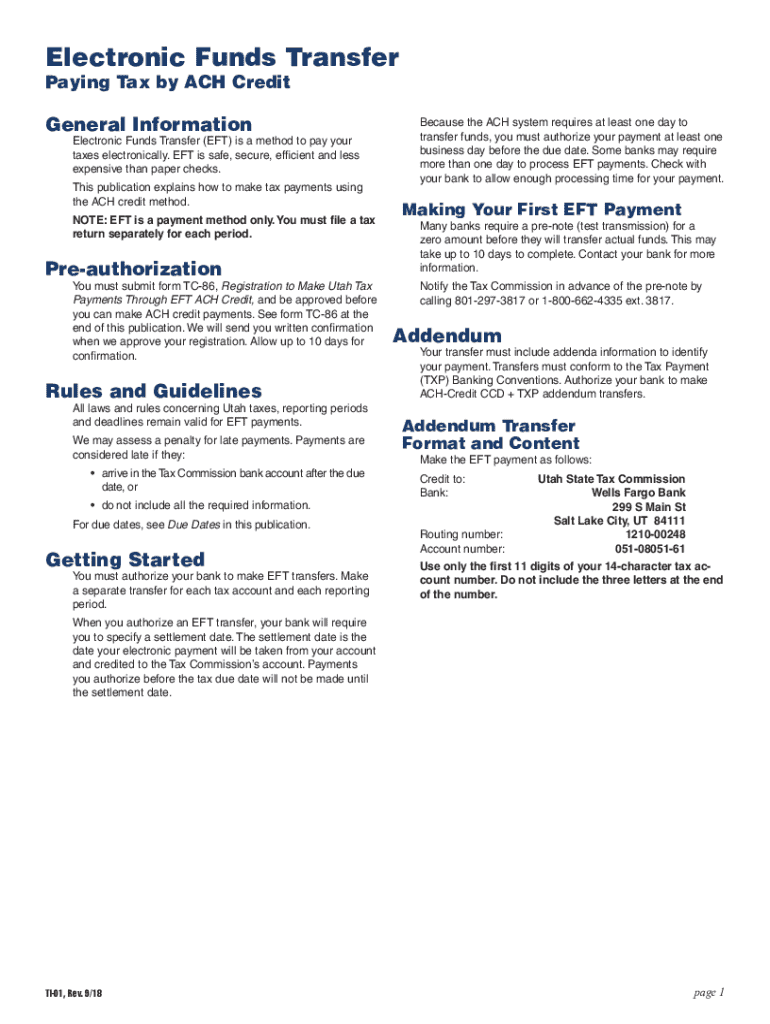

Get the free TI-01 ETF Paying Tax by ACH Credit. Forms & Publications

Get, Create, Make and Sign ti-01 etf paying tax

How to edit ti-01 etf paying tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ti-01 etf paying tax

How to fill out ti-01 etf paying tax

Who needs ti-01 etf paying tax?

