Get the free TIR 91-6: Reproduction of Department of Revenue Forms - stuff mit

Get, Create, Make and Sign tir 91-6 reproduction of

How to edit tir 91-6 reproduction of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tir 91-6 reproduction of

How to fill out tir 91-6 reproduction of

Who needs tir 91-6 reproduction of?

TIR 91-6 reproduction of form: A comprehensive how-to guide

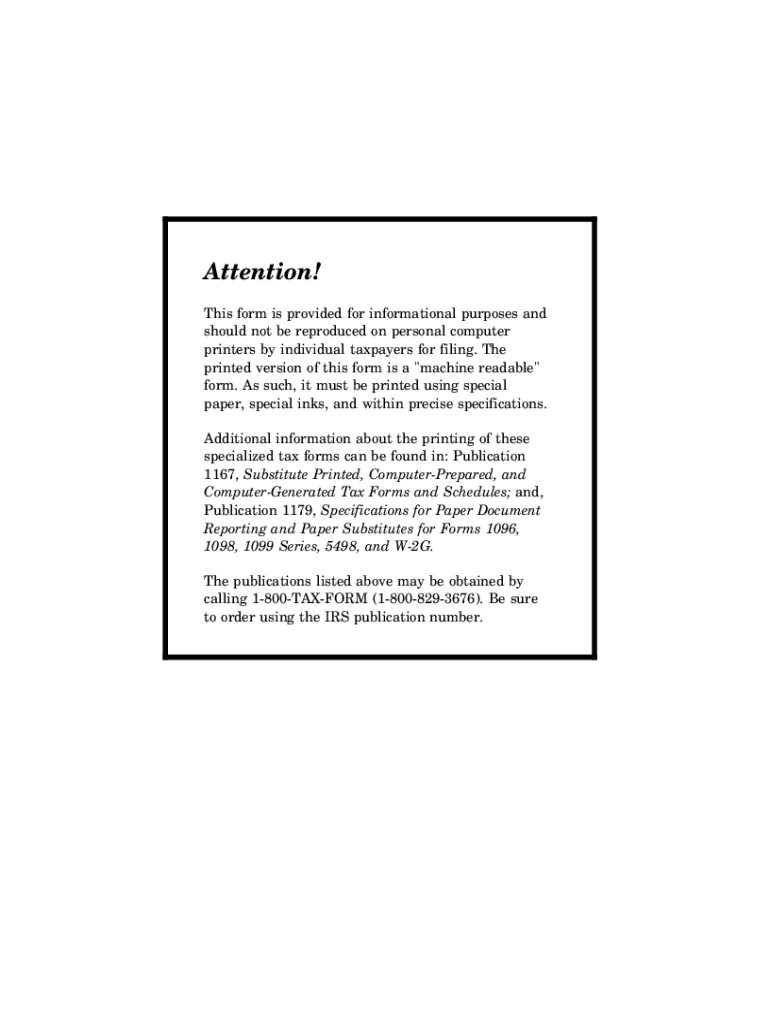

Overview of TIR 91-6

TIR 91-6 is a specific form used by dealers for the reproduction of certain documents related to vehicle sales, primarily focusing on regulatory compliance. This form serves a critical role in ensuring that necessary documentation is consistently accurate and up-to-date, particularly when it involves financial transactions, taxes, and fees. Given that inaccuracies in this form can lead to severe implications, both for buyers and sellers, understanding its purpose and relevance cannot be overstated.

Accurate reproduction of the TIR 91-6 form is essential as it helps prevent complications such as finance charge disputes, incorrect dealer document processing charges, and issues surrounding emissions testing charges. Every piece of information, from the sale price to finance rates, must be meticulously documented to safeguard all parties involved. A small error in the reproduction process could lead to costly repercussions, making it vital to understand and execute the requirements thoroughly.

Key features of the TIR 91-6 form

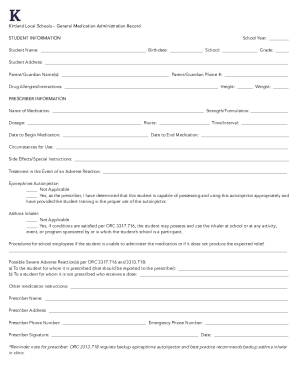

The TIR 91-6 form is structured into various sections, each serving a unique purpose in the documentation process. Typically, it includes areas for personal information of the buyer, the specifics of the vehicle, detailed financial terms, and more. Let's break down these sections further.

When filling out the form, it’s critical to provide accurate information in all these sections to avoid common mistakes such as overlooking important details or miscalculating fees. Missteps can lead to confusion when processing finance or taxes, thus delaying the transaction or raising compliance issues.

How to fill out the TIR 91-6 form

Before diving into filling out the TIR 91-6 form, it’s necessary to prepare all required documents. These may include proof of identity, vehicle documentation, and any supporting financial documents needed to establish the sale price and necessary charges. Having them at hand ensures that the process flows smoothly and remains efficient.

To assist you further, here’s a step-by-step guide to help demystify the process of filling out the form.

Reviewing your entries before finalizing is crucial. Double-checking helps identify and correct misplaced information such as wrong finance rates or incorrect personal details, thereby averting unnecessary complications in the submission process.

Editing and managing your TIR 91-6 form

Utilizing tools such as pdfFiller makes the management and editing of your TIR 91-6 form not only straightforward but also efficient. This platform allows users to edit the form in real-time, ensuring that any changes can be easily and quickly made whenever necessary.

One significant advantage of using a cloud-based document platform is the accessibility it offers. Users can access their forms from anywhere, making it easy to collaborate with team members or check on details that may have been previously overlooked.

Signing and finalizing the TIR 91-6 form

Once your TIR 91-6 form is filled out and reviewed, electronic signing is the next step. PdfFiller provides eSignature capabilities that allow you to sign documents securely and efficiently without the need for physical paperwork.

Final submission of the completed form involves a clear process to ensure that all steps are followed correctly. It’s vital to make sure that all necessary fields are filled out appropriately before submission to reduce the chances of rejection.

Frequently asked questions (FAQs)

As with any important document, questions often arise concerning the TIR 91-6 form. It's common for users to be uncertain about how to handle specific sections or what to do if they encounter issues during the process. This FAQ section aims to clarify common inquiries and provide troubleshooting tips.

Enhancing your document management experience

In today's fast-paced environment, efficient collaboration on forms like the TIR 91-6 is paramount. The collaboration features offered by pdfFiller enable teams to work together seamlessly, allowing for real-time edits and discussions around the form's content.

Ensuring compliance with relevant regulatory standards is another essential aspect of using pdfFiller. By keeping updated with the latest changes in document requirements, users can confidently submit forms that meet all legal necessities.

Exploring related forms

In addition to the TIR 91-6 form, various other forms are commonly utilized in vehicle transactions and dealer operations. Understanding these related forms can significantly improve your overall document management experience.

Common forms related to TIR 91-6 may include documents for sales tax exemption, warranty information, and vehicle registration forms. By equipping oneself with knowledge of these additional forms, users can ensure they do not miss any crucial steps in the documentation process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tir 91-6 reproduction of?

How do I edit tir 91-6 reproduction of straight from my smartphone?

How do I edit tir 91-6 reproduction of on an Android device?

What is tir 91-6 reproduction of?

Who is required to file tir 91-6 reproduction of?

How to fill out tir 91-6 reproduction of?

What is the purpose of tir 91-6 reproduction of?

What information must be reported on tir 91-6 reproduction of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.