Get the free Small Business Banking Application FormPDF

Get, Create, Make and Sign small business banking application

Editing small business banking application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out small business banking application

How to fill out small business banking application

Who needs small business banking application?

Understanding the Small Business Banking Application Form

Overview of small business banking application forms

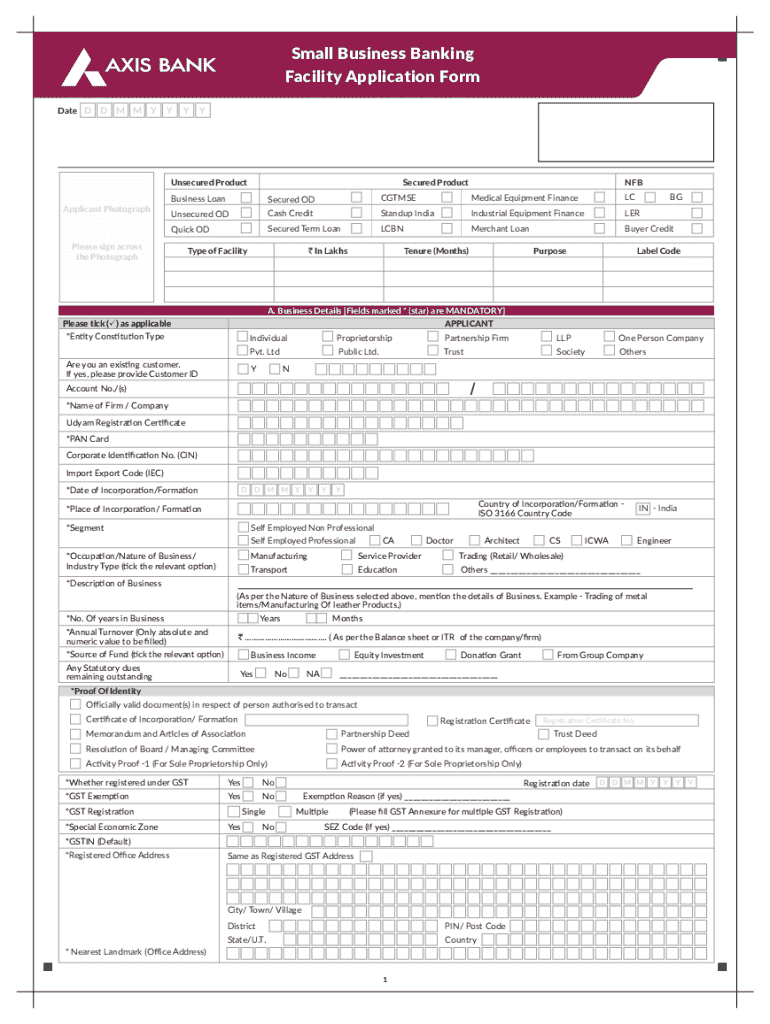

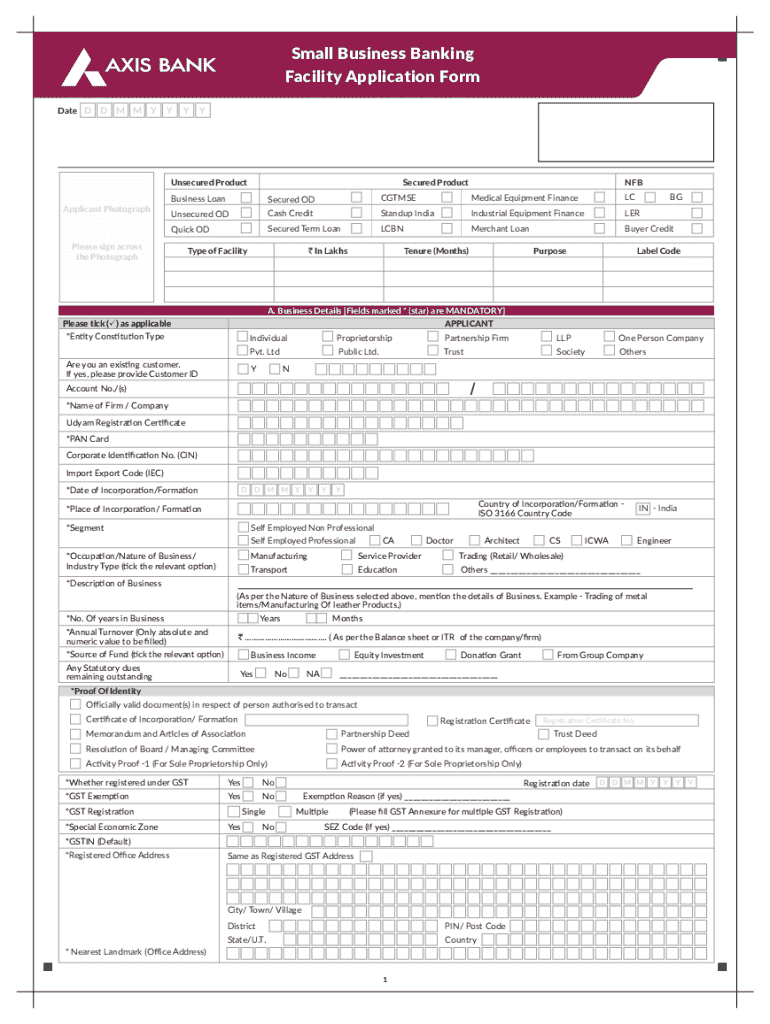

A small business banking application form is a crucial document that facilitates the establishment of a banking relationship between a small business and a financial institution. This form serves various purposes, including the opening of business accounts, applying for loans, or accessing specialized banking services tailored for small enterprises. For small businesses, securing a reliable banking partner is vital for day-to-day operations, financial transactions, and sustainable growth.

