Get the free IRS Form 1120 for C-Corporations Explained

Get, Create, Make and Sign irs form 1120 for

Editing irs form 1120 for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 1120 for

How to fill out irs form 1120 for

Who needs irs form 1120 for?

IRS Form 1120 for Form: A Comprehensive Guide

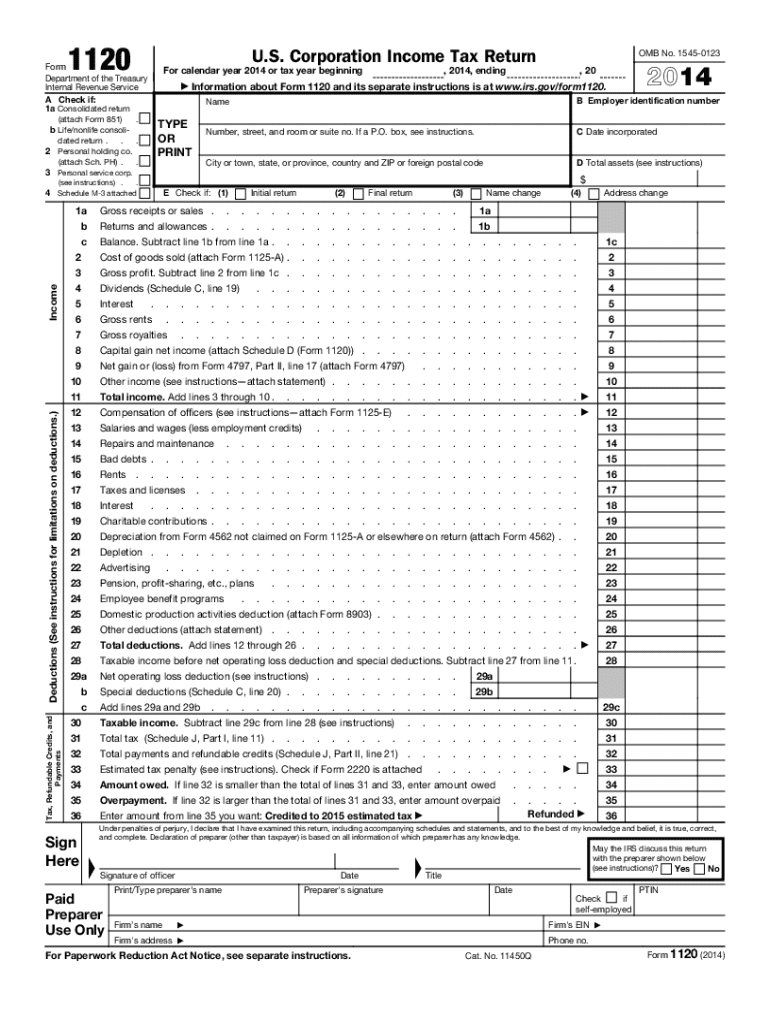

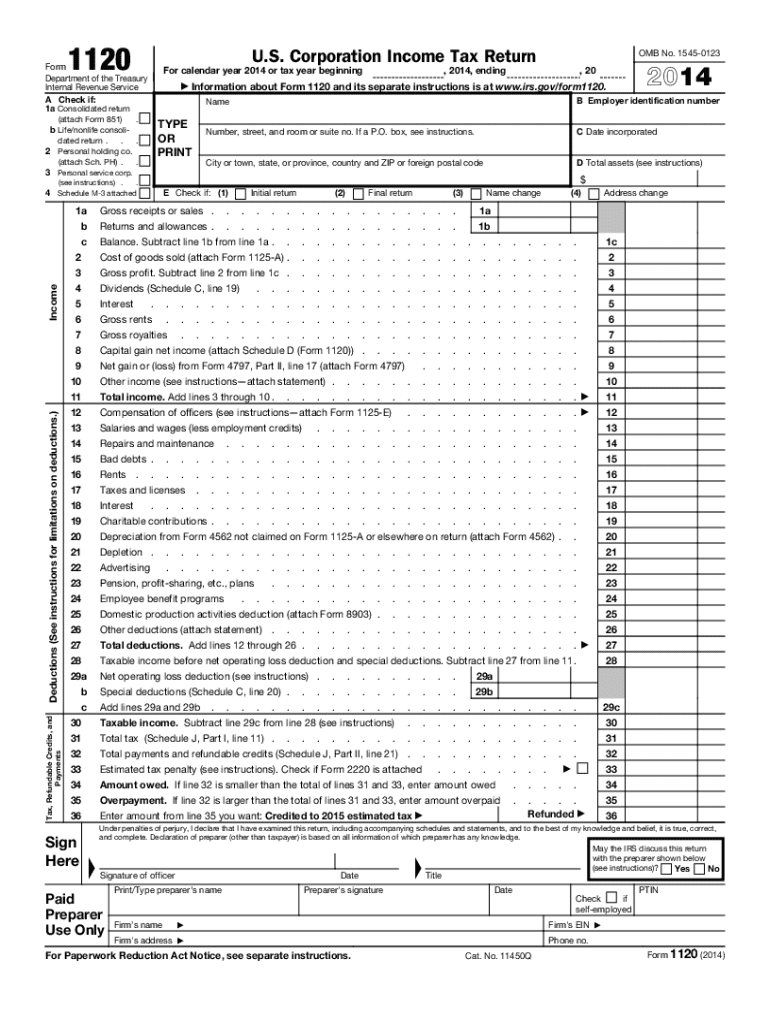

Understanding IRS Form 1120

IRS Form 1120 is the U.S. Federal Income Tax Return for corporations. Designed primarily for C corporations, this form enables the Internal Revenue Service (IRS) to determine the corporate income tax liability. The critical nature of this form lies in its role as a portal for corporate entities to report their income, deductions, gains, and losses for a tax year.

Understanding and completing Form 1120 accurately is essential for compliance with federal regulations. Beyond mere reporting, this form provides essential insights into a corporation's financial health and tax obligations, serving as a foundational document in corporate taxation.

Who needs to file IRS Form 1120?

IRS Form 1120 is primarily intended for C corporations. These are the standard corporations that pay corporate taxes separately from their shareholders. Any domestic corporation, including those formed in one of the U.S. territories, typically must file this form to report their income. Additionally, foreign corporations conducting business within the United States are also required to file Form 1120.

Certain entities, however, are exempt from this filing requirement. S corporations, which elect taxation under Subchapter S of the Internal Revenue Code, do not file Form 1120; instead, they file Form 1120S. Similarly, partnerships and limited liability companies (LLCs) have different filing requirements.

The purpose of IRS Form 1120

