Get the free Fiduciary Income Tax Forms Archive

Get, Create, Make and Sign fiduciary income tax forms

Editing fiduciary income tax forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fiduciary income tax forms

How to fill out fiduciary income tax forms

Who needs fiduciary income tax forms?

Comprehensive Guide to Fiduciary Income Tax Forms Form

Understanding fiduciary income tax forms

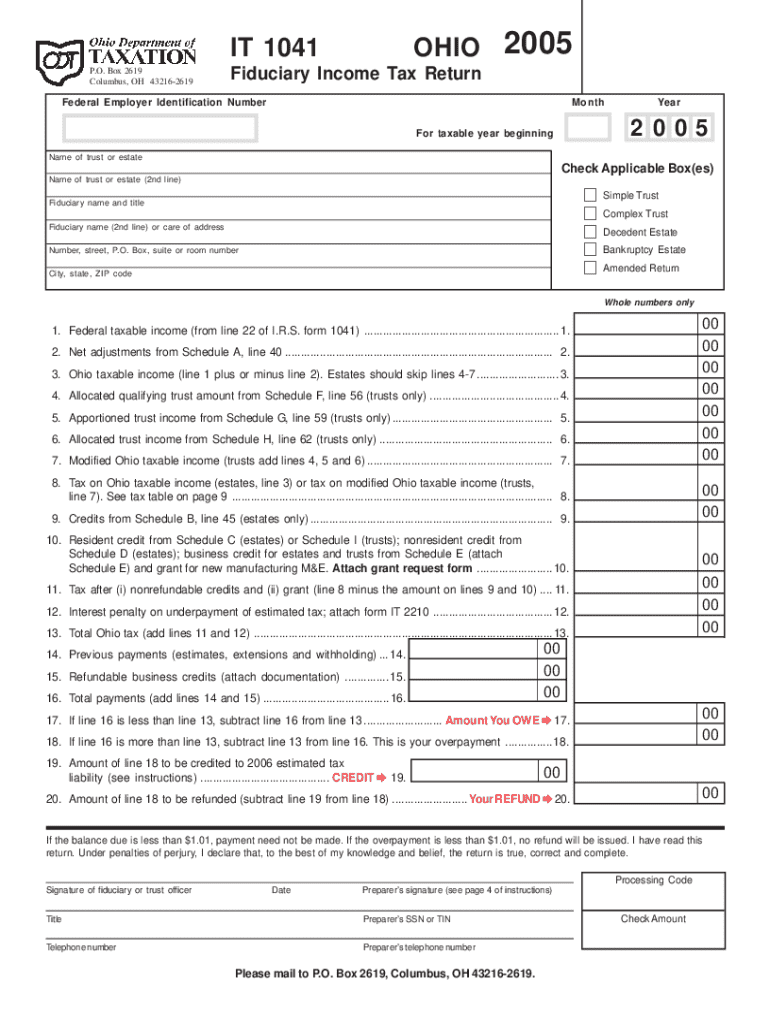

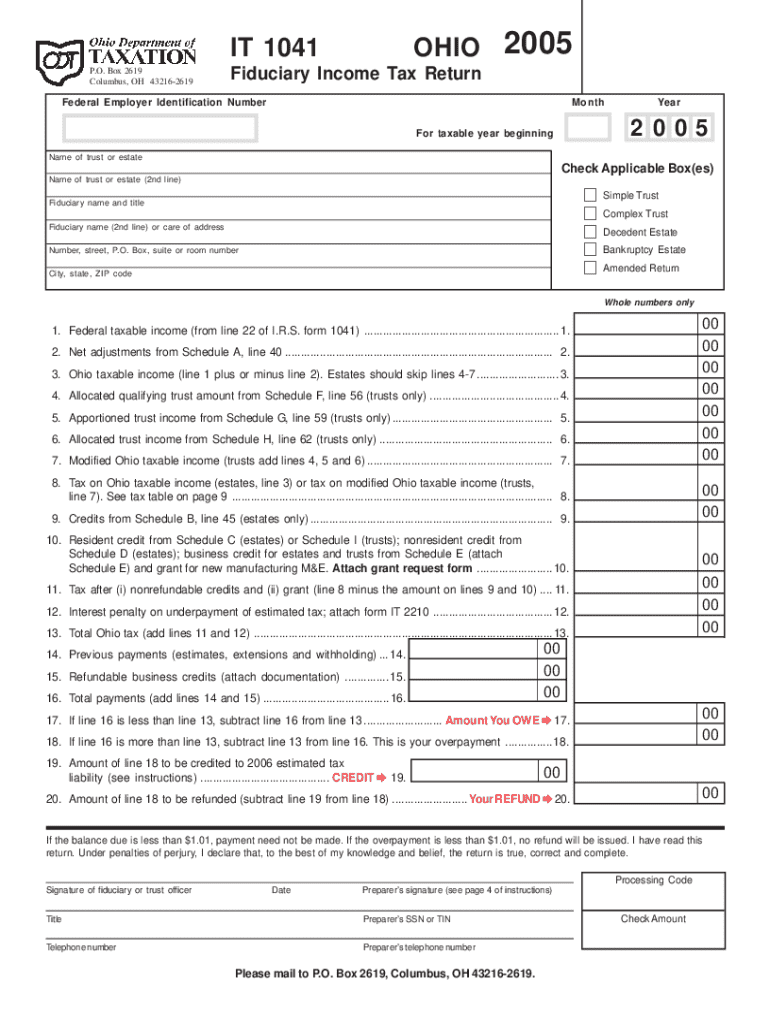

Fiduciary income tax forms are essential documents that enable fiduciaries—such as trustees or executors—to report income generated by estates or trusts for tax purposes. The primary form used in the United States for this purpose is Form 1041, which must be filed annually to report any income earned by the entity they manage. Filing these forms correctly is crucial as it ensures compliance with tax laws, preventing potential penalties or fines.

The importance of filing fiduciary income tax forms cannot be overstated; this not only keeps the estate or trust in good standing with the Internal Revenue Service (IRS) but also ensures that beneficiaries receive their rightful distributions free of tax complications. New filers should be particularly aware of different fiduciary income types, including taxable income, non-taxable income, distributions to beneficiaries, and deductions that can be claimed, which all necessitate accurate reporting.

Key components of fiduciary income tax forms

Fiduciary income tax forms include several critical sections that must be completed accurately. The first section requires personal information about the estate or trust, including the name, address, and identification number. This identification is crucial for the IRS to process the return effectively and match it to the fiduciary's records.

The subsequent sections focus primarily on income reporting, where fiduciaries must detail the sources and amounts of income received, such as dividends, interest, capital gains, and rental income. Additionally, the deductions and credits section allows fiduciaries to reduce taxable income by reporting valid expenses like administrative costs, tax payments, and distributions made to beneficiaries, which can often lower the tax burden for the trust or estate.

