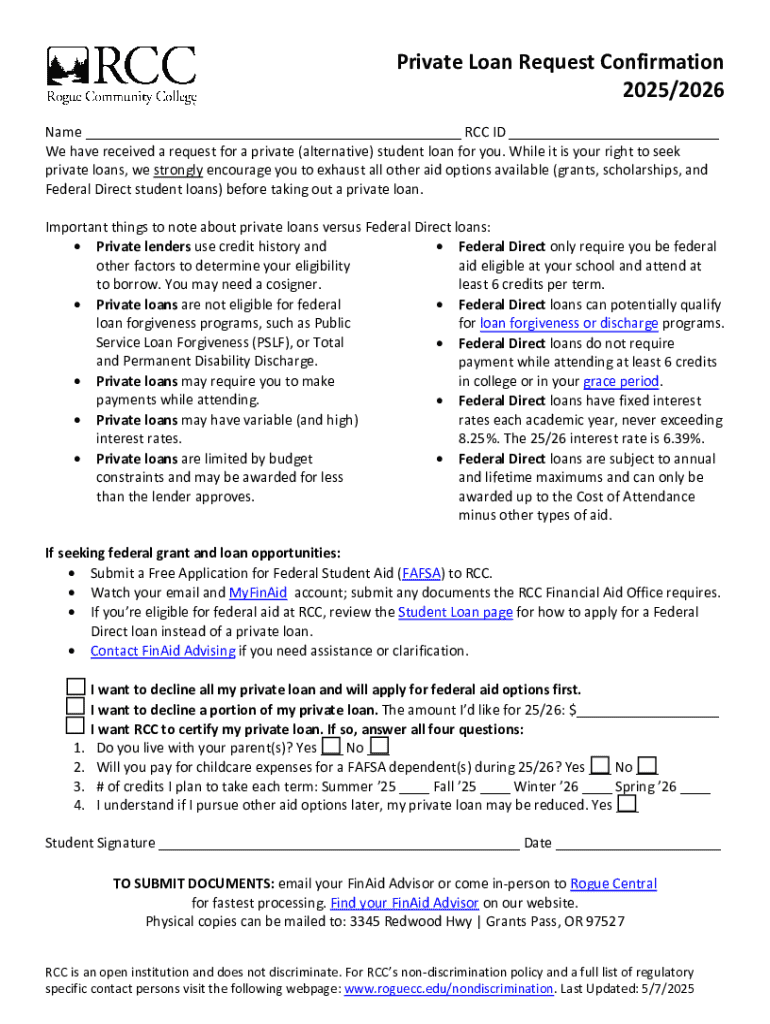

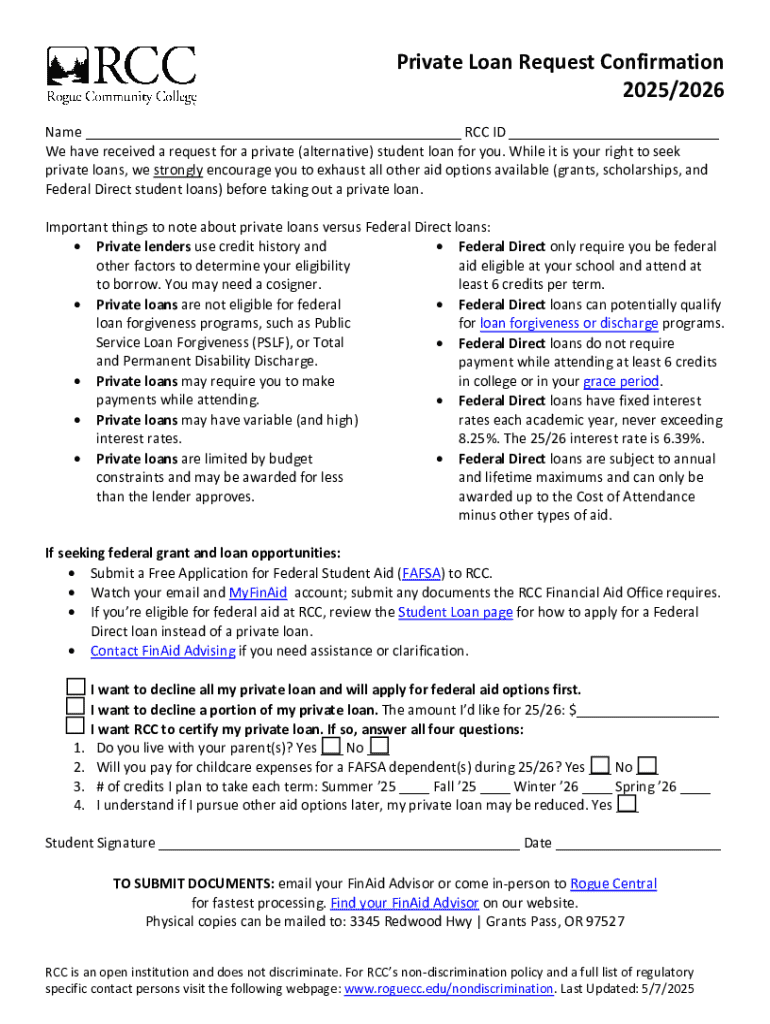

Get the free 2025-26 Private Loan Request Confirmation

Get, Create, Make and Sign 2025-26 private loan request

Editing 2025-26 private loan request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-26 private loan request

How to fill out 2025-26 private loan request

Who needs 2025-26 private loan request?

Comprehensive Guide to the 2025-26 Private Loan Request Form

Overview of the 2025-26 private loan request form

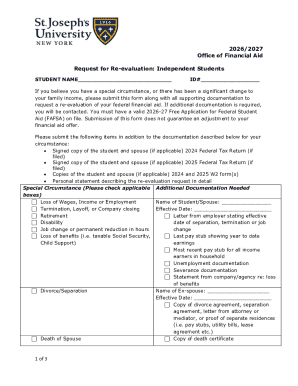

Securing private loans is a pivotal element for many students financing their education. The 2025-26 private loan request form is designed to facilitate this process, allowing students to request funding from private lenders efficiently. This form serves as a formal application to seek a financial lifeline to cover educational expenses that federal aid might not fully address.

The journey begins when potential borrowers interact with their chosen financial institutions. This brings into play lenders, students, and educational institutions that assess the need for private loan funding. Understanding this process is crucial for students, as it can affect their financial stability and overall academic success.

Key features of the 2025-26 private loan request form

The 2025-26 private loan request form is built around obtaining comprehensive details to evaluate a borrower’s eligibility thoroughly. Several key components must be filled out accurately to ensure a smooth application process.

Providing accurate and complete information is vital to expedite processing, minimizing delays that could interfere with educational starts.

Navigating the loan application process

Completing the Private Loan Request Form is a straightforward process when broken down into clear steps. Each step plays a role in ensuring the application submitted is thorough and accurate.

Avoiding common mistakes, such as leaving out crucial information or failing to get a co-signer if required, can make a significant impact on the timeliness of your application.

Frequently asked questions about the 2025-26 private loan request form

