Get the free PART 4 RECORD RETENTION

Get, Create, Make and Sign part 4 record retention

Editing part 4 record retention online

Uncompromising security for your PDF editing and eSignature needs

How to fill out part 4 record retention

How to fill out part 4 record retention

Who needs part 4 record retention?

Understanding the Part 4 Record Retention Form: A Comprehensive Guide

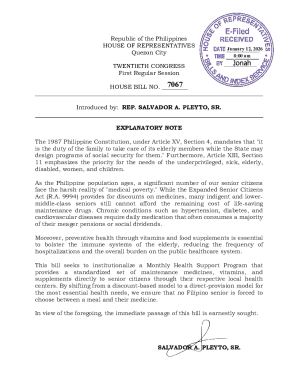

Understanding the importance of record retention

Record retention is crucial for any organization as it ensures compliance with various laws and regulations. Organizations that fail to implement a robust record retention policy may face severe penalties, legal actions, and reputational damage. Proper retention practices not only safeguard businesses and their stakeholders but also facilitate smoother operations, especially during audits and reviews.

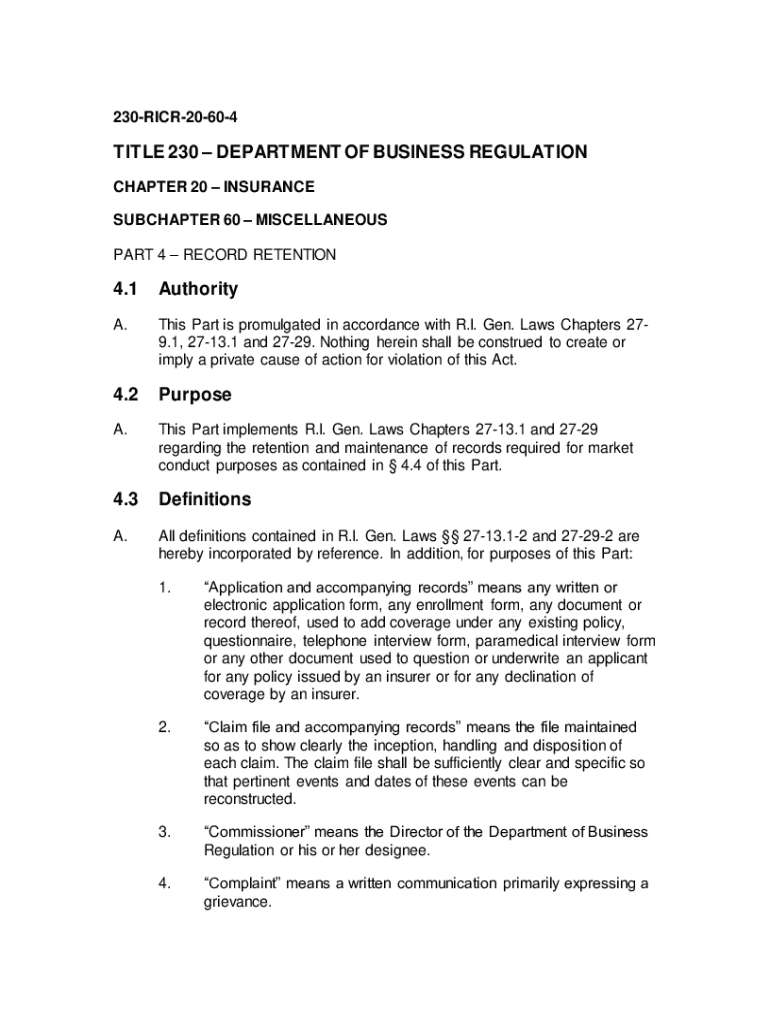

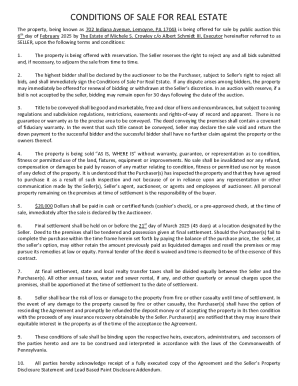

The Part 4 Record Retention Form specifically outlines what records need to be retained, how long they should be kept, and how to manage their eventual destruction. Compliance with these guidelines is essential for entities engaged in government contracting, especially those that must adhere to the Federal Acquisition Regulation (FAR). Understanding these parameters minimizes legal risks and contributes to the overall efficiency of business operations.

Essential definitions for record retention

When discussing the Part 4 Record Retention Form, it is essential to understand key terms to navigate the compliance landscape effectively. A 'record' is defined as any information that documents business activities or transactions, including emails, contracts, and reports. Each record has a 'retention period,' which is the duration for which it must be preserved. Lastly, 'destruction' refers to the authorized and systematic process of disposing of records once they are no longer needed.

Familiarity with commonly used acronyms and terms enhances understanding. For instance, the 'System for Award Management' (SAM) is crucial for businesses engaging with the federal government. Similarly, entities need to keep in mind identifiers like the 'procurement instrument identifier' when processing records related to government contracts.

