Get the free On-Line Form Instructions for Reporting Elder Abuse, ...

Get, Create, Make and Sign on-line form instructions for

Editing on-line form instructions for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out on-line form instructions for

How to fill out on-line form instructions for

Who needs on-line form instructions for?

On-line Form Instructions for Form

Overview of the on-line form process

An on-line form is a digital document that allows users to input data and submit responses over the internet. These forms replace traditional paper documents and are particularly essential in sectors where timely data collection is crucial. On-line forms enhance the efficiency of data collection, allowing businesses and individuals to streamline processes like applications, surveys, and registrations. With the advancement of technology, on-line forms are becoming increasingly integral to how we communicate and share information.

Using digital forms offers distinct advantages, including ease of access and the ability to fill them out from any device with internet connectivity. Today’s fast-paced environment demands effective solutions for document handling, and pdfFiller stands out in the realm of form management. It empowers users to create, edit, eSign, and manage forms effortlessly, fostering collaboration across teams and allowing for a more organized approach to document management.

Getting started with pdfFiller

Creating a pdfFiller account is the first step to mastering on-line forms. To initiate your signup process, visit the pdfFiller homepage and click on the 'Sign Up' button. You will need to provide your email address and create a password to register. After successfully signing up, verify your account through the link sent to your email.

Once your account is verified, you can log in and start exploring the dashboard. The dashboard presents an intuitive interface where users can find features such as template creation, document editing, form sharing, and more. Familiarize yourself with these tools, as they will significantly enhance your experience in managing on-line forms.

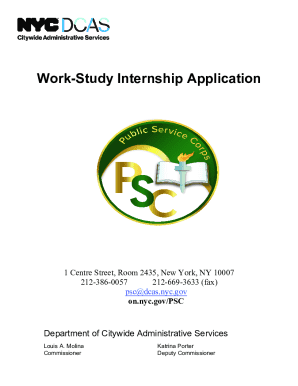

Accessing and selecting the right form

To find specific forms within pdfFiller, use the search function located at the top of the dashboard. Type in keywords relevant to the form you need—this could be related to tax forms, applications, or any other category. Additionally, you can filter forms by categories such as taxes, legal agreements, or medical forms to narrow down your options.

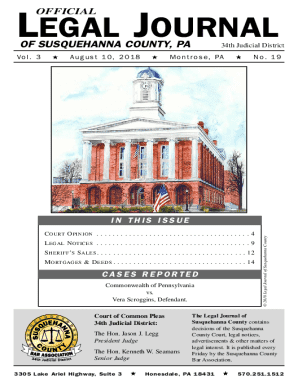

When selecting a form, consider factors such as form type, purpose, and regional specifications. For instance, if you're looking for a tax return form for residents of New York State, ensure that the template corresponds to New York’s tax department requirements. By filtering based on these criteria, you can swiftly locate and select the most appropriate form for your needs.

