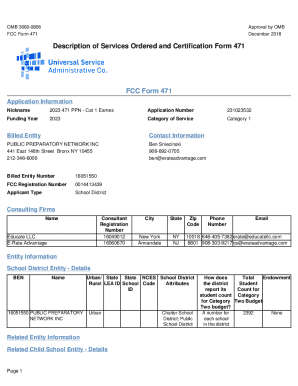

Get the free estimated tax - 2026

Get, Create, Make and Sign estimated tax - 2026

How to edit estimated tax - 2026 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estimated tax - 2026

How to fill out estimated tax - 2026

Who needs estimated tax - 2026?

Estimated Tax - 2026 Form: Your Comprehensive Guide

Understanding estimated taxes in 2026

Estimated taxes are payments made towards your annual tax liability, typically required by those who do not have sufficient tax withheld from their income. In 2026, this concept continues to be crucial, especially for self-employed individuals and others with significant income fluctuations. Estimated taxes are beneficial for managing your financial responsibilities throughout the year, ensuring you avoid large tax bills during tax season.

The importance of estimated taxes cannot be overstated. They help you spread your tax burden over the year, avoiding sudden financial strain. By making these payments, you proactively address any potential tax obligations that may arise from various income sources.

Key changes for 2026

As taxpayers prepare for 2026, it is essential to stay informed about the changes in tax laws impacting estimated taxes. Several updates have occurred that may influence how individuals calculate their estimated payments. Increased income thresholds for tax brackets, adjustments to standard deductions, and new credits or deductions for specific circumstances have all been introduced. It's vital to stay updated with current tax regulations to ensure accurate estimated tax calculations.

Who needs to pay estimated taxes?

Certain individuals are required to pay estimated taxes in 2026. Self-employed individuals, for example, often have no tax withheld from their income and must pay estimated taxes quarterly to cover their potential tax liability. Additionally, taxpayers with significant income sources not subject to withholding—such as investment income or side businesses—must consider their estimated tax obligations. This group must pay attention to their income levels, ensuring they meet the threshold requiring estimated payments.

There are also unique circumstances to consider. Retirees may not have adequate withholding from retirement distributions, necessitating estimated taxes. Likewise, student workers earning income from part-time jobs should track their earnings, as they may exceed the taxable threshold depending on their total income. Understanding who needs to pay estimated taxes is key to maintaining good financial health.

Calculating your estimated taxes for 2026

Calculating estimated taxes for 2026 can be straightforward if you follow a step-by-step approach. Start by using the previous year’s tax return as your baseline. Evaluate your total income and any deductions. Adjust these figures based on expected changes in your situation, such as additional income from a side business or a reduction in deductible expenses. These adjustments will give you a clearer picture of what your tax obligation may look like for the upcoming year.

To facilitate the calculation process, individuals may take advantage of interactive tools offered by pdfFiller. These tax calculators provide a user-friendly platform to input data, automatically calculate estimated taxes, and ensure accuracy in your assessments. Utilizing such tools not only simplifies the task but also enhances your understanding of your tax status.

