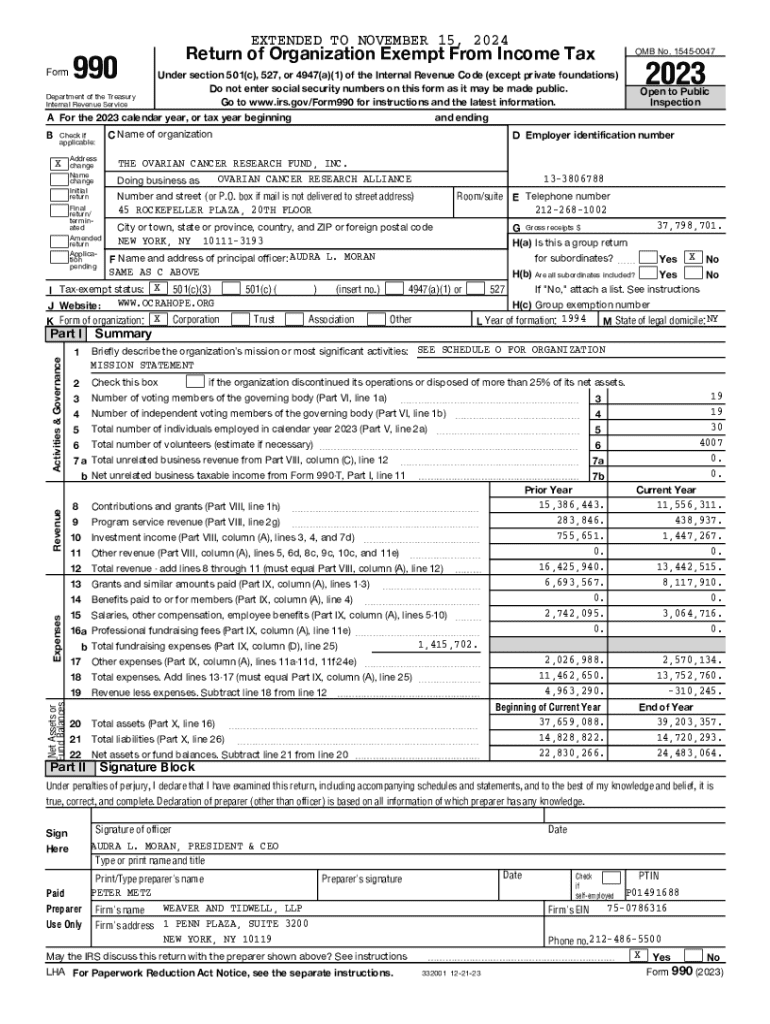

Get the free Name Change with IRS on extended tax return

Get, Create, Make and Sign name change with irs

Editing name change with irs online

Uncompromising security for your PDF editing and eSignature needs

How to fill out name change with irs

How to fill out name change with irs

Who needs name change with irs?

A complete guide to changing your name with IRS form

Understanding the IRS name change process

Changing your name with the IRS is a significant step in ensuring that your personal and tax records accurately reflect your current identity. It is essential to initiate a name change process with the IRS as soon as you have legally changed your name to avoid discrepancies that could lead to issues during tax seasons. The importance of this process lies not only in compliance with federal laws but also in ensuring that you receive any tax refunds or correspondence without delay. Failing to update your records can lead to errors that may complicate your financial situation.

There are various reasons one might need to change their name with the IRS. This could be due to marriage, divorce, personal preference, or changes in business names. Understanding the process behind updating your name can help you ensure compliance and maintain accurate records. Proper execution can save you from the hassle of potential audits or complications when filing your taxes.

Common scenarios for changing your name

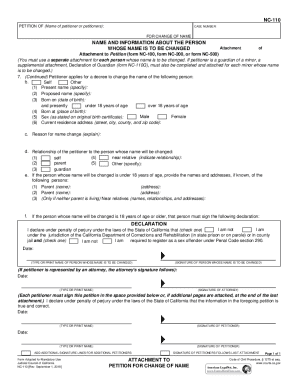

Name changes with the IRS often arise in common situations that are part of life events. The most frequent scenarios include when an individual changes their name due to marriage or divorce. Whether adopting a spouse's last name after marriage or reverting to a maiden name after a divorce, it’s critical to update your records promptly with the IRS to ensure all future tax filings reflect your legal name.