Understanding the TI-01 ETF Paying Tax Form: A Comprehensive Guide

Understanding the TI-01 ETF paying tax form

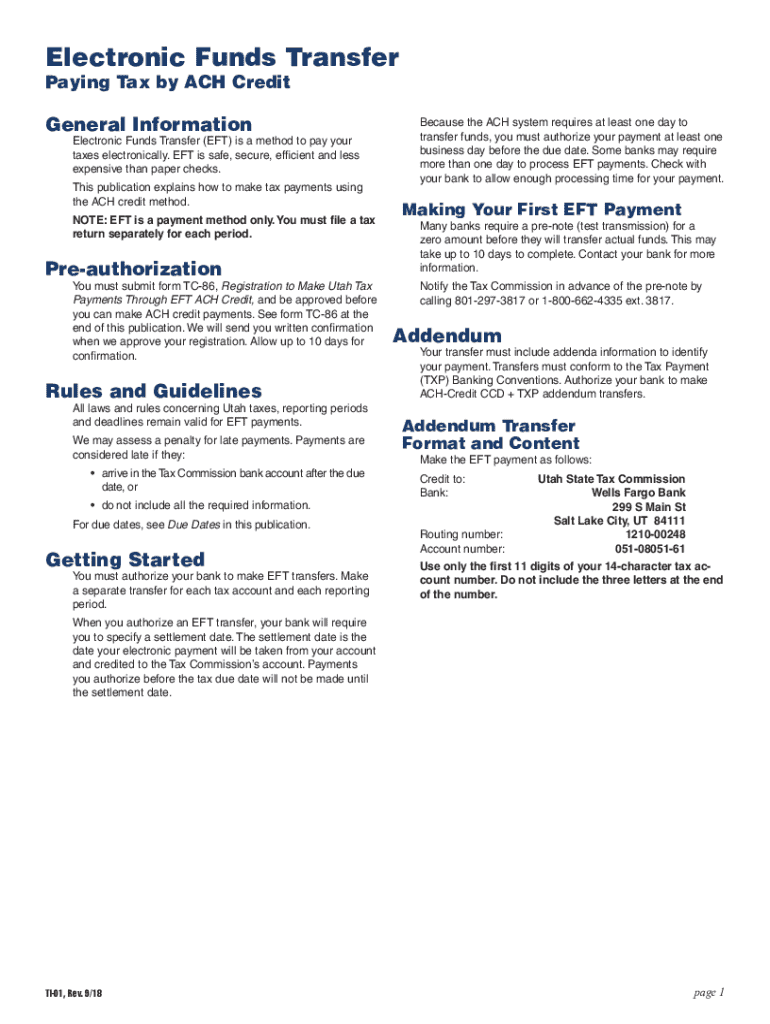

The TI-01 ETF paying tax form is a specialized document designed for the reporting of income derived from Exchange-Traded Funds (ETFs). This form captures crucial financial activities, allowing individuals and businesses to ensure they comply with tax regulations. As investment options grow, so does the need for clarity in reporting, making the TI-01 form an essential tool for accurate tax filing.

Properly using the TI-01 form is vital to avoid any discrepancies that may arise during tax submissions. Failing to account for income earned through ETFs, such as dividends or capital gains, can lead to penalties and interest charges from tax authorities. Thus, understanding the significance of this form cannot be overstated, especially for active investors.

The TI-01 form is particularly relevant for two groups: individuals who invest in ETFs on a personal basis and teams or business entities that include investment as part of their operations. Each group has unique reporting requirements, and the TI-01 form plays a pivotal role in ensuring compliance.

Key components of the TI-01 ETF paying tax form

The structure of the TI-01 form is organized into distinct sections that allow for clear presentation of necessary data. Breaking it down helps users navigate its requirements effectively, as each section serves a specific purpose in documenting investment activities.

Understanding common terms associated with the TI-01 form is also critical for accurate completion. Key definitions include ETFs (Exchange-Traded Funds), which are investment funds traded on stock exchanges, capital gains which represent the profit from selling an asset, and tax deductions that reduce taxable income, potentially lowering tax obligations.

Step-by-step instructions for completing the TI-01 form

Successfully completing the TI-01 form requires careful preparation and accuracy. Start by gathering all necessary information, such as investment records and details from previous tax filings. This foundational step helps streamline the subsequent process and ensures no vital information is overlooked.

Once the data is gathered, begin filling out the form section by section. For each portion of the form, understand the requirements clearly. For example, when entering personal information, ensure all names and identification numbers match official documents to avoid discrepancies.

After completing the sections, focus on calculating the tax due. This involves summing the total investment income and subtracting any applicable deductions or credits. Understanding these elements thoroughly is paramount to ensure full compliance with tax laws.

Common mistakes to avoid when filling out the TI-01 form

Filling out the TI-01 form comes with its challenges and potential pitfalls. Misreporting investment income is one of the most significant errors that can cause issues with tax authority reviews and audits. Make sure to accurately represent income from ETFs, differentiating between dividends and capital gains.

Timing issues can also arise, particularly concerning the recognition of income or capital gains. For example, it’s important to only report income that has been realized in the tax year, as premature reporting can lead to complications.

Tools and resources for managing your TI-01 form

Managing the TI-01 form becomes significantly easier with the right tools. pdfFiller stands out as a versatile platform equipped with interactive capabilities tailored for efficient document management. Its document editing features allow users to customize their forms and ensure all information is accurate before submission.

Collaboration features such as eSigning simplify getting necessary approvals and feedback, making the process smoother for teams. Furthermore, users may find it convenient to share their completed forms securely via email or save them to cloud storage, ensuring access from anywhere.

FAQs about the TI-01 ETF paying tax form

Potential issues with the TI-01 form may arise, and understanding how to rectify them is crucial. If an error is made on your TI-01 form, promptly contact the relevant tax authority to correct it. Timely amendments are essential to maintain good standing with tax regulations.

Be aware of submission deadlines, as they can vary based on the type of income and the investor's position. Familiarizing yourself with these timelines can help avoid late penalties.

Conclusion: Making the most of your TI-01 ETF paying tax form experience

Navigating the TI-01 form doesn’t have to be daunting. Leveraging tools like pdfFiller can elevate your document management process. The platform's cloud-based features facilitate seamless editing, eSigning, collaborating, and managing necessary documents for tax purposes.

Ultimately, the importance of timeliness and accuracy in tax filings cannot be overstated. Regularly reviewing your investment records and understanding the TI-01 form will empower you to take control of your financial responsibilities while maximizing your investment potential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in ti-01 etf paying tax without leaving Chrome?

Can I create an eSignature for the ti-01 etf paying tax in Gmail?

How do I fill out the ti-01 etf paying tax form on my smartphone?

What is ti-01 etf paying tax?

Who is required to file ti-01 etf paying tax?

How to fill out ti-01 etf paying tax?

What is the purpose of ti-01 etf paying tax?

What information must be reported on ti-01 etf paying tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.