It’s vital to recognize that trusts and estates have unique considerations when completing these forms. For example, trusts often distribute income to their beneficiaries, allowing beneficiaries to report it on their personal tax returns. In contrast, estates often retain income within the entity until a distribution is made or final payments are settled.

Important notice for the current tax year

Tax laws can change from year to year, and it’s essential for fiduciaries to stay informed about any new regulations affecting the submission of fiduciary income tax forms. Recent updates may impact the thresholds for income tax rates or the availability of certain deductions or credits. Notably, tax changes may also influence what constitutes taxable income, especially related to investments and distributions.

Timely submission is critical, with current deadlines typically falling on the 15th day of the fourth month after the end of the tax year (April 15 for calendar year filers). Fiduciaries may also opt for an extension, allowing for an additional six months to file, although it’s important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

Common pitfalls when filing fiduciary income tax forms include inaccurate income reporting, miscalculating distributions to beneficiaries, and overlooking available deductions. Each of these mistakes can lead to delays or increased scrutiny from the IRS, so vigilance during the filing process is essential.

Step-by-step guide to completing fiduciary income tax forms

Step 1: Gather necessary documents

Start the filing process by collecting all relevant documents. Required documentation typically includes:

Step 2: Filling out the form

Next, begin entering information into the fiduciary income tax form. Start with the personal information section, ensuring all names, identification numbers, and addresses are correct. Proceed to the income reporting section, detailing all sources of income accurately and ensuring that it adds up correctly. After that, move to the deductions and credits section; this is where documenting all allowable expenses is crucial to minimizing tax liability.

