Get the free Creation of Alphanumeric Tax Code (ATC) for Voluntary ...

Get, Create, Make and Sign creation of alphanumeric tax

How to edit creation of alphanumeric tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out creation of alphanumeric tax

How to fill out creation of alphanumeric tax

Who needs creation of alphanumeric tax?

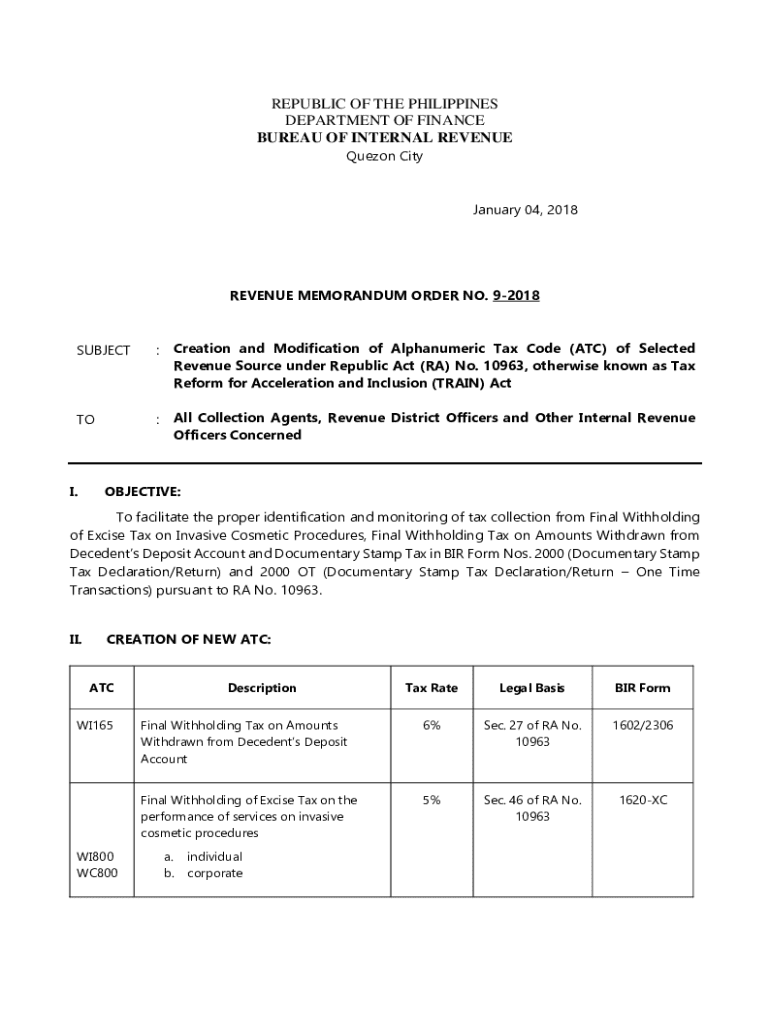

Creation of Alphanumeric Tax Form: A Comprehensive Guide

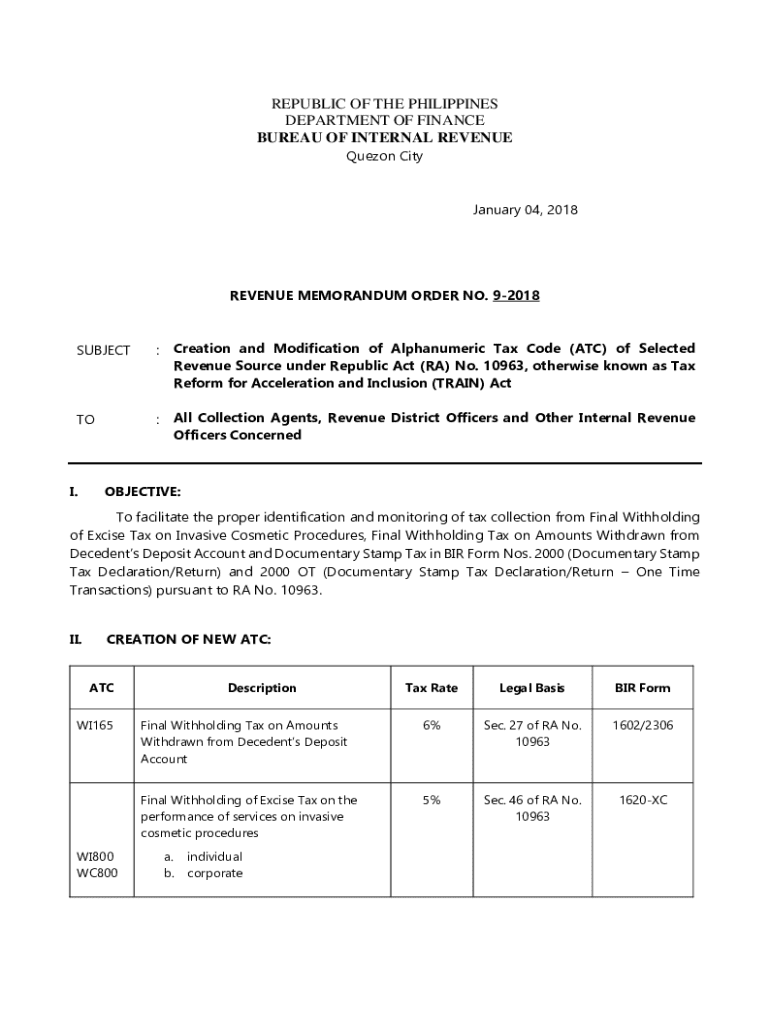

Understanding alphanumeric tax forms

Alphanumeric tax forms are essential documents that combine both letters and numbers in their format. Such forms include characters that allow for more precise identification of information, making the tax filing process both user-friendly and efficient. For instance, a standard tax form might include sections for social security numbers, deductions, and credits, all formatted to ensure that data is entered correctly and processed swiftly.

The significance of alphanumeric tax forms cannot be overstated. They not only facilitate easier data entry for taxpayers but also enhance data accuracy for tax authorities, contributing to a smoother tax collection process. Their structured format minimizes the chances of input errors, which can lead to costly penalties or refunds that delay the filing process.

Key differences between numeric and alphanumeric tax forms

Numeric tax forms consist solely of numbers, limiting their scope and flexibility. In contrast, alphanumeric forms incorporate letters, enabling the representation of a wider range of data types. For example, while a numeric tax form could provide only numerical data related to income, an alphanumeric form can capture various identifiers and other textual elements necessary for comprehensive tax processing.

The necessity of transitioning to alphanumeric forms

The shift to alphanumeric tax forms matters significantly in the context of evolving tax legislation and the increasing complexity of financial reporting. For users, this transition allows for a streamlined approach to tax filing, where various data points can be recorded in a cohesive format. For tax authorities, the benefits include smoother data processing and the potential for improved audit outcomes due to enhanced accuracy in reporting.

Additionally, improved data accuracy leads to increased compliance among taxpayers, as the forms are designed to guide users in correctly entering required information. This reduces the risk of audits and penalties stemming from incomplete or incorrect submissions.

