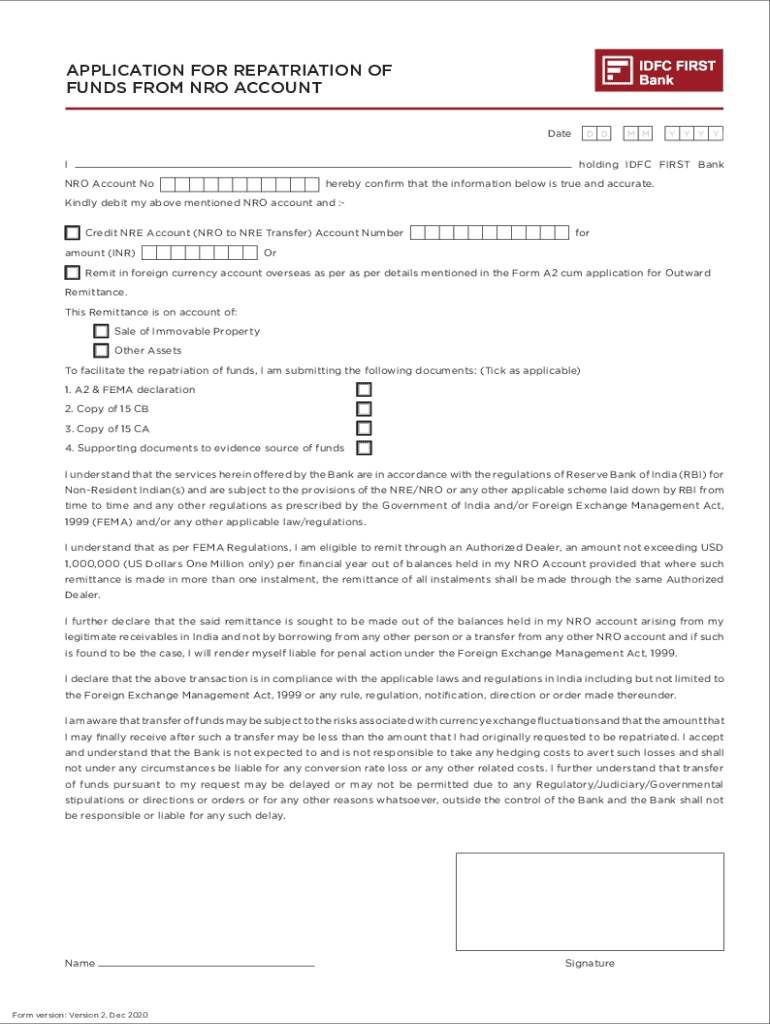

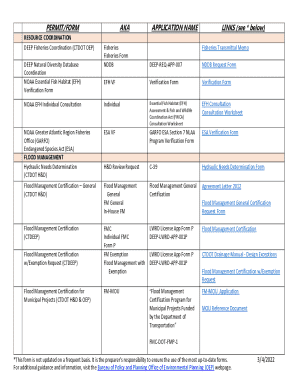

Get the free 2152- 20 NRO Repatriation Form.indd - IDFC FIRST Bank

Get, Create, Make and Sign 2152- 20 nro repatriation

How to edit 2152- 20 nro repatriation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2152- 20 nro repatriation

How to fill out 2152- 20 nro repatriation

Who needs 2152- 20 nro repatriation?

Understanding the 2152-20 NRO Repatriation Form: A Comprehensive Guide

Understanding the 2152-20 NRO repatriation form

The 2152-20 NRO repatriation form serves an essential function for non-resident Indians (NRIs) wishing to repatriate their earnings, assets, or funds back to India. This form is a critical part of ensuring compliance with tax regulations and demonstrating the legitimacy of these transactions. Familiarity with this form is crucial for any NRI looking to manage their finances efficiently while adhering to legal guidelines.

The significance of the 2152-20 NRO repatriation form lies in its role as a formal documentation mechanism. It provides the necessary evidence for banks and financial institutions to process repatriation requests. Without properly completing this form, individuals may face challenges or delays in accessing their funds.

Who needs to use the 2152-20 NRO repatriation form?

Individuals who fall under the category of non-resident Indians (NRIs) are the primary users of the 2152-20 NRO repatriation form. This includes Indian citizens who have relocated abroad for work, study, or other reasons, as well as those who maintain their income in India but reside outside the country. The form is critical for anyone looking to transfer money earned in India back to their accounts in a foreign country.

Key stakeholders involved in the repatriation process include banks that hold NRO accounts, financial institutions that facilitate international transfers, and taxation authorities that require documentation of repatriated funds. Understanding the needs and requirements of these parties can help streamline the process for NRIs.

Detailed insights into the 2152-20 NRO repatriation form

The 2152-20 NRO repatriation form is commonly used in several scenarios. For instance, an NRI selling a property in India may need to repatriate the proceeds of that sale. Similarly, an individual earning income through investments or business operations in India would require this form to transfer their earnings abroad. Each situation entails specific details that must be carefully outlined in the form for successful processing.

In terms of legal considerations, users must ensure that all information provided in the form is accurate and backed by appropriate documentation. This includes proof of income, residency status, and bank details for both Indian and foreign accounts. Furthermore, it’s essential to maintain compliance with the Foreign Exchange Management Act (FEMA) regulations while filing the form.

