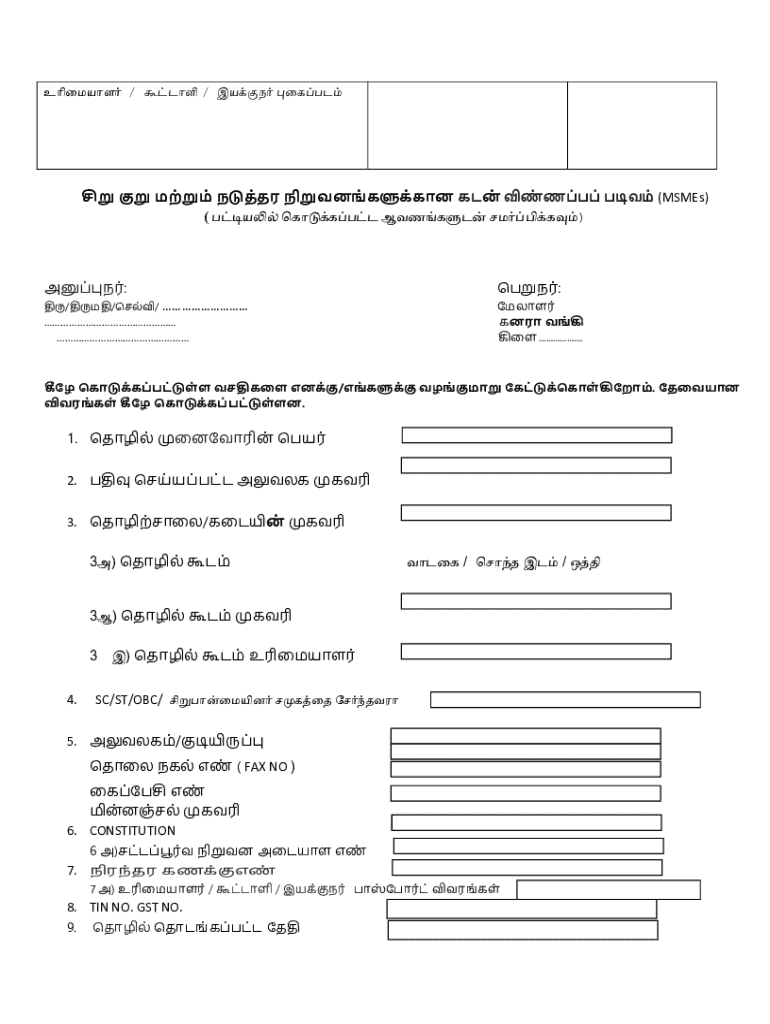

Get the free NF-998-COM APPLN FOR CR FACILITY TO MICRO & ...

Get, Create, Make and Sign nf-998-com appln for cr

Editing nf-998-com appln for cr online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nf-998-com appln for cr

How to fill out nf-998-com appln for cr

Who needs nf-998-com appln for cr?

Comprehensive Guide to the nf-998-com application for CR Form

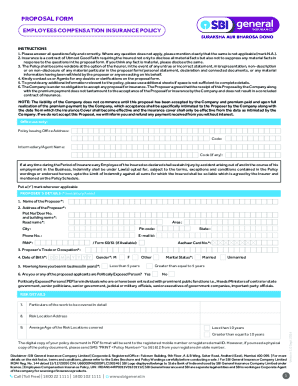

Understanding the nf-998-com application for CR form

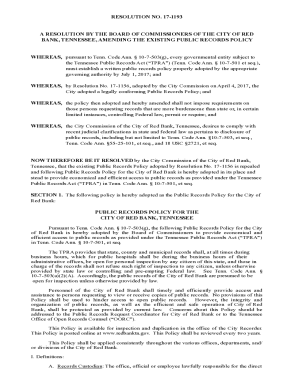

The nf-998-com CR form serves a pivotal role in ensuring compliance with various regulatory frameworks, particularly those related to property taxation and financial accountability. Designed to collect essential information regarding property taxes, this form helps streamline the assessment process, ensuring that all stakeholders are in alignment with county regulations. By utilizing the nf-998-com, property owners and relevant businesses can effectively contribute to accurate reporting of property value and tax obligations.

