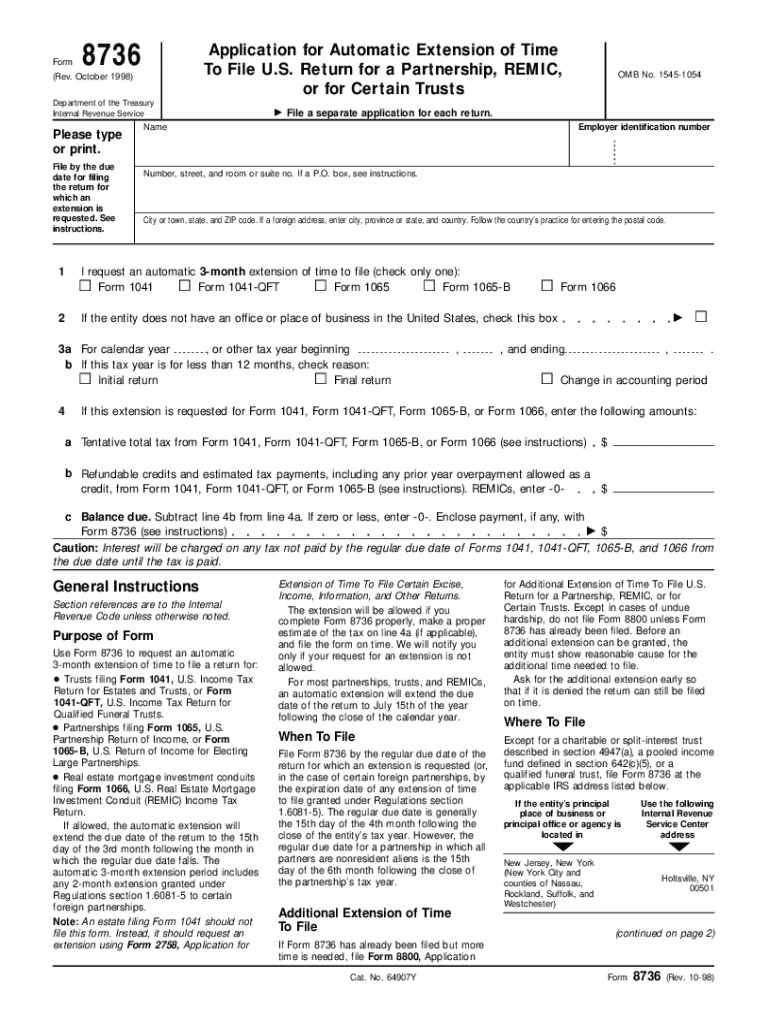

Get the free Form 8736, application for automatic extension of time to file ...

Get, Create, Make and Sign form 8736 application for

Editing form 8736 application for online

Uncompromising security for your PDF editing and eSignature needs

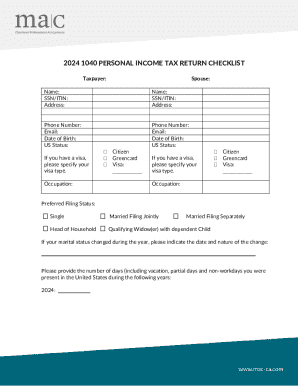

How to fill out form 8736 application for

How to fill out form 8736 application for

Who needs form 8736 application for?

