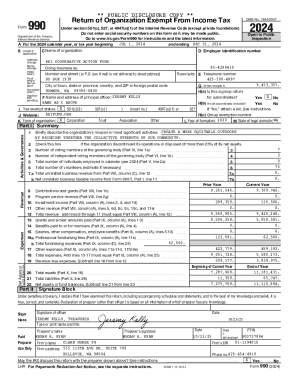

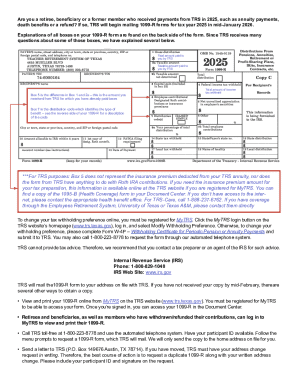

Get the free Use separate schedule

Get, Create, Make and Sign use separate schedule

How to edit use separate schedule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out use separate schedule

How to fill out use separate schedule

Who needs use separate schedule?

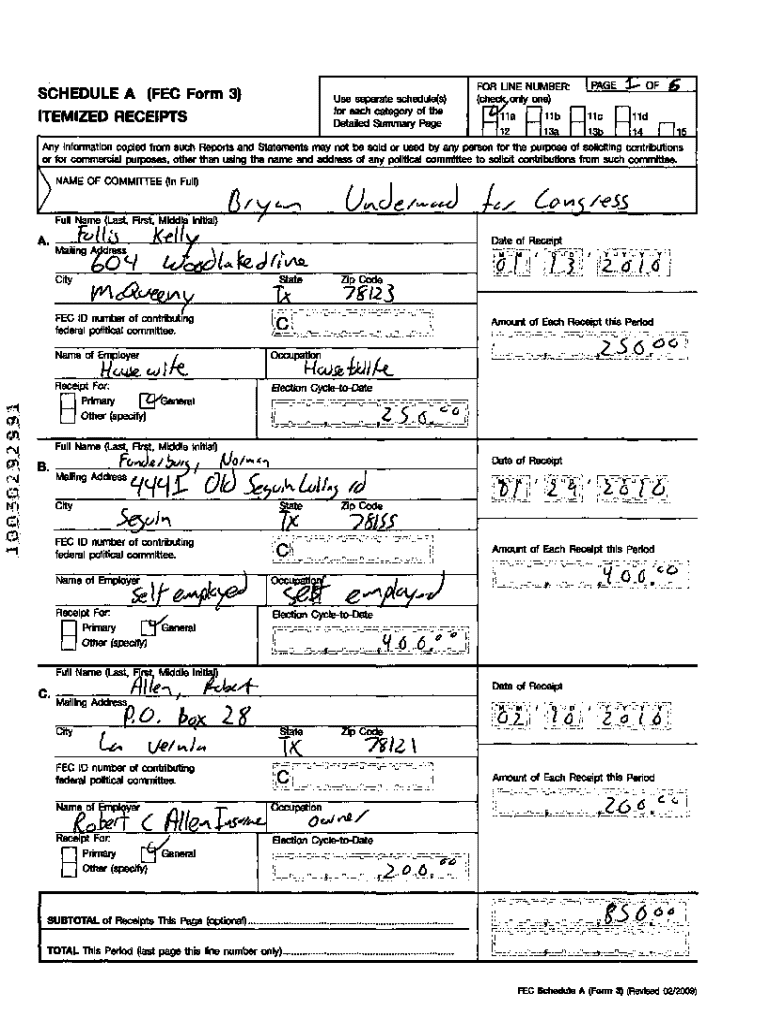

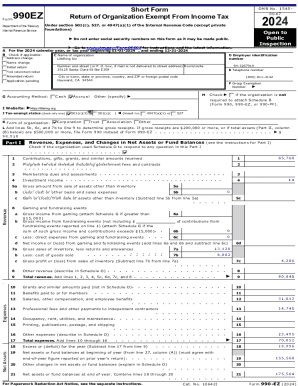

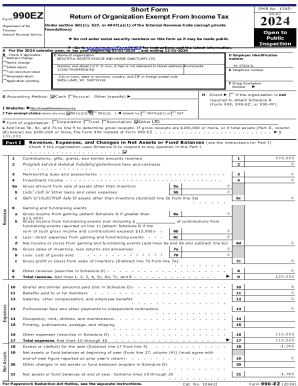

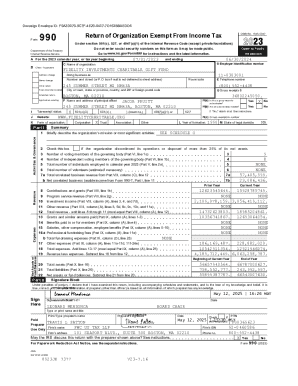

Using Separate Schedule Forms for Accurate Financial Reporting

Understanding the necessity of using separate schedule forms

Accurate financial reporting is essential for both individual taxpayers and businesses. It ensures that income is tracked correctly and deductions are claimed appropriately, which ultimately lowers tax burdens. Utilizing separate schedule forms allows for organized categorization of various income sources and expenses, leading to greater transparency in financial statements.