Filing estimated tax payments

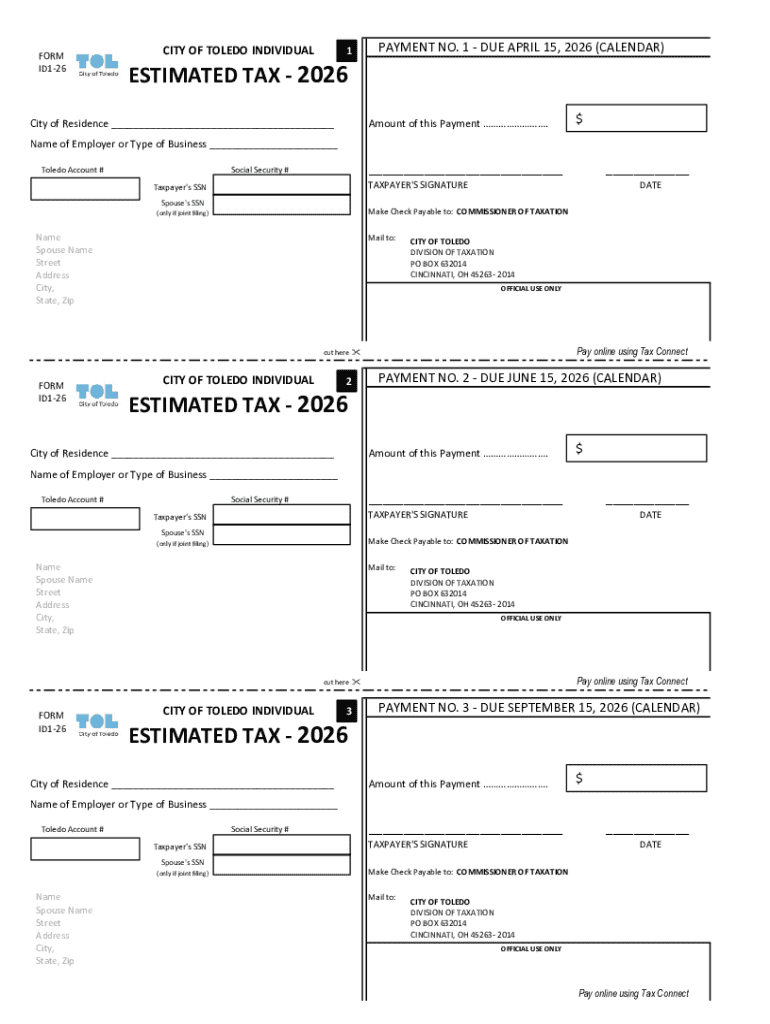

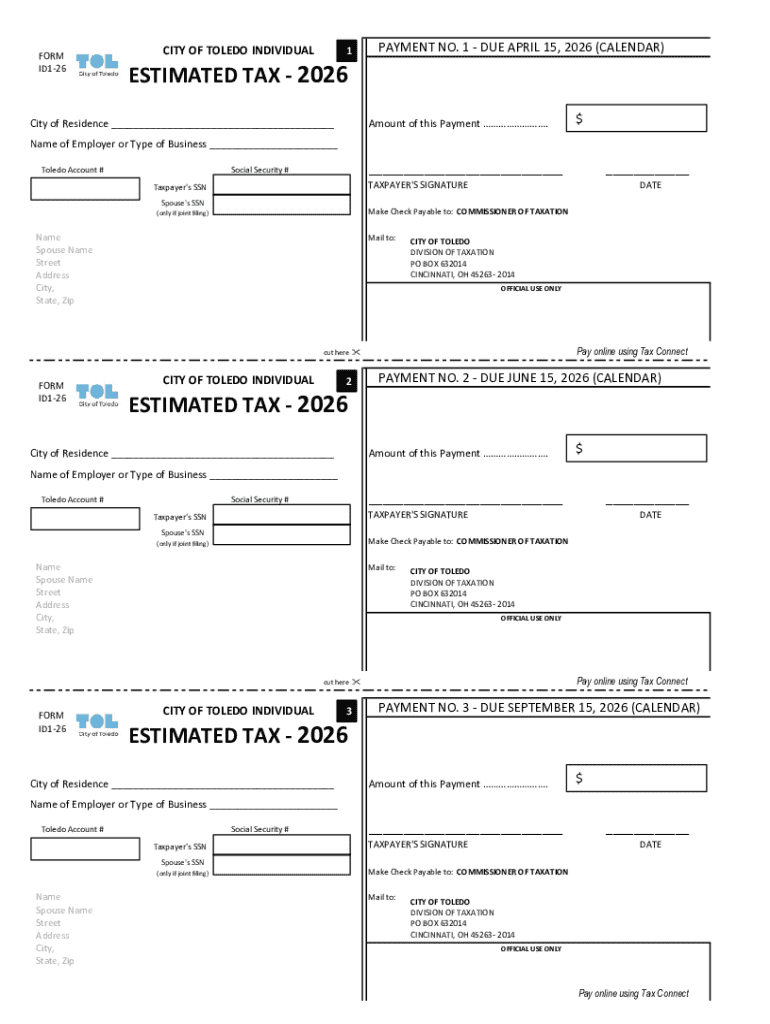

When it comes to filing estimated tax payments, adherence to the payment schedule is crucial. For 2026, the IRS has set specific due dates for quarterly payments, typically on April 15, June 15, September 15, and January 15 of the following year. Taxpayers may also consider the annualization option if their income is fluctuating or seasonal, allowing them to pay based on current earnings rather than a flat quarterly amount.

Accepted payment methods for estimated taxes have also evolved. You can pay electronically via the IRS website, through direct debit, or via a credit/debit card. Additionally, mailing a check remains an option, though electronic payments are often recommended for their immediacy and ease of tracking.

Completing and submitting the 2026 estimated tax form

The primary form used for calculating estimated taxes is Form 1040-ES. This form is designed specifically for taxpayers who need to report income and estimate their tax liability. To fill out the form, begin with a detailed breakdown of your expected income, followed by deductions and credits you may qualify for. Take care to accurately fill in each section, ensuring you account for your entire financial picture.

