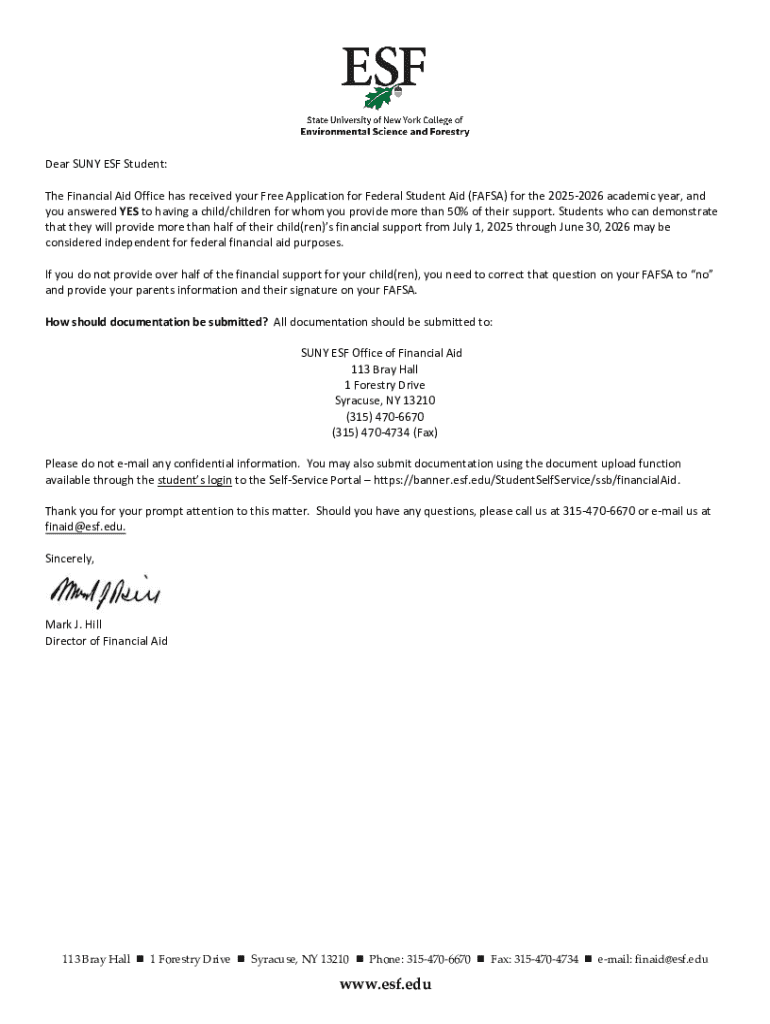

Get the free 2025 - 2026 Federal Student Aid Dependent Support worksheet. Federal Student Aid Dep...

Get, Create, Make and Sign 2025 - 2026 federal

Editing 2025 - 2026 federal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 - 2026 federal

How to fill out 2025 - 2026 federal

Who needs 2025 - 2026 federal?

2025 - 2026 Federal Form: A Comprehensive Guide

Understanding the 2025 - 2026 Federal Form

The 2025 - 2026 federal form represents a crucial tool for individuals and businesses in accurately reporting their incomes and complying with tax obligations. This form serves as the foundation for the entire tax filing process, outlining responsibilities and rights under federal law. The importance of timely and accurate completion cannot be understated, as it influences financial stability through potential refunds or liabilities.

For the 2025 - 2026 filing period, several key changes are worth noting. Adjustments in tax rates, deductions, and newly introduced credits have all been established to reflect shifts in economic conditions and legislation. Furthermore, a comparison between the 2024 form to the 2025 - 2026 federal form reveals significant differences in terms of layout and required information, emphasizing the necessity for thorough understanding and preparation.

Who needs to use the 2025 - 2026 federal form?

Eligibility to use the 2025 - 2026 federal form is broad, encompassing both individuals with varied income sources and businesses of different sizes. Primarily, any individual earning income above the minimum threshold must file, regardless of the source, including wages, dividends, and freelance work. Partnerships and corporations are also required to submit forms specific to their operations, ensuring everyone contributes to the collective tax framework.

