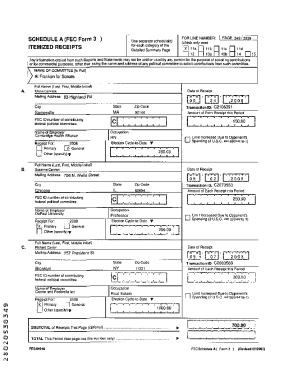

Get the free Direct Parent Plus Loan Change Form

Get, Create, Make and Sign direct parent plus loan

Editing direct parent plus loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct parent plus loan

How to fill out direct parent plus loan

Who needs direct parent plus loan?

Understanding the Direct Parent PLUS Loan Form: A Comprehensive Guide

Understanding the Direct Parent PLUS Loan

The Direct Parent PLUS Loan is a federal loan program specifically designed to assist parents of dependent undergraduate students in covering the cost of college. These loans enable parents to borrow money to pay for their child's education, ensuring that a lack of financial resources does not limit higher education opportunities.

In terms of eligibility, parents must demonstrate creditworthiness, meaning a credit check is part of the process. Additionally, the student must be enrolled at least half-time in an accredited institution. This loan is a viable option for families seeking a means to finance their child’s academic journey.

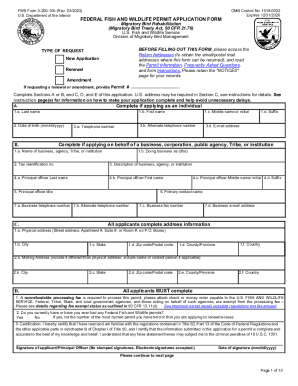

Steps to obtain a Direct Parent PLUS Loan

The journey to securing a Direct Parent PLUS Loan begins with preparation. Gather necessary documentation including your Social Security number, financial information, and your child's school costs. Understanding the cost of attendance is critical, as this will help you determine how much you might need to borrow.

Next, complete the application process by accessing the Federal Direct PLUS Loan application online via the U.S. Department of Education’s website. Submitting the application is straightforward, but pay attention to timing, as loan applications often have deadlines linked to your child's enrollment period.

Important information about loan terms

Interest rates on Direct Parent PLUS Loans can vary annually. As of the 2 academic year, the federal interest rate for these loans is set at 7.54%. Be aware that Parent PLUS Loans also come with origination fees, typically a percentage of the loan amount. It’s crucial to factor these fees into your borrowing decision.

Repayment terms are flexible, with standard repayment plans usually set at ten years. However, parents may have alternative options available, such as graduated or extended repayment plans that can lower monthly payments initially, adjusting over time.

If your Direct Parent PLUS Loan is denied

A common hurdle in securing a Direct Parent PLUS Loan is denial, often related to the credit check phase. If your credit report contains significant negative marks or lacks sufficient credit history, this can lead to denial. Inconsistencies or discrepancies in reporting are also common reasons.

If denied, you do have options. The appeal process involves addressing the issues outlined in the denial notice, potentially providing additional documentation. Alternatively, explore other financing avenues like private student loans or securing loans from family members.

Disbursement of funds

Once approved for the Direct Parent PLUS Loan, funds are typically processed and disbursed directly to the college or university for tuition and associated costs. Processing times can vary; usually, you can expect funds to be disbursed shortly before the start of the academic term.

Universities apply these funds toward tuition and fees first, with any excess funds allocated to the student for living expenses or other school necessities.

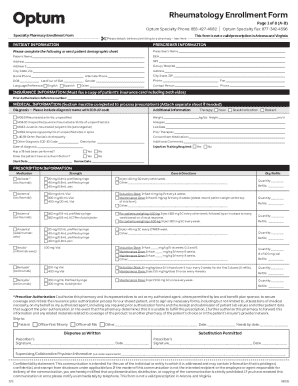

Managing your Direct Parent PLUS Loan

Keeping track of your Direct Parent PLUS Loan is essential for effective financial management. Online payments are made easier through your loan servicer’s portal, where you can easily view your balance and make payments.

