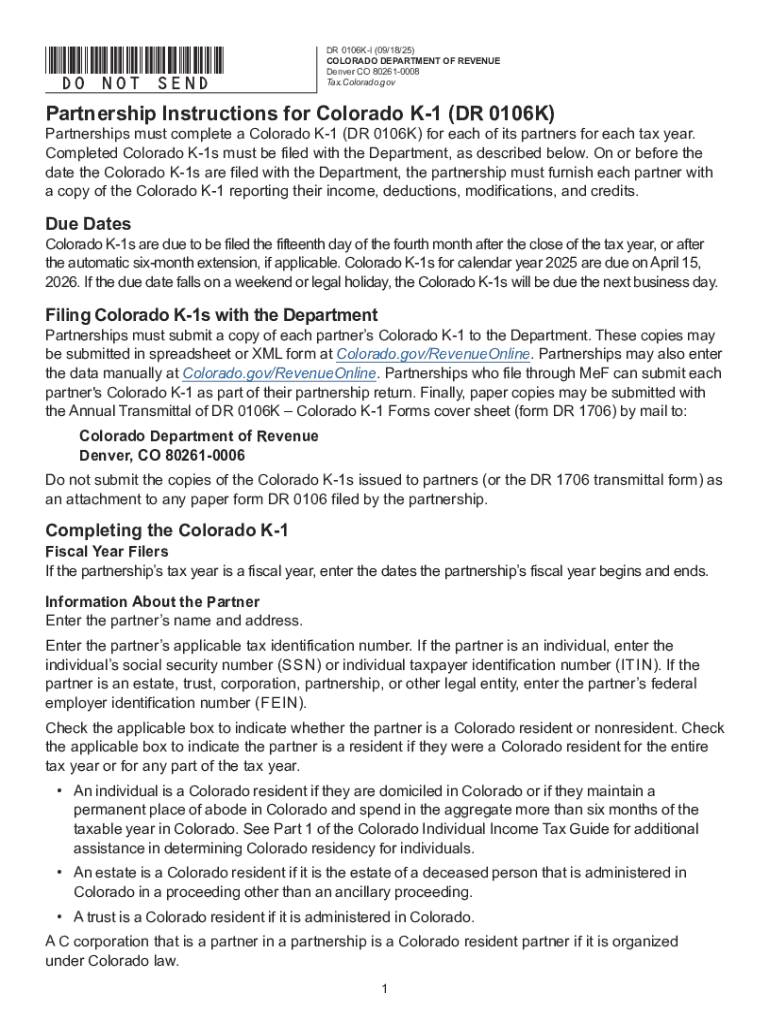

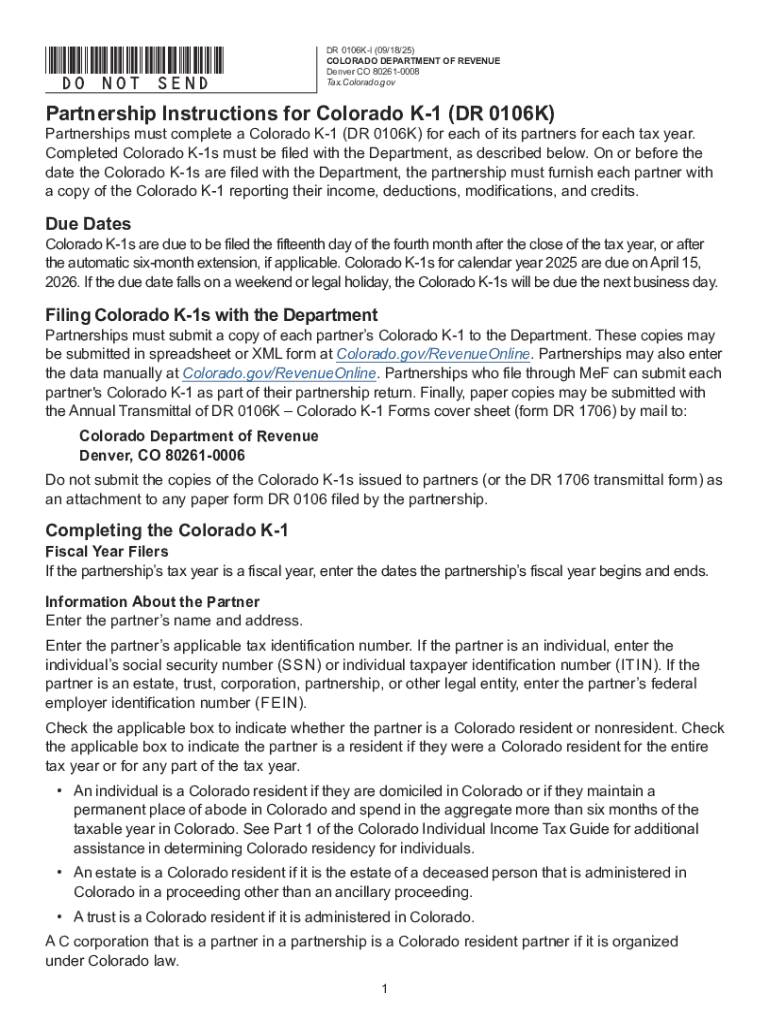

Get the free DR 0106K-I Partnership Instructions for Colorado K-1 (DR 0106K). If you are using a ...

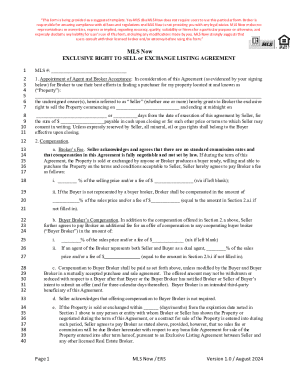

Get, Create, Make and Sign dr 0106k-i partnership instructions

Editing dr 0106k-i partnership instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dr 0106k-i partnership instructions

How to fill out dr 0106k-i partnership instructions

Who needs dr 0106k-i partnership instructions?

Your Guide to Filling Out the DR 0106K- Partnership Instructions Form

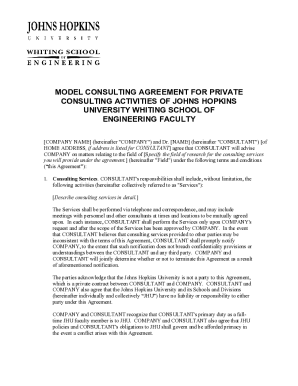

Understanding the DR 0106K- Partnership Instructions Form

The DR 0106K-I Partnership Instructions Form is essential for partnerships to report their income, deductions, and credits accurately. This form plays a pivotal role in ensuring that income is fairly distributed among partners, particularly when it involves S Corporations or other partnership structures. Filling out this form correctly not only ensures compliance with IRS regulations but also helps prevent any discrepancies in taxation that could arise from inaccurate reporting.

Partnerships may need to utilize the DR 0106K-I during the annual tax reporting season or when significant changes occur within the partnership, such as adding or removing a partner. Understanding the purpose and correct use of this form is critical for maintaining healthy partnerships and avoiding potential legal complications.

Key terminology related to the DR 0106K-I includes terms such as K-1, which refers to the schedule used to report each partner's share of profits and losses. This understanding is vital for interpreting the form correctly and filling it out without errors.

Preparing to fill out the DR 0106K- Partnership Instructions Form