Regulatory guidelines surrounding alphanumeric forms

Government regulations dictate how tax forms should be formatted and submitted, with various guidelines emerging around alphanumeric formats. Each filing period presents specific deadlines, and taxpayers must remain compliant with these standards to avoid penalties. Familiarizing yourself with these guidelines allows for smoother filing and less stress as deadlines approach.

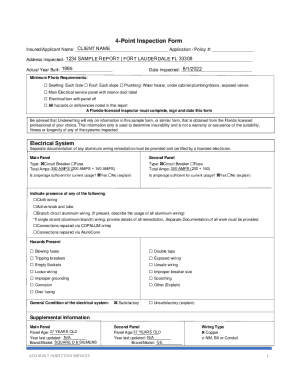

Steps to create an alphanumeric tax form

Creating an alphanumeric tax form involves several steps to ensure accuracy and compliance. First, gather all necessary information such as income details, identification numbers, and any applicable tax deductions or credits that will need to be reported. This preparatory step is crucial for setting up a smooth filing experience.

Next, pdfFiller offers interactive tools designed specifically for form creation. To access these features, simply log in to your pdfFiller account and navigate to the tax forms section. Utilizing these interactive features can simplify the process, leading to faster and more accurate tax form creation.

Filling out the form

When filling out your alphanumeric tax form, enter data meticulously and double-check for any potential input errors. Common mistakes include transpositions of digits or overlooking required fields. To avoid these issues, consider breaking the process down into smaller tasks — tackle one section at a time, ensuring complete accuracy before moving on.

Reviewing and editing your form

Once the form is filled out, leverage pdfFiller's editing features to review your entries. You can check for discrepancies, and collaborate with team members or advisors by sharing the form for feedback. This collaborative effort ensures that nothing has been overlooked, leading to a more robust filing.

Signing the alphanumeric tax form

E-signatures facilitate the signing process, allowing you to finalize documents efficiently. Using pdfFiller, ensure your e-signature is securely integrated and validated within the form. A secure signing process ensures the integrity of the document and meets legal requirements.

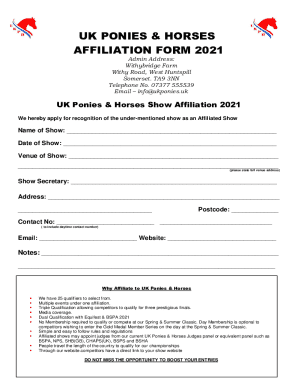

Managing your alphanumeric tax forms

After creating and signing your alphanumeric tax forms, managing them effectively is vital. Use pdfFiller's document management features to store and organize your forms securely. Establish a system that allows easy access to necessary forms at a moment's notice, reducing the stress associated with tax season.