Step-by-step guide for completing the 2152-20 NRO repatriation form

Completing the 2152-20 NRO repatriation form involves several key sections. First, it is crucial to gather all necessary personal information. Section one typically requires your full name, address, contact information, and identification details such as your passport number or PAN card number. Accuracy in this section ensures that your application can be traced and that any communications can be directed appropriately.

In section two, focus on providing detailed repatriation information. This includes the amount being transferred, the currency type, and the purpose of the repatriation. Be transparent and detailed; the more information you provide, the easier it is for institutions to process your request. Section three requests supporting documentation, which might include bank statements, property sale agreements, or proof of income. Ensure all documents mentioned in the guidelines are included to avoid delays.

Tips for editing and formatting the 2152-20 NRO repatriation form

The editing and formatting of your 2152-20 NRO repatriation form can make a significant difference in how quickly and effectively your request is processed. Best practices for document editing suggest ensuring that all fields are visible, clear, and legible. Poor handwriting or unclear printing can lead to errors or misunderstandings. Therefore, utilizing digital formats can be advantageous.

Using a platform such as pdfFiller can offer tools that enhance the document's aesthetics and readability. Features like text alignment, font choices, and size adjustments help create a professional-looking form. Additionally, if you’re working collaboratively with others, pdfFiller enables collaborative editing, ensuring all input is collected efficiently.

eSigning the 2152-20 NRO repatriation form

The advent of electronic signatures (eSigning) has revolutionized how documents can be executed and submitted. The legality of eSigning the 2152-20 NRO repatriation form is recognized by several regulatory bodies, provided the signature is affixed in a manner that ensures authenticity. Using tools from pdfFiller guarantees that your electronic signature meets the required legal standards.

When securely eSigning the form, follow these steps: log into pdfFiller, select the document, and navigate to the eSignature field. Affix your signature using your finger, mouse, or stylus, ensuring it matches your official signature. Once completed, save the document and proceed to share it with your bank or financial institution.

Collaborating with others on the repatriation process

Collaboration can enhance the repatriation process, especially if multiple parties are involved in the submission or approval of the 2152-20 NRO repatriation form. Utilizing pdfFiller's multi-user features, you can invite stakeholders to review, provide feedback, or enter their respective portions into the document. This helps consolidate all necessary information and ensures consistency in what is submitted.

Sharing the form becomes straightforward with pdfFiller. Use the share feature to send the document link to colleagues, financial advisors, or banking representatives, allowing them to provide input or execute the necessary signatures without the need for physical meetings. This feature supports a seamless workflow that can significantly reduce processing time.

Managing and storing your 2152-20 NRO repatriation form

Once the 2152-20 NRO repatriation form is completed and submitted, effective management and storage are paramount to ensure its availability for future reference. Cloud-based document management systems like pdfFiller provide a secure and organized approach for storing your documents. This not only protects against loss but also allows quick access, should the need to revisit the document arise.

To organize documents efficiently, categorize them based on type (e.g., financial transactions, tax documents) and assign appropriate tags for easy searching. pdfFiller's search functionality assists in quickly locating previously stored forms, enhancing productivity and ensuring you remain organized.

Troubleshooting common issues with the 2152-20 NRO repatriation form

Common pitfalls in completing the 2152-20 NRO repatriation form can lead to delays or rejections. One frequent error is providing incorrect personal information or failing to include all necessary documentation. It’s crucial to double-check all entries against your original documents to ensure accuracy. Additionally, be cautious about submission deadlines to avoid missing your window for processing.

If the form is rejected, don’t be discouraged. Carefully review the rejection reason provided by the institution. This often contains specific instructions on what needs to be corrected or resubmitted. Utilizing pdfFiller's document tracking can also help you retain a history of changes made, making it easier to address any issues in a subsequent submission.

Interactive tools for a seamless experience

pdfFiller provides a range of interactive form features designed to enhance the user experience while completing the 2152-20 NRO repatriation form. These include built-in help texts, customizable fields, and templates that can guide users efficiently through the form. Such features minimize the risk of errors by clearly outlining what each section requires.

Additionally, tracking changes and revisions within pdfFiller allows users to maintain a clear record of modifications made over time. This promotes accountability and ensures you can revert to a previous version if necessary, greatly simplifying the process of managing your documentation.

Enhancing your experience with additional pdfFiller features

Beyond just filling out the 2152-20 NRO repatriation form, pdfFiller offers analytics tools that allow users to analyze their document interactions. Understanding how your document is viewed or edited can provide insights into how to streamline future submissions. This level of analysis can help identify common issues that may require rectification or enhancement.

Moreover, pdfFiller's integration capabilities with other commonly used applications enable users to create a more cohesive workflow. Whether you're incorporating financial software or CRM systems, connecting these platforms can significantly speed up processes, helping you manage your financial documentation effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2152- 20 nro repatriation without leaving Google Drive?

How can I edit 2152- 20 nro repatriation on a smartphone?

How can I fill out 2152- 20 nro repatriation on an iOS device?

What is 2152- 20 nro repatriation?

Who is required to file 2152- 20 nro repatriation?

How to fill out 2152- 20 nro repatriation?

What is the purpose of 2152- 20 nro repatriation?

What information must be reported on 2152- 20 nro repatriation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.