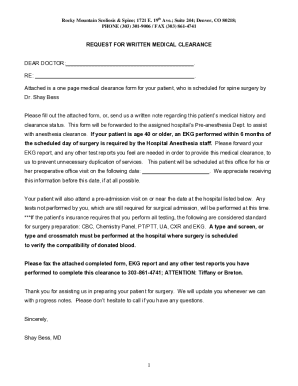

To successfully complete Page 706, it is essential to gather all pertinent documentation beforehand. You will need access to the decedent's will, asset appraisals, previous tax returns, and additional financial documents that substantiate the estate's value. If the task feels overwhelming, enlisting the help of estate planning professionals can be beneficial.

Filling out Page 706 involves several structured steps. You will start by providing personal details about the decedent and their estate. Then, estimate the estate's overall value, listing all assets—real and personal—before transitioning to deductions and credits that could affect the taxable amount.

Expect to encounter challenges while filling out Page 706. Common pitfalls include missing information, inaccurate asset valuations, and misunderstanding tax deductions. A systematic approach will help mitigate these issues and ensure a smoother filing process.

Frequently asked questions about page 706

Queries regarding Page 706 often center on who is required to file it. Generally, if the gross estate exceeds the exemption threshold, you must file. This includes not only real estate owners but also those with significant ownership stakes in businesses or other assets.

Filing deadlines for Form 706 are stringent; the return must be filed within nine months post-death, with possible extensions available. Failing to meet this deadline could lead to substantial penalties, as can inaccuracies in reporting asset values or deductions.

Recent changes and updates to form 706

The 2023 version of Form 706 features notable amendments that reflect changes in estate law. One of the most significant updates is the adjustment of tax exemption amounts, which can greatly affect estate tax calculations. Recent court decisions have also clarified filing requirements, particularly for estates involving more complex assets like cryptocurrencies or electronic wills.

Understanding these updates is essential for effective estate planning. Future considerations for Form 706 may involve ongoing legislative changes that could impact estate tax obligations, necessitating regular reviews of both federal and state regulations to ensure compliance.

Interactive tools for filing page 706

pdfFiller offers an array of interactive tools designed to simplify the Form 706 filing process. Their platform enables users to fill out the form digitally, ensuring an error-free submission. Features such as template editing and collaborative options enhance user experience, making it easier for families or estate executors to work together on the filing.

The benefits of using pdfFiller extend beyond simple completion. It includes eSigning capabilities and document management solutions that allow users to securely store and track estate tax documents. This all-in-one approach aids in compliance, reduces risk, and fosters clear communication among all parties involved in estate planning.

Legal resources and support for form 706

Navigating the complexities of Form 706 may warrant professional legal assistance, especially for larger estates or unique asset holdings. Estate planning attorneys have the expertise to guide executors through the filing process and ensure compliance with both IRS regulations and state laws, particularly in regions like Chester County, Pennsylvania, where local laws may influence estate tax matters.

When to seek help depends on the estate's complexity and the decedent's wishes. In particular, understanding estate obligations within electronic wills legislation can further complicate the filing process. Resources for finding qualified estate attorneys include local bar associations or estate planning organizations that can match potential clients with experienced practitioners.

Reporting and tracking your estate taxes

After submitting Page 706, it’s crucial to monitor the status of your estate tax filing. Maintaining organized records ensures clarity should the IRS require further documentation or clarifications in the future. If amendments to Page 706 are necessary, understand the procedure for filing an amended return, which enables corrections without starting from scratch.

Establishing a streamlined process for handling any issues with the IRS is also essential. Keep detailed records of communications and follow-up inquiries to ensure transparency and compliance. Proactive management of your tax obligations helps mitigate potential disputes with heirs and ensures adherence to all necessary filing requirements.

Personal stories and case studies

Real-life examples can often illuminate the complexities associated with filing Form 706. Case studies reveal that many executors faced setbacks due to inadequate record-keeping or misvaluations. Lessons learned from these situations emphasize the importance of thoroughness, transparency, and the potential need for legal support during the filing process.

Expert insights from estate planners highlight the advantages of utilizing platforms like pdfFiller to avoid common mistakes. Streamlining communication and focusing on accurate asset valuation significantly enhance the likelihood of a smooth filing experience, ultimately benefiting beneficiaries and helping to preserve family legacies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in page 706 of without leaving Chrome?

How do I fill out the page 706 of form on my smartphone?

Can I edit page 706 of on an iOS device?

What is page 706 of?

Who is required to file page 706 of?

How to fill out page 706 of?

What is the purpose of page 706 of?

What information must be reported on page 706 of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.