Another common scenario involves business entities. Corporations, LLCs, and partnerships may change their registered names, significantly impacting their employer identification number (EIN) and tax filings. Moreover, name changes for personal reasons, such as gender transitions or simply personal preference, are also valid circumstances under which individuals need to update their name with the IRS.

Essential IRS forms for name change

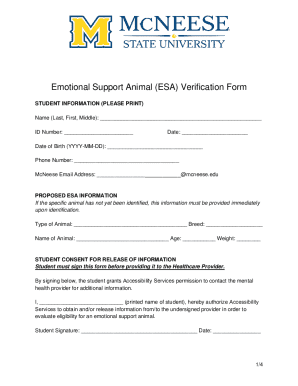

When undergoing a name change with the IRS, awareness of the relevant forms is vital. Two primary forms are often required: Form SS-5 and Form 8822. Understanding the purpose of each will streamline the name change process. Form SS-5 is the application for a Social Security card, which you need to fill out if your name has changed, as the IRS matches tax records with Social Security Administration data.

Filling out Form SS-5 is straightforward. You will need to provide personal identification details, including your old name, the new name, and acceptable identification forms. This is crucial because the IRS requires your name to match your Social Security records. Additionally, Form 8822 is the Change of Address form, which can also be utilized in the case that your name change coincides with a move. This form is useful for notifying the IRS of both your new name and address, ensuring they have your latest contact information for future correspondence.

Step-by-step guide to changing your name with the IRS

To ensure a smooth name change process with the IRS, following organized steps is essential. Begin by preparing the required documentation, where supporting legal documents such as your marriage certificate, divorce decree, or a court order will be necessary. This documentation corroborates your new name and is critical for both the Social Security Administration and the IRS.

Next, complete the appropriate forms. Fill out Form SS-5 meticulously with accurate personal details and appropriate documentation attached. If you are also updating your address, fill out Form 8822 with the updated address details. Finally, submitting your name change request is the crucial final step; typically, it can be done by mail. Always keep a copy of your documents for your records. Processing times can vary, but generally, the IRS states that it may take up to two weeks for them to process an update depending on their backlog.

