Get the free annual bank franchise tax report 2025

Get, Create, Make and Sign annual bank franchise tax

How to edit annual bank franchise tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual bank franchise tax

How to fill out annual bank franchise tax

Who needs annual bank franchise tax?

A comprehensive guide to the annual bank franchise tax form

Understanding the annual bank franchise tax

The annual bank franchise tax is a crucial component of the financial landscape in Texas. This tax is not merely a revenue-generating tool for the state; it serves a foundational purpose of ensuring that financial institutions contribute to the essential public services that the state provides. The assessment works by evaluating various aspects of a bank's operations and is designed to be proportional to their economic presence in Texas.

Primarily, the tax impacts banks, credit unions, and other financial entities. By requiring these institutions to file this annual tax form, Texas can maintain an equitable system where the financial sector supports the community infrastructure. The concept of 'franchise' in the tax name reflects that it is a tax on the privilege of doing business in the state rather than one based directly on profits or income.

Who is subject to the tax?

In Texas, the annual bank franchise tax primarily applies to financial institutions classified broadly under banks and credit unions. This classification can often lead to confusion, as both large commercial banks and smaller credit unions fall under its purview. Key characteristics that determine whether an institution is liable for this tax include their size, structure, and the nature of their operations within the state.

Certain entities may qualify for exemptions from this tax. For example, religious institutions, non-profit organizations, and sometimes smaller community banks pleasing certain criteria can be exempt. Understanding these classifications and potential exemptions can save financial institutions significant amounts of tax liability.

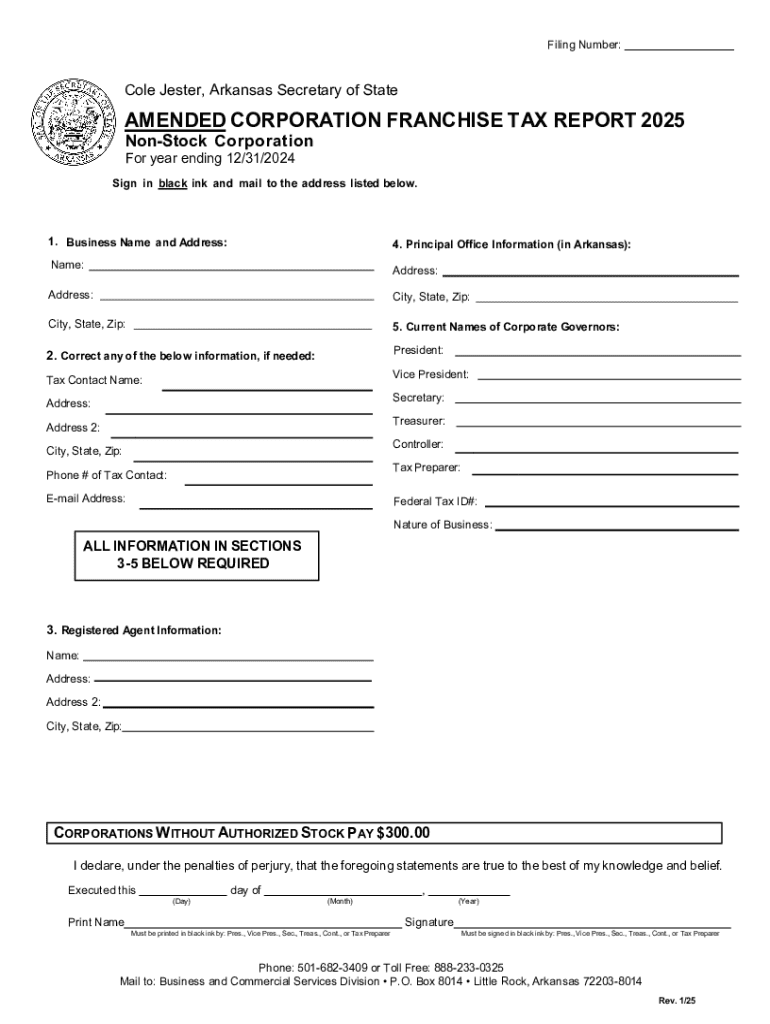

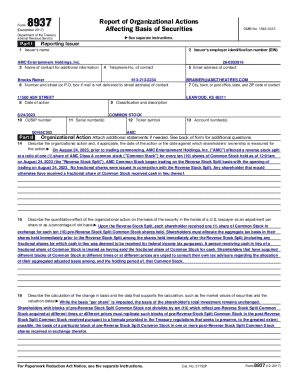

Key components of the annual bank franchise tax form

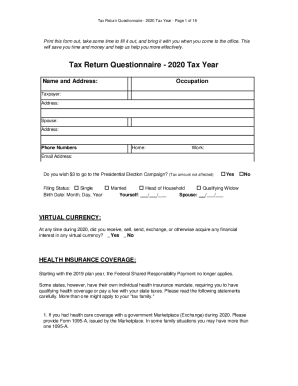

Filling out the annual bank franchise tax form requires several essential pieces of information. Firstly, institutions must provide their business name, contact details, and their unique Federal Employer Identification Number (EIN). This identification is critical as it correlates directly to the institution’s tax liability and reporting requirements.

