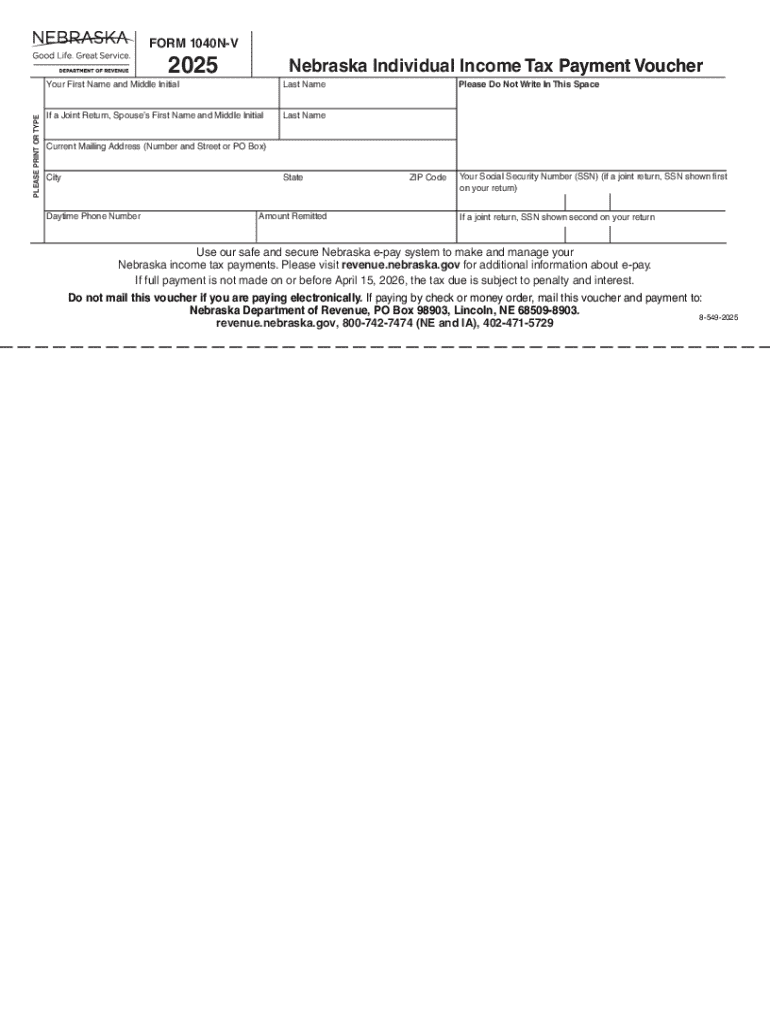

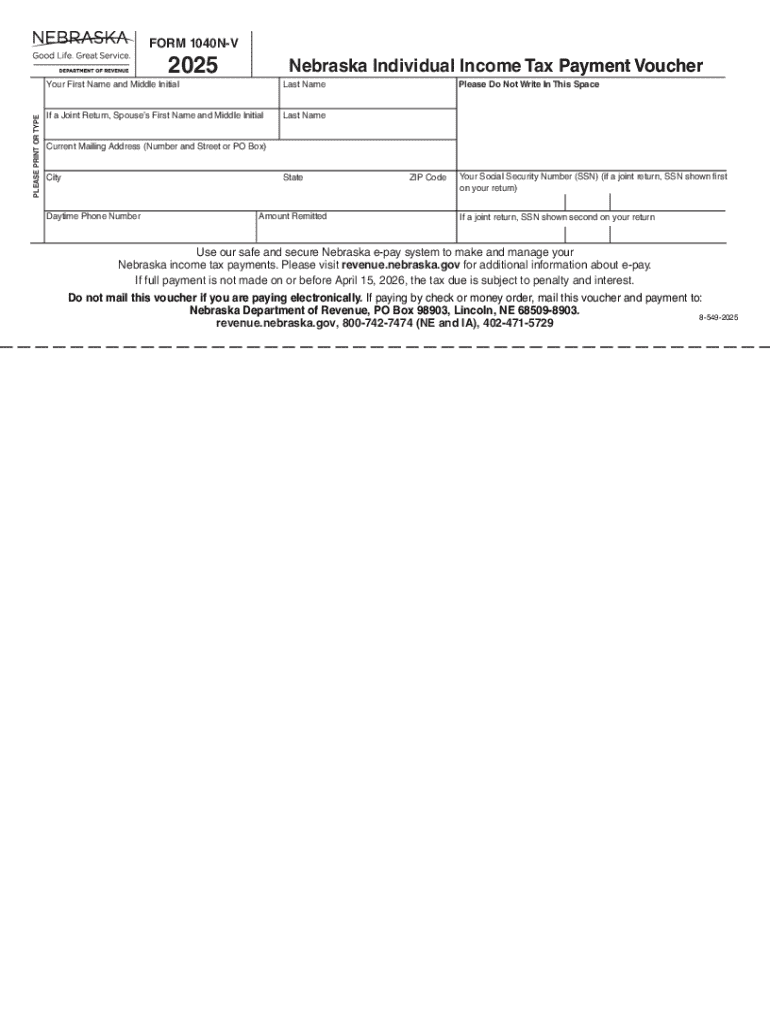

Get the free Nebraska Nebraska Individual Income Tax Payment Voucher

Get, Create, Make and Sign nebraska nebraska individual income

Editing nebraska nebraska individual income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska nebraska individual income

How to fill out nebraska nebraska individual income

Who needs nebraska nebraska individual income?

