Get the free A Complete Guide to Pay Your UScellular Bill Over ...

Get, Create, Make and Sign a complete guide to

Editing a complete guide to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a complete guide to

How to fill out a complete guide to

Who needs a complete guide to?

A complete guide to form

Understanding the purpose of the form

Forms serve as vital tools for collecting information systematically, serving a wide range of purposes across various industries. Whether you need to submit tax filings, apply for a loan, or request services, forms streamline these processes by consolidating essential data in a consistent format. They enhance clarity and ensure that all necessary information is provided to facilitate decision-making.

The significance of understanding each form's purpose cannot be overstated. Different contexts require unique forms, and using the appropriate one can prevent delays and complications, ensuring efficient processing. This importance becomes especially clear in areas like tax returns, where mistakes can lead to unwanted consequences or financial penalties.

Who needs to use this form?

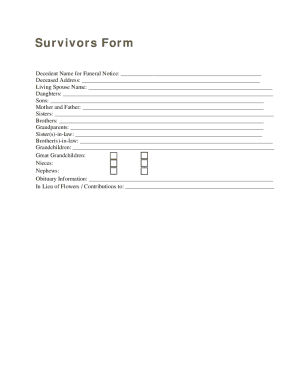

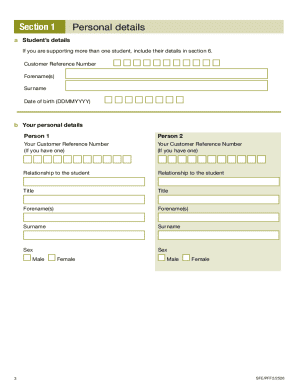

Target audiences for forms can include a diverse range of individuals and organizations, each with specific needs. Individuals may need forms for personal purposes, such as tax declarations, medical records, or rental applications. On the other hand, businesses and organizations often require forms for employee onboarding, service agreements, or compliance documentation. Understanding who needs a particular form allows for tailored completion and maximizes its usability.

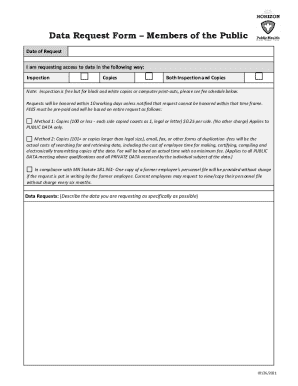

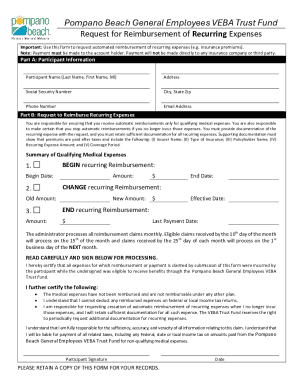

Key components of the form

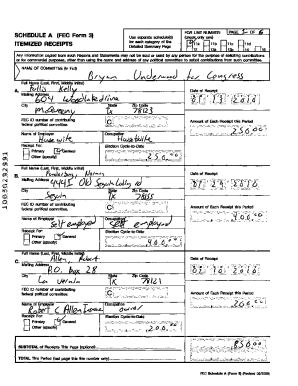

A form generally consists of several key components, each playing a critical role in gathering the required data. These sections typically include personal information, legal confirmations, and any necessary attachments. Familiarizing yourself with these sections can dramatically improve your efficiency in filling the form accurately.

Moreover, it’s essential to understand the specific information required within each section. For instance, personal data fields usually ask for your name, address, and contact details, while essential identifiers can include your Tax ID or Social Security number. Not only does this structure ensure systematic data collection, but it also aids in verification processes down the line.

Breakdown of sections

Step-by-step instructions for filling out the form

To ensure successful form submission, adhering to a step-by-step process is fundamental. The first step involves gathering all necessary information. This might include tax documents, prior returns, personal identification, and specific details related to your employer or retirement administrator.

Once you've collected your documents, the next step is accessing the form. You can obtain it online through government websites or specific organizational portals. Many forms are also available in downloadable formats such as PDF for convenience. After accessing the form, focus on completing it section by section.