As students embark on their loan application journey, they may have various questions about the private loan landscape.

Important reminders when submitting the private loan request form

Before hitting 'submit' on the form, it’s important to double-check all aspects of your application. A well-prepared application can significantly reduce processing times and increase the likelihood of approval.

How to submit the 2025-26 private loan request form

Submitting the 2025-26 private loan request form can be done in various ways, depending on the lender's offerings. Familiarizing yourself with the submission methods will ensure that you choose the one that best suits your needs.

Tracking your private loan application status

Once your application is submitted, tracking its status becomes essential to understand the progress of your request. Many lenders provide online portals for this purpose.

Resources for managing your loan

After receiving approval for a private loan, managing that loan becomes essential. Understanding repayment terms, monitoring interest rates, and keeping track of payments can lead to better financial outcomes.

Financing options after loan approval

Approval of a private loan opens various avenues for financing your education. Students should be aware of the disbursement timelines and how to manage their new financial responsibilities.

Interactive tools for better document management

In today's digital world, effective document management is crucial. pdfFiller provides an array of interactive tools specifically designed to enhance your experience with the 2025-26 private loan request form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2025-26 private loan request directly from Gmail?

How do I fill out 2025-26 private loan request using my mobile device?

How do I edit 2025-26 private loan request on an Android device?

What is 2025-26 private loan request?

Who is required to file 2025-26 private loan request?

How to fill out 2025-26 private loan request?

What is the purpose of 2025-26 private loan request?

What information must be reported on 2025-26 private loan request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.