Additionally, specific financial data must be submitted, including gross revenue information, which denotes total income before any deductions. Another crucial component is the calculation of the taxable margin, which plays into determining the amount owed. Financial institutions need to be meticulous with these figures, as inaccuracies can lead to penalties or miscalculated tax obligations.

Important filing dates are also vital to keep in mind. The deadline for filing the annual bank franchise tax form in Texas is typically May 15 each year, allowing ample time for institutions to prepare their documentation. Missing this deadline can result in severe penalties or interest on unpaid taxes.

Step-by-step guide to completing the annual bank franchise tax form

Before diving into the form itself, proper pre-filling preparations will ensure a smoother process. Gather all necessary documentation, including previous tax returns, financial statements, and any relevant records that indicate gross revenue and expenses. This simplifies calculations and ensures accuracy.

When filling out the form, each section serves a specific purpose that should not be overlooked. The Business Identification Section collects fundamental details, while the Revenue Calculation Section ensures all financial figures are accurately reported. For those who believe they qualify for exemptions, proper documentation must be included to substantiate such claims.

Reviewing the completed form is crucial before submitting it. Double-check all entries for accuracy, especially key figures and identifying information. Common pitfalls include misreporting revenue or forgetting to sign and date the form, both of which can lead to complications with the Texas Comptroller.

Filing options for your annual bank franchise tax form

Financial institutions have multiple filing options available for the annual bank franchise tax form, with electronic filing via pdfFiller gaining popularity. The benefits of filing online include ease of use, quicker submission, and an automatic error-checking system that can help eliminate mistakes before submission.

To eFile using pdfFiller, begin by creating an account or logging in. Upload your completed tax form and follow the outlined steps for electronic submission. Additionally, pdfFiller offers editing features, allowing for quick adjustments if you identify any errors post-review.

For institutions preferring paper filing, clearly follow the designated instructions for submitting a printed form. Ensure you have the correct address for mailing the completed document to avoid any delays in processing.

Payment of bank franchise tax

Upon completing the annual bank franchise tax form, the next step is handling the payment. Texas provides various electronic payment methods, including direct bank transfers and credit card options, allowing for flexibility based on institutional preference. Institutions should familiarize themselves with these options to choose one that aligns with their financial workflows.

For those opting to pay via check, the guidance is straightforward — ensure the check is written to the Texas Comptroller and mailed to the appropriate address along with the tax form. It's vital to note that any failures to pay on time can lead to penalties and accumulating interest, emphasizing the importance of timely submission.

Common questions and troubleshooting

Despite meticulous planning, errors can occur on the annual bank franchise tax form. If an error is identified post-submission, it's essential to act quickly. Institutions should file an amended form, ensuring to highlight the sections that require correction and including adequate documentation for adjustments. Failing to correct errors can lead to discrepancies in tax liability and potential audits.

For further inquiries or specialized assistance, Texas's tax assistance centers maintain dedicated resources for addressing tax-related questions. Institutions can contact them directly or refer to their online portals for guidance on common issues and filing nuances.

Utilizing pdfFiller for your tax documentation needs

pdfFiller serves as an invaluable tool for handling the annual bank franchise tax form, providing a comprehensive document management solution. It allows for seamless editing, signing, and collaboration on tax forms, ensuring all stakeholders in an institution can participate in the process, regardless of their physical location.

Furthermore, pdfFiller offers various collaboration tools that enhance team engagement during the filing process. Features such as real-time editing and comment sections enable teams to communicate effectively about any errors or adjustments needed without the hassle of email exchanges. Users can also access other related tax forms easily through pdfFiller’s extensive library, ensuring all necessary documentation is at their fingertips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify annual bank franchise tax without leaving Google Drive?

How can I send annual bank franchise tax to be eSigned by others?

How do I fill out annual bank franchise tax on an Android device?

What is annual bank franchise tax?

Who is required to file annual bank franchise tax?

How to fill out annual bank franchise tax?

What is the purpose of annual bank franchise tax?

What information must be reported on annual bank franchise tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.