The Complete Guide to the Nebraska Individual Income Form

Understanding the Nebraska Individual Income Form

The Nebraska Individual Income Form is the official document used by residents and non-residents to report their income and calculate their state income tax obligations. Whether you’re a full-time Nebraska resident or simply working temporarily in the state, understanding this form is crucial to fulfilling your legal responsibilities and ensuring that you pay the correct amount in taxes.

Filing this form accurately is vital as it impacts not only your tax liability but also any potential refunds you may be entitled to. Additionally, missing the filing deadline can result in late fees and interest penalties, which further complicate your financial standing.

Who needs to file the Nebraska Individual Income Form?

Determining who is required to file the Nebraska Individual Income Form hinges on several factors, including income level, residency status, and employment sources. All Nebraska residents need to file if their income exceeds certain thresholds based on their filing status.

For non-residents, the requirement to file may depend on whether they earned income in Nebraska during the tax year. Generally, if you received income as a resident or from any source within Nebraska, you’re mandated to file a return.

Preparing to fill out the Nebraska Individual Income Form

Before embarking on filling out the Nebraska Individual Income Form, gathering all necessary documents ensures a smoother filing experience. You’ll need to collate your identification information, income statements such as W-2s and 1099s, and understand which deductions and credits you may qualify for.

Understanding whether to use the digital or paper form can impact your workflow. Digital forms can be processed faster and are often more convenient for editing, whereas paper forms may carry a sense of familiarity for some individuals.

Step-by-step instructions for completing the form

Completing the Nebraska Individual Income Form involves methodically progressing through each section. Begin with your personal information, ensuring accuracy to avoid any future complications. Next, report all sources of income truthfully; this includes wages, self-employment income, interest, and dividends.

Deductions and credits play a significant role in reducing your overall tax burden. Understanding what’s eligible can save you substantial amounts. After detailing your income and deductions, calculating your total tax liability involves applying the appropriate Nebraska income tax rates.

Utilizing pdfFiller's tools for seamless form management

pdfFiller stands out as a powerful resource that enhances the filing experience for the Nebraska Individual Income Form. With its capabilities for easy PDF editing, eSigning options, and collaborative tools, you can ensure a smooth process from start to finish.

Interactive tools can help catch errors before submission, and history tracking ensures you can revisit previous edits. This helps maintain an organized filing strategy and ultimately supports your overall tax process.

Common mistakes to avoid when filing

When it comes to filing the Nebraska Individual Income Form, common mistakes can lead to complications and delays. It’s important to pay attention to details, such as entering the wrong Social Security number or failing to report all income sources.

Double-checking your entries can save you from potential audits and additional tax liabilities. Ensuring that your calculations are accurate is paramount, as an error here can change your entire tax situation.

What to do after filing the Nebraska Individual Income Form

Once you have submitted your Nebraska Individual Income Form, staying proactive is crucial. Tracking the status of your filing is essential, whether it’s online or via direct communication with the state tax office. Understanding refund timelines helps you manage your finances better and anticipate any payments owed.

Additionally, prepare for potential audits by keeping your records organized and readily accessible. Knowing what to expect in terms of timeframes for refunds or any additional actions required will ease your tax season stress.

Additional forms and resources

In addition to the Nebraska Individual Income Form, various other forms may apply depending on your tax situation. For instance, if you have business income, various schedules and documentation will be required to provide a comprehensive picture of your tax position.

Accessing online resources provides valuable information, including downloadable forms and guides tailored specifically for Nebraska taxpayers. Utilizing professional assistance is also recommended for complex situations, ensuring all bases are covered.

Frequently asked questions

When it comes to the Nebraska Individual Income Form, several common questions arise among taxpayers. Issues such as the tax implications surrounding changes in residency or reporting income from multiple states must be clarified to avoid unexpected tax liabilities.

Furthermore, knowing how to amend a filed form if errors are discovered is vital. This can help rectify mistakes and ensure that your tax records remain accurate and up-to-date.

Conclusion of the filing process

Organizing your records post-submission is essential for managing your tax obligations and preparing for future filing seasons. Keeping a thorough record of your submissions and any related correspondence helps streamline future filings, ensuring you stay compliant with Nebraska tax regulations.

Engaging in proactive tax planning can yield significant benefits, such as maximizing deductions and credits. By staying informed and organized, you set yourself up for success, easing the burden of tax season with practical foresight and preparation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nebraska nebraska individual income without leaving Google Drive?

How do I complete nebraska nebraska individual income online?

Can I edit nebraska nebraska individual income on an Android device?

What is nebraska nebraska individual income?

Who is required to file nebraska nebraska individual income?

How to fill out nebraska nebraska individual income?

What is the purpose of nebraska nebraska individual income?

What information must be reported on nebraska nebraska individual income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.