Get the free SEC targets small proponents in latest shareholder restriction

Get, Create, Make and Sign sec targets small proponents

Editing sec targets small proponents online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec targets small proponents

How to fill out sec targets small proponents

Who needs sec targets small proponents?

SEC targets small proponents form: A comprehensive how-to guide for advocacy

Understanding the SEC's focus on small proponents

The U.S. Securities and Exchange Commission (SEC) plays a pivotal role in regulating securities markets, ensuring transparency, fairness, and protection for all investors. Among its regulatory activities, the SEC focuses significantly on small proponents—individual or small group shareholders who advocate for changes within publicly traded companies. These small proponents typically hold a relatively modest stake in the company yet play an essential role in amplifying shareholder voices and championing various corporate governance issues. Historically, the SEC has engaged with small proponents to enhance shareholder rights, counterbalance management power, and foster dialogue around corporate governance.

Small proponents matter significantly in today’s corporate landscape. Their proposals often address pressing issues such as environmental sustainability, social responsibility, and corporate governance reforms. This grassroots activism can influence major shareholders and prompt companies to adopt more progressive practices. Hence, understanding the SEC’s approach to small proponents is crucial for anyone interested in participating in corporate governance.

The latest developments in SEC regulation

Recently, the SEC has introduced key regulations targeted at streamlining the process for shareholder proposals while also adjusting the thresholds for eligibility. These changes favor larger shareholders while simultaneously creating obstacles for smaller proponents. The 2020 amendments to Rule 14a-8, for instance, have raised the ownership requirements for certain proposals, impacting smaller shareholders’ ability to effect change. Such regulations can stifle shareholder engagement and limit the diversity of perspectives presented in proxy contests.

Numerous case studies illustrate the rise and challenges faced by small proponents. For example, proposals aimed at increasing corporate transparency around climate risks have garnered significant support when presented by larger investors, but smaller, innovative proposals often struggle for recognition. Small proponents can learn valuable lessons from both successful and unsuccessful initiatives, enabling them to craft more impactful proposals in alignment with shareholder interests.

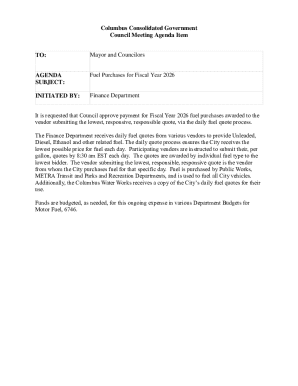

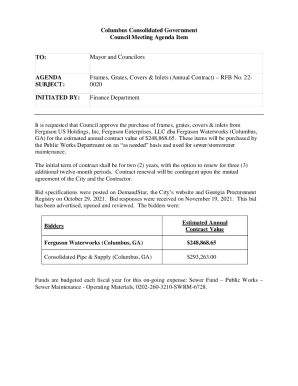

Navigating SEC requirements for shareholder proposals

To submit a successful shareholder proposal, understanding the eligibility criteria set by the SEC is essential. A small proponent typically must have continuously held at least $2,000 in market value of the company’s stock for one year. This ownership requirement ensures that proponents have a genuine interest in the company’s long-term success. Additionally, proposals need to be properly documented and submitted in compliance with SEC rules.

Strategies for successful proposal submission

Crafting an effective proposal requires attention to detail and a clear understanding of shareholder interests. A compelling proposal typically includes a strong rationale, evidence of stakeholder support, and anticipated benefits to the company. Leveraging existing industry news or trends can also enhance your proposal’s significance. Structuring your proposal to align with the company’s objectives will create a stronger case, making it more appealing to other shareholders and management.

Engaging other shareholders is a critical step in building broader support for your proposal. Tools such as email updates and folders dedicated to outreach can facilitate communication and ensure stakeholders are informed of the proposal's purpose and potential benefits. Consider establishing a coalition with like-minded shareholders to amplify your message and increase the chances of a successful outcome.

Anticipating challenges and how to overcome them

Management often responds to shareholder proposals with objections, ranging from questioning the proposal’s relevance to suggesting that it conflicts with company strategy. Small proponents should anticipate these rebuttals and prepare strong responses. Engaging legal counsel or utilizing resources from advocacy organizations can provide additional support in navigating these challenges.

Understanding potential legal and compliance issues is crucial. Small proponents must be aware of SEC litigation and enforcement actions that can arise from poorly formed proposals. Being well-informed about the SEC's rules and the implications of any violations will arm you with knowledge to reposition your strategy effectively. Staying updated with industry news on similar proposals can also provide insight into emerging trends and potential pitfalls.

Resources for small proponents

pdfFiller offers interactive tools that simplify the proposal creation process. With features allowing users to easily draft, edit, and sign documents, small proponents can efficiently manage their proposals. Whether creating a preliminary draft or preparing the final submission, pdfFiller's cloud-based platform streamlines the document workflow, empowering users to focus on content while overcoming the technicalities of form submission.

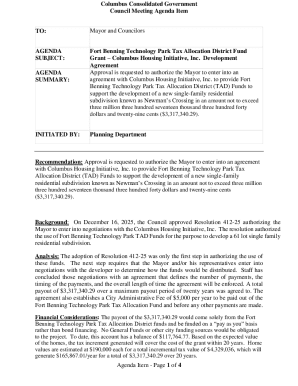

Future trends in SEC regulation for small proponents

Looking forward, potential changes in SEC regulations could further shape the landscape for small proponents. There has been speculation surrounding adjustments that might lower barriers for smaller stakeholders, potentially enhancing their participation in corporate governance. As other collaborative trends emerge within the industry, small proponents can prepare by monitoring regulatory developments and embracing proactive engagement strategies.

Long-term strategies for advocacy include diversifying your engagement efforts and fostering relationships with other stakeholders. Regularly updating your knowledge base with industry news and actively participating in shareholder meetings can help maintain relevance and influence. Small proponents must position themselves as informed participants, continuously adapting to changes in the regulatory environment and investor expectations.

Conclusion and next steps

With the SEC's evolving stance on small proponents, it is crucial for individuals looking to make an impact to leverage available resources effectively. By utilizing tools from pdfFiller for document management and developing strategic proposals, small proponents can navigate regulatory complexities and advocate for their interests with confidence. Staying engaged with fellow shareholders, monitoring industry trends, and refining advocacy strategies will empower small proponents in their pursuit of corporate governance change.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sec targets small proponents directly from Gmail?

How do I execute sec targets small proponents online?

How do I make edits in sec targets small proponents without leaving Chrome?

What is sec targets small proponents?

Who is required to file sec targets small proponents?

How to fill out sec targets small proponents?

What is the purpose of sec targets small proponents?

What information must be reported on sec targets small proponents?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.