This form not only aids in compliance but significantly impacts the efficiency of property tax database management. Properly completed applications ensure that tax assessors can accurately gauge the market appraisal of properties, maintaining a transparent and just property taxation system. Therefore, understanding the nf-998-com application is crucial for anyone involved in property ownership or management.

But who exactly needs to complete this form? The answer varies, including a diverse target audience.

Step-by-step guide to completing the nf-998-com CR form

Completing the nf-998-com CR form requires careful attention to detail. Here’s a step-by-step guide that outlines the process, ensuring that users can easily navigate through the requirements.

Step 1: Gathering required information

Before diving into the form, gather all necessary documentation. This includes personal identification details and specific property information like property tax IDs, legal descriptions, and market appraisal data. Additional documentation might include past tax returns or any previous correspondence with tax assessors. The completeness of this information is crucial for a smooth submission process.

Step 2: Navigating the form sections

Every section of the nf-998-com CR form has specific requirements, divided into logical parts such as property information, personal details, and tax data. Each section demands precision; thus, taking the time to read the provided instructions carefully before filling the fields is advisable. Moreover, consider using the pdfFiller editing tools, which can guide you in filling out complex fields accurately.

Step 3: Common mistakes to avoid

Common errors often lead to delays in processing the nf-998-com applications. Examples of frequent mistakes include inaccuracies in property descriptions, miscalculated tax amounts, and incomplete signature fields. To prevent any oversight, double-check your information against the gathered documents before submission.

Tools for enhanced document management

Utilizing tools such as pdfFiller can significantly enhance the nf-998-com form completion experience. This platform offers various advantages that streamline not only the editing but also the overall document management process.

Utilizing pdfFiller for seamless form completion

pdfFiller provides an interactive interface that allows users to fill out, edit, and eSign documents seamlessly. Some of its standout features include smart fill options that automatically input common data across forms, and integration capabilities that connect with other databases, making retrieval of necessary records easier. This can save both time and effort while ensuring compliance.

Collaborative features for teams

For teams working on the nf-998-com CR form, collaborative features are invaluable. Multiple users can work on the document simultaneously, allowing for real-time updates and input. Features such as commenting and sharing options ensure that everyone involved can contribute effectively, reducing the chances of miscommunication or oversight.

Editing and managing your nf-998-com CR form

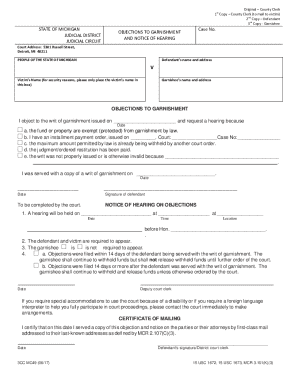

Once the nf-998-com CR form is completed, you may find that you need to make edits post-submission. Understanding how to navigate this process is essential.

How to edit your form post-completion

Editing capabilities within pdfFiller allow users to make necessary adjustments even after the document has been sent off. This includes modifying any incorrect entries or providing updated information regarding property status. It’s best practice to revise any input accurately to maintain compliance with regulatory standards.

Secure signing options available

Additionally, pdfFiller offers various electronic signature options, ensuring that all signatures are legally valid. Whether choosing to eSign with a stylized signature or affixing initials, the method is straightforward and secure, leading to a reliable completion cycle for the nf-998-com application.

FAQs about the nf-998-com application process

Navigating the nf-998-com CR form can raise a variety of questions. Addressing some of these frequently asked questions can clarify the process for applicants.

Where to submit your completed nf-998-com CR form?

Submission guidelines typically dictate that completed applications be sent to the local assessor's office or regulatory authority overseeing property assessments. Be sure to check the specific requirements for your county, as local practices can vary. Ensuring that paperwork reaches the correct office promptly is crucial to avoid any delays in processing.

What to do if you encounter issues?