Special considerations apply to unique situations such as taxpayers with investments, expatriates, or those with multiple income streams. There are common myths surrounding federal tax forms, such as the belief that self-employed individuals can bypass filing if earnings are low or that only full-time employees are obligated to submit forms. Understanding the eligibility criteria is vital to ensure compliance.

Detailed walk-through of the 2025 - 2026 federal form

Completing the 2025 - 2026 federal form requires meticulous attention to detail across several key sections. The personal information section demands accurate representation of your identifiers, including Social Security Number and marital status. Common errors, such as misentered digits or incorrect status declarations, can lead to processing delays or issues with the IRS. Thus, verification is critical.

The next area focuses on income reporting which encompasses income from various sources. Common sources of income include wages, self-employment income, rental income, and investment earnings. Freelancers with multiple gig jobs need clarity on how to report varying income streams effectively. This intricate process also requires documentation of ‘special cases’ where income may be difficult to quantify, such as shares earned through stock options.

Deductions and credits form another essential aspect. Understanding recent changes enables taxpayers to maximize their benefits, such as home mortgage interest deductions and educational credits. The review of tax rates and brackets for 2025 - 2026 further provides insights on tax liabilities and planning. Comprehensive knowledge here can lead to significant savings.

Interactive tools for easier form management

Utilizing tools like pdfFiller enhances the form management process significantly. pdfFiller allows seamless editing of the 2025 - 2026 federal form, making it easier to complete sections without needing to print and rewrite. The platform provides intuitive step-by-step instructions for editing PDFs, ensuring users don't miss critical information or deadlines.

In addition to editing, pdfFiller includes features for adding signatures and annotations, allowing for a complete digital filing. Collaboration features further enhance the process, enabling teams to work together on the form, offering real-time editing capabilities, sharing options, and access management.

Tips and tricks for efficient form submission

To enhance the chances of successful submission, establishing best practices when reviewing your completed form is essential. Double-check for miscalculations in income or deductions and ensure that personal details match IRS records. Additionally, consider how you will submit the form—electronically or by mail—both options have pros and cons. Electronic submission is faster and comes with instant confirmation; however, mailing provides a physical record of your submission.

Important deadlines dictate when forms must be submitted and penalties for lateness. For the 2025 - 2026 filing period, staying ahead of deadlines not only avoids penalties but also allows taxpayers time to react to any misfiled documents or correction requirements.

Troubleshooting common issues

While filing the 2025 - 2026 federal form may seem straightforward, many taxpayers encounter common problems. Issues such as incomplete forms, incorrect calculation of income, or misunderstanding eligibility for certain deductions can lead to inefficient filings. Understanding these issues can significantly improve compliance and reduce stress associated with tax filings.

If errors occur after submission, knowing how to amend the form is crucial. Filing an amendment with the IRS can be completed by using Form 1040-X. Common questions arise concerning timelines for submission and whether penalties will result from errors. It’s advisable to review IRS resources or consult with a tax professional when in doubt.

Finalizing and managing your documents with pdfFiller

After completing the 2025 - 2026 federal form, effective document management is paramount. pdfFiller provides users with tools to organize and store completed forms securely. This management system not only helps keep tax records easily accessible for review but also ensures that sensitive data is protected.

Additionally, users can easily archive documents from previous filing years, creating a well-structured filing system. This ongoing organization simplifies tax prep for future years and helps build a comprehensive financial history, which is beneficial for various financial undertakings.

Future-proofing your filing process

Horizon scanning for changes in tax laws post-2025 - 2026 is crucial for proactive tax planning. Staying informed about upcoming regulations and amendments can secure your tax benefits and encourage mindful financial decisions. Utilizing resources such as the IRS site, reputable tax news outlets, and engaging with tax professionals can keep you ahead.

Leveraging tools like pdfFiller guarantees ongoing support beyond the filing season, ensuring that you have everything in hand for future needs. The platform is continually updated to reflect any regulatory changes, keeping your processes efficient and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2025 - 2026 federal online?

How do I make edits in 2025 - 2026 federal without leaving Chrome?

How do I fill out the 2025 - 2026 federal form on my smartphone?

What is 2025 - 2026 federal?

Who is required to file 2025 - 2026 federal?

How to fill out 2025 - 2026 federal?

What is the purpose of 2025 - 2026 federal?

What information must be reported on 2025 - 2026 federal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.