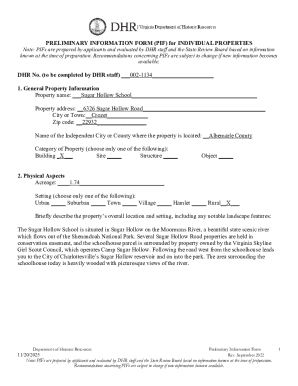

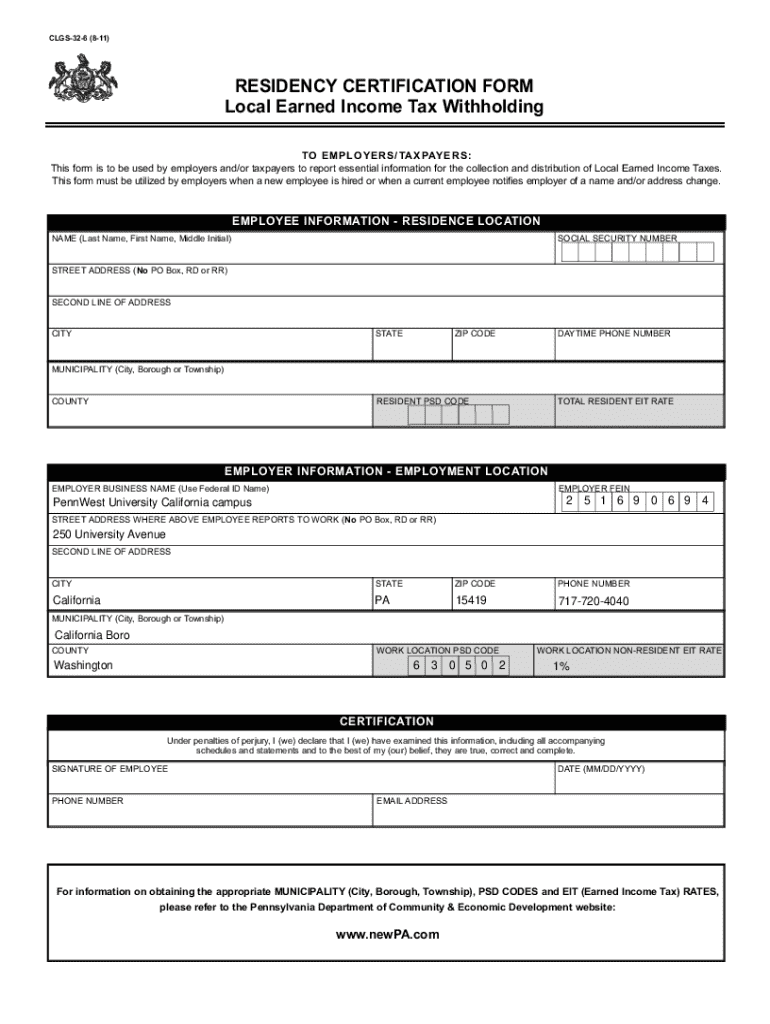

Get the free Local Earned Income Tax Certification FormPDF

Get, Create, Make and Sign local earned income tax

How to edit local earned income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out local earned income tax

How to fill out local earned income tax

Who needs local earned income tax?

Navigating the Local Earned Income Tax Form: A Comprehensive Guide

Understanding local earned income tax

Local earned income tax is a tax imposed by local governments and municipalities on individuals based on their earned income. Unlike federal and state income taxes, which apply broadly, local earned income tax rates and regulations vary significantly from one jurisdiction to another. The primary purpose of this tax is to fund local services, including education, public safety, and infrastructure developments. Understanding local earned income tax is essential for individuals and organizations alike. Completing the local earned income tax form ensures you contribute your fair share to your community, while also keeping you compliant with local laws.

The importance of filing this form cannot be overstated. It not only fulfills your civic duty but also ensures that you are not subject to penalties that could arise from underreporting income or failing to file altogether. Additionally, knowing the specifics of local earned income tax regulations helps in financial planning and management.

Who needs to file the local earned income tax form?

Typically, any individual earning income within a locality where the earned income tax is imposed must file the local earned income tax form. This includes employees, self-employed individuals, and freelancers. It is crucial to understand that just because you are working remotely or within a different jurisdiction does not exempt you from filing taxes in your local area. Furthermore, businesses operating in the jurisdiction are also required to file local earned income taxes based on the income of their employees.

There are, however, exemptions and special cases to consider. Students earning income below a certain threshold, retirees with fixed incomes, and certain low-income earners may qualify for exemptions from local earned income tax. Understanding the specific exemptions available in your locality can greatly impact your overall tax obligations. It is advisable to check with your local tax authority for detailed information regarding your specific circumstances.