If any issues arise during the application process, applicants can reach out to the customer support services or property assessment departments for assistance. This proactive approach can resolve problems quickly, ensuring all necessary information is correctly received.

Timeline for processing applications

Processing times for nf-998-com applications can vary based on numerous factors, including the volume of applications received by the county office and the complexity of the individual properties involved. Generally, you can expect a turnaround from several weeks to months. Staying informed about processing times in your area can help you manage expectations.

Best practices for future form submissions

To optimize your experience with the nf-998-com application process, adopting best practices for future submissions is advisable.

Staying organized with document management

Establishing a robust document management system is vital for maintaining comprehensive records of all submitted forms. This includes keeping both physical and digital copies. Utilize organized folders on cloud storage platforms like pdfFiller, allowing for quick access to documents when needed.

Keeping up with regulatory changes

Finally, staying informed about regulatory changes that may impact the nf-998-com CR form is essential. Regularly check government websites or relevant news outlets for updates, ensuring that you stay compliant and aware of any modifications. Utilizing resources dedicated to property and tax regulation updates can be particularly helpful.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit nf-998-com appln for cr in Chrome?

How do I fill out nf-998-com appln for cr using my mobile device?

How do I complete nf-998-com appln for cr on an Android device?

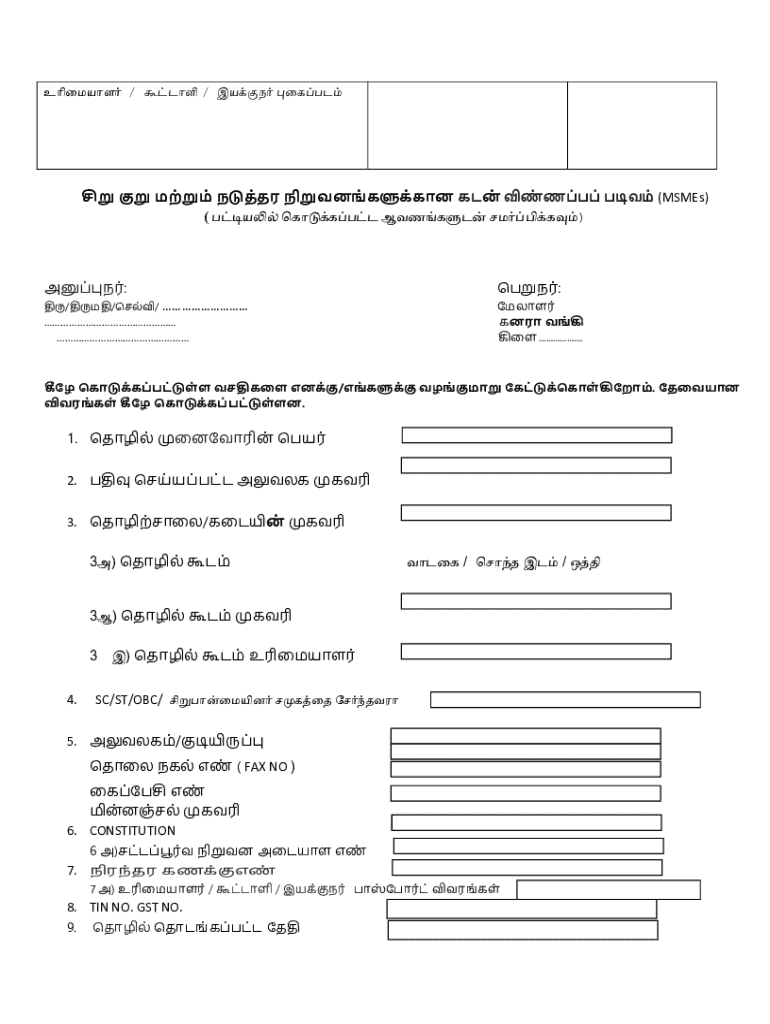

What is nf-998-com appln for cr?

Who is required to file nf-998-com appln for cr?

How to fill out nf-998-com appln for cr?

What is the purpose of nf-998-com appln for cr?

What information must be reported on nf-998-com appln for cr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.