Detailed section-by-section guidance

Pay careful attention to each section, ensuring all fields are filled accurately. Use the following tips to avoid common mistakes: double-check your data entry, review for missing information, and confirm that dates and figures are accurate. After completing all sections, it's time to review your completed form thoroughly.

Digital options for managing the form

Today, managing forms digitally offers unparalleled flexibility and efficiency. Utilizing platforms like pdfFiller allows users to edit PDFs directly from their browser, eliminating the need for printing and scanning. This connectivity enhances document management by simplifying the editing process and ensuring that users can update details on the fly.

E-signing is another significant digital feature. It allows users to add an electronic signature with ease, often via a simple click, thus expediting the submission process. Collaborating with teammates becomes seamless, as pdfFiller enables users to share forms for review or completion, enhancing teamwork and improving overall efficiency.

Submission methodologies

The methods for submitting forms vary and can include online submission or mailing a printed copy. Each submission option has its own set of instructions and requirements, making it vital for users to follow the specified guidelines to ensure successful filing. For example, submitting forms electronically may require specific digital formats or encryption methods.

Can you e-file the form? Yes, many forms allow electronic filing, which offers significant advantages, such as faster processing times and immediate confirmation of receipt. However, it’s important to check specific requirements for each form to ensure compliance. After submission, always follow up to check your form's status or to make any amendments if necessary.

Common challenges and solutions

One common challenge when dealing with forms, especially during tax season, is the reception of related tax documents after you've already filed. It's essential to know how to handle these late documents to amend your submissions efficiently. Often, you can file an amended return to update your information and avoid any penalties.

Moreover, troubleshooting common issues is vital. Users frequently encounter problems like missing information, misplaced documents, or system errors during electronic submissions. Addressing these concerns promptly can prevent unnecessary headaches, ensuring that your form processing goes as smoothly as possible.

Leveraging pdfFiller's tools

One of the standout features of pdfFiller is how it enhances document management. Users can create and edit documents effortlessly while also being able to retain previous versions if necessary. This kind of functionality is invaluable, especially for those handling multiple tax forms or business documents.

Additionally, the benefits of a cloud-based solution cannot be overstated. Accessibility from any device, automatic saving, and the ability to collaborate in real-time are just a few examples of the advantages provided by pdfFiller. These features alleviate the stress associated with managing multiple forms, making it an ideal solution for both individuals and teams.

Best practices for completing and managing forms

An effective routine to manage forms efficiently can save users time and reduce the likelihood of mistakes. Establishing a checklist for what documents are needed, when submissions are due, and confirming receipt of submissions can create a streamlined workflow. Regular updates to your records will ensure you maintain an organized system.

Data privacy is another paramount concern when completing forms, especially those that contain sensitive information, such as Social Security numbers or financial details. Use secure platforms like pdfFiller that offer encryption and security measures to protect your data during the completion and submission processes. Being cautious with your information can safeguard against potential identity theft or data breaches.

Real-world applications of the form

Forms are applicable in a variety of real-world situations. For example, tax season highlights the importance of accurate and timely form completion. Individuals might need multiple forms depending on their income sources, while businesses often face additional forms for compliance and regulatory reasons. These scenarios exemplify how essential forms are for smooth operations in several contexts.

Success stories abound of individuals who have streamlined their processes using forms through pdfFiller. Users have reported significant reductions in time spent on paperwork and a notable increase in their filing accuracy. These testimonials underscore the platform's value in easing the overall burden of form management.

Future developments to consider

Keeping a pulse on anticipated changes in form regulation is essential for compliance. Tax codes often evolve, and the forms associated with them may undergo revisions to reflect these changes. Staying updated on regulatory developments ensures that users remain compliant with new guidelines.

Innovations in document management technologies are also emerging, with many platforms, including pdfFiller, continually enhancing their offerings. Users can expect features like AI assistance in data entry or automated reminders for submissions, making the overall experience more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the a complete guide to in Chrome?

How do I edit a complete guide to straight from my smartphone?

How do I fill out a complete guide to using my mobile device?

What is a complete guide to?

Who is required to file a complete guide to?

How to fill out a complete guide to?

What is the purpose of a complete guide to?

What information must be reported on a complete guide to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.