The primary purpose of IRS Form 1120 is to report income earned by corporations during the tax year. This includes all sources of income such as sales revenue, dividends, and interest. The form also provides corporations the opportunity to claim various deductions and credits that can help reduce their overall tax liability, ultimately benefiting a corporation’s bottom line.

Furthermore, the financial reports submitted alongside Form 1120 offer valuable insights into the operational efficiency and economic health of the corporation. This information can not only aid the IRS in tax collection but can also be instrumental for corporations seeking financing or assessing performance.

Key components of IRS Form 1120

IRS Form 1120 comprises several critical sections that capture essential information about a corporation's financial performance. The form is divided into income, deductions, and tax sections, along with other schedules that may be required depending on the filing specifics.

The first section details income, including gross receipts and other types of income generated during the fiscal year. In the deductions section, corporations can outline business expenses such as salaries, rents, and cost of goods sold. Finally, the tax section reveals the corporation's tax responsibilities based on the reported figures.

Preparing to complete IRS Form 1120

Preparation for completing IRS Form 1120 involves gathering comprehensive financial documentation. Accurate information is vital to ensure compliance and to avoid penalties. Businesses should collect financial records such as profit and loss statements, balance sheets, and cash flow statements, as well as prior tax returns for reference.

In addition to financial documents, corporate entities must have their legal documentation accessible, including articles of incorporation and EIN (Employer Identification Number) documents. Organizing these materials effectively can streamline the filing process and mitigate confusion during preparation.