Navigating the local earned income tax form: A step-by-step guide

When preparing to complete your local earned income tax form, organization is key. Here’s how you can simplify the process:

Filling out the local earned income tax form

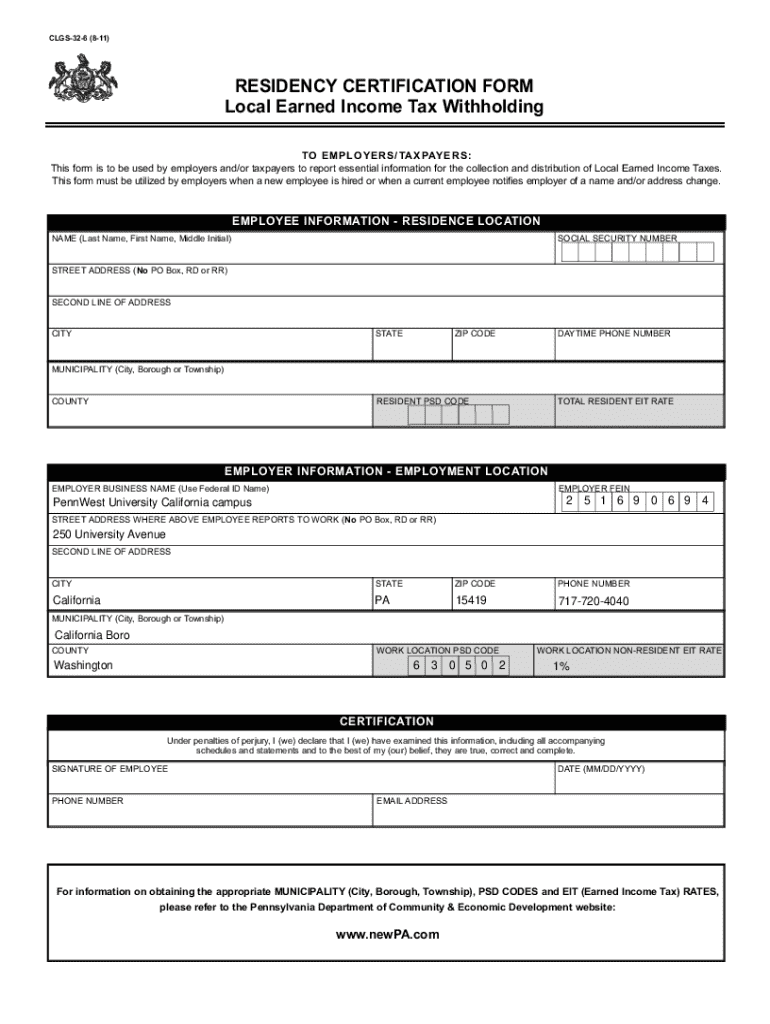

Filling out the local earned income tax form accurately is crucial to ensure you do not face any issues later. The form generally consists of several sections that require detailed information. In the personal information section, you need to provide your full name, address, and Social Security number. Accuracy here is key because any discrepancies could delay processing or prompt audits.

Moving on to income reporting, detail all sources of earned income, ensuring to categorize each type correctly. Common types of income include wages from employment, business profits, and freelance earnings. Additionally, familiarize yourself with deductions and credits that apply to your situation, as these can significantly reduce your overall taxable income.

It's also important to be aware of common mistakes that filers make when completing their local earned income tax forms. Double-checking all details and ensuring that you have not left any required fields blank can save you from unnecessary complications.

Editing, signing, and submitting your local earned income tax form

Once your local earned income tax form is completed, the editing phase is vital. Utilizing tools like pdfFiller allows you to simplify this process with interactive features designed for seamless document completion. You can easily edit fields, cross-check filled information, and use eSign capabilities to digitally sign your form, making the submission process smoother.

After ensuring that your form is accurately filled out, you must consider how to submit it. Most municipalities allow online submissions through their official sites. Alternatively, you can mail a printed copy of your form. It's essential to pay attention to submission deadlines to avoid late fees or penalties.

Frequently asked questions (FAQs)

Mistakes can happen when filling out your local earned income tax form. If you realize you have made an error after submitting, it’s important to contact the local tax office immediately to learn how to correct it. You may need to submit an amended return.

Amending your local earned income tax return is often a straightforward process, but specific procedures can vary based on local regulations. Be sure to follow the guidance provided by your local tax authority.

The processing time for your form can also differ, depending on the volume of submissions your local tax office receives. Typically, processing can take several weeks, so if you are expecting a refund or have any concerns, it’s advisable to follow up as needed.

Local earned income tax: Latest updates and news

Tax regulations are subject to change, often reflecting economic conditions and governmental policy shifts. It is crucial to stay informed about the latest updates to local earned income tax laws that might affect your filing. Recent changes may include adjustments in rates, new exemptions, or revised regulations that could alter your tax obligations.

Being aware of these updates can help you strategize for the upcoming tax year. Frequent consultation with local tax websites and news sources can provide the information you need directly relevant to local earned income tax requirements in your area.

Interactive tools and resources for local earned income tax filing

Tools like pdfFiller are invaluable assets during your local earned income tax filing process. Utilizing document management features, you can streamline your form adjustments and maintain organized records of your submissions and supporting documentation. Such resources enable a more efficient filing process with an emphasis on accuracy.

For those needing assistance, pdfFiller also offers tutorials and customer support to guide users through any uncertainties they may encounter while filling out forms. Accessing these resources can reduce the overall stress associated with tax filing.

Real stories: Successes in local earned income tax filing

Real-life examples of individuals and teams who have successfully navigated the local earned income tax filing process can provide valuable insights and encouragement. Many have shared their experiences of how pdfFiller simplified their tax preparations, allowing them to complete their forms with confidence and ease.

Testimonials from satisfied users typically focus on the platform's flexibility and user-friendly interface, which facilitate collaboration on documents. Whether filing independently or as part of a larger team, having effective tools at your disposal can lead to successful outcomes in local earned income tax reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify local earned income tax without leaving Google Drive?

Can I create an eSignature for the local earned income tax in Gmail?

Can I edit local earned income tax on an Android device?

What is local earned income tax?

Who is required to file local earned income tax?

How to fill out local earned income tax?

What is the purpose of local earned income tax?

What information must be reported on local earned income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.