Get the free 2025 Oklahoma Individual Income Tax Forms and Instructions ...

Get, Create, Make and Sign 2025 oklahoma individual income

How to edit 2025 oklahoma individual income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 oklahoma individual income

How to fill out 2025 oklahoma individual income

Who needs 2025 oklahoma individual income?

2025 Oklahoma Individual Income Form: Your Comprehensive Guide

Understanding the 2025 Oklahoma Individual Income Form

Oklahoma residents are required to file an individual income tax return, which encompasses various sources of income and exemptions. For the 2025 tax year, understanding local tax obligations is crucial as it ensures compliance and maximizes potential refunds.

Accurate filing is not just beneficial; it is legally required. The Oklahoma individual income tax form plays a vital role in reporting your earnings, claiming deductions, and paying any taxes owed. Not keeping up with the latest requirements can lead to potential penalties and interest on unpaid liabilities.

Key features of the 2025 Oklahoma Individual Income Form

Every tax year may bring new regulations, and 2025 is no exception. Noteworthy changes may include new exemptions, deductions, or credits designed to alleviate the tax burden on residents.

The 2025 form covers various income types including wages, self-employment income, and investment earnings. Recognizing how to report each category is essential for accurate tax filings.

Preparing to complete the 2025 Oklahoma Individual Income Form

Preparation is critical when it comes to filing taxes efficiently. Gathering the necessary documentation ahead of time can significantly streamline the process.

Organizing tax information beforehand—perhaps by using folders or digital tools—can help minimize last-minute stress when filling out the 2025 Oklahoma Individual Income Form.

Step-by-step instructions for filling out the 2025 form

Filling out the Oklahoma income tax form can seem daunting, but breaking it down into sections simplifies the process. Starting with personal information, you’ll need to provide your name, address, and Social Security number.

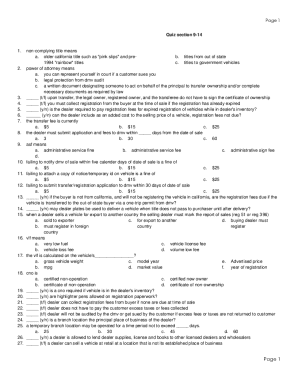

The next section concerns income reporting. Make sure to accurately report different types of income: wages reported on W-2 forms, self-employment income, and even dividends or interest from investments.

Deciding between taking the standard deduction or itemizing your deductions is another vital step. Understanding what you spent in one year can influence this decision significantly.

Upon computing total income, the final part will require you to calculate your tax owed or any potential refund. For a seamless experience, consider using interactive tools like pdfFiller’s form templates, which offer access to editing tools to ensure precise tax filing.

eSigning and submitting the 2025 Oklahoma Individual Income Form

After completing the form, eSigning is your next step. An electronic signature is legally recognized for tax documents in Oklahoma, allowing you to proceed without needing to print.

When it comes to submission, you can choose between online filing or mailing your form. e-Filing is increasingly popular, offering benefits like faster processing times, immediate confirmation, and reduced error rates.

Common mistakes to avoid when filing the 2025 form

Tax filing can be a taxing task, but there are common pitfalls to evade. The most frequent errors often stem from simple arithmetic miscalculations or forgetting to claim valid deductions.

Resources for assistance with the 2025 Oklahoma Income Tax Form

For those who may need additional guidance, help is readily available. The Oklahoma Tax Commission provides official resources and assistance centers where taxpayers can seek answers.

The FAQs section on the tax commission's site also addresses many common inquiries, making it a valuable resource during tax preparation.

Managing your tax documents after filing

After submitting your 2025 Oklahoma Individual Income Form, it’s crucial to retain your documentation. Understanding the importance of document retention helps ensure that you have necessary records for future reference or audits.

Using pdfFiller provides an effective cloud-based opportunity for ongoing document management. You can not only store but also easily retrieve your tax files whenever needed.

Benefits of using pdfFiller for your tax needs

pdfFiller offers a streamlined workflow for document creation and management, making your tax preparation smoother and more efficient. Its enhanced collaboration features allow teams to work together seamlessly, discussing and editing forms in real-time.

Furthermore, pdfFiller prioritizes secure document handling and storage, alleviating worries over data breaches or unauthorized access. All these features make pdfFiller an invaluable tool for individual filers and teams alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2025 oklahoma individual income?

How do I fill out the 2025 oklahoma individual income form on my smartphone?

How do I edit 2025 oklahoma individual income on an Android device?

What is 2025 Oklahoma individual income?

Who is required to file 2025 Oklahoma individual income?

How to fill out 2025 Oklahoma individual income?

What is the purpose of 2025 Oklahoma individual income?

What information must be reported on 2025 Oklahoma individual income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.