Proper preparation is critical when sitting down to complete the DR 0106K-I Partnership Instructions Form. Before starting, ensure that you gather all essential information regarding both the partnership and its individual partners. This includes the partnership's legal name, address, and taxpayer identification number, as well as each partner's name, address, and social security number. Having these specifics at your fingertips will make the process smoother and more efficient.

Additionally, having documentation on hand, such as previous year's forms, financial statements, and other partnership-related records, will help substantiate the information you are entering. This ensures all data is accurate and consistent, reducing the chances of mistakes.

Organizing this information effectively involves setting up a spreadsheet where you can input the details systematically. This method will not only help you keep track of your entries but will also allow you to spot discrepancies before they become an issue on the form.

Steps to complete the DR 0106K- Partnership Instructions Form

Completing the DR 0106K-I is a step-by-step process requiring attention to detail. Below is a breakdown of sections within the form to guide you.

Section 1: Partnership identification

This section requests fundamental information about the partnership, including name, address, and the business structure type. Common pitfalls are entering incorrect partnership names or addresses, which can cause confusion during processing. Always verify this information against official documents.

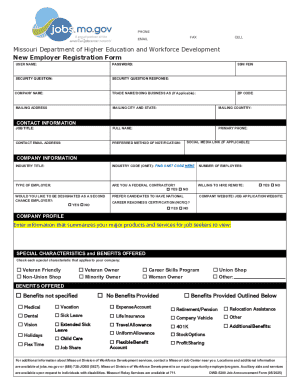

Section 2: Partner information

Here, you will need to list all partners involved in the business. Each partner's full name, address, and taxpayer identification number, or social security number, must be accurately recorded. For partnerships with multiple partners, ensure that each entry is distinctly separated and all information is complete to avoid any delays.