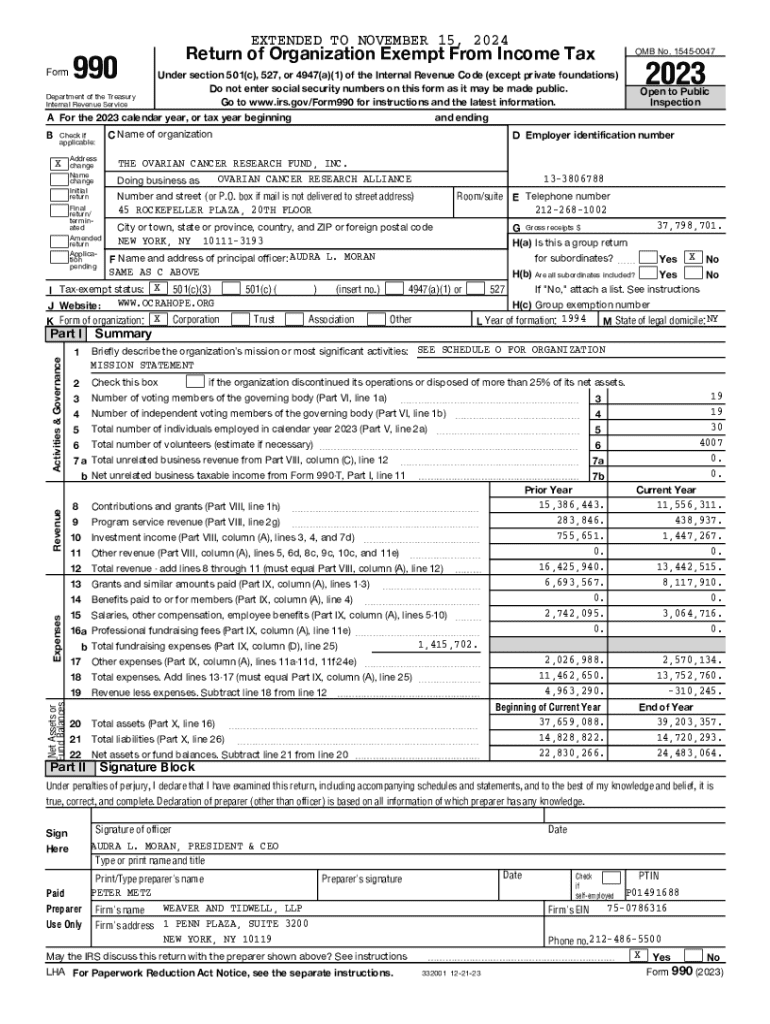

Updating your business name with the IRS

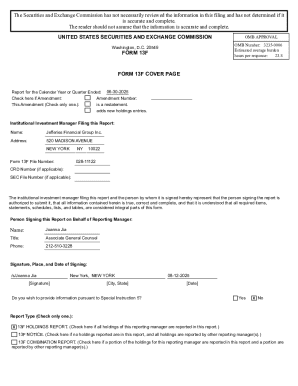

Corporations, partnerships, and other business entities need to update their names with the IRS to ensure compliance with tax laws. For corporations, the name change must also be communicated to other agencies and financial institutions. The IRS requires specific forms; for partnerships, the Form 1065 is critical, while corporations might need to amend their Articles of Incorporation, alongside updating their EIN records with the new name.

Updating your business name isn't just an IRS requirement; it also has significant implications for your branding and legal status. Businesses should ensure that the updated name is reflected in licenses, bank accounts, and contracts to avoid confusion and potential legal issues down the line. Keeping everything aligned not only simplifies your administrative tasks but also upholds the integrity of your business’s record.

Other considerations after your name change

After successfully changing your name with the IRS, it’s crucial to consider updating your name across all federal and state agencies. This includes the Social Security Administration, Department of Motor Vehicles, and anywhere else where your name is on file. The change of name might have implications for your tax returns as well. For your next filing, ensure your new name is accurately presented, corresponding to your updated records to prevent any delays or withheld refunds.

Maintaining updated records is essential to prevent issues in the future. This proactive approach ensures smooth financial transactions and accurate correspondence with tax authorities, which in turn, minimizes the risk of audits or penalties. Creating a checklist can help you map out all the places your name needs to be updated.

Impact on insurance, banking, and benefits

A name change is not merely a detail; it extends its impact to various aspects, including insurance policies and banking. All insurance providers require notification of a name change, as it can affect policy documents and claims processing. An oversight can result in complications when trying to make a claim or when renewing policies.

Bank accounts and financial records also need to be updated to reflect your new name. If your account details do not match your IRS records during transactions, you can encounter difficulties. Moreover, your Social Security benefits might be impacted by a name change. You must ensure that your name matches the records with the Social Security Administration to continue receiving accurate benefits.

Troubleshooting common issues

Even with meticulous attention to detail, issues can arise when changing your name with the IRS. If you find that the name change is not processing, double-check that all submitted forms are correctly filled out and that all necessary documentation was included. Occasionally, processing delays may occur, so it's advisable to follow up directly with the IRS. Keeping a record of your submissions will assist in resolving any discrepancies.

If discrepancies exist in your IRS records after the name change, contact them promptly for a resolution. In some cases, you may need to provide additional documentation to rectify the records. Understanding your rights and responsibilities helps empower you to navigate these situations more effectively.

Utilizing pdfFiller for your name change documentation

pdfFiller is an excellent tool to streamline the process of filling out and managing IRS forms related to your name change. The platform allows users to edit PDF documents easily, ensuring that all necessary information is accurately presented. With interactive features, you can fill, sign, and store forms securely in one centralized location, which is exceptionally beneficial for individuals and teams looking for efficiency.

Moreover, pdfFiller’s eSigning capability allows for quick execution of documents, making collaboration easy if more than one person is involved in the name change process. Utilizing these features helps eliminate errors and facilitates a smoother experience in updating your name with the IRS.

FAQs about name changes with the IRS

Addressing common questions can provide clarity regarding the name change process with the IRS. For instance, many wonder if they need to inform the IRS every time they change their name. The answer is yes; you need to ensure that the IRS has the most current information. Misconceptions often arise regarding the time frame for processing these changes. Generally, the IRS indicates that it can take up to two weeks, but this may vary based on their workload.

Understanding these nuances allows for better preparation when undertaking a name change. Additionally, using resources from pdfFiller can enhance your efficiency and clarity as you navigate through this process without the need for external aids or attorneys.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send name change with irs for eSignature?

Where do I find name change with irs?

Can I create an electronic signature for signing my name change with irs in Gmail?

What is name change with IRS?

Who is required to file name change with IRS?

How to fill out name change with IRS?

What is the purpose of name change with IRS?

What information must be reported on name change with IRS?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.