Scope of part 4 record retention

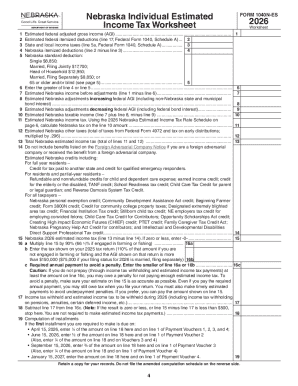

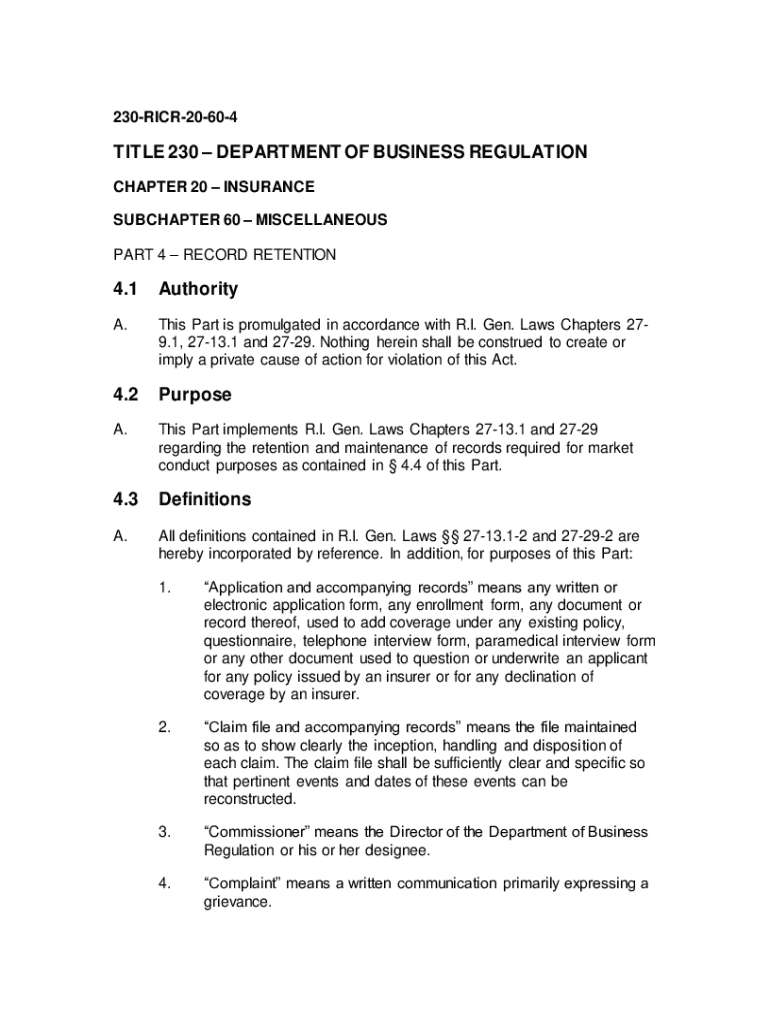

The scope of the Part 4 Record Retention Form encompasses various types of records critical for entities involved in federal procurement. Financial records, including invoices and payment documents, must be retained to demonstrate compliance with government regulations. Additionally, correspondence related to contracts and project management is crucial for tracking communication and decisions throughout the project lifecycle.

Moreover, employee records are also covered under Part 4 retention requirements. This includes employment contracts, tax documents, and performance evaluations, which are necessary for compliance with labor laws. Recognizing exclusions and exceptions is also vital; certain documents, like classified information as per industry 4.401 regulations, may have different retention and destruction protocols.

Completing the part 4 record retention form

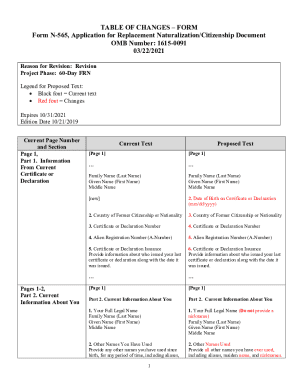

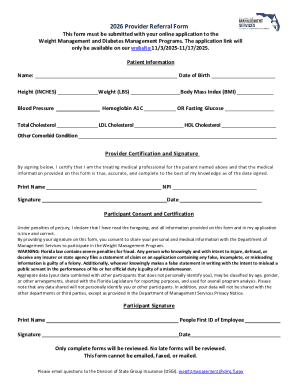

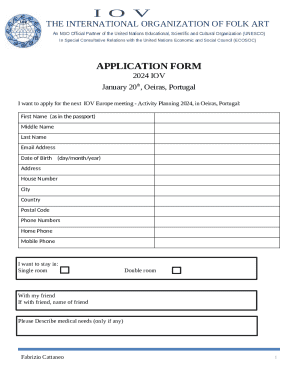

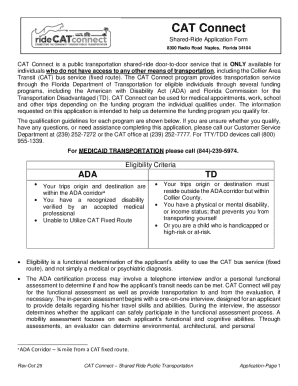

Gathering required information is the first step in completing the Part 4 Record Retention Form. Necessary documentation includes the identification of record categories related to financial, personnel, and operational data. Properly categorizing records helps streamline the retention process and simplifies future audits.