Understand your repayment schedule to ensure you meet payment obligations. Monthly payment calculations should align with your earnings, while amortization methods will dictate how quickly your loan reduces over time.

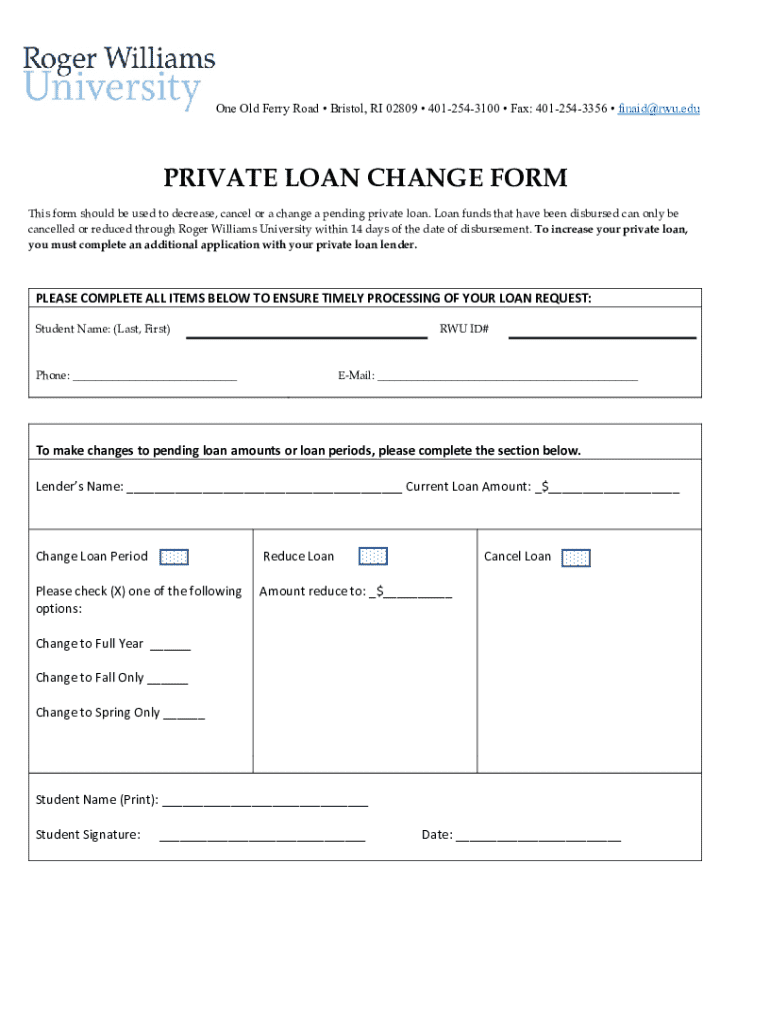

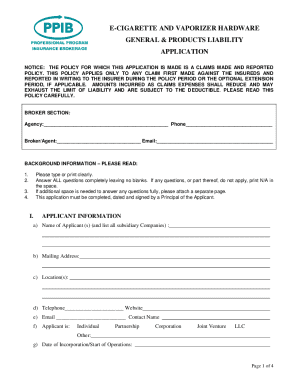

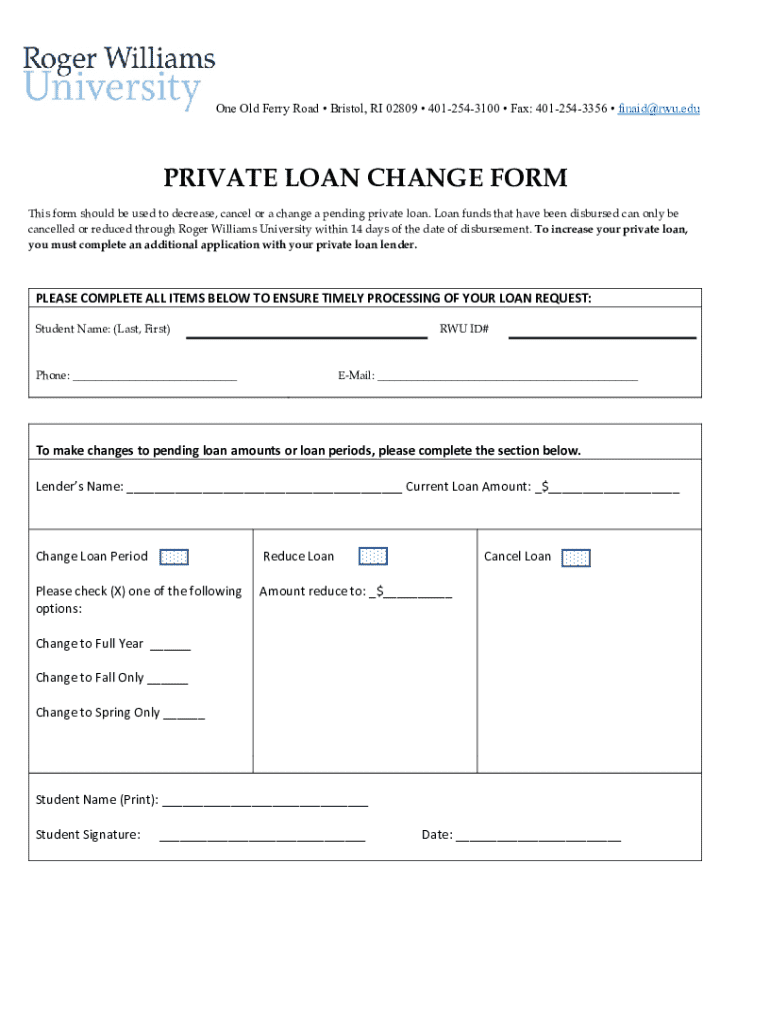

Requesting a change to your Direct Parent PLUS Loan

Circumstances may arise where you need to request changes to your Direct Parent PLUS Loan, such as an increase in loan amounts due to unexpected educational costs or a transition from a standard to an income-driven repayment plan.

You should contact your loan servicer to initiate this request, providing the necessary documentation to support your case. Each change request is evaluated on its own merits, so be prepared for follow-up questions or clarifications.

Direct Parent PLUS Loan refunds

In situations where you borrow more than the amount needed, you may be eligible for a refund. This often occurs when your child’s expenses are fully covered but funds remain.

To request a refund, contact your college’s financial aid office to initiate the process. Typically, it can take several weeks for refunds to process, so it's essential to stay informed and check the status after submission.

Deferment & forbearance options

Navigating financial challenges might necessitate considering deferment or forbearance options on your Direct Parent PLUS Loan. Deferment is a temporary suspension of payments under specific circumstances, such as returning to school, economic hardship, or unemployment.

Forbearance allows a temporary halt in payments, though interest accrues during this period. To apply for either option, submit an application through your loan servicer, detailing your situation, as they have specific guidelines on what qualifies.

Direct Parent PLUS Loan consolidation

Loan consolidation can simplify your financial management by combining multiple loans into one, potentially lowering your interest rate. This process can be particularly beneficial for parents with multiple loans, easing the burden of keeping track of various payment dates.

To initiate consolidation, gather all loan information and contact your loan servicer. They will guide you through the steps and inform you of eligibility based on your financial profile.

Interactive tools and resources

Leveraging interactive tools can help demystify the financial obligations associated with the Direct Parent PLUS Loan. Loan calculators available online can assist you in estimating monthly payments and understanding total repayment costs.

For official guidance and further assistance, the U.S. Department of Education’s website provides a wealth of resources, including direct access to application forms and contact information for customer service, ensuring you have all the help you need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my direct parent plus loan directly from Gmail?

How can I send direct parent plus loan to be eSigned by others?

Can I edit direct parent plus loan on an iOS device?

What is direct parent plus loan?

Who is required to file direct parent plus loan?

How to fill out direct parent plus loan?

What is the purpose of direct parent plus loan?

What information must be reported on direct parent plus loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.