Submission can be done via e-filing or paper filing. E-filing offers a more streamlined approach, allowing for quicker processing times and instant confirmation of submission. Those choosing to paper file must ensure they mail their forms well before the due date to avoid penalties.

Managing your estimated tax payments

Tracking your estimated tax payments is vital for future planning and compliance. Keeping meticulous records will help you ensure you’re on track with your payments and will also aid in preparing for future tax filings. Utilizing pdfFiller’s document management features can significantly simplify this process. The platform allows you to categorize, store, and retrieve tax-related documents effortlessly.

Adjusting your payments is another essential part of managing your estimated taxes. If your income fluctuates due to unforeseen circumstances or new business ventures, you may need to adjust your estimated payments accordingly. Understanding when and how to file for a change in estimated taxes can save you from potential penalties and ensure you remain compliant with IRS requirements.

Frequently asked questions (FAQs)

A common question around estimated taxes is when individuals should begin making payments. Typically, if you expect to owe tax of $1,000 or more when filing your return, payments should start quarterly. Another prevalent query is what happens if you've overpaid or underpaid your estimated taxes. In the case of an overpayment, taxpayers can typically claim a refund when they file their return, while underpayment could result in penalties or interest depending on the severity and duration of the underpayment.

Consequences for not paying estimated taxes are serious. The IRS may impose penalties and interest rates on any outstanding owed amount, which can accumulate quickly. Understanding these potential repercussions can motivate taxpayers to remain diligent about their estimated tax responsibilities.

Resources and tools for individuals and teams

Plenty of interactive tools are available at pdfFiller to help users navigate the complexities of tax preparation. From filling forms to e-signing and collaboration, leveraging these tools can streamline the process for individuals and teams alike. Familiarizing yourself with pdfFiller’s offerings will enable you to manage your estimated tax responsibilities more effectively.

Adopting a cloud-based document management strategy is another critical aspect. By having access to your documents from anywhere, you can efficiently organize tax related materials, ensuring that nothing gets lost and everything is up-to-date. This strategy allows for peace of mind and greater control over your tax situation as you prepare for the 2026 tax year.

Considerations for teams and businesses

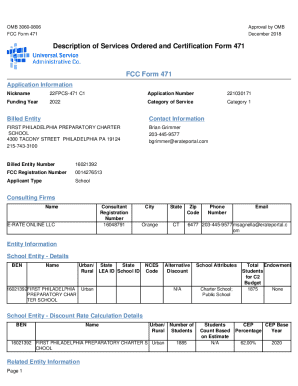

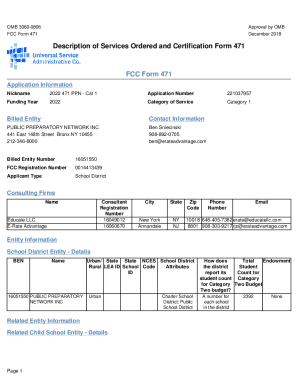

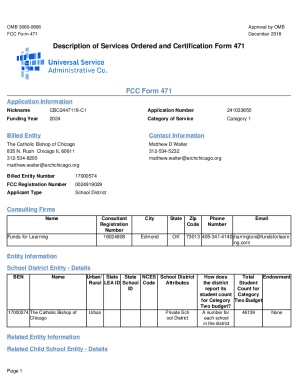

Businesses will find that estimated tax requirements can vary vastly depending on their structure. For example, LLCs and Corporations must follow different filing requirements and payment schedules. It is vital to understand these distinctions to ensure compliance and optimize financial strategies.

Encouraging collaborative document practices within teams is crucial when preparing estimated tax documents. Platforms like pdfFiller allow multiple users to work jointly on documents, providing tools for seamless communication and information sharing. By utilizing these collaborative features, teams can enhance productivity and accuracy in tax preparation and filing.

Unique tax scenarios to consider

Handling unique tax scenarios requires an understanding of specific tax implications for various income types. For example, if you're earning rental income or capital gains, you must consider the tax obligations these income sources entail. Self-employed individuals often face added complexity due to business deductions and variable income, necessitating careful planning to ensure accurate estimated tax payments.

Consultation with tax professionals is strongly advised for individuals navigating these complexities. As tax laws evolve, having expert guidance can help you avoid costly mistakes, optimize your filings, and enhance your tax savings, especially during significant changes in your financial situation or when facing unique scenarios.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit estimated tax - 2026 from Google Drive?

How do I execute estimated tax - 2026 online?

Can I create an electronic signature for signing my estimated tax - 2026 in Gmail?

What is estimated tax - 2026?

Who is required to file estimated tax - 2026?

How to fill out estimated tax - 2026?

What is the purpose of estimated tax - 2026?

What information must be reported on estimated tax - 2026?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.