Filling out the on-line form

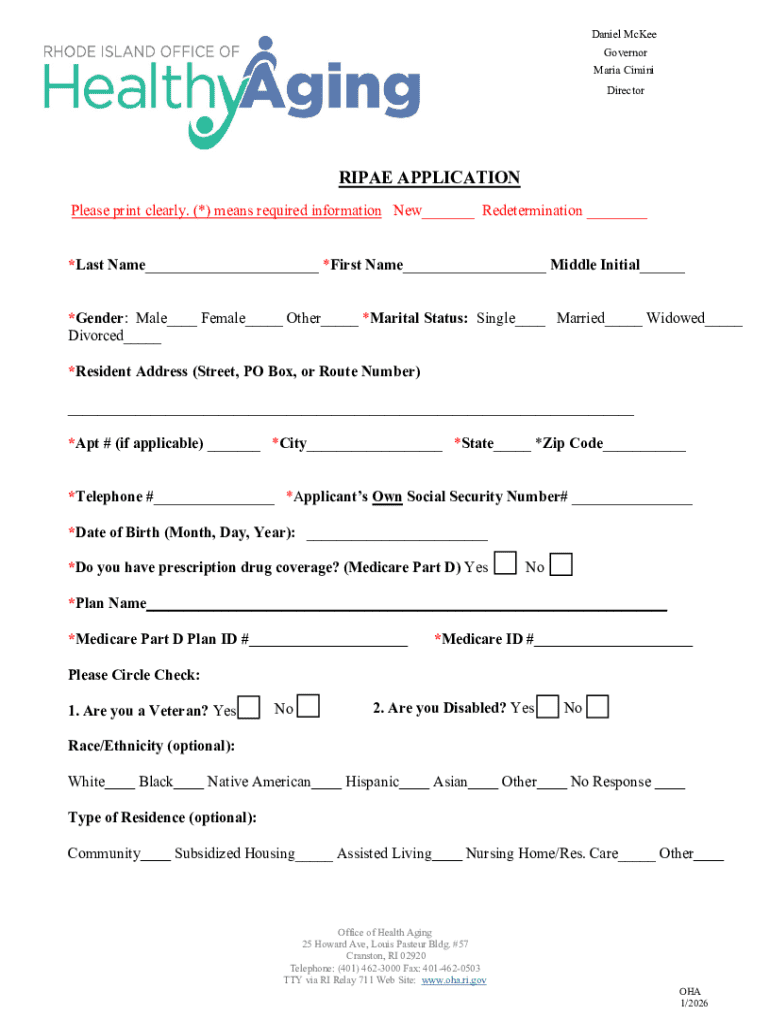

Completing the on-line form efficiently involves a series of straightforward steps. After selecting your form, click on the interactive fields such as text boxes, checkboxes, and dropdowns. Start with the most pertinent sections, plugging in the required information such as gross income, spouse details, and residency information, ensuring accuracy in your entries.

It's crucial to avoid common pitfalls when filling out forms. Double-check the information for accuracy, particularly numeric entries, to prevent complications later, such as delays in processing your tax refund. Utilize built-in tips within pdfFiller to navigate potential missteps and ensure that additional comments or explanations are included where necessary, enhancing clarity in your form submission.

Editing and customizing the form

pdfFiller offers robust editing tools that allow you to tailor forms to your specifications. You can add or remove sections easily, enabling you to customize forms based on specific needs or to comply with updated regulations. For instance, if you need to include a box for additional income sources or adjust layouts to enhance readability, you'll find the tools readily accessible.

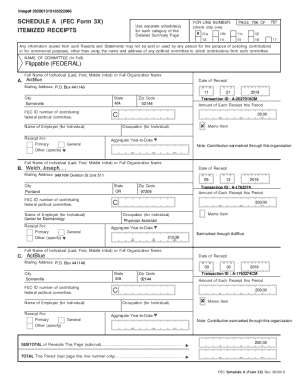

Incorporating annotations and stamps can also clarify crucial points or signify importance—users can highlight specific areas of the form such as where to enter an amount for tax refunds or where to include details about dependents. These visual indicators can facilitate better understanding and communication when sharing forms with collaborators or other stakeholders.

eSigning the form

In the digital age, eSigning has become a crucial part of formalizing documents. Using pdfFiller, you can easily add electronic signatures to your completed forms. First, choose the 'eSignature' option within the editing tools. You can create a handwritten signature using your mouse or touchscreen or select from pre-drawn signatures that match your style.

To maintain legal compliance, ensure that your signature accurately reflects your identity and is unique to you. Once you add your signature, you can also include the date and any other required authentication markers, helping to solidify the legitimacy of your document as you submit it to the tax department or relevant authorities.

Collaborating with others

If your form requires input or feedback from team members or collaborators, pdfFiller provides an easy way to share documents. Simply use the 'Share' options available within the platform to send forms directly via email or through shared links. You can set permissions for editing and reviewing, ensuring that only authorized individuals can make changes.

Utilizing version control is vital during collaboration. pdfFiller automatically tracks changes made to the document, allowing you to review different revisions. This feature is particularly beneficial in situations where there are multiple contributors, as it helps maintain a clear and organized workflow, making it easy to revert to previous versions if necessary.