Step 3: Reviewing your information

After completing the form, review your information thoroughly. Cross-verify all numbers and facts against your gathered documents to check for any discrepancies. Consider having a trusted individual or tax professional double-check your form to catch any potential errors.

Step 4: Submitting your form

Finally, submit your completed fiduciary income tax form. You can choose between electronic submission via e-filing or mailing a paper form to the IRS. Electronic submissions are often processed faster. Keep records of your submission and any confirmations received to track your filing’s progress and ensure compliance with tax regulations.

Utilizing interactive tools for form management

Platforms like pdfFiller offer interactive features to streamline the process of managing fiduciary income tax forms. Users can easily edit and customize templates to fit their needs, allowing for swift adjustments to ensure accurate reporting. With these tools, fiduciaries can also add digital signatures to forms, making the finalization process seamless.

Collaboration is made easy with the ability to share documents with other stakeholders, such as co-trustees or accountants. This collaborative approach helps ensure that all parties involved are on the same page, reducing the risk of mistakes and miscommunication.

Navigating common challenges in fiduciary income tax filing

Filing fiduciary income tax forms can come with its own set of challenges. For instance, many fiduciaries are uncertain about what steps to take if they realize a mistake has been made after submission. If this occurs, the process for amending a submitted fiduciary income tax form is relatively straightforward: one must file Form 1040X to correct the return. This form ensures that any discrepancies are appropriately accounted for.

It is also not uncommon to encounter complex situations, especially involving multiple beneficiaries. In such cases, fiduciaries should seek out resources, such as guidance from the division of taxation or professional tax consultants, to ensure compliance with income tax regulations and equitable treatment among beneficiaries. Additionally, utilizing online forums can provide valuable insights from others who may have faced similar challenges.

Accessing help and support for fiduciary income tax forms

Those looking for professional assistance with fiduciary income tax forms have multiple avenues at their disposal. Tax professionals specializing in fiduciary taxation can provide tailored advice and support, ensuring compliance and correctness in all filings.

Online resources, such as articles and forums, can also be informative, guiding users through common queries. Websites like pdfFiller include customer support specifically focused on tax form management, offering additional help where needed. Finally, it is wise for fiduciaries to stay updated on announcements from the IRS or local state tax agencies concerning any changes that may affect their filings.

Additional information about fiduciary tax forms

Staying informed about legislative updates and trends affecting fiduciary filings is crucial for effective tax management. For instance, changing regulations around sales tax and the new definitions related to capital gains can significantly impact how estates and trusts are administered. Case studies showcasing real-life examples of fiduciary income tax filings can shed light on best practices and common pitfalls, helping fiduciaries refine their approach as needed.

Maintaining a proactive stance on new developments within taxation ensures fiduciaries are well-prepared to manage their responsibilities effectively. Resources such as webinars from recognized tax professionals provide valuable training and updates, helping fiduciaries navigate the complexities of estate management and maximizing financial outcomes for beneficiaries.

About pdfFiller

pdfFiller’s mission is to empower users with tools that facilitate seamless document management. By offering comprehensive solutions for editing, filling, signing, and tracking forms, pdfFiller simplifies the often complex process of fiduciary income tax filing.

Users have reported increased efficiency and reduced errors when utilizing pdfFiller’s services for fiduciary income tax forms. With the capability to collaborate in real-time, many have achieved successful outcomes in their form submissions, thanks to the streamlined approach supported by the platform.

Language assistance

Understanding that the user base is diverse, pdfFiller offers language options to ensure that all users can effectively complete fiduciary income tax forms regardless of their first language. This feature is particularly beneficial for aiding non-native English speakers in navigating the complexities of tax documents.

Various multilingual support tools are available throughout the platform, enhancing user experience and understanding during form completion. This commitment to accessibility reinforces pdfFiller's goal of providing a document management solution that truly caters to the needs of an evolving global user base.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete fiduciary income tax forms online?

How do I edit fiduciary income tax forms in Chrome?

How do I fill out the fiduciary income tax forms form on my smartphone?

What is fiduciary income tax forms?

Who is required to file fiduciary income tax forms?

How to fill out fiduciary income tax forms?

What is the purpose of fiduciary income tax forms?

What information must be reported on fiduciary income tax forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.