The importance of this form cannot be overstated. It signifies a legitimate entry into the world of formal business finance, offering access to essential resources such as business loans and credit lines. Small businesses, which form the backbone of the economy in the United States, often require quick access to capital, professional banking services, and financial advice. Therefore, understanding how to navigate the application process is a necessity for entrepreneurs.

Common use cases

Different types of small businesses—ranging from retail shops and service providers to home-based ventures—regularly use banking application forms to set up accounts for operational banking functions. Whether starting from scratch or transitioning from personal banking to business banking, entrepreneurs find themselves needing to fill out this form. Specific scenarios warranting its use may include securing a loan for equipment purchase, applying for a merchant account to accept credit card payments, or establishing multiple accounts for better fund management.

Key sections of the small business banking application form

The small business banking application form typically comprises several key sections that capture essential business and financial information. The first section, business information, includes the legal business name, registration details, and business structure—be it an LLC, partnership, or corporation. Understanding how to correctly provide this information is crucial, as discrepancies can delay processing or even result in rejections.

Next comes the personal information of owners, including details of all owners and significant stakeholders. This section is critical as banks often require personal guarantees from business owners, which means their personal creditworthiness can impact business loans—or vice versa. The financial information segment will require documentation like profit and loss statements, balance sheets, and disclosure of current assets and liabilities. Finally, the banking preferences section allows business owners to indicate which types of accounts and services they are interested in, such as checking accounts, savings accounts, or loans.

Step-by-step instructions for filling out the application form

Filling out a small business banking application form can seem overwhelming, but following a systematic approach can simplify the process. Begin with Step 1: gathering required documentation. This typically includes business licenses, tax identification numbers, personal identification for owners, and financial statements. It's wise to organize these documents in folders, either physical or digital, to streamline the process.

Step 2 involves actually completing the application. Take your time to fill out each section accurately, carefully reviewing the details. When detailing financial information, double-check figures to avoid common pitfalls. Mistakes can lead to delays or complications in approval. Finally, Step 3 is the submission. Depending on the bank, applications can often be submitted online, in person, or via mail. Always check your application status after submission to ensure all goes smoothly.

Editing and signing the application form

Editing forms can significantly enhance clarity and precision. Tools like pdfFiller offer editable formats that allow users to modify the application easily before submission. With a cloud-based document editor, small business owners can make adjustments from anywhere, which is particularly helpful for those on the go. Furthermore, these tools simplify collaboration among various stakeholders or team members involved in the application process, making it easy to share and incorporate various perspectives.

The integration of eSignature capabilities within such platforms greatly simplifies the signing process. Most banks require a signed application to validate the identity of the person submitting the application and hold them accountable. Using pdfFiller, signing can be done electronically, ensuring that the completed documents are signed securely and efficiently, which is essential for both compliance and speeding up application processing times.

Managing your small business banking application

After submitting your application, managing the process continues. Keep track of your application status by following up with the bank, as many institutions provide online portals for tracking. Documenting all communication with bank representatives can be beneficial, especially if any issues arise. This record could be helpful in case of disputes or if you need to amend any application information later.

What should you do if your application is rejected? It can be disheartening, but understanding common reasons for rejection, such as insufficient credit scores or improper documentation, can help address issues effectively. Gather feedback from the bank on how to amend the application and resubmit it, improving your chances of success.

Interactive tools and resources for applicants

The journey doesn’t end once you submit the application. Participating in online workshops can be immensely beneficial. These webinars often cover nuances of the application process, allowing attendees to ask questions in real-time. Interactive sessions can enhance your understanding and improve your application strategy.

Additionally, it’s helpful to review a Frequently Asked Questions (FAQ) section specifically tailored for banking applications. These resources address common issues faced by small businesses, such as identifying necessary documents or understanding specific policies related to different financial institutions.

Advantages of using pdfFiller for your banking needs

Employing pdfFiller as a document management solution can greatly streamline the banking application process. Aside from its editing capabilities, the platform allows easy sharing, real-time collaboration, and cloud storage, helping small businesses maintain organization and accessibility. It's particularly beneficial in maintaining copies of completed forms as proof of submissions.

Accessibility is a priority, and with pdfFiller, businesses can work on their applications from anywhere, facilitating teamwork and ensuring that deadlines are met. Moreover, data security is paramount for small businesses. pdfFiller offers robust security measures to safeguard sensitive information, ensuring compliance with regulations while providing peace of mind to users.

User testimonials and success stories

Many businesses have discovered efficiency gains through pdfFiller's user-friendly platform. Testimonials highlight how quickly and easily users have navigated the small business banking application form, often noting the simplicity of editing and signing documents online. Success stories showcase not just effective submission processes but also the resulting positive relationships built with banking institutions.

Case studies further illustrate how pdfFiller's features have translated into successful application experiences. Users report improved tracking of applications and greater confidence in their submissions due to enhanced document management capabilities.

Troubleshooting common issues

Despite careful preparation, applicants may encounter technical problems when filling out forms online, such as issues with browser compatibility or software glitches. A simple solution is to ensure that your browser and software are up to date, as these factors can significantly impact functionality.

If problems persist, contacting customer support should be your next step. pdfFiller offers dedicated support teams ready to assist users with document-related inquiries and technical issues, ensuring that their needs are met swiftly and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in small business banking application?

Can I edit small business banking application on an iOS device?

How do I edit small business banking application on an Android device?

What is small business banking application?

Who is required to file small business banking application?

How to fill out small business banking application?

What is the purpose of small business banking application?

What information must be reported on small business banking application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.