Maintaining separate schedules can significantly enhance accuracy. For instance, a dog groomer may have self-employment income, while also earning rental income from a side property. Keeping these income streams separate is crucial for ensuring that each source is reported accurately and that appropriate deductions are made for each type of business activity.

When to use a separate schedule form

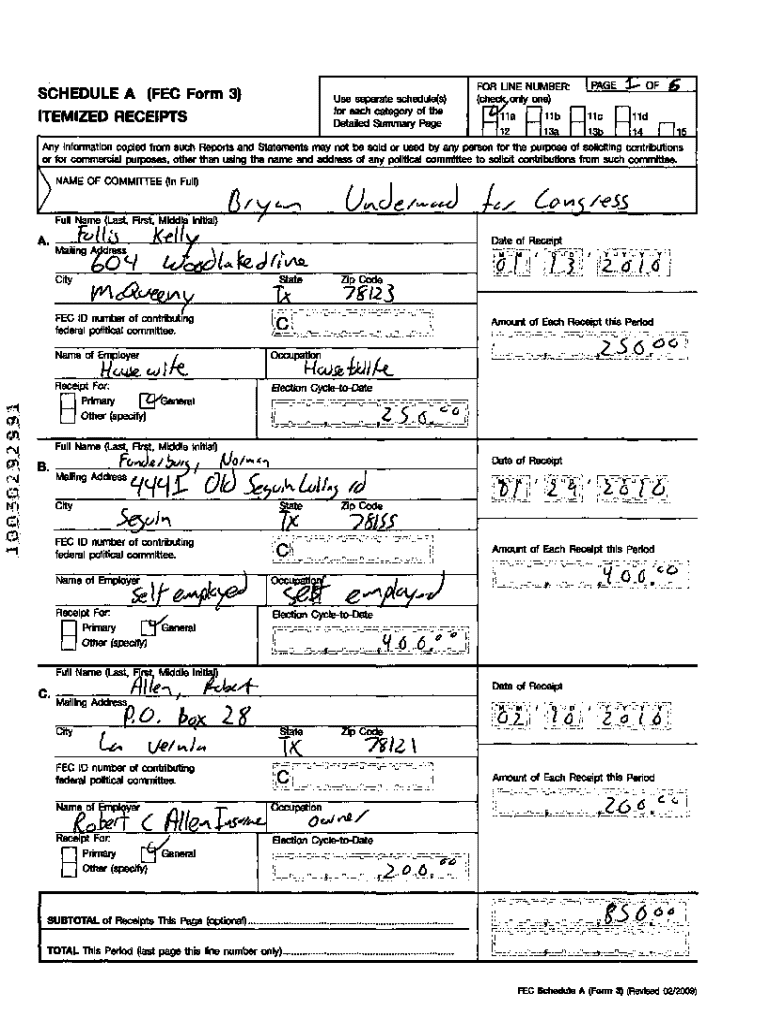

Identifying when to use a separate schedule form is vital for tax efficiency. Individuals with multiple income streams—such as freelancers, rental property owners, or those with investments—should evaluate their reporting requirements. The IRS has set specific guidelines that dictate the necessity of separate reporting based on various income types.

For example, if you operate a side hustle alongside your main job, you might need to fill out additional forms to report your self-employment income accurately. The criteria for determining when separate schedules are needed may include the type of income, activities involved, and overall business structure.

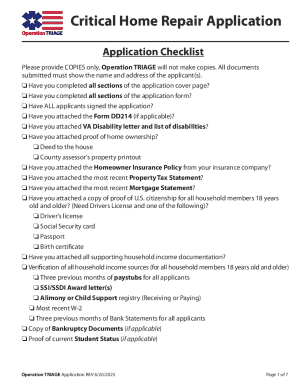

Step-by-step guide to completing a separate schedule form

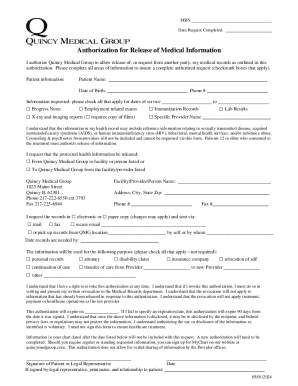

Completing a separate schedule form might seem daunting, but it can be streamlined into manageable steps. The first step is to gather all relevant documentation, including income statements for your business activities and receipts for any expenses incurred.