Step-by-step guide to completing IRS Form 1120

Filling out IRS Form 1120 can be broken down into clear sections that make the process manageable. Starting with the Income section, corporations should accurately report all revenue streams, detailing sales, dividends, and interest income. It’s crucial to be diligent here as any discrepancies can lead to significant compliance issues.

Moving on to the Deductions section, corporations can select between standard and itemized deductions. Common corporate deductions include expenses like rent, salaries, and office supplies. Lastly, the Tax and Payments section requires careful calculations to ensure the correct tax liability is reported, including addressing any payments or potential refunds.

Filing IRS Form 1120: What to know

Filing deadlines for IRS Form 1120 are crucial to understand. Generally, the form must be filed by the 15th day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this translates to an April 15 deadline. Failure to file on time can result in penalties and interest accruing on any unpaid taxes.

Certainly, corporations have the option for eFiling, which offers advantages such as quicker processing times and confirmation notifications. However, some still prefer traditional paper filing, which might feel more secure for certain entities. If mistakes are made on the form, corporations have the ability to amend the form using Form 1120X; prompt action is key in these scenarios to avoid penalties.

Implications of failing to file IRS Form 1120

Neglecting to file IRS Form 1120 can result in severe consequences for corporations. Potential penalties include hefty fines that can accumulate based on the duration of non-compliance. Furthermore, ongoing business operations and the ability to secure funding could be jeopardized due to incomplete or missing tax filings.

Long-term effects may include heightened scrutiny from the IRS, which can lead to audits. If forms are missed, corporations have options, including filing late and potentially negotiating penalties with the IRS, highlighting the importance of timely filings and compliance.

Frequently asked questions about IRS Form 1120

After filing IRS Form 1120, corporations often have questions regarding the will of their submission. A common query revolves around how to amend or correct any information after submission. To address this, corporations can utilize Form 1120X for any adjustments necessary, ensuring corrections are submitted as promptly as possible.

Moreover, corporations sometimes face IRS audits post-filing due to inconsistencies or high-value deductions. Understanding the audit process and preparing accurate documentation is crucial for a smooth inquiry. Being proactive about maintaining accurate records can shield corporations from unnecessary stress during audits.

Utilizing pdfFiller for IRS Form 1120 management

pdfFiller provides a seamless environment for completing IRS Form 1120, focusing on ease of use and functionality. Users can access the form from anywhere, fill it out digitally, and save their work with a few simple clicks. The platform also offers an elegant editing tool that simplifies the process of making any changes or adjustments prior to submission.

Moreover, pdfFiller supports collaboration among team members, allowing multiple users to contribute to the document effectively. Cloud-based solutions for document management reduce the risk of losing important files, enhancing not only efficiency but also compliance tracking throughout the filing process.

Real-life scenarios: Case studies on filing Form 1120

Examining real-life scenarios, we uncover various outcomes faced by corporations regarding IRS Form 1120. A small C corporation that overstated deductions faced penalties when the IRS audited their return. Learning from this, they implemented stricter internal controls and engaged a CPA to handle future filings.

Conversely, a mid-sized corporation streamlined their filing process using pdfFiller, which allowed them to submit accurately and timely. Their success demonstrated how leveraging technology can mitigate compliance risks and enhance operational effectiveness. Such varied experiences highlight the importance of knowledge and the right tools in navigating Form 1120.

Keeping up-to-date on IRS Form 1120 changes

Staying informed about changes to IRS Form 1120 is imperative for all corporations. Recent updates may affect filing requirements or criteria for deductions, and corporations need to incorporate these changes into their financial practices to ensure compliance. Engaging with IRS publications and tax updates can provide clarity on recent developments.

Regular review of filing procedures and taking advantage of expert advice can significantly enhance the accuracy and relevance of submissions. Utilizing resources available through pdfFiller can also support corporations in maintaining awareness of updates, ensuring preparedness for tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send irs form 1120 for for eSignature?

How do I fill out the irs form 1120 for form on my smartphone?

How can I fill out irs form 1120 for on an iOS device?

What is irs form 1120 for?

Who is required to file irs form 1120 for?

How to fill out irs form 1120 for?

What is the purpose of irs form 1120 for?

What information must be reported on irs form 1120 for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.