Section 3: Income reporting

In this section, you'll need to report the income for the partnership. This is where you identify sources of income and categorize them accordingly. Be detailed in your reporting to reflect accurate numbers. Common income sources include business revenue, interest income, and capital gains. Ensure you have documented proof for each category recorded.

Section 4: Deductions and credits

Eligible deductions can significantly impact your overall tax liability, making this section crucial. Common deductions for partnerships may include operational costs, employee salaries, and certain administrative expenses. Understand the rules surrounding credits to take full advantage of available benefits; if you're unsure about a particular deduction, seek tax professional advice.

Reviewing your completed DR 0106K- Partnership Instructions Form

After completing the form, a thorough review is vital before submission. Double-checking your work can help catch any errors that may affect the integrity of your tax reporting. Pay particular attention to the names, taxpayer IDs, and numerical entries, as these are common areas where mistakes can occur.

Utilizing tools like pdfFiller’s editing features can streamline this review process. The platform allows you to edit, proofread, and even use tools like spell-check to enhance the accuracy of your work, eliminating the reliance on manual corrections. The convenience of digital reviews significantly outweighs manual checks, saving you both time and potential penalties.

Submitting the DR 0106K- Partnership Instructions Form

Once you've confirmed the accuracy of your DR 0106K-I form, it’s time to submit it. There are options for both online and physical submission. While online submission is streamlined and often quicker, physical submission may provide a paper trail in instances where electronically filing is not an option. Each method comes with its own set of potential issues; online submissions may encounter errors in electronic systems, whereas physical submissions can be delayed in processing.

Tracking your submission is equally important. If you submitted online, request a confirmation receipt. For physical submissions, consider using certified mail to ensure delivery and provide confirmation of receipt. If any complications arise post-submission, having evidence of your submission can facilitate follow-up communications with tax authorities.

Managing your partnership documents with pdfFiller

Efficient document management is essential for any partnership. With pdfFiller, you can maintain an organized storage system for your partnership documents, from the DR 0106K-I form to all necessary supporting paperwork. Utilizing cloud-based features allows for easy access from anywhere, ensuring that you can find the documents you need instantly.

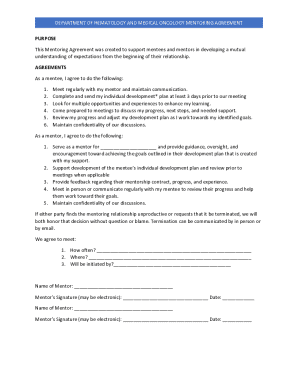

Collaboration among partners is seamless with pdfFiller. The platform supports real-time editing and commenting functionalities, allowing you to work on partnership documents collaboratively. This is essential for larger teams or partnerships with multiple stakeholders who need to review and approve documents regularly.

Frequently asked questions (FAQs)

Understanding the DR 0106K-I form can provoke many questions. Common queries often revolve around specific sections of the form or how to navigate unique partnership scenarios. It's essential for users to seek clarifications to avoid issues during tax filing. For example, partners may inquire about how to accurately reflect their share of profits and losses on the K-1 forms or how to account for special allocations in profit sharing.

Having answer keys to these FAQs can offer clear guidance, ensuring that partners feel confident in handling their tax obligations. Collaborating with tax professionals can also be beneficial for specific cases, helping to eliminate potential errors and promoting compliance.

Enhancing your document management experience

pdfFiller offers unique features that simplify the management of partnership documentation. The eSigning feature allows partners to sign documents digitally, eliminating the need for printing, scanning, or physical mail. This efficiency helps speed up processes that traditionally take days.

Additionally, the platform enables users to customize their document creation experience. You can utilize templates specifically designed for partnership needs, making it easier to create consistent documents across your firm. This tailored approach not only saves time but also enhances the professional appearance of your documentation, fostering trust and credibility among partners and stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute dr 0106k-i partnership instructions online?

How do I make edits in dr 0106k-i partnership instructions without leaving Chrome?

How do I edit dr 0106k-i partnership instructions straight from my smartphone?

What is dr 0106k-i partnership instructions?

Who is required to file dr 0106k-i partnership instructions?

How to fill out dr 0106k-i partnership instructions?

What is the purpose of dr 0106k-i partnership instructions?

What information must be reported on dr 0106k-i partnership instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.