Sharing forms securely with stakeholders is also vital to the management process. Avoid sending sensitive documents through unsecured channels. Instead, utilize pdfFiller's secure sharing capabilities, allowing you to control access while ensuring your data's safety.

Tracking changes and versions of your forms

Utilizing pdfFiller's version control features enables effective tracking of changes made to your tax forms. This feature is especially beneficial for teams, as it ensures that everyone is on the same page and that the most current version is always available, preventing confusion or potential errors.

Common challenges with alphanumeric tax forms and solutions

As with any process, the creation and submission of alphanumeric tax forms come with their set of challenges. Users frequently encounter formatting errors or mismatches in data during submission. These obstacles can lead to delays and complications in the filing process.

Fortunately, pdfFiller provides resources and tools that address these typical problems. For instance, their support team is readily available to assist with issues, ensuring users can file their forms correctly. Additionally, tutorials and help documents cover common challenges and provide solutions.

Future trends in tax documentation

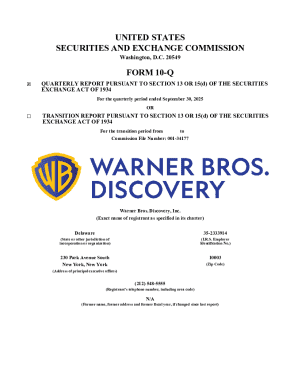

The future of alphanumeric forms appears promising as tax documentation evolves. Predictions suggest a continued emphasis on digital solutions and enhanced automation, making tax filing more efficient. As governments adapt their systems to meet modern expectations, users can expect more intuitive formats and intuitively structured forms that meet their needs.

Integrating technology will play a crucial role in streamlining tax processes, leading to a future where tax filing becomes largely automated. From AI-assisted data entry to real-time error correction, the enhancements in technology will transform the way individuals and teams approach their tax documentation.

Testimonials and case studies

Real-life experiences with creating alphanumeric tax forms highlight the practical benefits of transitioning to this format. Users have reported improved accuracy in their filings, resulting in fewer audits and quicker refunds. Such testimonials reinforce the effectiveness of utilizing pdfFiller in simplifying the tax process.

Moreover, teams that adopt pdfFiller have noticed an upsurge in productivity, attributing their improved workflows to seamless collaboration and document management capabilities. The integration of e-signatures and effective editing tools has streamlined their entire tax reporting process, allowing for agile responsiveness to changing tax regulations.

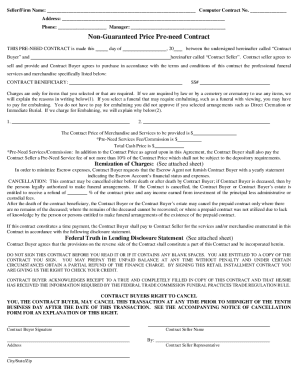

Interactive tools and resources

pdfFiller provides various interactive tools that simplify the creation of alphanumeric tax forms. These tools allow users to drag and drop text boxes, checkboxes, and signatures into the form, making the documentation process intuitive and efficient. Familiarizing yourself with these features can significantly reduce the time spent on tax form preparation.

In addition, pdfFiller continuously updates its platform with new features aimed at enhancing the user experience. Keeping an eye on these updates ensures that you will always have access to the most recent tools and functionalities available.

Conclusion on the value of alphanumeric tax forms

The creation of alphanumeric tax forms delivers numerous benefits, including increased efficiency, enhanced compliance, and a satisfying user experience. By leveraging the features of pdfFiller, users can navigate the complexities of tax documentation with ease, ensuring that their financial reporting is both accurate and timely.

In conclusion, understanding and effectively utilizing alphanumeric tax forms is essential for individuals and teams looking to streamline their tax processes. With pdfFiller, users gain access to a robust platform that simplifies form creation, editing, signing, and management, empowering them to handle their tax documentation confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify creation of alphanumeric tax without leaving Google Drive?

Can I sign the creation of alphanumeric tax electronically in Chrome?

Can I create an eSignature for the creation of alphanumeric tax in Gmail?

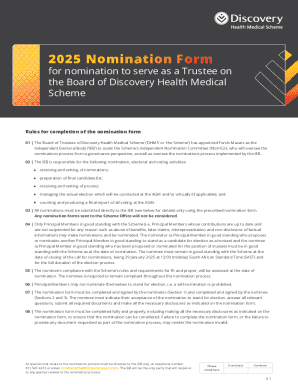

What is creation of alphanumeric tax?

Who is required to file creation of alphanumeric tax?

How to fill out creation of alphanumeric tax?

What is the purpose of creation of alphanumeric tax?

What information must be reported on creation of alphanumeric tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.