Managing your completed forms

Once your forms are completed and eSigned, managing them effectively is crucial for organization. pdfFiller allows users to save and export completed forms in various formats, including PDF and Word. Exporting your forms not only makes it easy to store them in your desired format but also allows for easy sharing when necessary.

Moreover, users can organize their forms within the pdfFiller account. Utilize folders and tags to sort forms by categories—tax returns for a resident servicemember or applications for benefits. The cloud storage integration means you can access your forms from anywhere, ensuring that you have all necessary documents at your fingertips.

Security measures and best practices

When dealing with on-line forms, protecting your personal information is paramount. pdfFiller employs multiple security measures, including encryption and secure data storage protocols to safeguard sensitive details such as income information and marital status. Always verify that the forms you're completing are legitimate by checking for official sources, especially in scenarios involving financial disclosures.

Adopting best practices for form submission is also essential. Be cautious with sharing sensitive information and only use trusted platforms like pdfFiller for completing forms. Keeping your account credentials secure and enabling two-factor authentication can further protect your personal data from unauthorized access.

Troubleshooting common issues

When using on-line forms, encountering technical issues can be a hassle. Some common problems include submission errors, issues with loading forms, or trouble signing in. In such cases, a good first step is to refresh the page or check your internet connection. If problems persist, pdfFiller offers a robust support system—users can contact customer service for assistance via chat, email, or phone.

It’s also helpful to review FAQs related to on-line form usage provided on the pdfFiller site. These frequently asked questions often address commonly faced issues and offer quick resolutions, helping you get back on track with your form management.

Recommendations for future use

For ongoing success in using on-line forms, establish a routine that includes regular checks for document updates. Since tax forms and legal documents often change, staying informed about these modifications will help you maintain accuracy in your submissions. Keeping your records organized ensures that you can quickly access previously filled forms whenever needed.

Additionally, consider setting reminders for when forms need to be completed—like income tax returns for the upcoming tax season—so you’re never rushed into last-minute submissions. Engaging with pdfFiller webinars or tutorials can also enhance your mastery of the platform, allowing you to use every feature at your disposal.

Exploring additional features in pdfFiller

Upon becoming familiar with the basic functionalities, explore pdfFiller's advanced features that accelerate your workflow. Integrating with other applications such as CRMs or email services can streamline document handling, allowing forms to be accessed and processed efficiently. Automation features are also available, enabling routine documents to be automatically filled out based on predefined criteria or data fields.

Utilizing templates for recurring form needs, such as those required for the Gross Income Tax Return in New York, can save time and ensure consistency. By leveraging these tools, on-line form management becomes a more fluid experience, particularly beneficial for businesses needing to maintain uniformity across multiple submissions.

User testimonials and success stories

Many individuals and teams have found great success using pdfFiller’s on-line forms. For example, a nonprofit organization streamlined their grant application process using customizable forms, leading to quicker approvals and less time spent on paperwork. Testimonials highlight how users appreciate the ease of use and the efficiency gained by shifting to an electronic format for essential documentation.

Real-life outcomes, such as reduced processing times and improved collaboration, showcase how pdfFiller positively impacts workflow, helping teams meet deadlines without the previously associated stress of paper forms.

Next steps and ongoing learning

The journey of mastering on-line forms with pdfFiller doesn’t stop here. Encourage yourself to explore other related forms and templates available on the site. Engaging in pdfFiller’s regularly scheduled webinars or tutorials can provide deeper insights into not just form management but also best practices for document handling.

Staying updated with changes to relevant forms, especially in light of evolving regulations and requirements for tax returns, is crucial. Education and adaptability will empower you to navigate the complexities of form submissions with confidence and accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send on-line form instructions for to be eSigned by others?

How do I execute on-line form instructions for online?

How do I fill out on-line form instructions for using my mobile device?

What is on-line form instructions for?

Who is required to file on-line form instructions for?

How to fill out on-line form instructions for?

What is the purpose of on-line form instructions for?

What information must be reported on on-line form instructions for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.