Once you have those at hand, fill out the necessary sections, detailing each income source clearly and categorizing expenses accurately to avoid misclassification. It's advisable to review and validate all information before submission, cross-checking calculations and ensuring compliance with IRS regulations. Finally, choose your submission method—whether electronically or by mail—and be mindful of deadlines to avoid late filing penalties.

Common mistakes to avoid when using a separate schedule form

Navigating financial documentation is essential, but common pitfalls can derail even the most meticulous individuals. One frequent mistake is overlooking minor income sources, which can lead to underreporting and penalties. It's equally important not to misclassify expenses, as this can affect your taxable income.

Proper record-keeping is another often neglected aspect of filing separate schedules. It's crucial to maintain good records, as this not only supports your claims but also prepares you for any potential audits. Lastly, some users may ignore specific jurisdiction requirements, meaning they fail to comply with local tax obligations and regulations.

Interactive tools and resources for managing schedule forms

Utilizing efficient tools can greatly enhance your experience when managing separate schedule forms. For instance, document management solutions available on pdfFiller provide seamless editing and eSigning capabilities, making it easy to complete and submit forms. Templates for various schedule forms are also readily available, giving you a structured starting point.

Additionally, consider collaborative tools that allow you to work alongside tax professionals or accountants in real time. Whether you're a small business owner or a freelancer, these resources can make the process of handling tax documentation easier and more effective.

Frequently asked questions (FAQs) about using separate schedule forms

Questions often arise regarding the necessity and specifics of using separate schedule forms. For instance, individuals often inquire about what qualifies as a separate schedule. Generally, any income that requires differentiated reporting—like self-employment versus investment income—warrants its own schedule.

Many wonder how to determine which schedule to use; typically, consulting IRS guidelines or a tax professional can provide clarity. Once submitted, it is always possible to amend a schedule if errors are discovered, though this process involves specific steps. Lastly, errors on forms can lead to issues with the IRS, thus emphasis on accuracy is crucial.

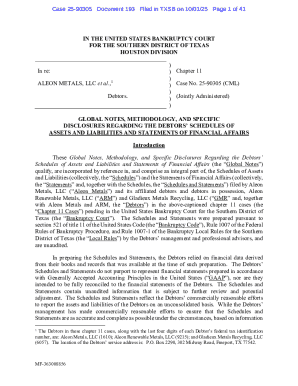

Case studies: Real-life examples of using separate schedule forms

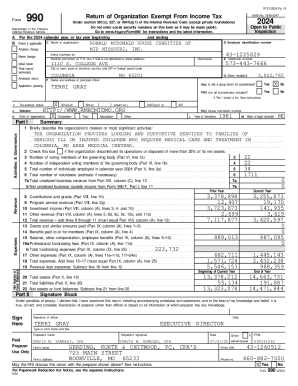

Understanding the practical applications of separate schedule forms can demystify the process. Consider a dog groomer with multiple clients; they might need to separate their grooming income from other earnings, such as dog training or selling pet supplies, to present a clearer financial picture.

A property owner earning rental income from multiple properties would require distinct schedule forms for each venture, which ensures that property management expenses are accurately tracked. Similarly, a consultant running various business activities would need separate schedules to appropriately report income derived from different consulting projects.

The bottom line: Maximizing benefits of separate schedule forms

Employing separate schedule forms effectively allows for enhanced clarity in your financial reporting. By organizing income and expenses distinctly, you reduce the risk of misreporting and bolster your legal compliance. Streamlined tax preparation becomes achievable with a well-structured document management system, such as that offered by pdfFiller.

Using these forms can set you up for successful audits and ensure that all deductions are accounted for accurately, optimizing your overall tax situation. As financial landscapes become more complex, the importance of diligent reporting continues to grow, making separate schedule forms a valuable asset for anyone managing multiple income streams.

Related posts and further insights

Exploring the implications of mixed income sources is essential for nuanced tax understanding. Related articles delve into maximizing deductions on Schedule C, especially as it pertains to freelancers and self-employed individuals. In addition, utilizing technology such as pdfFiller can significantly simplify the management of tax documents, allowing users to focus on their core business activities.

The basics of Schedule : A tool for independent contractors and small business owners

Schedule C is an essential document for independent contractors and small business owners. It allows for the detailing of income and expenses related to business activities, differentiating it from other tax forms. Understanding the key differences between Schedule C and other schedules ensures accurate reporting, particularly for those engaged in multiple business activities or side hustles.

To efficiently utilize Schedule C, it is advisable to keep a close eye on profit margins using the profit rule-of-thumb. Recording income and related expenses systematically helps maximize deductions and offers greater clarity into overall earnings or losses, enhancing your financial strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit use separate schedule from Google Drive?

How can I edit use separate schedule on a smartphone?

How do I fill out use separate schedule on an Android device?

What is use separate schedule?

Who is required to file use separate schedule?

How to fill out use separate schedule?

What is the purpose of use separate schedule?

What information must be reported on use separate schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.