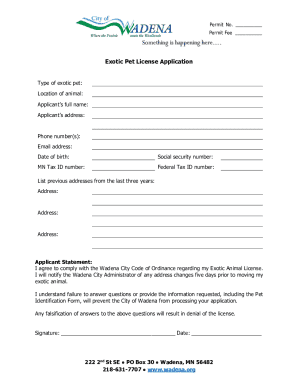

Comprehensive Guide to Form 8736 Application

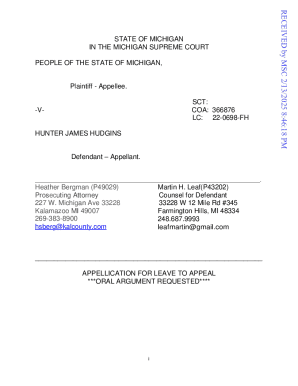

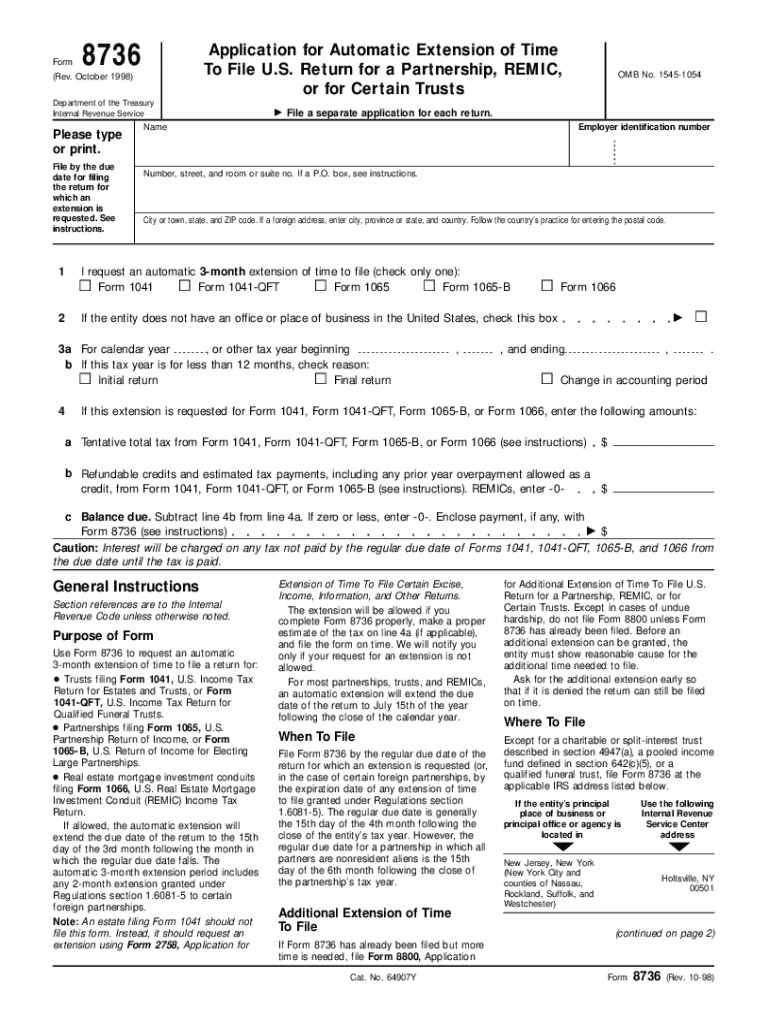

Understanding Form 8736

Form 8736 is a vital document for individuals and organizations looking to request an extension of time for IRS Form 8862, which is used to claim certain tax credits. This application form streamlines the process by allowing taxpayers to formally request additional time to submit their forms, ensuring compliance without the risk of penalties.

Understanding the application process for Form 8736 is crucial for managing deadlines effectively. Filling out this form not only helps in staying compliant with tax laws but also provides taxpayers the opportunity to clarify their position regarding eligibility for credits. The official procedure entails collecting necessary information and submitting it within the stipulated time frame.

Who should fill out Form 8736?

Understanding who is required to fill out Form 8736 is vital. Typically, any taxpayer who needs more time to prepare their IRS Form 8862 or reclaims tax credits should consider using this application. This may include individuals and entities who have had previous claims denied or who need more time to gather necessary documentation.

A few scenarios where Form 8736 is critical include those who have historically faced issues with tax credits, like the Earned Income Tax Credit or the Additional Child Tax Credit. Various industries such as self-employed or freelance sectors often encounter these situations during tax preparation seasons.

Step-by-step guide to filling out Form 8736

To fill out Form 8736 effectively, the first step is gathering all necessary documentation. This will include personal identification, previous tax returns, and any correspondence related to your tax credits. Keeping this information handy ensures you can fill out the application accurately and completely.

Now, let’s dive into the specific sections of the form:

Each part demands precise details to avoid rejection from the IRS. For example, in the Declaration section, inaccuracies can lead to further delays or complications.

Editing and managing your Form 8736

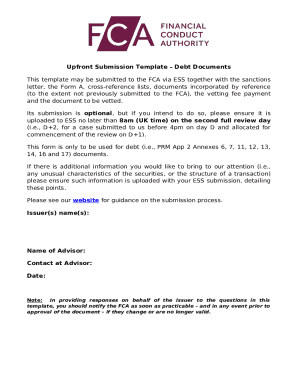

Editing Form 8736 can be efficiently accomplished using pdfFiller. The platform allows users to upload the PDF file, making it simple to edit text, adjust layouts, and insert missing details where necessary. For users unfamiliar with PDF editing, pdfFiller provides an intuitive interface that includes features like autofill for convenience.

Moreover, collaboration is made easy. Sharing your Form 8736 with team members allows for real-time feedback and modifications. This feature is particularly beneficial when multiple eyes are needed to review the documentation for accuracy prior to submission.

Common mistakes to avoid when filling out Form 8736

Even small errors on Form 8736 can have significant consequences on your application’s status. Some frequent mistakes include providing incorrect personal information, failing to sign the document, and leaving out important details in the Specific Requirements section. Each of these errors can lead to delays or outright rejections from the IRS.

To ensure accuracy, consider implementing a thorough checklist review before submission. This should include:

Frequently asked questions (FAQs)

Several questions often arise about Form 8736 from taxpayers including the time needed to process this application and the scenarios that would lead to its denial. For instance, processing typically takes about 6-8 weeks. It’s crucial to ensure the accuracy and completeness of the form to prevent any unnecessary delays.

Technical issues can also arise while filling out this form, and platforms like pdfFiller provide support through user guides and help centers to resolve common issues, ensuring a smooth experience.

Resources for further information

For those keen on delving deeper into the use of Form 8736, various support and help centers offer resources to guide you. Websites and tax preparation platforms provide comprehensive materials that detail every nuance of the application process.

pdfFiller also expands its offerings with additional templates that facilitate other similar applications, allowing users to streamline their document management efforts.

Related forms and applications

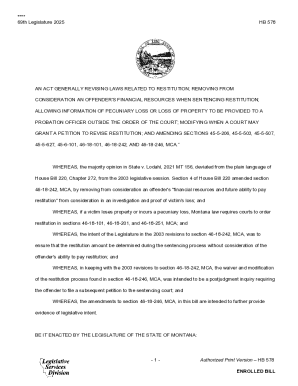

Exploring related forms can give taxpayers insights into additional benefits or procedures. Forms such as IRS 8862, which focuses on the eligibility for credits, and others like Form 1040 can often be found within the same filing context as Form 8736.

Utilizing tools on pdfFiller not only aids in completing Form 8736 but enhances overall tax documentation efficiency by integrating various forms into one workflow.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 8736 application for in Chrome?

How do I edit form 8736 application for straight from my smartphone?

How do I edit form 8736 application for on an Android device?

What is form 8736 application for?

Who is required to file form 8736 application for?

How to fill out form 8736 application for?

What is the purpose of form 8736 application for?

What information must be reported on form 8736 application for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.