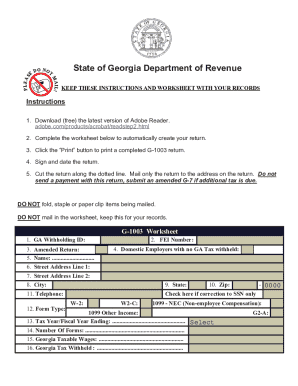

Following a systematic procedure is essential while filling out the form. Start by accurately entering your organization's name, DUNS number, and contract details. Each section should be completed with precision, as common mistakes include incorrect retention periods or failing to categorize records. Ensuring accuracy in this submission is paramount for compliance.

Submitting the part 4 record retention form

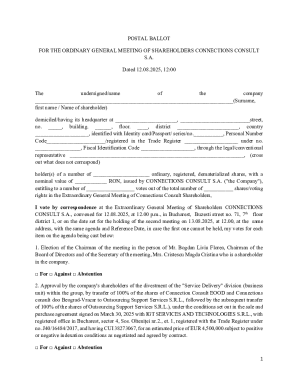

Once the Part 4 Record Retention Form is filled out correctly, submitting it can be done through various methods. Electronic submissions can be made using cloud platforms like pdfFiller, ensuring that documentation is not only safely stored but easily retrievable when necessary. Alternatively, physical submissions may still be required depending on specific agency requirements, necessitating adherence to submission guidelines, such as including any pertinent attachments.

After submitting the form, it is crucial to maintain a record of this submission. Confirmations received via email or automated systems offer assurance that the form has been accepted. Ensuring that responses are tracked is essential for future follow-ups, and maintaining detailed records of submissions plays an integral role in continuous compliance.

Managing and storing retained records

With records retained, effective management is crucial. Organizations must establish best practices for storage to ensure that records remain accessible and secure. Digital storage options, such as those provided by pdfFiller, allow for organized, cloud-based access to documents, significantly enhancing the efficiency of record management compared to traditional physical storage.

Integrating organizational systems helps streamline the retention process. From clearly labeled folders to comprehensive indexing, modern practices improve both accessibility and retrieval speed. Regular reviews and audits are paramount to ensure that outdated records are flagged for destruction and new records are adequately protected.

Safeguarding information throughout retention

Security compliance becomes a critical component when it comes to retaining records, especially sensitive information. Businesses need to comply with data protection regulations that ensure the safeguarding of client and employee information throughout its retention life cycle. Implementing secure access protocols, such as two-factor authentication, can significantly mitigate risks of unauthorized access.

Handling sensitive information requires specific protocols to maintain confidentiality. Employees tasked with managing records should be adequately trained to recognize sensitive material and implement necessary reporting procedures in the event of a data breach. Ensuring that transparency and accountability are priorities minimizes risks related to information management.

Managing destruction of records

Destruction of records has its own set of regulations that must be adhered to. Knowing when and how to destroy records involves following approved methods that safeguard information from unauthorized access. Guidelines on destruction methods are often stipulated in the Part 4 Record Retention requirements and must be followed diligently.

Prior to destruction, maintaining proper documentation is necessary to demonstrate compliance with retention policies. The destruction process itself should be documented, detailing what was destroyed and why. Understanding liability after destruction is essential; retaining non-compliant records post-destruction poses significant risks, and organizations should familiarize themselves with the legal implications involved.

FAQs about the part 4 record retention form

Organizations commonly have questions about the Part 4 Record Retention Form. One frequent query pertains to how long records should be retained. Generally, this is determined by the type of record and can range from several years for financial records to permanent retention for critical documents like contracts. The question of what happens if records are kept too long also arises, as this may lead to compliance risks under federal procurement data systems.

For further guidance, many resources are available online, including links to official regulations and compliance assistance contacts. Organizations can maximize their adherence to the Part 4 retention requirements by leveraging expert guidance.

Conclusion

Understanding the Part 4 Record Retention Form is imperative for organizations engaged in federal contracting and similar activities. By enhancing familiarity with retention policies and submitting accurate forms, entities safeguard themselves against legal repercussions while ensuring smooth compliance with regulatory requirements. Leveraging platforms like pdfFiller allows users to effectively manage their documentation, ensuring compliance and streamlining processes, ultimately creating a robust framework for record retention.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my part 4 record retention directly from Gmail?

Where do I find part 4 record retention?

Can I edit part 4 record retention on an Android device?

What is part 4 record retention?

Who is required to file part 4 record retention?

How to fill out part 4 record retention?

What is the purpose of part 4 record retention?

What information must be reported on part 4 record retention?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.